Summary Of the Markets Today:

- The Dow closed up 450 points or 1.18%,

- Nasdaq closed up 1.99%,

- S&P 500 closed up 1.26%,

- Gold $2,309 down $0.40,

- WTI crude oil settled at $78 down $0.86,

- 10-year U.S. Treasury 4.500% down 0.071 points,

- USD index $105.05 down $0.250,

- Bitcoin $62,117 up $2,956 (4.94%),

- Baker Hughes Rig Count: U.S. -8 to 605 Canada +2 to 120

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

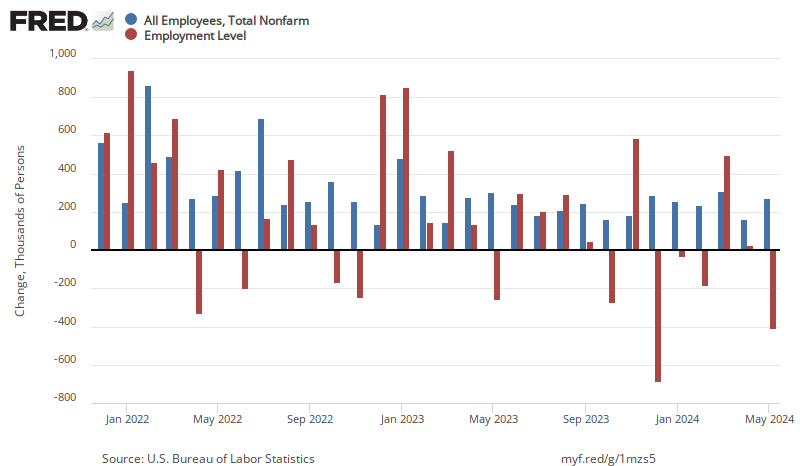

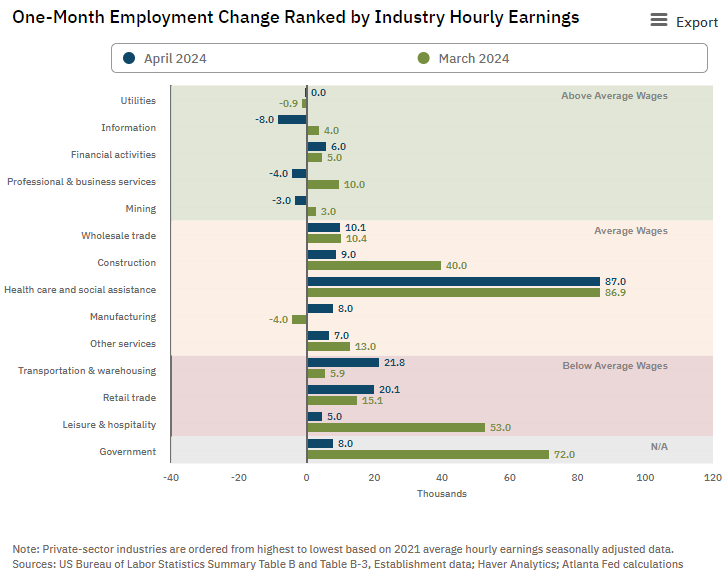

Total nonfarm payroll employment increased by 175,000 (establishment survey) in April 2024, and the unemployment rate changed little at 3.9 % (household survey). The majority of job gains occurred in health care, in social assistance, and in transportation and warehousing. There was a major discrepancy this month with the household survey only showing 25,000 jobs added (red bar in graph below) against the headlined 175,000 from the establishment survey (blue bar in graph below). Before the pandemic, it was estimated that the US economy needed to add 60,000–100,000 jobs each month to keep up with population growth and retirements. Chicago Federal Reserve President Austan Goolsbee views April’s 175,000 job gains as “very solid.” It’s a sign the economy is shifting back toward pre-Covid “conventional times.

In April 2024, the ISM Services PMI® registered 49.4%, 2 percentage points lower than March’s reading of 51.4%. The composite index indicated contraction in April after 15 consecutive months of growth since a reading of 49 percent in December 2022, the first contraction since May 2020 (45.4 percent). The Business Activity Index registered 50.9 percent in April, which is 6.5 percentage points lower than the 57.4 percent recorded in March. This low reading is a warning that the services side of the economy is stalling.

