Summary Of the Markets Today:

- The Dow closed up 322 points or 0.85%,

- Nasdaq closed up 1.51%,

- S&P 500 closed up 0.91%,

- Gold $2,314 up $2.70,

- WTI crude oil settled at $79 up $0.01,

- 10-year U.S. Treasury 4.583% down 0.008 points,

- USD index $105.34 down $0.410,

- Bitcoin $59,329 up $1,843 (3.20%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

U.S.-based employers announced 64,789 job cuts in April 2024, a 28% decrease from the 90,309 cuts announced one month prior. It is also down 3.3% from the 66,995 cuts announced in the same month in 2023. So far this year, companies have announced 322,043 job cuts, down 4.6% from the 337,411 announced through April last year.

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was up 16.4% year-over-year in March 2024 – the deficit is worsening. Imports are up 2.7% year-over-year while exports are up 1.4% year-over-year. A worsening trade deficit moderates GDP.

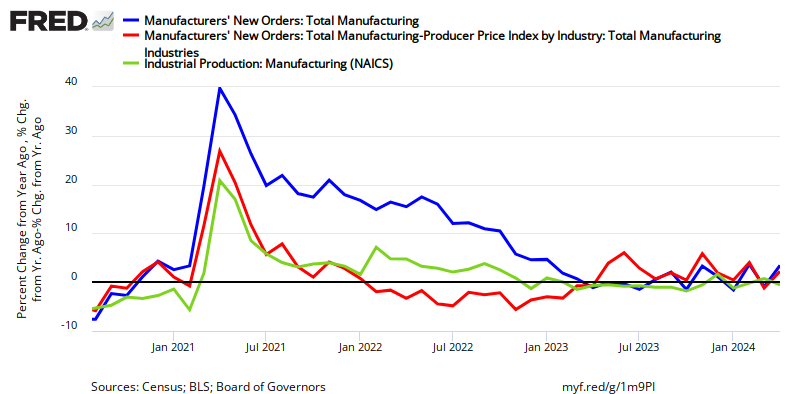

New orders for manufactured goods in March 2024 are down 0.9% year-over-year – down 1.3% inflation adjusted. This is directly opposite to the Federal Reserves manufacturing index which is up 1.0% year-over-year. In any event, manufacturing is not doing well in the current economy.

In the week ending April 27, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 210,000, a decrease of 3,500 from the previous week’s revised average. The previous week’s average was revised up by 250 from 213,250 to 213,500.

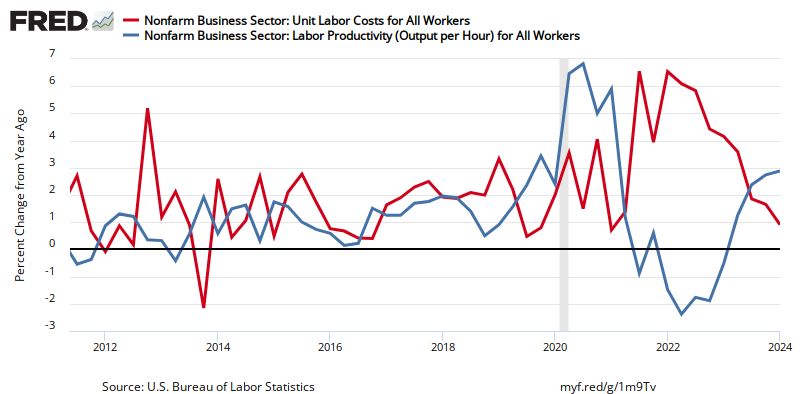

Nonfarm business sector labor productivity in 1Q2024 increased 2.9% year-over-year whilst unit labor costs increased 1.8% year-over-year. As long as productivity increases faster than costs – it slows export of jobs out of the U.S.

According to NFIB’s monthly jobs report, 40% (seasonally adjusted) of all owners reported jobs openings they could not fill in the current period, up three points from March, which was the lowest reading since January 2021. The percent of small business owners reporting labor cost as their top small business operating problem increased one point from March to 11%, only two points below the highest reading of 13 percent reached in December 2021. NFIB Chief Economist Bill Dunkelberg stated:

Hiring plans among small businesses increased once again in April, but open positions remain largely unfilled as owners struggle month after month to find employees. Overall, small businesses are not reporting net gains in employment as wage pressures and inflation keep the labor market tight.

