02 May 2023 Market Close & Major Financial Headlines: Markets Opened Moderately Higher, Slipped Into The Red Briefly, Then Traded Upwards Closing Sharply Higher In The Green

Summary Of the Markets Today:

- The Dow closed up 322 points or 0.85%,

- Nasdaq closed up 1.51%,

- S&P 500 closed up 0.91%,

- Gold $2,314 up $2.70,

- WTI crude oil settled at $79 up $0.01,

- 10-year U.S. Treasury 4.583% down 0.008 points,

- USD index $105.34 down $0.410,

- Bitcoin $59,329 up $1,843 (3.20%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

U.S.-based employers announced 64,789 job cuts in April 2024, a 28% decrease from the 90,309 cuts announced one month prior. It is also down 3.3% from the 66,995 cuts announced in the same month in 2023. So far this year, companies have announced 322,043 job cuts, down 4.6% from the 337,411 announced through April last year.

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was up 16.4% year-over-year in March 2024 – the deficit is worsening. Imports are up 2.7% year-over-year while exports are up 1.4% year-over-year. A worsening trade deficit moderates GDP.

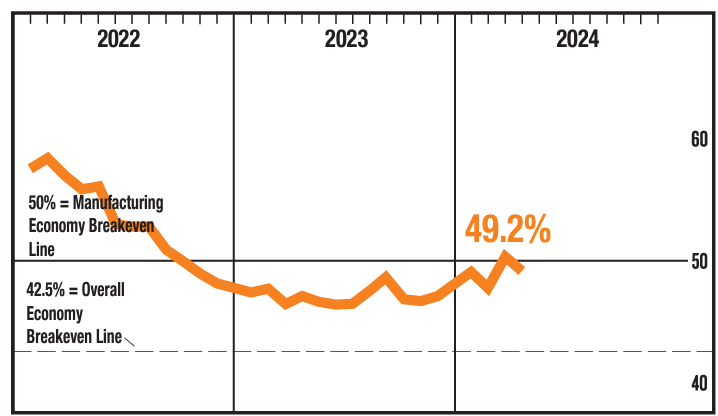

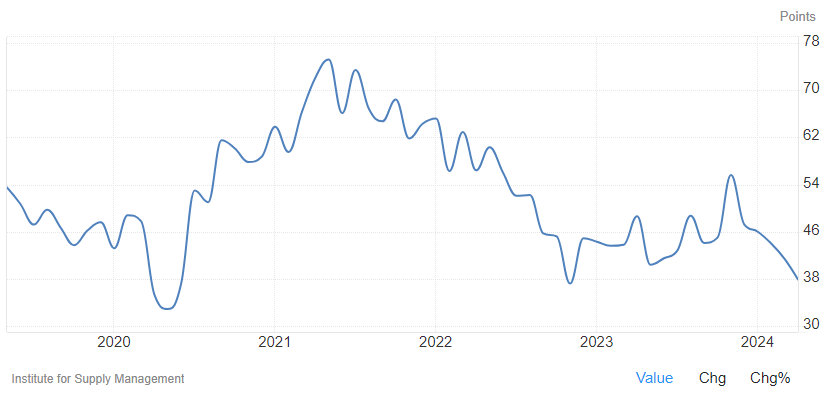

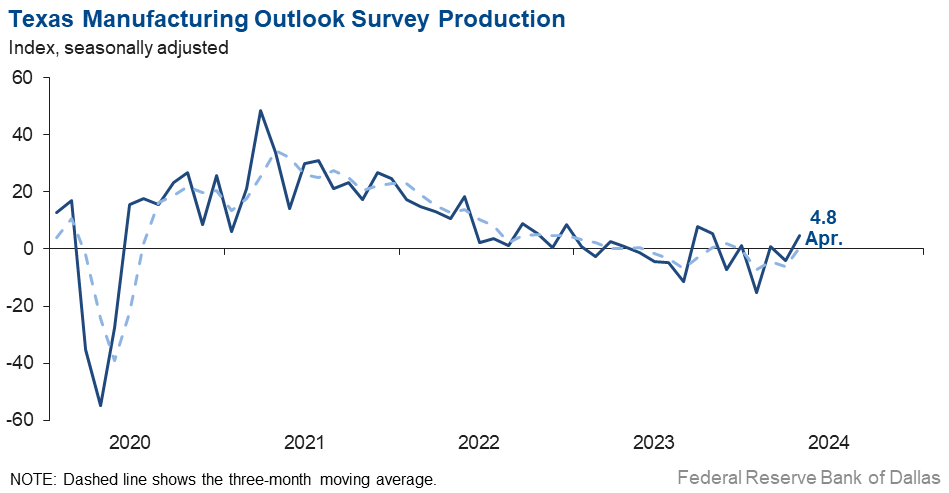

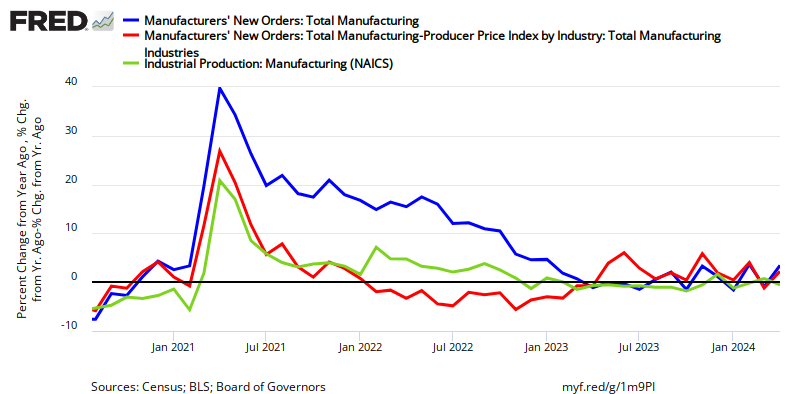

New orders for manufactured goods in March 2024 are down 0.9% year-over-year – down 1.3% inflation adjusted. This is directly opposite to the Federal Reserves manufacturing index which is up 1.0% year-over-year. In any event, manufacturing is not doing well in the current economy.

In the week ending April 27, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 210,000, a decrease of 3,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 213,250 to 213,500.

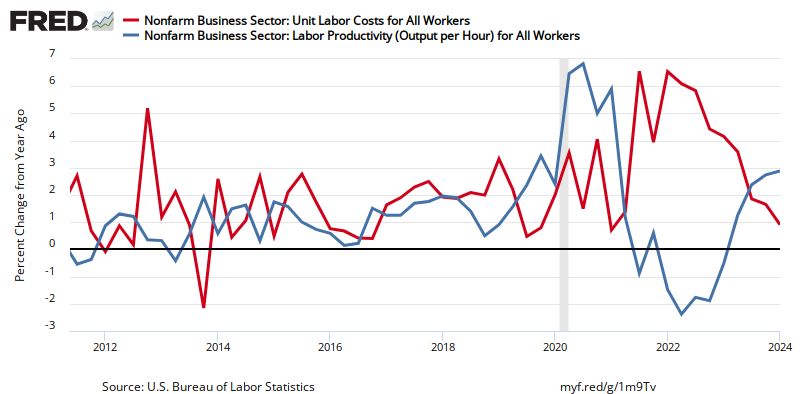

Nonfarm business sector labor productivity in 1Q2024 increased 2.9% year-over-year whilst unit labor costs increased 1.8% year-over-year. As long as productivity increases faster than costs – it slows export of jobs out of the U.S.