Here is a summary of headlines we are reading today:

- Automotive Industry Grapples with Plummeting Resale Values of EVs

- UK Awards 31 New North Sea Oil and Gas Exploration Licenses

- U.S. Oil, Gas Drillers See Continued Slowdown

- Oil Prices Under Pressure as Bearish Sentiment Builds

- G7 Acknowledges Russian Asset Seizure Not on the Table

- Oil Prices Fall to 7-Week Low as Market Pressures Mount

- Dow closes higher by more than 400 points as April jobs report bolsters Fed rate cut hopes: Live updates

- Apple on pace for best day since 2022 after earnings beat, $110 billion stock buyback

- Bitcoin tops $61,000 after weaker-than-expected April jobs report: CNBC Crypto World

- Interest rates and the AI-fueled rally remain top of mind for stock investors in the week ahead

- “Irrevocably Shaken”: Columbia Law Review Editors Ask For Cancellation Of Exams Due To Protests

- Slowdown in US job growth revives rate cut talk

- Treasury yields see biggest weekly drops in months as tepid April jobs report raises rate-cut hopes

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

High Costs Threaten to Derail Europe’s Plans to Decarbonize Steel IndustryAs the energy transition continues at pace, reducing the carbon footprint of traditionally high-emitting industries is increasingly crucial to limiting global emissions. Of these hard-to-abate sectors, steel manufacturing is one of the most challenging. Despite incentives and tax breaks designed to promote the production of green steel – produced using zero-carbon electricity – European steel mills are facing an up-hill struggle. The long-term economic viability of green steel versus grey steel – produced using fossil fuels –… Read more at: https://oilprice.com/Energy/Energy-General/High-Costs-Threaten-to-Derail-Europes-Plans-to-Decarbonize-Steel-Industry.html |

|

Automotive Industry Grapples with Plummeting Resale Values of EVsShares in names like VW, Mercedes and Stellantis were lower this week, heading into Wednesday’s session, after news of “falling demand” in Europe. In the first quarter of this year, Europe’s top two car manufacturers faced a downturn due to diminished demand in China and domestic markets, Financial Times reported on Tuesday this week. Volkswagen Group saw a significant decline in profits, dropping by a fifth from the previous year to €4.6bn, largely attributed to declining resale values and supply issues at Audi, a key brand within the… Read more at: https://oilprice.com/Energy/Energy-General/Automotive-Industry-Grapples-with-Plummeting-Resale-Values-of-EVs.html |

|

Exxon Completes $60B Acquisition of PioneerExxon Mobil Corporation has finalized its acquisition of Pioneer Natural Resources, marking a monumental milestone in the energy sector. With a price tag of $60 billion, this deal stands as one of the largest oil-and-gas acquisitions in recent memory, reshaping the landscape of the industry. The completion of this megadeal significantly bolsters Exxon’s presence in the coveted Permian Basin. This strategic move effectively doubles Exxon’s footprint in the region, solidifying its position as a dominant player in one of the most prolific oil-producing… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Exxon-Completes-60B-Acquisition-of-Pioneer.html |

|

Anglo American Rejects BHP’s $38.8 Billion Takeover BidMetal Miner Metals markets recently saw UK metal and mining multinational Anglo American reject a £31.1 billion ($38.8 billion) takeover bid from Australia’s BHP. Meanwhile, shareholders in the latter company continue to urge an increase in the offer price.On April 26, London- and Johannesburg-listed Anglo American’s board of directors unanimously rejected BHP’s unsolicited, all-share offer made the previous day. Under the offer, Anglo American would demerge all its shareholdings in Anglo American Platinum Limited and Kumba… Read more at: https://oilprice.com/Finance/the-Markets/Anglo-American-Rejects-BHPs-388-Billion-Takeover-Bid.html |

|

UK Awards 31 New North Sea Oil and Gas Exploration LicensesThe UK’s North Sea Transition Authority (NSTA) offered on Friday another 31 licenses for North Sea exploration in the final tranche of the 33rd oil and gas licensing round. In all three tranches of the licensing round, the UK regulator has awarded over the past few months a total of 82 licenses to 50 companies. The first tranche offered 27 licenses in October 2023, with the second offering 24 licenses in January 2024. The 33rd round has attracted 115 bids from 76 companies across 257 blocks and part-blocks, NSTA said.… Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Awards-31-New-North-Sea-Oil-and-Gas-Exploration-Licenses.html |

