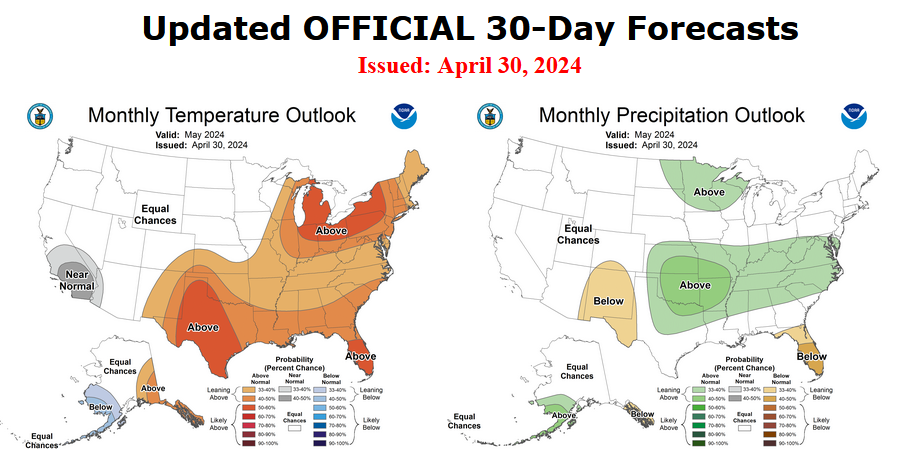

Today Through the Fourth Friday (22 to 28 days) Weather Outlook for the U.S. and a Six-Day Forecast for the World: posted May 5, 2024

It is difficult to find a more comprehensive Weather Outlook anywhere else with the ability to get a local 10-day Forecast also.

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks and a six-day World weather outlook which can be very useful for travelers.

First the NWS Short Range Forecast. The afternoon NWS text update can be found here but it is unlikely to have changed very much. The images in this article automatically update.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Sun May 05 2024

Valid 12Z Sun May 05 2024 – 12Z Tue May 07 2024…There is a Moderate Risk of excessive rainfall over parts of the

Southern Plains on Sunday and a Slight Risk over the Northern High Plains

and Central Plains/Middle Mississippi Valley on Monday……Heavy snow over the southern Cascades, Northern Rockies, and Uinta

Mountains on Sunday and Monday……There is a Moderate Risk of severe thunderstorms over parts of the

Central/Southern High Plains on Monday…A front extending from the Northern Intermountain Region to Southern

California on Sunday will advance eastward to the Northern/Middle

Mississippi Valley and then to the Southern Plains. At the same time, the

associated surface low deepens significantly by Tuesday.The system will produce rain and higher-elevation snow over parts of the

Pacific Northwest, Northern Intermountain Region, and Great Basin, with

heavy snow developing over parts of the Southern Cascades. Scattered rain

and higher-elevation snow will also develop over parts of California.

Overnight Sunday, the snow will expand into the Northern/Central Rockies

as light rain develops over the Northern High Plains.On Monday, the snow will continue over parts of the Northern Intermountain

Region and Northern/Central Rockies, with heavy snow developing over parts

of the Northern Rockies and Uinta Mountains.Moreover, moisture from the Gulf of Mexico will stream northward over the

Pains Sunday night into Monday and Tuesday. The moisture will aid in

creating showers and thunderstorms with heavy rain over parts of eastern

Montana. Therefore, the WPC has issued a Slight Risk (level 2/4) of

excessive rainfall over parts of the Northern High Plains from Monday into

Tuesday morning. The associated heavy rain will create mainly localized

areas of flash flooding, with urban areas, roads, small streams, and

low-lying areas the most vulnerable.Furthermore, showers and thunderstorms with heavy rain will develop over

parts of eastern Kansas/Nebraska and western Iowa/Missouri as the front

moves out of the Rockies onto the Plains. Therefore, the WPC has issued a

Slight Risk (level 2/4) of excessive rainfall over parts of the Central

Plains/Middle Mississippi Valley from Monday into Tuesday morning. The

associated heavy rain will create mainly localized areas of flash

flooding, with urban areas, roads, small streams, and low-lying areas the

most vulnerable.More significantly, the system will produce showers and severe

thunderstorms as the boundary moves onto the Plains. Therefore, the SPC

has issued a Moderate Risk (level 4/5) of severe thunderstorms over parts

of the Central/Southern Plains from Monday into Tuesday morning. The

hazards associated with these thunderstorms are frequent lightning, severe

thunderstorm wind gusts, hail, and a few tornadoes. There will be the

added threat of EF2 to EF5 tornadoes, severe thunderstorm wind gusts of 65

knots or greater, and hail two inches or greater over the area.Meanwhile, another front extending from the Great Lakes to the Southern

Plains will slowly move eastward off the Northeast Coast on Sunday. At the

same time, the western portion returns northward as a warm front over the

Middle Mississippi/Ohio Valleys by Tuesday. Moisture from the Western Gulf

of Mexico will stream northward over eastern Texas, producing showers and

thunderstorms with heavy rain. Therefore, the WPC has issued a Moderate

Risk (level 3/4) of excessive rainfall over eastern Texas through Monday

morning. The associated heavy rain will create numerous areas of flash

flooding. Furthermore, many streams may flood, potentially affecting

larger rivers.In addition, some of the showers and thunderstorms will be severe.

Therefore, the SPC has issued a Slight Risk (level 2/5) of severe

thunderstorms over parts of the Southern Plains through Monday morning.

The hazards associated with these thunderstorms are frequent lightning,

severe thunderstorm wind gusts, hail, and a few tornadoes. Also, showers

and thunderstorms will extend from the Lower Great Lakes/Ohio Valley to

the Southeast on Sunday. The showers and thunderstorms will continue along

and near the boundary from the Ohio Valley to the Mid-Atlantic and

southward from the Lower Mississippi Valley to the Southeast Monday into

Tuesday morning.