According to NFIB’s monthly jobs report, 40% (seasonally adjusted) of all owners reported jobs openings they could not fill in the current period, up three points from March, which was the lowest reading since January 2021. The percent of small business owners reporting labor cost as their top small business operating problem increased one point from March to 11%, only two points below the highest reading of 13 percent reached in December 2021. NFIB Chief Economist Bill Dunkelberg stated:

Hiring plans among small businesses increased once again in April, but open positions remain largely unfilled as owners struggle month after month to find employees. Overall, small businesses are not reporting net gains in employment as wage pressures and inflation keep the labor market tight.

Here is a summary of headlines we are reading today:

- Asian Oil Imports Dropped in April

- Clean Energy Sector Ignoring Growing Cybersecurity Threat, Experts Warn

- Stagflation Signals Soar as Manufacturing Surveys Show Skyrocketing Prices

- Gazprom Grapples with Historic Net Loss Amidst Gas Revenue Decline

- Exxon’s $60 Billion Pioneer Deal Set to Create Energy Supergiant

- Norway’s Cash Flow From Offshore Fields Crashes Due to Low Natural Gas Prices

- Dow closes more than 300 points higher, S&P 500 posts first winning day in three: Live updates

- Sony and Apollo send letter expressing interest in $26 billion Paramount buyout as company mulls Skydance bid

- Wall Street is confused and divided over how many times the Fed will cut rates this year

- Bitcoin climbs back to $59,000 after Fed signals it’s unlikely to raise rates: CNBC Crypto World

- IRS aims to more than double its audit rate for wealthiest taxpayers in strategic plan update

- “Sticky Inflation” Mentions On Earnings Calls Hits New High As Big Brands Warn About Buckling Consumers

- Weight loss drug wins 25,000 new US users a week

- 2-year Treasury yield ends at lowest in nearly a month after Powell suggests rate hike is unlikely

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.