The full data sets for the 71 years from 1952 to 2022 show no discernable association patterns (correlations) for financial sector debt (FSD) and inflation changes.1 Thus, we started an analysis by looking specifically at the various regimes of inflation change during the 71-year timeline. The most recent post2 analyzed the eight time periods over 71 years with positive inflation surges. This article analyzes the association of FSD during the five periods from 1952 to 2022 with negative inflation (disinflation/deflation) surges.

Photo by Ehud Neuhaus on Unsplash.

Introduction

The 71 years from 1952 to 2022 are divided into three types of inflationary behavior:1

- Significant inflation increases;

- Significant inflation decreases;

- No significant inflation changes.

An inflation change is significant if it is ≥4.0% with no intervening countertrend change >1.5%.

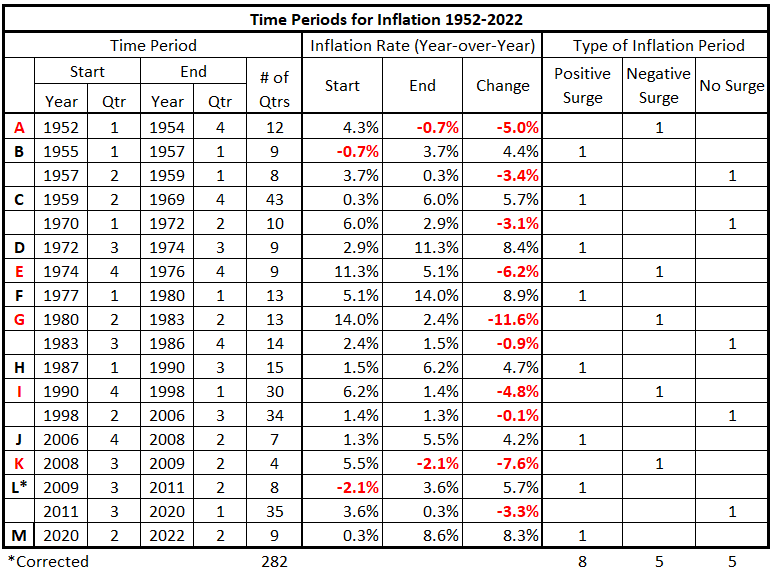

Previously, we defined the partitioning of inflation into the pattern in Table 1.

Table 1. Timeline of Inflation Data 1952-2022 (Previously Table 4*.1)

We will examine each category of inflation behavior separately. In this piece, we analyze the significantly negative periods of inflation (disinflation and deflation surges).

Data

The data is from Tables 5-17, prepared previously.1

There are 13 quarterly timeline alignments:

- Financial Sector Debt and CPI Inflation quarters are coincident.

- Financial Sector Debt leads and lags CPI Inflation by one quarter (±3 months)

- Financial Sector Debt leads and lags CPI Inflation by two quarters (±6 months)

- Financial Sector Debt leads and lags CPI Inflation by three quarters (±9 months)

- Financial Sector Debt leads and lags CPI Inflation by four quarters (±12 months)

- Financial Sector Debt leads and lags CPI Inflation by six quarters (±18 months)

- Financial Sector Debt leads and lags CPI Inflation by eight quarters (±24 months)

Analysis

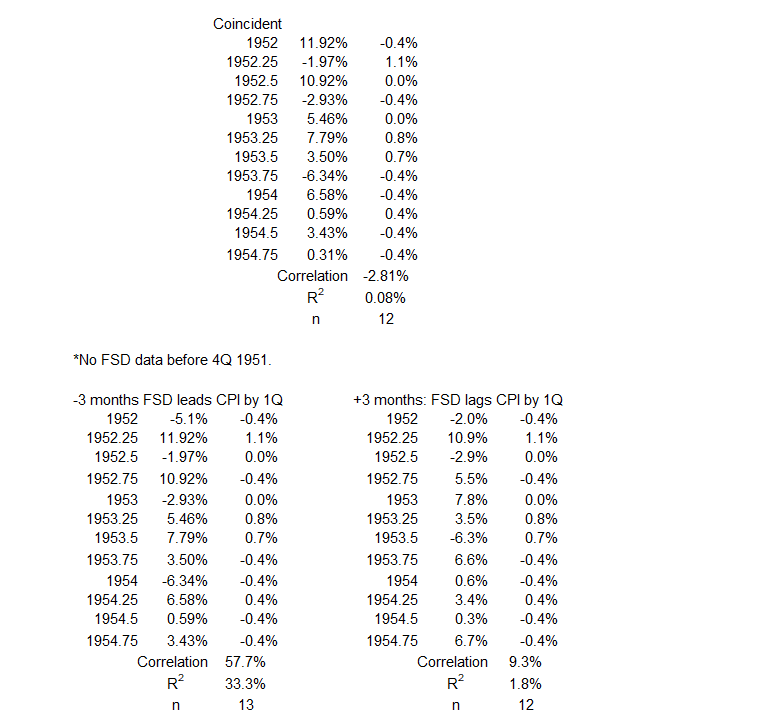

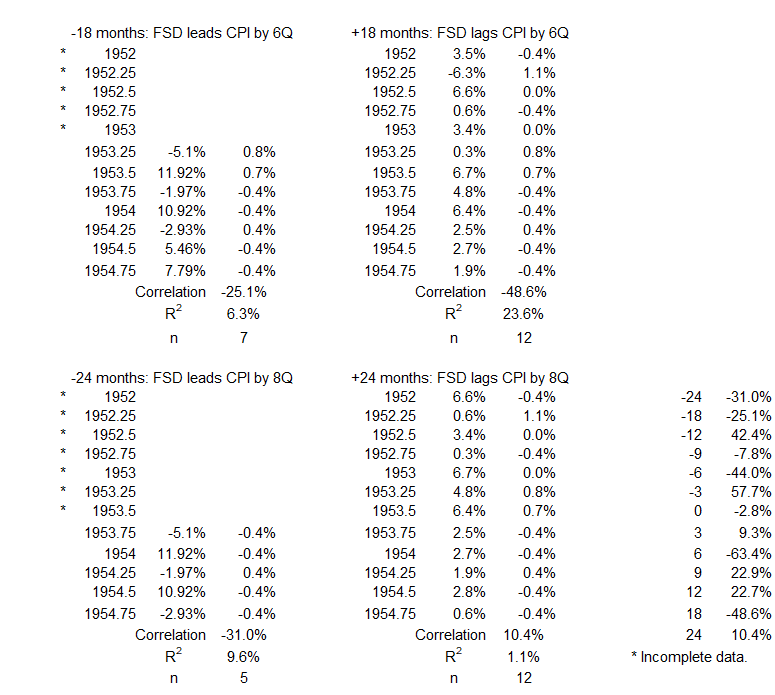

1Q 1952 – 4Q 1954

Figure 1. U.S. FSD and Inflation 1Q 1952 – 4Q 1954

The trends for financial sector debt (FSD) and inflation changes are down. The downtrend for FSD changes is much stronger than for CPI. The volatility for FSD changes is almost an order of magnitude greater than for CPI.