Here is a summary of headlines we are reading today:

- Asian Oil Imports Dropped in April

- Clean Energy Sector Ignoring Growing Cybersecurity Threat, Experts Warn

- Stagflation Signals Soar as Manufacturing Surveys Show Skyrocketing Prices

- Gazprom Grapples with Historic Net Loss Amidst Gas Revenue Decline

- Exxon’s $60 Billion Pioneer Deal Set to Create Energy Supergiant

- Norway’s Cash Flow From Offshore Fields Crashes Due to Low Natural Gas Prices

- Dow closes more than 300 points higher, S&P 500 posts first winning day in three: Live updates

- Sony and Apollo send letter expressing interest in $26 billion Paramount buyout as company mulls Skydance bid

- Wall Street is confused and divided over how many times the Fed will cut rates this year

- Bitcoin climbs back to $59,000 after Fed signals it’s unlikely to raise rates: CNBC Crypto World

- IRS aims to more than double its audit rate for wealthiest taxpayers in strategic plan update

- “Sticky Inflation” Mentions On Earnings Calls Hits New High As Big Brands Warn About Buckling Consumers

- Weight loss drug wins 25,000 new US users a week

- 2-year Treasury yield ends at lowest in nearly a month after Powell suggests rate hike is unlikely

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Asian Oil Imports Dropped in AprilAsian crude oil imports fell in April from March, according to estimates by LSEG Oil Research, suggesting sluggish growth in Asia’s crude purchases so far this year. Last month, Asia – the bellwether of crude imports and implied import demand – saw imports averaging 26.89 million barrels per day (bpd), per LSEG Oil Research data cited by Reuters’s Asia Commodities and Energy Columnist, Clyde Russell. The April imports declined from 27.33 million bpd of crude oil Asia imported in March and were flat compared to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Asian-Oil-Imports-Dropped-in-April.html |

|

Clean Energy Sector Ignoring Growing Cybersecurity Threat, Experts WarnThe looming threat of cyberattacks from China is intensifying in the United States. Already, incidences of attacks from Chinese spy agencies are increasing in the West, and Beijing could seriously escalate its cyber warfare tactics if it sensed any heightened threat from the U.S. or its allies. As such, increased planning and investment in cybersecurity is more important than ever across key U.S. industries. However, one of the quickest growing sectors in the country – the clean energy sector – has dedicated worryingly little attention… Read more at: https://oilprice.com/Energy/Energy-General/Clean-Energy-Sector-Ignoring-Growing-Cybersecurity-Threat-Experts-Warn.html |

|

Stagflation Signals Soar as Manufacturing Surveys Show Skyrocketing PricesWhile ‘hard’ data has been improving recently (albeit then downwardly revised a month later), it is the ‘soft’ survey data that has collapsed amid Bidenomics. Source: Bloomberg And this morning continued that trend as S&P Global’s US Manufacturing PMI (survey) fell from 51.9 in March to 50.0 as the final print for April (49.9 flash). ISM’s Manufacturing survey also missed, dropping from 50.3 to 49.2 (contraction). Source: Bloomberg Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said: “Business conditions… Read more at: https://oilprice.com/Finance/the-Economy/Stagflation-Signals-Soar-as-Manufacturing-Surveys-Show-Skyrocketing-Prices.html |

|

Plasma Physicists Use Magnetic Imperfections to Enhance Fusion ReactionPrinceton Plasma Physics Laboratory (PPPL) idea follows the Japanese art of kintsugi, an artist takes the broken shards of a bowl and fuses them back together with gold to make a final product more beautiful than the original. Image Credit: Princeton Plasma Physics Laboratory. Click the press release link for the largest view and more images. That idea is inspiring a new approach to managing plasma, the super-hot state of matter, for use as a fusion power source. Scientists are using the imperfections in magnetic fields that confine a reaction… Read more at: https://oilprice.com/Energy/Energy-General/Plasma-Physicists-Use-Magnetic-Imperfections-to-Enhance-Fusion-Reaction.html |

|

France Crafts Offshore Wind Expansion to Meet Climate GoalsFrance has revealed an ambitious strategy to amplify its offshore wind capacity, signaling a determined effort to make as much progress as neighboring nations in meeting climate objectives. In an announcement during a visit to Saint-Nazaire on the Atlantic coast, Finance Minister Bruno Le Maire unveiled a comprehensive plan encompassing tenders and incentives aimed at increasing its offshore wind capacity sixfold by 2035. This ambitious endeavor comes as a response to the wind industry’s recent struggles with escalating costs and supply-chain bottlenecks.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/France-Crafts-Offshore-Wind-Expansion-to-Meet-Climate-Goals.html |