|

U.S. Oil, Gas Drillers See Continued SlowdownThe total number of active drilling rigs for oil and gas in the United States fell this week, according to new data that Baker Hughes published on Friday. The total rig count fell by 8 to 605 this week, compared to 748 rigs this same time last year. The number of oil rigs fell by 7 this week, after falling by 5 in the week prior. Oil rigs now stand at 499–down by 89 compared to this time last year. The number of gas rigs fell by 3 this week to 102, a loss of 55 active gas rigs from this time last year. Miscellaneous rigs rose by 2. Meanwhile,… Read more at: https://oilprice.com/Energy/Energy-General/US-Oil-Gas-Drillers-See-Continued-Slowdown.html |

|

Chevron Says It Will Take Weeks to Restore Gorgon LNG OutputChevron is repairing a mechanical fault in a turbine at one of the three LNG production trains at its Gorgon LNG facility in Australia, with works expected to take weeks, the local unit of the U.S. supermajor told LNG Prime on Friday. The fault at the turbine occurred in the afternoon local time on Tuesday, April 30, the company said on Friday. Chevron Australia has already started working to repair the fault, with works expected to “take a number of weeks,” a spokesperson for Chevron Australia told LNG… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Says-It-Will-Take-Weeks-to-Restore-Gorgon-LNG-Output.html |

|

China, Australia, and Russia Dominate Global Gold ProductionOver 3,000 tonnes of gold were produced globally in 2023. In this graphic, Visual Capitalist’s Marcus Lu lists the world’s leading countries in terms of gold production. These figures come from the latest USGS publication on gold statistics (published January 2024). China, Australia, and Russia Produced the Most Gold in 2023 China was the top producer in 2023, responsible for over 12% of total global production, followed by Australia and Russia. Gold mines in China are primarily concentrated in eastern provinces such as Shandong, Henan, Fujian,… Read more at: https://oilprice.com/Metals/Gold/China-Australia-and-Russia-Dominate-Global-Gold-Production.html |

|

Strong Natural Gas Demand Helps TC Energy Top Q1 Profit EstimateTC Energy Corporation reported on Friday an increase in comparable earnings for the first quarter of 2024 versus the same period last year, beating analyst estimates, as natural gas pipeline deliveries from western Canada to domestic and export markets jumped to a record. The Canada-based pipeline operator booked comparable earnings of US$0.91 (C$1.24) per common share for the first quarter, compared to US$0.89 (C$1.21) per common share for the first quarter of 2023. The earnings per share for Q1 2024 topped the average analyst… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Strong-Natural-Gas-Demand-Helps-TC-Energy-Top-Q1-Profit-Estimate.html |

|

Oil Prices Under Pressure as Bearish Sentiment BuildsBearish sentiment is building in oil markets after the latest U.S. economic data sparked concerns over demand. Rising oil inventories and a potential cooling in geopolitical tensions only added to the downward pressure on oil prices.Friday, April 3rd 2024The disappointment of the money markets with yet another hotter-than-expected set of US inflation data, aggravated by higher crude inventories and slackening geopolitical risk, has triggered a notable drop in oil prices, with both WTI and Brent shedding more than $5 per barrel since last… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Under-Pressure-as-Bearish-Sentiment-Builds.html |

|

OPEC Resolves Compensation Plans for Overproducing MembersOPEC convened a workshop today to address oil overproduction issues and devise comprehensive compensation plans to make up for previous overages, according to an official OPEC press release. The push for production cut compliance comes as the price of Brent crude is trading down roughly $6 per barrel over the last 30 days. The workshop brought together technical experts from Iraq and Kazakhstan, along with industry professionals from secondary sources, and was prompted by the recent mandates outlined in the 35th OPEC and non-OPEC Ministerial Meeting… Read more at: https://oilprice.com/Latest-Energy-News/World-News/OPEC-Resolves-Compensation-Plans-for-Overproducing-Members.html |

|

Glencore Could Start a Bidding War for Anglo AmericanCommodity giant Glencore has held early internal discussions about making a potential approach for mining giant Anglo American, which has just rejected an initial takeover offer from BHP, Reuters reported on Friday, quoting two sources. Glencore, which is active in both commodity mining and trading, hasn’t approached Anglo American yet, and it may not do it as all discussions have been internal and preliminary, one of the sources told Reuters. “We do not comment on market rumor or speculation,” a spokesperson for Glencore… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Glencore-Could-Start-a-Bidding-War-for-Anglo-American.html |