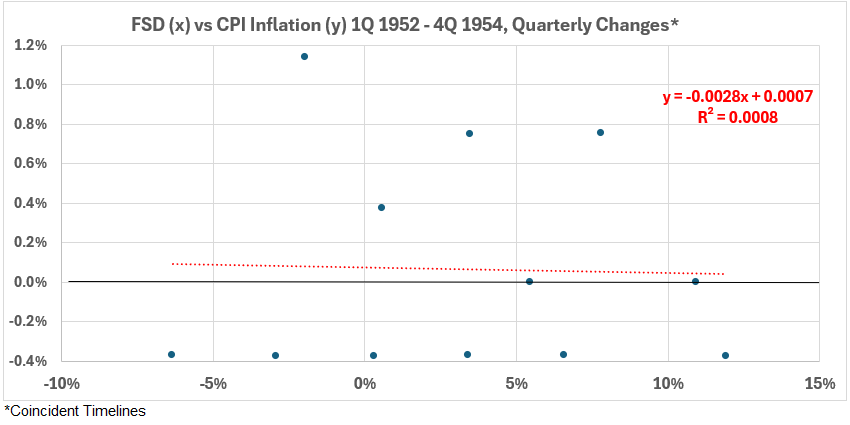

Figure 2. Quarterly Changes in FSD (x) vs. CPI Inflation (y) 1Q 1952 – 4Q 1954

The association between the two variables with coincident timelines is negligible. R = –2.8% and R2 = 0.08%.

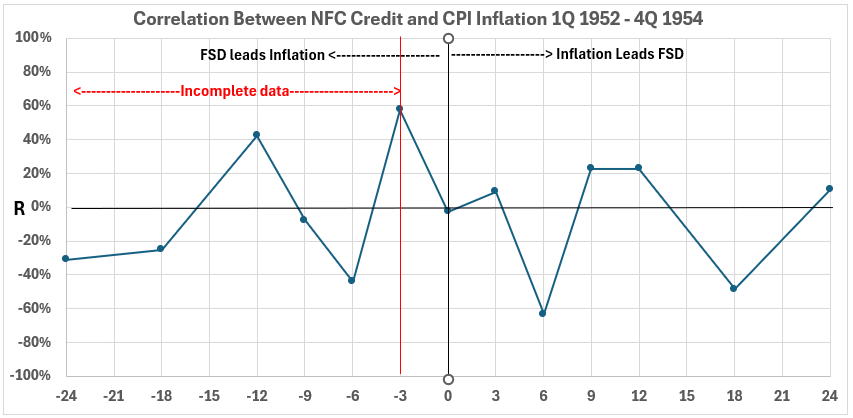

Figure 3. Correlation Between FSD and CPI Inflation 1Q 1952 – 4Q 1954

As the timelines shift relative to each other, the association (correlation) is mostly weak and negligible, both negative and positive, for coincident data and FSD following inflation by the number of months indicated. The largest association is moderate and negative for inflation change occurring 6 months before FSD change. R = –63% and R2 = 40%. This does not indicate much chance for cause and effect. However, the one moderate data point does leave the possibility open that decreasing inflation might be a contributing cause to increasing financial sector debt six months later. There is no data for NFC before 1952 in this dataset, so the left-hand side of the graph for NFC credit occurring before CPI inflation is constructed with incomplete data and should not be included in any analysis.