|

Turkmenistan Tops Russia in Gas Export Earnings to ChinaRussia’s energy behemoth Gazprom announced with great fanfare in early 2024 that it had overtaken Turkmenistan as China’s largest supplier of natural gas in terms of volume. But when it comes to export earnings, Ashgabat still tops Moscow. The Turkmen portal, Oil & Gas, reports that during the first quarter of this year, Ashgabat generated $2.4 billion in income from gas exports to China. That figure was confirmed by Daryo, Uzbekistan’s most popular news website. The Daryo report noted that Russia earned $2 billion… Read more at: https://oilprice.com/Energy/Natural-Gas/Turkmenistan-Tops-Russia-in-Gas-Export-Earnings-to-China.html |

|

Gazprom Grapples with Historic Net Loss Amidst Gas Revenue DeclineRussia’s Gazprom Group, a state-controlled energy giant, has disclosed its first annual net loss in 23 years, signaling a significant shift in financial performance attributed to dwindling gas shipments to Europe and pricing pressures. In the wake of restricted gas flows to Europe, historically Gazprom’s primary market, and plummeting gas prices exacerbated by geopolitical tensions, Gazprom Group, which encompasses oil and power ventures alongside its core gas operations, reported a substantial 629 billion-ruble ($6.84 billion) loss for the fiscal… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gazprom-Grapples-with-Historic-Net-Loss-Amidst-Gas-Revenue-Decline.html |

|

Egypt Eyes Large Role in Green Hydrogen ProductionAs host of COP27 two years ago, Egypt saw a flurry of announcements for large scale green hydrogen production mostly in the huge Suez Canal Economic Zone (SCZone) that straddles the ship canal from Port Said to the Gulf of Suez. The proposals draw upon Egypt’s rich solar and wind resources to power electrolysis, anticipating ammonia and other hydrogen derivative exports. At COP27, the government hailed the signing of eight framework agreements with companies including ACWA Power, Alfanar, Masdar, Scatec, TotalEnergies, and others. The hydrogen… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Egypt-Eyes-Large-Role-in-Green-Hydrogen-Production.html |

|

Taliban Aims to Create Energy Trade Hub Eyeing Russian Oil ExportsThe Taliban, who govern Afghanistan, are working with Kazakhstan and Turkmenistan to create a regional energy trade hub that would facilitate oil sales from Russia to South Asia, Taliban acting commerce minister Nooruddin Azizi told Reuters this week. Representatives of Afghanistan, Kazakhstan, and Turkmenistan have recently discussed in Kabul the idea of creating an energy and logistics hub in the Herat province in western Afghanistan. The three countries plan to invest in the hub, which is expected to be a hub for oil from Russia to the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Taliban-Aims-to-Create-Energy-Trade-Hub-Eyeing-Russian-Oil-Exports.html |

|

Exxon’s $60 Billion Pioneer Deal Set to Create Energy SupergiantHaving adversely intervened in virtually every other M&A deal in the past 3 years, the Biden FTC will reportedly allow Exxon’s $60 billion purchase of Pioneer to go through after the companies agreed to minor concessions, Bloomberg reported citing people familiar with the matter. The announcement of the deal will likely come any moment, and the resulting deal will make Exxon – a company which Biden once said makes money money than god – far and away the biggest oil and natural gas producer in the Permian Basin, North America’s largest… Read more at: https://oilprice.com/Energy/Crude-Oil/Exxons-60-Billion-Pioneer-Deal-Set-to-Create-Energy-Supergiant.html |

|

Canadian Natural Resources Misses Q1 Earnings ExpectationsCanadian Natural Resources (NYSE: CNQ), the top oil and gas producer in Canada, reported lower-than-expected earnings for the first quarter, dragged down by weaker prices for synthetic crude oil and natural gas. Canadian Natural Resources reported on Thursday adjusted net earnings per share of US$1.00 (C$1.37), compared to the average analyst estimate of US$1.08 (C$1.48) per share, according to LSEG data cited by Reuters. While realized prices for crude were slightly higher than in Q4 2023, the realized natural gas prices and synthetic… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Canadian-Natural-Resources-Misses-Q1-Earnings-Expectations.html |

