Irene Wong: Dancing for fun and business

Irene never anticipated that her late-teen dream of ballroom dancing would not only come true but also blossom into a midlife passion and business in ballroom dancing.

Irene never anticipated that her late-teen dream of ballroom dancing would not only come true but also blossom into a midlife passion and business in ballroom dancing.

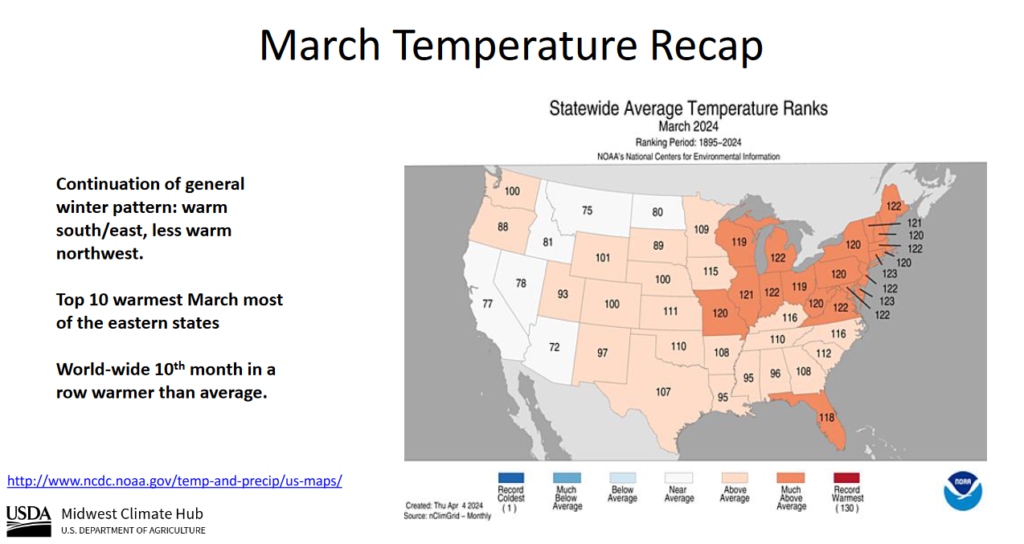

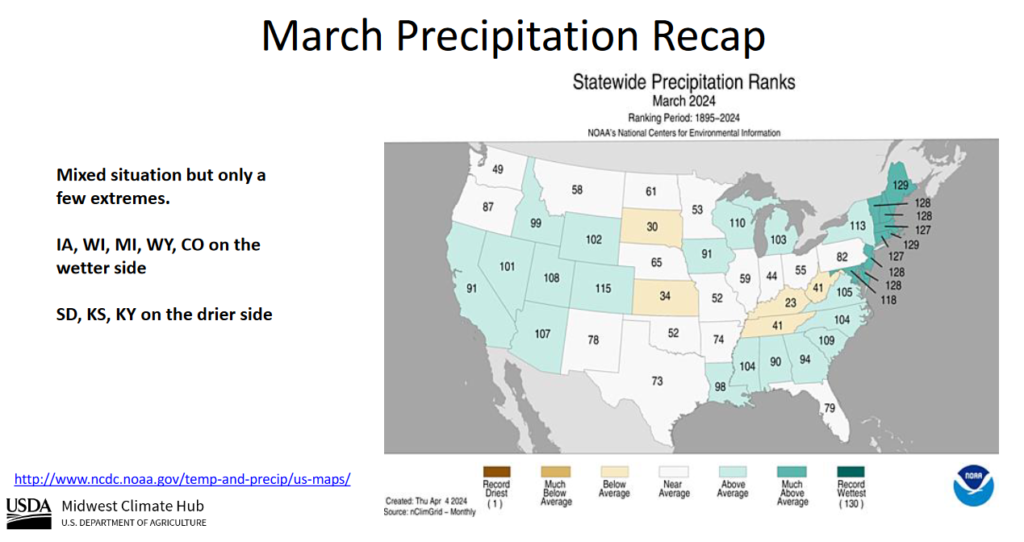

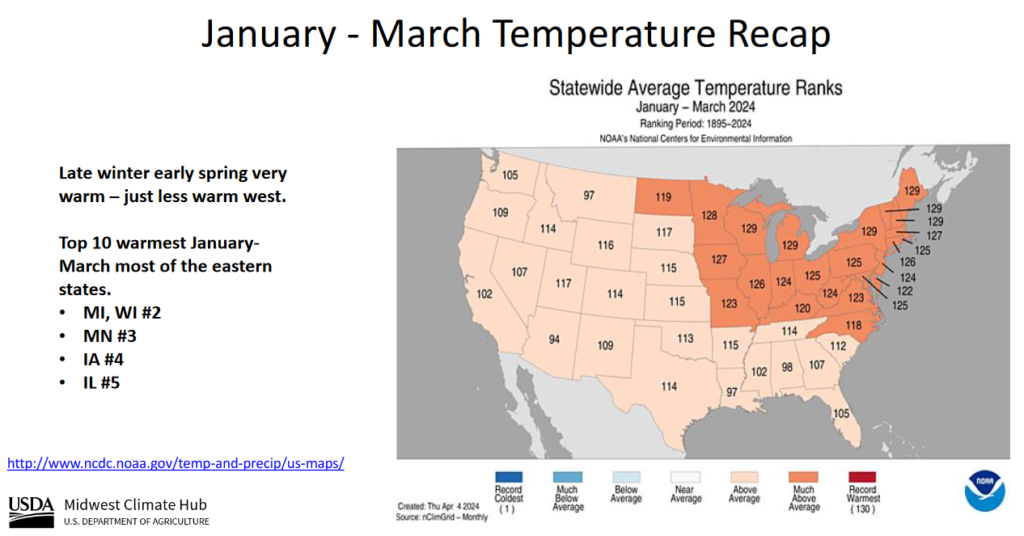

| You can see the large number of much above-average temperature states. Many of these were in the North Central area. |

| The North Central had average to slightly above normal precipitation. It was very wet in the Northeast. |

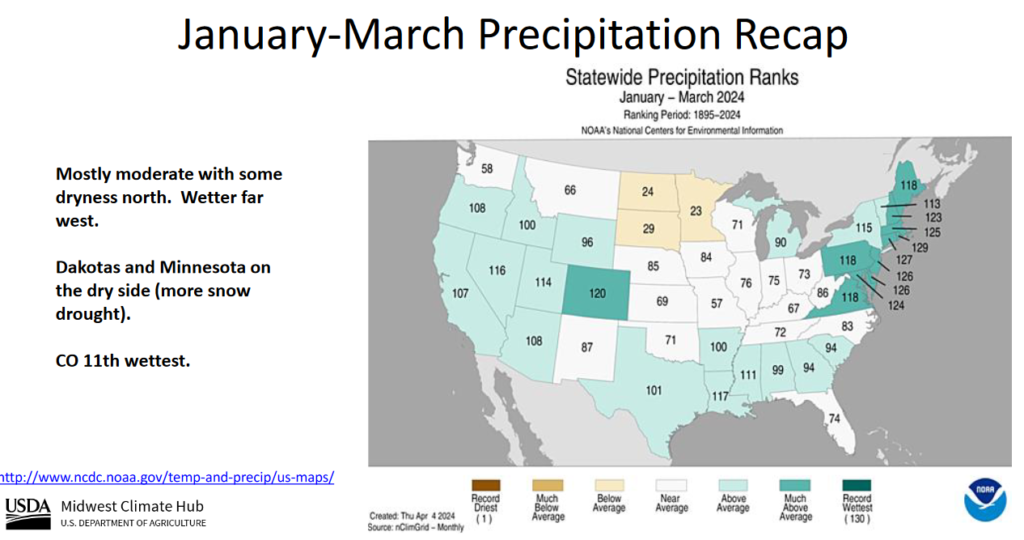

| Jan to March shows a similar situation but more states were above average or much above average. |

–

| This shows the El Nino pattern but not dramatically wet except in the Northeast. |

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

348 AM EDT Wed Apr 24 2024Valid 12Z Wed Apr 24 2024 – 12Z Fri Apr 26 2024

…Unsettled weather and severe thunderstorm chances gradually expand

across much of the central United States over the next several days……Active fire weather pattern to become situated over the southern High

Plains……Above average temperatures shift from the Great Basin to the Plains,

while the West and East remain cool through the end of the week…The benign weather pattern experienced throughout much of the Nation over

the last few days is expected to conclude as developing upper troughing

over the western U.S. helps create a ripe spring severe weather setup over

parts of the central and southern Plains. This trough is expected to enter