|

G7 Acknowledges Russian Asset Seizure Not on the TableOfficials from the G7 group of the world’s most industrialized nations are privately admitting that an all-out seizure of frozen Russian assets is no longer on the table, the Financial Times reported on Friday. Ukraine has been pushing for the West to seize the frozen Russian assets, but the U.S., the EU, and various other G20 countries disagree on whether confiscation of assets should be an option, FT notes. G7 officials are privately ruling out the idea of outright asset seizure and are exploring other “ways of extracting funding… Read more at: https://oilprice.com/Latest-Energy-News/World-News/G7-Acknowledges-Russian-Asset-Seizure-Not-on-the-Table.html |

|

Texas Is Preparing for Electricity Demand to Surge1. Shell Remains on the Right Track to Recovery – UK-based energy major Shell was one of the rare oil companies to surpass analyst expectations with its Q1 reported profit of $7.7 billion, buoyed by rebounding LNG production. – Shell’s cash flow rose by 6% from Q4 2023 to $13.3 billion, prompting the oil major to ramp up share repurchases by a further $3.5 billion over the next three months. – Compared to somewhat disappointing Exxon and Chevron results, Shell timed its refinery maintenance for the last quarter of 2023, allowing… Read more at: https://oilprice.com/Energy/Energy-General/Texas-Is-Preparing-for-Electricity-Demand-to-Surge.html |

|

Oil Prices Fall to 7-Week Low as Market Pressures MountOil prices have dipped to their lowest levels in nearly two months, with U.S. West Texas Intermediate (WTI) and Brent crude being particularly impacted. These declines reflect a complex interplay of escalating supply levels, subdued demand, and challenging economic indicators, all of which signal a potentially extended bearish phase in the oil markets. Supply Factors The unexpected rise in U.S. crude inventories, as reported by the American Petroleum Institute (API), has notably contributed to the downward pressure on oil prices. A significant… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Fall-to-7-Week-Low-as-Market-Pressures-Mount.html |

|

Dow closes higher by more than 400 points as April jobs report bolsters Fed rate cut hopes: Live updatesFollowing April’s weaker-than-expected job growth and moderating wage gains in April, traders are pricing in a second rate cut by the end of the year. Read more at: https://www.cnbc.com/2024/05/02/stock-market-today-live-updates.html |

|

Here’s where the jobs are for April 2024 — in one chartHealth care and social assistance led the way, while construction hiring slowed. Read more at: https://www.cnbc.com/2024/05/03/heres-where-the-jobs-are-for-april-2024-in-one-chart.html |

|

Berkshire Hathaway’s big mystery stock wager could be revealed soonWarren Buffett’s bet, shrouded in mystery, has captivated Berkshire Hathaway investors since first appearing in disclosures late last year. Read more at: https://www.cnbc.com/2024/05/03/berkshire-hathaways-big-mystery-stock-wager-could-be-revealed-soon.html |

|

Apple remains Buffett’s biggest public stock holding, but his thesis about its moat faces questionsBerkshire Hathaway has been amassing a stake in Apple since 2016, and now owns about 6% of the iPhone maker. Read more at: https://www.cnbc.com/2024/05/03/apple-is-buffetts-biggest-stock-but-moat-thesis-faces-questions.html |

|

BlackRock says now is the time to lock in higher yields and move cash into bondsHistory shows investors can miss out on locking in higher yields if they wait for an answer on Fed rate cuts, a new BlackRock report says. Read more at: https://www.cnbc.com/2024/05/03/blackrock-says-its-time-to-start-moving-cash-into-bonds.html |

|

Apple on pace for best day since 2022 after earnings beat, $110 billion stock buybackApple shares popped on Friday after the company reported better-than-expected second-quarter earnings and the largest-ever stock buyback program. Read more at: https://www.cnbc.com/2024/05/03/apple-stock-on-pace-for-best-day-since-2022-after-earnings-beat.html |

|

SEC charges Trump Media auditor with ‘massive fraud’ on hundreds of companies, imposes lifetime banTrump Media, the owner of the Truth Social app, trades under the DJT ticker. Former President Donald Trump is the majority shareholder of the company. Read more at: https://www.cnbc.com/2024/05/03/trump-media-auditor-charged-by-sec-with-massive-fraud-permanently-barred-from-public-company-audits.html |

|

Bitcoin tops $61,000 after weaker-than-expected April jobs report: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Crypto World takes a look at MNTGE, a fashion brand embracing blockchain technology to bring web3 and NFTs to vintage clothing. Read more at: https://www.cnbc.com/video/2024/05/03/bitcoin-tops-61000-weaker-than-expected-april-jobs-report-crypto-world.html |