|

UAE Quietly Boosts Oil Production Capacity Ahead of OPEC MeetingThe United Arab Emirates state-owned oil company, Adnoc, has updated its maximum crude oil production capacity figure—and without much fanfare. ADNOC has quietly updated the figure on its website but did not make an official announcement. The new capacity is 4.85 million barrels per day (bpd)—up from the 4.65 million bpd that it published in 2023. Its published natural gas production capacity is 11.5 bcf per day. ADNOC has plans to increase its oil production capacity to 5 million bpd by 2027—a target the state-owned… Read more at: https://oilprice.com/Energy/Energy-General/UAE-Quietly-Boosts-Oil-Production-Capacity-Ahead-of-OPEC-Meeting.html |

|

Norway’s Cash Flow From Offshore Fields Crashes Due to Low Natural Gas PricesNorway saw cash flow from its stakes in oil and gas fields nearly halve in the first quarter of 2024 compared to the same period of 2023, as natural gas prices slumped and gas consumption in Europe was below expectations, said state company Petoro, which manages field holdings of Western Europe’s top oil and gas producer. In the first quarter of the year, Petoro delivered a cash flow of $5.4 billion (60 billion Norwegian crowns) from the State’s Direct Financial Interest (SDFI) to Norway. The cash flow was $5.14 billion (57 billion… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Norways-Cash-Flow-From-Offshore-Fields-Crashes-Due-to-Low-Natural-Gas-Prices.html |

|

Major Australian Pension Fund to Restrict Coal InvestmentsAustralian Retirement Trust, which manages $183 billion (AUS$280 billion) of retirement savings, is placing thermal coal on its exclusion list as of July 1, as it looks to have a net-zero emissions portfolio by 2050. Thermal coal includes the mining of lignite, bituminous, anthracite, and steam coal and its sale to external parties, the second-largest Australian pension fund said in updates to its product offering. The fund will be screening its investments and exclude direct investments in coal companies that have 10% of revenue from… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Major-Australian-Pension-Fund-to-Restrict-Coal-Investments.html |

|

Shell Starts $3.5-Billion Share Buyback as Q1 Profits Trump EstimatesHelped by higher crude and product trading profits and increased refining margins, Shell (NYSE: SHEL) smashed earnings estimates for the first quarter of the year and announced a new $3.5-billion share buyback as the UK-based supermajor looks to close the stock valuation gap to its U.S. peers. Shell reported on Thursday adjusted earnings of $7.7 billion for the first quarter, down from $9.6 billion for the same period of 2023. This year’s first-quarter earnings were higher by 6% compared to the fourth quarter of 2023, thanks to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-Starts-35-Billion-Share-Buyback-as-Q1-Profits-Trump-Estimates.html |

|

Dow closes more than 300 points higher, S&P 500 posts first winning day in three: Live updatesStocks rose Thursday as investors looked ahead to more corporate earnings and a key labor report set for later in the week. Read more at: https://www.cnbc.com/2024/05/01/stock-market-today-live-updates.html |

|

Apple’s China sales in focus ahead of earningsInvestor expectations are low and Apple could surpass them even if sales growth is weak. Read more at: https://www.cnbc.com/2024/05/02/apple-aapl-earnings-report-q2-2024.html |

|

Sony and Apollo send letter expressing interest in $26 billion Paramount buyout as company mulls Skydance bidSony and Apollo showed formal interest in a Paramount Global buyout as Paramount’s special committee is prepared to give its recommendation to Skydance. Read more at: https://www.cnbc.com/2024/05/02/sony-apollo-express-interest-in-paramount-buyout-amid-skydance-bid.html |

|

Wall Street is confused and divided over how many times the Fed will cut rates this yearMost economists for the biggest forecasting firms expect the central bank will lower benchmark interest rates sometime later this year. Read more at: https://www.cnbc.com/2024/05/02/wall-street-is-confused-and-divided-over-how-many-times-the-fed-will-cut-rates-this-year.html |

|

JPMorgan is cautious on crypto as retail investors dump following ETF hypeThe crypto market was upbeat on Wednesday after the Fed pause, but investors should still tread carefully, according to JPMorgan. Read more at: https://www.cnbc.com/2024/05/02/jpmorgan-is-cautious-on-crypto-as-retail-investors-dump-following-etf-hype.html |