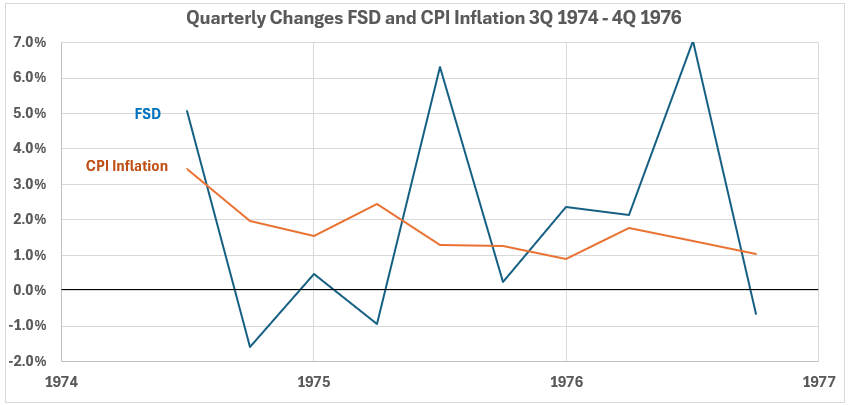

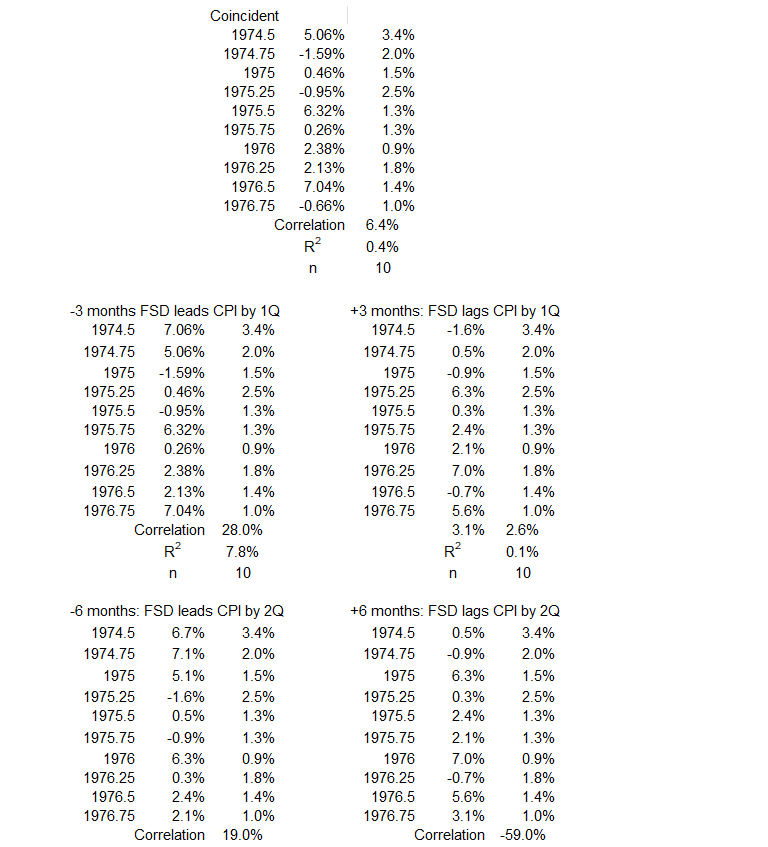

4Q 1974 -4Q 1976

Figure 4. U.S. FSD and Inflation 4Q 1974 – 4Q 1976

FSD changes and inflation changes declined at the beginning of this period. But then the trend for NFC quarterly changes increased while inflation changes continued to get smaller. As in the previous data, FSD changes show much more volatility than do those for inflation.

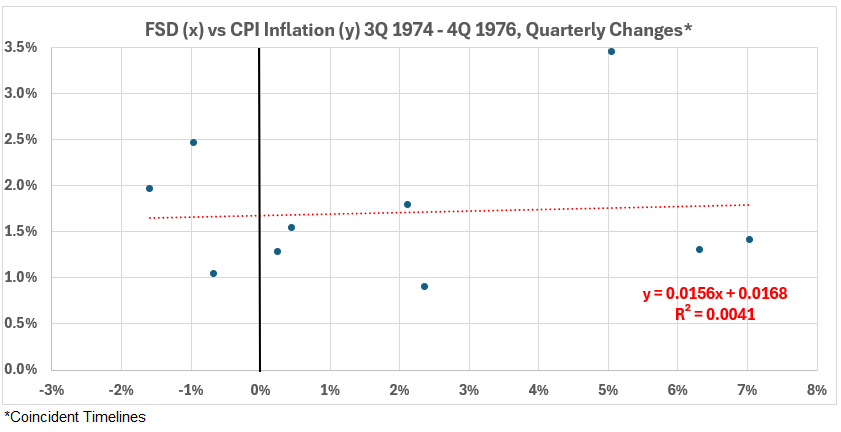

Figure 5. Quarterly Changes in FSD (x) vs. CPI Inflation (y) 4Q 1974 – 4Q 1976

When the data timelines coincide, the overall association between these two variables is negligible. R = 6.4% and R2 = 0.4%.

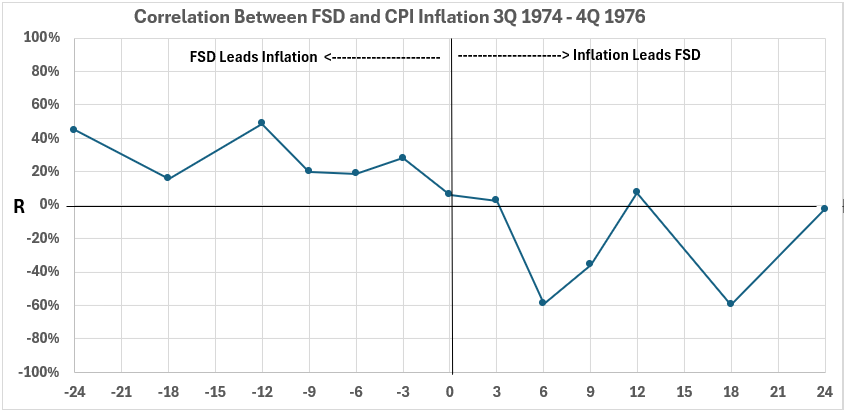

Figure 6. Correlation Between FSD and CPI Inflation 4Q 1974 – 4Q 1976

The positive association of FSD with inflation is weak when debt changes come before inflation. The largest values for R2 are 49% and 45% at -12 months and -24 months, respectively. The strongest correlations are moderate and negative, occurring when inflation changes come before debt changes. At 6 and 18 months, R values are ~60% and R2 values are ~30%.

As in the preceding period, declining inflation might again contribute to increases in financial sector debt.

From the data on the right side of Figure 6, a possibility exists that up to ~20% of declining inflation might have resulted from declining financial sector debt changes.

This is a good time for a reminder: association only means cause-and-effect might be possible. Other information is needed to determine if there is any causation at all.

