Comparing Two Data Organizations for Federal Deficit Spending vs Inflation. Part 1

Two studies have been performed on the correlations between U.S. Federal Deficit Spending and CPI Inflation. The first used federal deficits for fiscal years between 1914 and 2022. The second study used the quarterly data available for federal deficit spending starting in 1966. This article compares the results of the two studies.

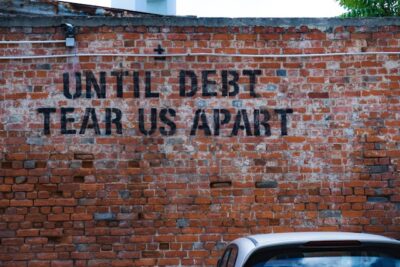

Photo by Indira Tjokorda on Unsplash