Financial Sector Debt and Inflation. Part 3

The full data sets for the 71 years from 1952 to 2022 show no discernable association patterns (correlations) for financial sector debt (FSD) and inflation changes.1 Thus, we started an analysis by looking specifically at the various regimes of inflation change during the 71-year timeline. The most recent post2 analyzed the eight time periods over 71 years with positive inflation surges. This article analyzes the association of FSD during the five periods from 1952 to 2022 with negative inflation (disinflation/deflation) surges.

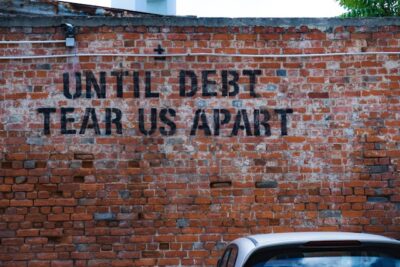

Photo by Ehud Neuhaus on Unsplash.