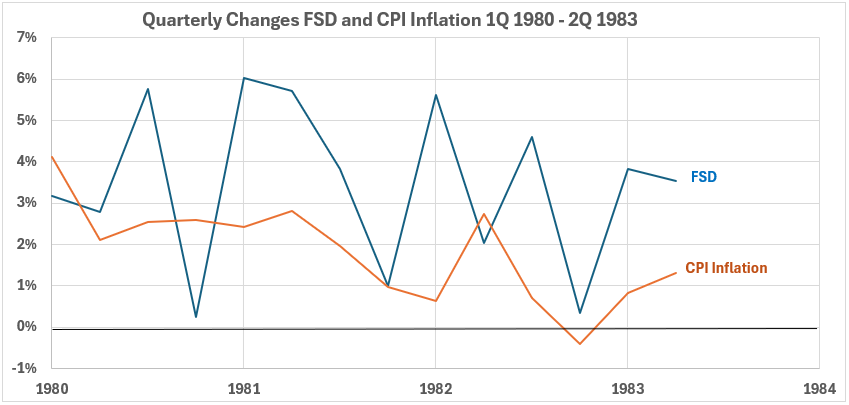

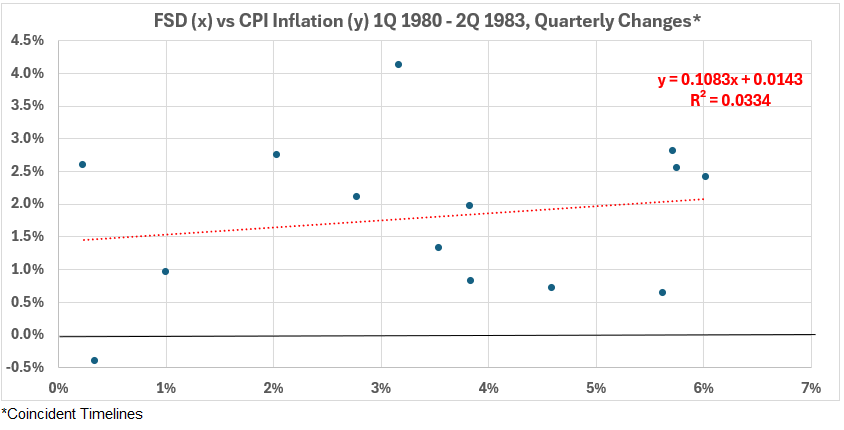

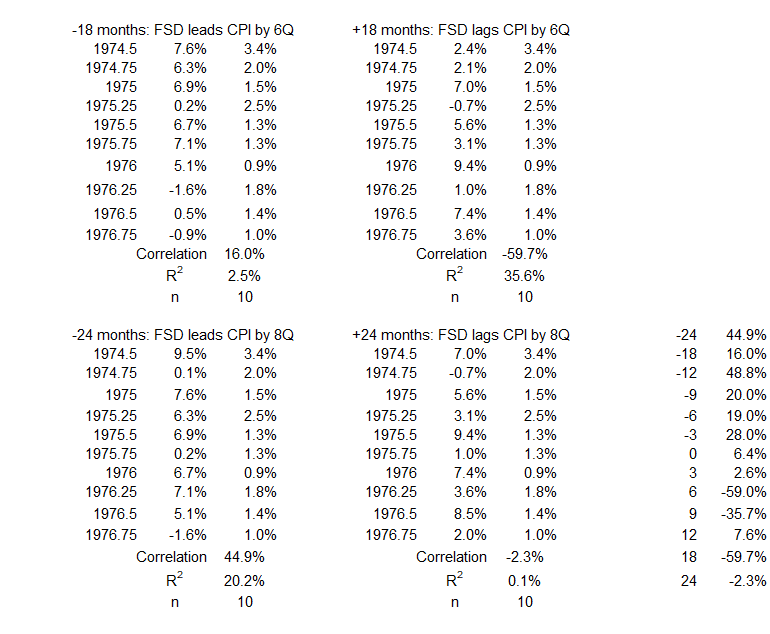

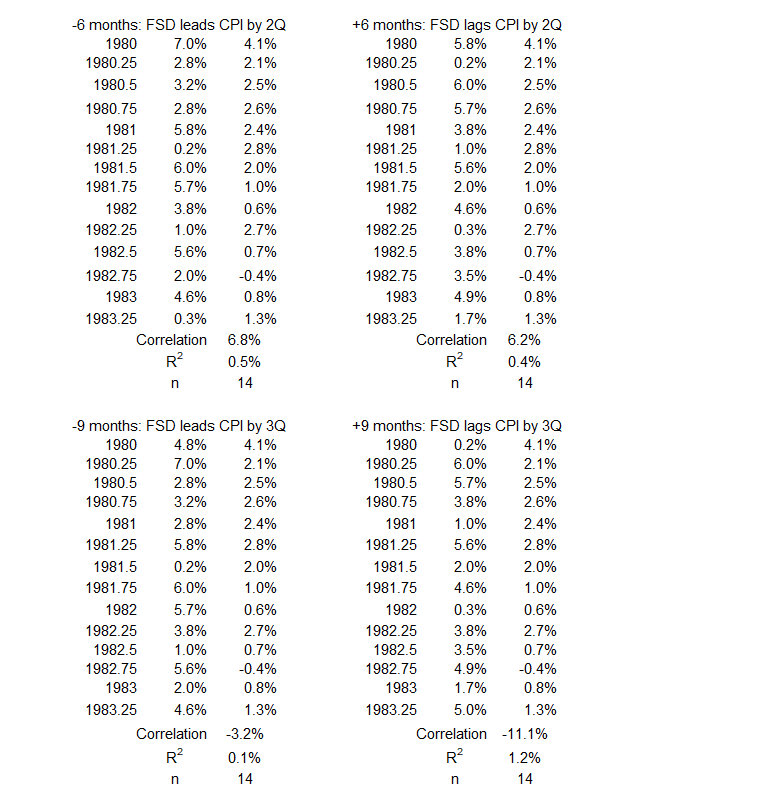

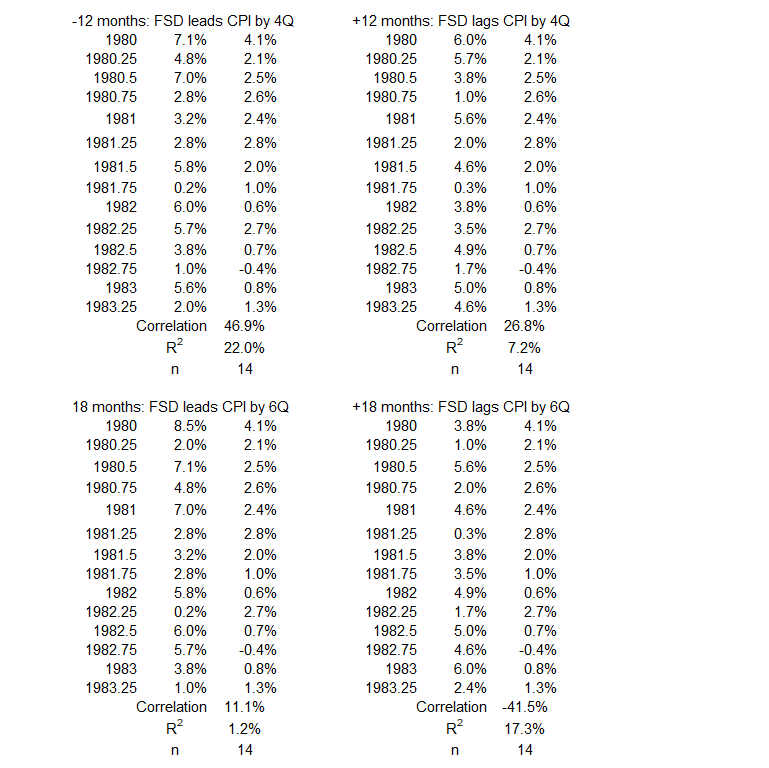

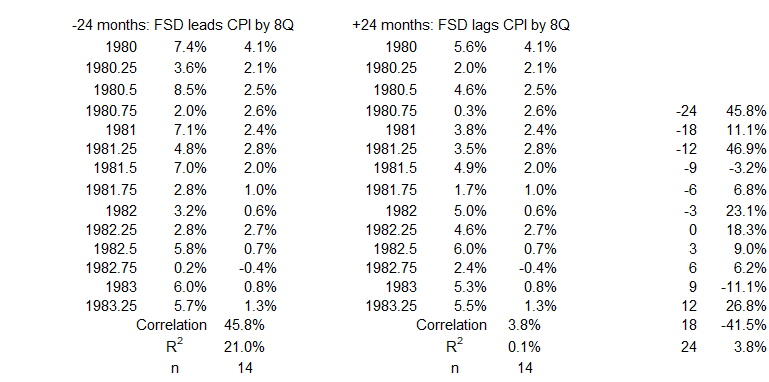

2Q 1980 – 2Q 1983

Figure 7. U.S. FSD and Inflation 1Q 1980 – 2Q 1983

The trends for FSD changes and the CPI Inflation changes trend generally down throughout the period. This period contrasts with the two preceding periods in that the trend for inflation changes is steeper than for debt changes. The relative volatilities for the two variables are closer in this period but still larger for FSD.