|

Guo Wengui chief of staff Yvette Wang pleads guilty to $1 billion fraud conspiracy in New YorkGuo Wengui, an associate of Trump White House advisor Steve Bannon, is due to stand trial in the fraud case in New York federal court in several weeks. Read more at: https://www.cnbc.com/2024/05/03/guo-wengui-chief-of-staff-pleads-guilty-to-1-billion-fraud.html |

|

Trump trial: Former top aide Hope Hicks cries as cross-examination beginsJudge Juan Merchan has yet to rule on whether Donald Trump once again violated the gag order barring him from speaking about jurors and witnesses. Read more at: https://www.cnbc.com/2024/05/03/trump-trial-resumes-after-infamous-cohen-phone-call-tape-is-played-for-jury-.html |

|

First Berkshire Hathaway annual meeting without Charlie Munger: What to expect from Warren BuffettThe absence of Charlie Munger will be on everyone’s mind when Berkshire Hathaway’s annual shareholder meeting kicks off Saturday in Omaha. Read more at: https://www.cnbc.com/2024/05/03/berkshire-hathaways-2024-meeting-is-saturday-heres-how-to-watch.html |

|

Buffett disciple Bill Stone shares key lessons he’s learned after going to 20 annual meetingsA longtime Warren Buffett disciple and a Berkshire shareholder since 1999, Bill Stone’s investing style has been inspired by the Oracle of Omaha. Read more at: https://www.cnbc.com/2024/05/03/buffett-disciple-bill-stone-shares-key-lessons-hes-learned-after-going-to-20-annual-meetings.html |

|

Interest rates and the AI-fueled rally remain top of mind for stock investors in the week aheadThe future direction of Federal Reserve interest rate policy as well as opportunities tied to artificial intelligence remain hot topics among investors. Read more at: https://www.cnbc.com/2024/05/03/interest-rates-and-the-ai-rally-stay-top-of-mind-for-stock-investors-next-week.html |

|

Russian Troops Enter Air Base Hosting US Soldiers In Post-Coup NigerUS diplomats and the Pentagon have been in retreat from the West African nation of Niger, while also scrambling to maintain some influence there, following the junta seizing power in a coup in July 2023. Niger’s military toppled the US-friendly government of President Mohamed Bazoum, who was taken hostage. Among the first orders of the junta was to tell US troops in the country to pack up their stuff and get out. The US is commonly estimated to have had 1,100 troops in the country. At the same time the junta is displaying its warmer relations with Russia and its forces, declaring an alliance with ‘anti-imperialist’ nations. French troops have already exited the country. On Friday there are widespread reports that Russian troops have actually entered American military bases, with US troops in the process exiting, but some still present. This is said to already be happening at Air Base 101 in Niamey, the capital city.

Read more at: https://www.zerohedge.com/geopolitical/russian-troops-enter-air-base-hosting-us-soldiers-post-coup-niger |

|

Watch: Biden’s Head Of Economic Advisors Try To Explain Government BorrowingAuthored by Mike Shedlock via mishtalk.com, Jared Bernstein was asked about Modern Monetary Theory (MMT)…

MMT says government is different. It owes the money to itself and the debt can be canceled at will. In MMT theory, a benevolent government would spend the money wisely, cancel all the debt or pay interest to itself, and everyone will essentially live happily ever after. The notion is really amusing. But it was more amusing watching Bernstein try to address a question on it.

|

|

“World Cup Of Shed Hunting” Underway In Jackson HoleShed hunting season has opened up for Wyoming residents this week, as well as non-residents who must purchase a conservation stamp before collecting shed antlers on designated lands. The Wall Street Journal describes the mania in the hills around the Bridger-Teton National Forest, near Jackson, Wyoming, as the “World Cup of shed hunting.” People across the state and from across the country are scouring the hills for freshly dropped antlers that haven’t yet been sun-bleached and are called “brown” or “brown gold” by some antler hunters.