|

FTC accuses ex-Pioneer CEO of colluding with OPEC, blocks him from Exxon board seatThe FTC has decided to refer the allegations to the Justice Department for a potential criminal investigation, according to The Wall Street Journal. Read more at: https://www.cnbc.com/2024/05/02/ftc-accuses-ex-pioneer-ceo-of-colluding-with-opec-blocks-him-from-exxon-board.html |

|

Peloton CEO Barry McCarthy to step down, company to lay off 15% of staff as it looks to refinance debtPeloton announced Thursday that CEO Barry McCarthy will be stepping down just over two years after he took over from founder John Foley. Read more at: https://www.cnbc.com/2024/05/02/peloton-ceo-barry-mccarthy-steps-down-15percent-of-staff-laid-off.html |

|

Bitcoin climbs back to $59,000 after Fed signals it’s unlikely to raise rates: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Alex Marinier of New Form Capital discusses Wall Street’s growing interest in blockchain technology. Read more at: https://www.cnbc.com/video/2024/05/02/bitcoin-climbs-to-59000-fed-signals-unlikely-to-raise-rates-crypto-world.html |

|

Democratic senator aims at Amazon’s labor practices with first federal bill regulating quotasThe bill seeks to regulate productivity quotas used by warehouse employers, including Amazon. Read more at: https://www.cnbc.com/2024/05/02/senator-takes-aim-at-amazons-labor-practices-with-federal-quota-bill.html |

|

Trump Media pushes House to probe 8 firms over short-selling of DJT sharesDonald Trump is the majority shareholder in Trump Media and the best-known user of its Truth Social app. When DJT shares fall, his net worth can take a bit hit. Read more at: https://www.cnbc.com/2024/05/02/djt-trump-media-ids-firms-for-house-short-selling-probe.html |

|

IRS aims to more than double its audit rate for wealthiest taxpayers in strategic plan updateThe IRS has released an update on its strategic operating plan, which includes more audits on the wealthiest taxpayers, large corporations and partnerships. Read more at: https://www.cnbc.com/2024/05/02/irs-aims-to-more-than-double-its-audit-rate-on-wealthiest-taxpayers-.html |

|

World’s largest olive oil producer says the industry faces one of its toughest moments everSpain’s Deoleo says the industry must undergo a “profound transformation” as it grapples with one of the most challenging moments in its history. Read more at: https://www.cnbc.com/2024/05/02/spains-deoleo-says-olive-oil-sector-faces-one-of-its-toughest-moments.html |

|

Warren Buffett’s annual meeting may explain surprising moves in his stock portfolioThe 93-year-old icon might spell out at Berkshire’s annual meeting this weekend some of the recent moves in his giant equity portfolio. Read more at: https://www.cnbc.com/2024/05/02/souring-on-apple-mystery-bank-stock-buffett-may-clarify-portfolio-at-annual-meeting.html |

|

“Sticky Inflation” Mentions On Earnings Calls Hits New High As Big Brands Warn About Buckling ConsumersOn Wednesday, Fed Chairman Jerome Powell dismissed the idea that the economy could slide into “stagflation” despite multiple warning signs of a slowing economy and inflation reaccelerating higher. “I was around for stagflation, and it was 10% unemployment, it was high-single-digit inflation,” Powell said, noting, “Right now we have 3% growth, which is pretty solid growth, I would, say by any measure, and we have inflation running under 3%.” Powell then claimed he didn’t see “stag” or the “flation” anywhere. However, Powell has been very wrong before. He missed the initial surge in inflation in the months following the virus pandemic after the government helicopter dropped trillions of dollars on the economy. More recently, Powell prematurely pivoted on the interest rate hiking cycle before having to backtrack. Meanwhile, America’s largest companies are warning consumers are buckling due to the weight of inflation. This comes amid the failure of Bidenomics, where a new Gallup poll has shown a parabolic surge in households complaining about inflation-related financial problems.

|

|

“This Conversation Didn’t Happen”: Matt Gaetz Demands Investigation After CIA Program Manager Gets Loose Lips About TrumpCongressman Matt Gaetz (R-FL) has called for an investigation into claims made by a CIA “senior intelligence officer with a top-secret” during an undercover encounter with a journalist working for James O’Keefe of O’Keefe Media Group.