Figure 8. Quarterly Changes in FSD (x) vs. CPI Inflation (y) 1Q 1980 – 2Q 1983

The correlation when the two data timelines coincide is weak. R = 18% and R2 = 3.3%.

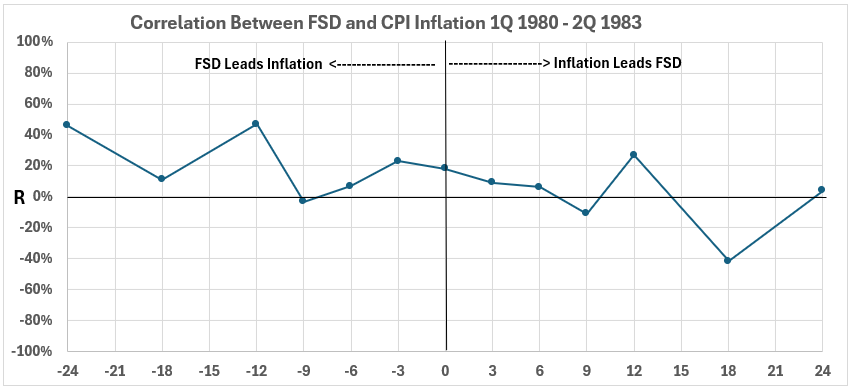

Figure 9. Correlation Between FSD and CPI Inflation 1Q 1980 – 2Q 1983

There is some possibility for cause-and-effect relationships during this period. The highest positive association is for FSD change coming 12 months before CPI change R = 47%, R2 = 22%. The largest negative association (NFC change 18 months after inflation change) is R = -41%, R2 = 17%.