“It’s the adrenaline rush that you get, plus you’re outside, you’re away from people,” said antler hunter John Bishop, adding, “There’s really no worldly obligations anymore at that point. It’s just you and whatever else is out there.” Earlier this week, Bishop and his group of friends, along with hundreds of other hunters, eagerly awaited the lifting of restrictions on antler hunting in the� … Read more at: https://www.zerohedge.com/commodities/world-cup-shed-hunting-underway-jackson-hole |

|

“Irrevocably Shaken”: Columbia Law Review Editors Ask For Cancellation Of Exams Due To ProtestsAuthored by Jonathan Turley, In recent years, there has been much discussion of the claims of “trauma” by students caused by court rulings and other events. These developments are often cited as a basis for the cancellation of exam or classes. Conservative speakers, case decisions, and protests have all been cited in the past for such demands as well as the creation of therapy tents and trauma counseling. Now, editors of the Columbia Law Review (and editors of other journals) have called for the outright cancellation of exams due to the trauma of watching recent protests on campus. This is indeed a learning moment. Law students need to be able to face such moments without shutting down due to the stress. Our profession is filled with stress and trauma. It is the environment in which we operate. In those moments, we do not have the option of being a no-show. We make our appearance and speak for others. Read more at: https://www.zerohedge.com/political/irrevocably-shaken-columbia-law-review-editors-ask-cancellation-exams-due-protests |

|

Post Office lawyer accused of ‘big fat lie’Former senior Post Office solicitor Jarnail Singh denies knowing about Horizon bugs in 2010. Read more at: https://www.bbc.com/news/articles/c1d4j5m3l08o |

|

Slowdown in US job growth revives rate cut talkEmployers in the US added 175,000 jobs in the US in April, while the unemployment rate ticked up to 3.9%. Read more at: https://www.bbc.com/news/articles/c88zj7kde9zo |

|

Tata redundancy offer callous, say steel unionsUnions say company disregards the impact of its changes on workers, families and communities. Read more at: https://www.bbc.com/news/articles/cv2931zykk2o |

|

RBI: Govt to buy back bonds worth Rs 40,000 crore; move to ease tight liquidityThe unexpected move is also seen bringing down yields on short-term government bonds, as the three securities that the government has chosen to buy back are all maturing within six to nine months. A fall in government bond yields brings down cost of borrowing for companies as pricing of corporate bonds is benchmarked to sovereign debt. A bulk of corporate borrowing is through short-term papers. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/india-to-buy-back-4-8-billion-worth-of-securities-cenbank-says/articleshow/109823573.cms |

|

NSE board approves 4:1 bonus issue, dividend of Rs 90 per shareA company issues bonus shares for their shareholders in order to increase the liquidity of the stock as well as to decrease its stock price thereby making it affordable for investors. All shareholders who own company shares before the record date, which is determined by the firm, are eligible for additional shares. The dividend is 9,000% on the face value of each share for the financial year ended March 2024. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/nse-board-approves-41-bonus-issue-dividend-of-rs-90-per-share/articleshow/109822253.cms |

|

Tech View: Nifty forms Doji candle on weekly scale. What traders should do next weekTechnically, the index closed below the level of 22,500, which has been acting as a minor support for the last couple of days. While this is a negative development, it’s not something that opens a big downside, observed an expert. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-doji-candle-on-weekly-scale-what-traders-should-do-next-week/articleshow/109820125.cms |

|

‘He’s holding all the cards’: My mother, 86, has dementia. Her partner of 30 years is on the deed to her home. How can I gain control of her finances?“I asked to be put on the deed to my mother’s home and I was met with a swift ‘no’ from her partner. He said that since he had paid off the mortgage, the house is his.” Read more at: https://www.marketwatch.com/story/hes-holding-all-the-cards-my-mother-86-has-dementia-her-partner-of-30-years-is-on-the-deed-to-her-home-how-can-i-gain-control-of-her-finances-951b76b8?mod=mw_rss_topstories |

|

Treasury yields see biggest weekly drops in months as tepid April jobs report raises rate-cut hopesTreasury yields finished at their lowest levels in three weeks on Friday after April’s official jobs report brought the potential for a Federal Reserve interest-rate cut back to the minds of some traders. Read more at: https://www.marketwatch.com/story/bond-yields-drift-ahead-of-jobs-data-that-could-challenge-powells-dovish-tone-845d4854?mod=mw_rss_topstories |

|

Cemeteries get a new lease on life as dog parks, antique markets and picnic grounds“As cemeteries run out of space, they are going to have to adapt or die.” Read more at: https://www.marketwatch.com/story/cemeteries-get-a-new-lease-on-life-as-dog-parks-antique-markets-and-picnic-grounds-0a4af23e?mod=mw_rss_topstories |

Illustrative military file image, Getty Images.< …

Illustrative military file image, Getty Images.< …