the Southwest by early Thursday and swing into the central Plains by

Friday. At the surface, returning moisture from the Gulf of Mexico will

begin to lift northward today and pool along a gradually lifting warm

front draped across the southern Plains. Combined with a southern High

Plains dryline, a few developing thunderstorms could turn severe today

from West Texas to central Oklahoma, as well as the chances for isolated

flash flooding. A greater severe weather threat exists beginning on

Thursday as a surface cyclone rapidly deepens over the central High Plains

in response to the approaching upper level trough. The aforementioned warm

front is expected to continue lifting northward while the High Plains

dryline pushes east. This environment is anticipated to produce numerous

thunderstorms across the central and southern Plains, with scattered

storms turning severe. The Storm Prediction Center has issued an Enhanced

Risk (level 3/5) for severe weather across parts of

southwest/south-central Kansas and western Oklahoma into the eastern Texas

Panhandle. Very large hail, severe wind gusts, and a couple strong

tornadoes will all be possible. Multiple rounds of heavy rain could also

lead to scattered flash flooding, which has prompted a Slight Risk (level

2/4) of Excessive Rainfall across parts of northeast Oklahoma, eastern

Kansas, western Missouri, and northwest Arkansas. By Friday, the

aforementioned low pressure system is forecast to deepen and slide east

into the central Plains while shower and thunderstorm chances also push

eastward into the Upper Midwest, Middle/Lower Mississippi Valley, and

southern Plains.Behind the dryline across the southern High Plains, the combination of