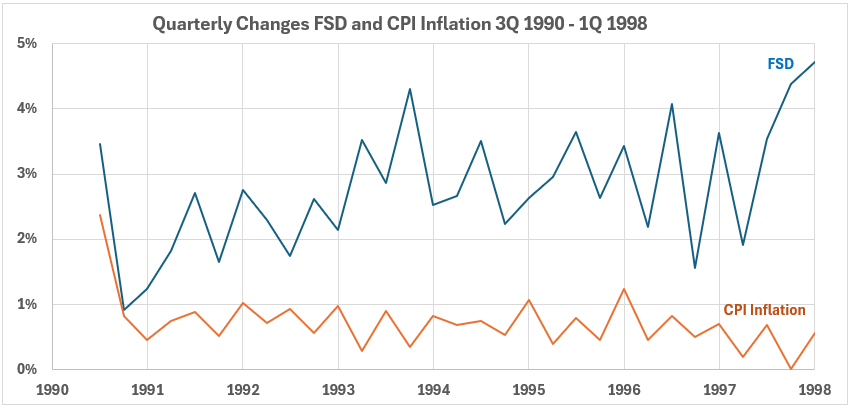

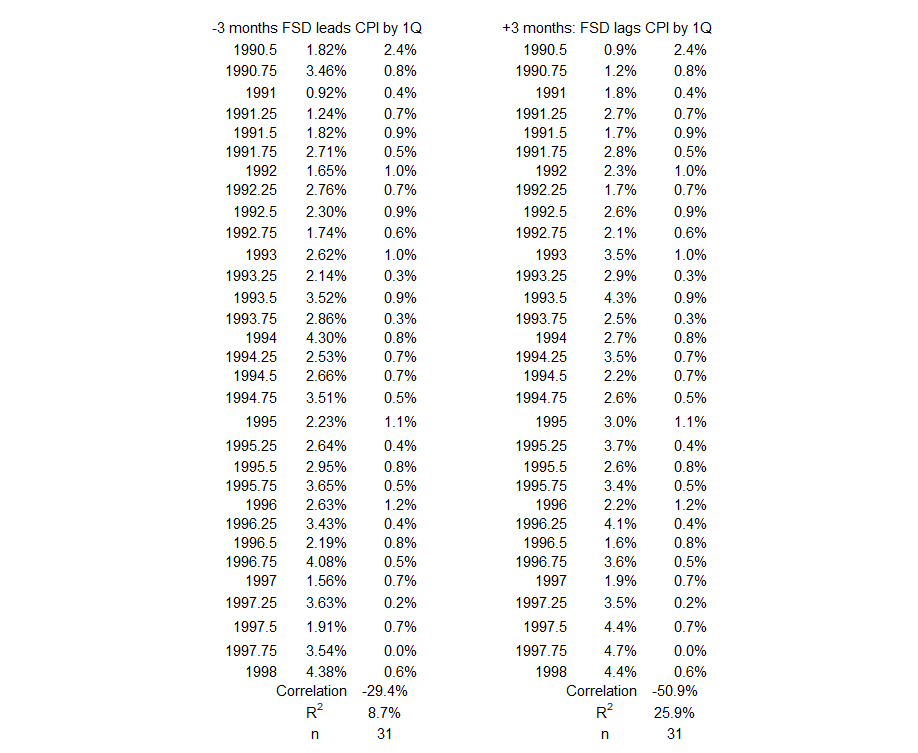

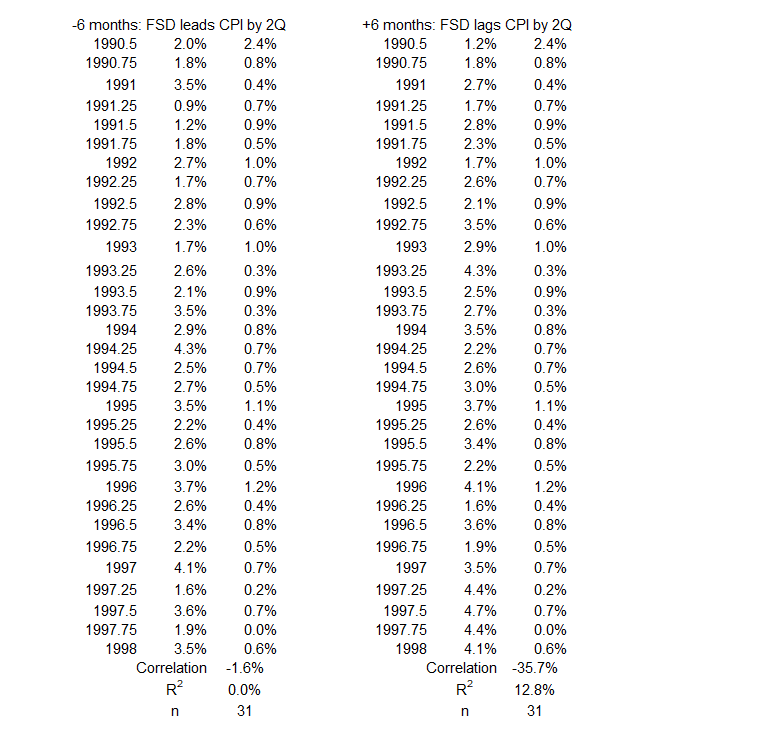

4Q 1990 – 1Q 1998

Figure 10. U.S. FSD and Inflation 3Q 1990 – 1Q 1998

After the first quarter, the trend for FSD changes generally increased with a flat-to-down period from the middle of 1993 to the middle of 1996. Inflation change also had a big drop for the opening quarter. Then, the changes were quite level until there was a declining trend for 1996 and 1997. There is not much visual evidence of correlation here.

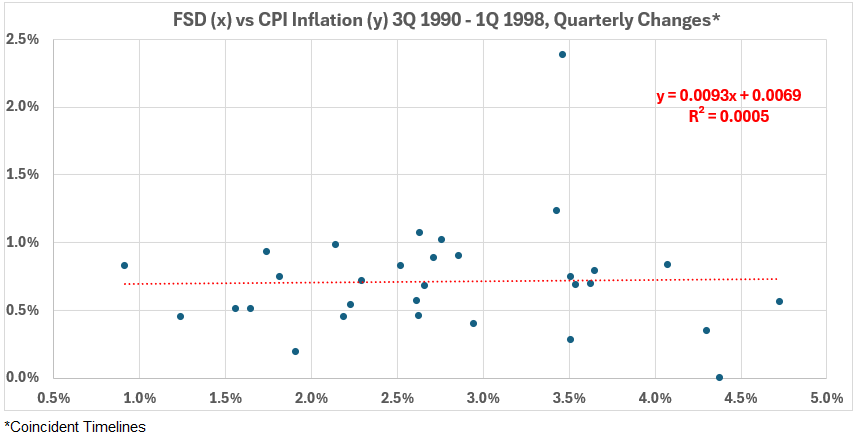

Figure 11. Quarterly Changes in FSD (x) vs. CPI Inflation (y) 3Q 1990 – 1Q 1998

The scatter plot (Figure 11) confirms the general observation made for Figure 10: There is a negligible association between coincident financial sector debt changes and inflation during the 1990s. R = 2.2% and R2 = 0.0%.