The CIA contractor of more than a decade, Amjad Fseisi, revealed among other things, that:

|

|

COVID-19 Linked To ‘Alarming Rise’ Of Rare And Highly Lethal Fungal InfectionAuthored by Megan Redshaw, J.D. via The Epoch Times (emphasis ours),

Research suggests that the SARS-CoV-2 virus, the overuse of immunosuppressive COVID-19 treatments such as corticosteroids and antibiotics, and the global pandemic response made people more susceptible to coinfections such as COVID-19-associated mucormycosis (CAM). Mucormycosis, also known as Read more at: https://www.zerohedge.com/medical/covid-19-linked-alarming-rise-rare-and-highly-lethal-fungal-infection |

|

Biden Calls US Allies Japan & India ‘Xenophobic’: “They Don’t Want Immigrants”President Biden chose a strange moment to lash out at allies and humiliate them, given his administration is busy trying to build international consensus against Russia as it continues the war in Ukraine, and on sensitive flashpoint issues like the Israel-Hamas conflict. On Wednesday Biden called Japan and India ‘xenophobic’ during off-camera remarks at a campaign fundraiser in D.C. He included these longtime US allies in the controversial statement alongside Washington rivals and enemies China and Russia.

President Joe Biden, Japan’s Prime Minister Fumio Kishida and South Korea’s President Yoon Suk Yeol last year, via Reuters. He said all of these countries are unwelcoming to migrants ultimately “because they are xenophobic.” Leaders in Japan and India are without doubt blistering with outrage. “This election is about freedom, America and democracy. That’s why I badly need you. You know, one of the reasons why our e … Read more at: https://www.zerohedge.com/geopolitical/biden-calls-us-allies-japan-india-xenophobic-they-dont-want-immigrants |

|

Post Office ‘saw postmasters as enemies’A former top lawyer at the postal group admitted its security team took an “adversarial” approach Read more at: https://www.bbc.com/news/articles/c97zpq95npmo |

|

Goldman Sachs removes bankers’ bonus limitInvestment bank becomes the first to bring in changes first announced by Kwasi Kwarteng in 2022 Read more at: https://www.bbc.co.uk/news/business-68945638 |

|

Weight loss drug wins 25,000 new US users a weekNovo Nordisk is under pressure to cut US prices of its weight loss drug, as demand soars. Read more at: https://www.bbc.com/news/articles/ck7lv4rmryno |

|

Mark your calendar! These key events may move stock markets in MayHere’s a look at other key macro events that can impact the stock markets this month Read more at: https://economictimes.indiatimes.com/markets/stocks/news/mark-your-calendar-these-key-events-may-move-stock-markets-in-may/slideshow/109786102.cms |

|

Technical Breakout Stocks: REC, CESC and Power Grid hit fresh highs; here’s how to trade power stocks on FridayRally was seen in power and utilities indices, which were up over 1% each, followed by gains in auto and metal stocks. Some profit taking was seen in banks, telecom and consumer durables. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/technical-breakout-stocks-rec-cesc-and-power-grid-hit-fresh-highs-heres-how-to-trade-power-stocks-on-friday/articleshow/109788535.cms |

|

2-year Treasury yield ends at lowest in nearly a month after Powell suggests rate hike is unlikelyRates on U.S. government debt finished mostly lower on Thursday, a day after Federal Reserve Chair Jerome Powell guided financial markets away from the likelihood of any interest-rate hike. Read more at: https://www.marketwatch.com/story/two-year-treasury-yields-back-below-5-after-powell-suggests-rate-hike-unlikely-130e25ba?mod=mw_rss_topstories |

|

Dave & Buster’s allowing arcade gambling raises ‘significant concerns,’ advocacy group saysOne problem-gambling organization is concerned about ‘youth exposure’ to betting at Dave & Buster’s. Read more at: https://www.marketwatch.com/story/dave-busters-allowing-arcade-gambling-raises-significant-concerns-advocacy-group-says-dac504dc?mod=mw_rss_topstories |

|

‘I live in a slum’: My ex-husband knocked down, then rebuilt my home and left it in foreclosure. Now he refuses to pay alimony.“He woke one morning and announced he was done.” Read more at: https://www.marketwatch.com/story/i-live-in-a-slum-my-ex-husband-knocked-down-then-rebuilt-my-home-and-left-it-in-foreclosure-now-he-refuses-to-pay-alimony-dd18b330?mod=mw_rss_topstories |

(Freepik/Shutterstock)The COVID-19 pandemic has caused an alarming rise of an aggressive and highly fatal secondary fungal infection among those with active or recovered COVID-19.

(Freepik/Shutterstock)The COVID-19 pandemic has caused an alarming rise of an aggressive and highly fatal secondary fungal infection among those with active or recovered COVID-19.