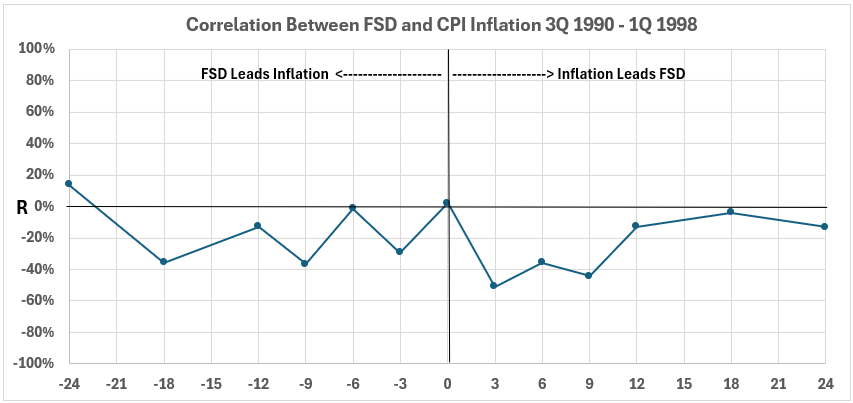

Figure 12. Correlation Between FSD and CPI Inflation 3Q 1990 – 1Q 1998

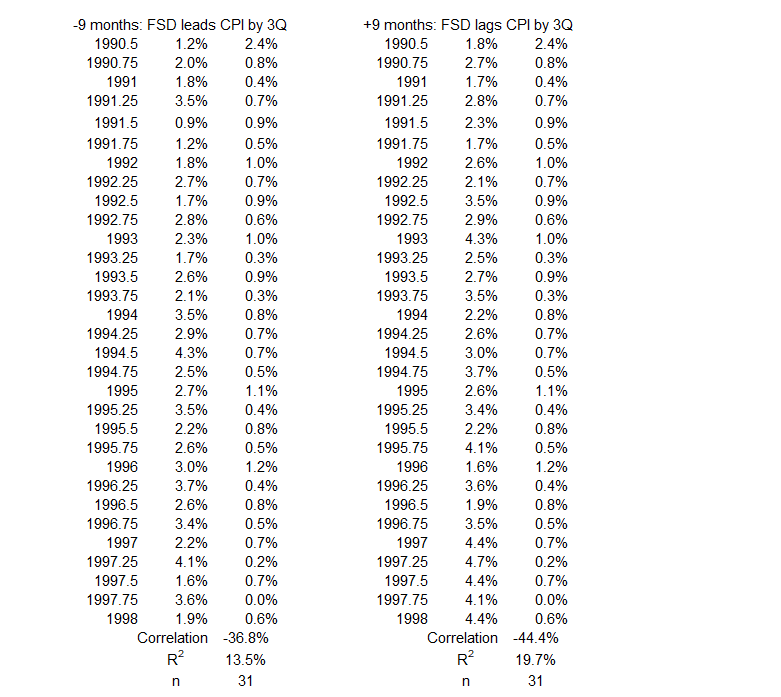

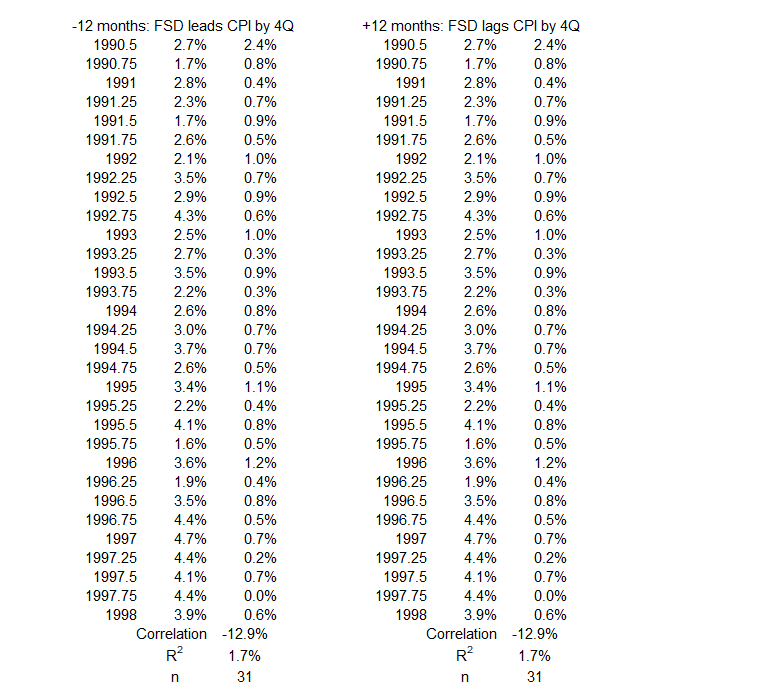

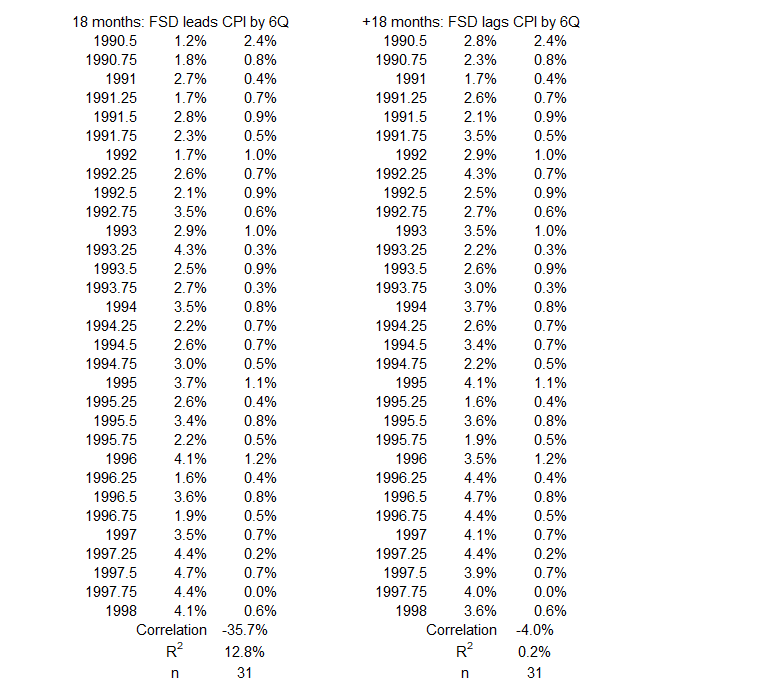

Figure 12 shows limited opportunity for major cause-and-effect relationships when NFC credit changes come before inflation (left side of the graph). Weak negative correlations exist for -9 and -18 months, R ~ –36% and R2 ~ 13%.

There are weak negative correlations on the right side, with one moderate association for inflation change three months before NFC credit change (R = –51% and R2 = 26%). The six and nine-month data points straddle R = 40%. The R2 values are ~16%. Because there are so many data points in a narrow range, we should not dismiss the possibility that up to 26% of an increase in the size of FSD quarterly changes could be caused by the decreasing inflation changes during the 1990s.

Caveat: Possibility does not prove anything. Additional information is needed for cause-and-effect proof.

3Q 2008 – 2Q 2009

Figure 13. U.S. FSD and Inflation 3Q 2008 – 2Q 2009

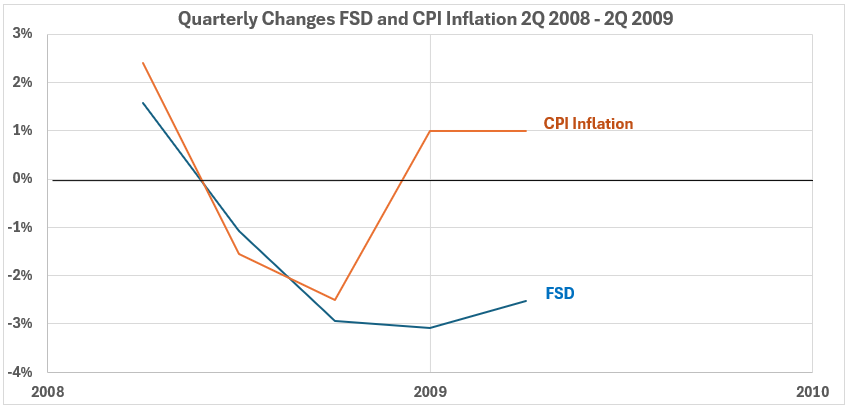

In Figure 13, we see a data set that is different from the first four we analyzed. CPI Inflation changes have a “wild” pattern, while NFC credit changes show a smooth decline from slightly positive to significantly negative.

Figure 14. Quarterly Changes in FSD (x) vs. CPI Inflation (y) 3Q 2008 – 2Q 2009

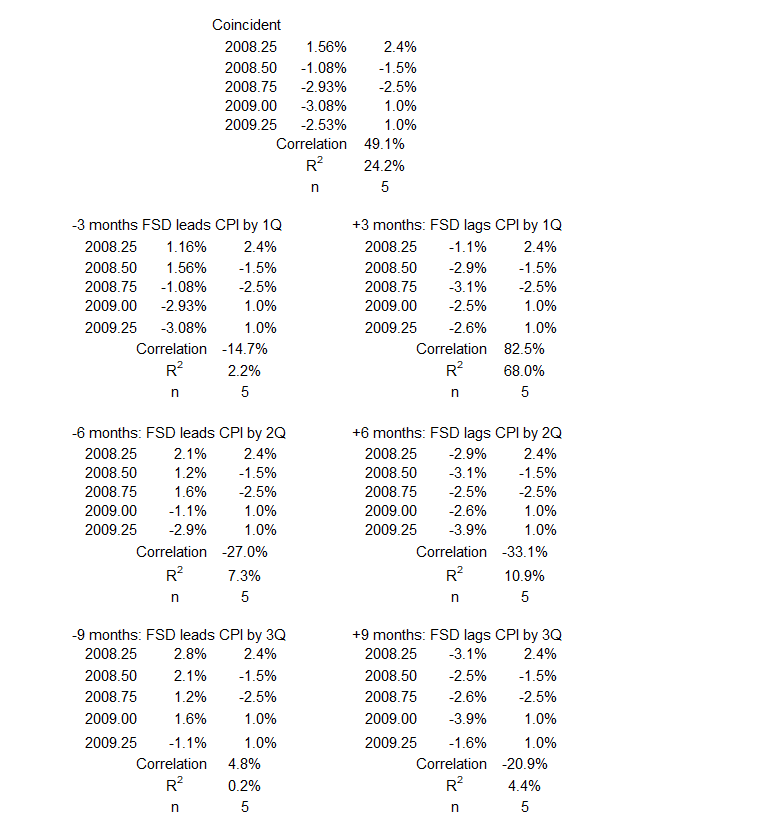

There is a lot of scatter in Figure 14, suggesting that analysis of this small data set may offer some problems. For a discussion, see this.3 The association here is weak but close to moderate and positive. R = 49% and R2 = 24%. The correlation shown in Figure 14 is entirely dominated by one data point in the upper right. The data for a scatter diagram of the other four points produces y = -0.603x – 0.0197, R = –31%, and R2 = 10%.

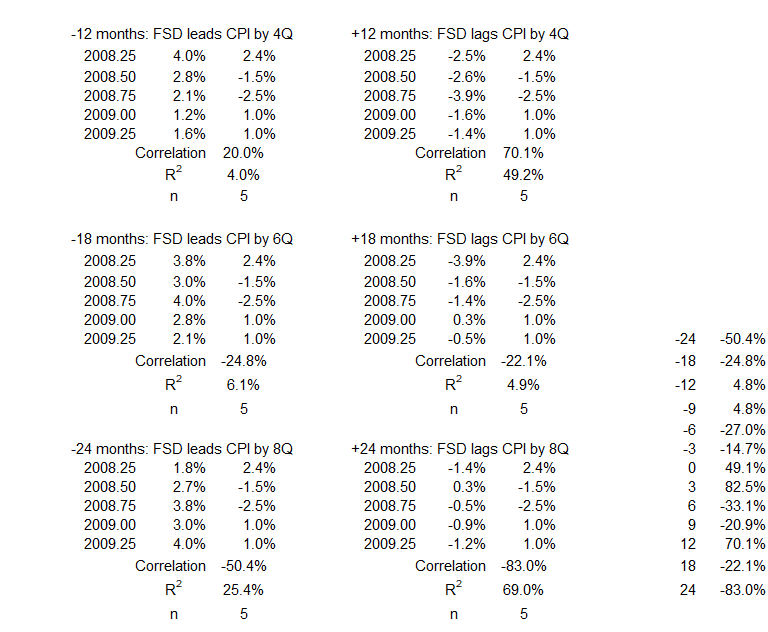

Figure 15. Correlation Between FSD and CPI Inflation 3Q 2008 – 2Q 2009

The very small data sample makes extracting any meaning from Figure 15 problematic.

Conclusion

There are no possible cause-and-effect relationships (>25%) for financial sector debt changes possibly causing inflation changes.

There are three periods with a moderate possibility that smaller CPI changes might have contributed to the causes of FSD changes increasing:

- Up to 40% contribution might have occurred in the 1952-54 period.

- Up to 36% contribution might have occurred during the 1974-76 period.

- Up to 26% contribution might have occurred during the 1990s.

After analyzing periods with no significant inflation changes, there will be more discussion of the results. That comes next week.

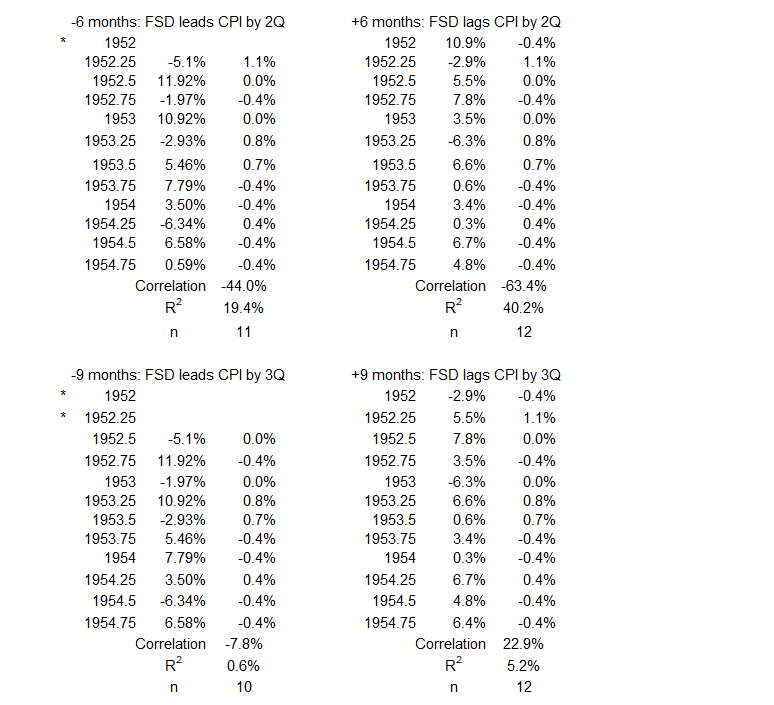

Appendix

Below are the data sets for each significant negative inflation (disinflation and deflation) period. They come from the tables of timeline aligments1 (Financial Sector Debt and Inflation: Part 1).

1Q 1952 – 4Q 1954

4Q 1974 -4Q 1976

2Q 1980 – 2Q 1983

4Q 1990 – 1Q 1998

3Q 2008 – 2Q 2009

Footnotes

1. Lounsbury, John, “Financial Sector Debt and Inflation, Part 1″, EconCurrents, March 10, 2024. https://econcurrents.com/2024/03/10/financial-sector-debt-and-inflation-part-1/.

2. Lounsbury, John, “Financial Sector Debt and Inflation, Part 2″, EconCurrents, March 17, 2024. https://econcurrents.com/2024/03/17/financial-sector-debt-and-inflation-part-2/.

3. Hole, Graham, “Eight things you need to know about interpreting correlations,” Research Skills One, Correlation interpretation, Graham Hole v.1.0., October 5, 2015. https://users.sussex.ac.uk/~grahamh/RM1web/Eight%20things%20you%20need%20to%20know%20about%20interpreting%20correlations.pdf.