very low relative humidity and gusty winds are expected to create Critical

Fire Weather on Thursday and Friday. Any fires that develop will likely

spread rapidly. Outdoor burning is not recommended. Additionally, gusty

winds up to 55 mph could lead to areas of blowing dust.Precipitation chances will also exist elsewhere across the Nation. A cold

front crossing the Northeast today will spread showers over the region,

with snow showers possible across northern New England. Unsettled weather

is expected to develop over the West, Great Basin, and Rockies as well

over the next few days underneath the deepening upper trough. Most

precipiation is expected to remain mostly light, with embedded downpours

and high elevation heavy snow by Friday across the Rockies. This active

weather will also lead to a cooling trend throughout the West compared to

the spring warmth felt over the last few days. Chilly weather is also

forecast across the Northeast through the end of the week as high pressure

builds southward from Canada. Low temperatures could dip below freezing on

Thursday morning and have prompted Freeze Watches to be issued from the

Lower Great Lakes to southern New England. Most of the above average

warmth will be found throughout the Plains, besides of any areas

experiencing prolonged periods of rainfall, with highs into the 80s

remaining across the Southern Tier States until Friday.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Sales of new single‐family houses in March 2024 is 8.3% above March 2023. The median sales price of new houses sold in March 2024 was $430,700. The average sales price was $524,800.

The seasonally‐adjusted estimate of new houses for sale at the end of March was 477,000. This represents a supply of 8.3 months at the current sales rate. New home sales have been a bright spot in the economy.

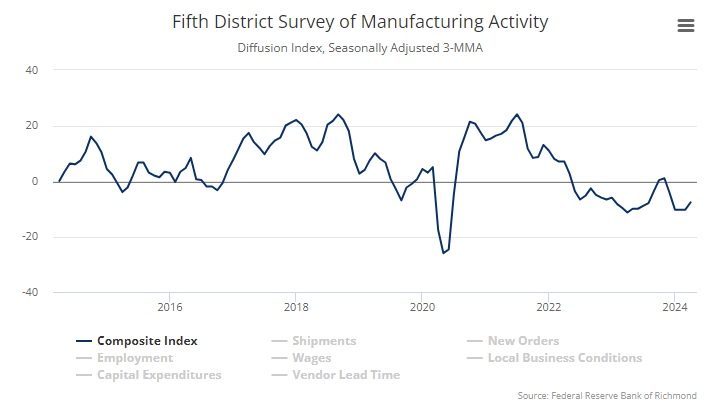

Richmond Fed Manufacturing activity remained slow in April 2024. The composite manufacturing index increased from −11 in March to −7 in April. Of its three component indexes, shipments increased from −14 to −10, new orders increased from −17 to −9, and employment fell from 0 to −2. Manufacturing is far from a bright spot in the current economy.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Tue Apr 23 2024

Valid 12Z Tue Apr 23 2024 – 12Z Thu Apr 25 2024…Unsettled weather and severe thunderstorm chances ramp up across parts

of the central and southern Plains this week……Above average temperatures throughout the western and central United

States, with cooler weather in the Great Lakes and much of the East…The mostly quiet weather pattern experienced the last few days over the

Lower 48 is expected to gradually retreat as an upper trough develops over

the western U.S. midweek and sparks increasing thunderstorm chances

throughout the Great Plains and parts of the Midwest. First, a pair of

cold fronts crossing the Great Lakes and Ohio Valley today will spread

showers and isolated thunderstorms over the region before reaching the

Northeast on Wednesday. Temperatures may drop rapidly enough for

precipitation to end as snow across northern New England. Meanwhile, a

trailing cold front entering the southern Plains will be the focus for

thunderstorms over the next few days from northern and West Texas to

central Oklahoma. A few storms could be capable of producing large hail

and damaging wind gusts across northwest Texas today, which has prompted

the Storm Prediction Center to issue a Slight Risk (level 2/5) of severe

weather. A few isolated severe thunderstorms may also develop off a

southern High Plains dryline on Wednesday ahead of the approaching western

upper trough. This upper level system will aid in more widespread shower

and thunderstorm activity throughout the central and southern Plains on

Thursday. Scattered severe thunderstorms are possible as low pressure

develops over the central High Plains and a strengthening dryline pushes

eastward, with most of the severe potential located between south-central

Nebraska and northern Texas. Along with the severe thunderstorm threat,

heavy rain could lead to isolated instances of flash flooding.Elsewhere, unsettled weather is also in the forecast throughout parts of

the Great Basin and eventually the Pacific Northwest by Thursday as

initial upper ridging and well above average temperatures gradually erode.

Much of the rainfall is expected to be mostly beneficial outside of any

lightning potential with thunderstorms over the central Great Basin. Highs

throughout the southwest are anticipated to reach the 80s and 90s through

Wednesday, with 60s and 70s for much of the Intermountain West.Cooler weather is in store for the Great Lakes and much of the eastern

U.S. beginning with the potential for frost this morning from the southern

Appalachians to southern New England. Lows dipping into the 30s here may

damage sensitive plants and vegetation if left unprotected. Temperatures

are forecast to rebound this afternoon as highs reach into the 60s and 70s

ahead of the next spring cold front entering from the Great Lakes tonight.

This will allow for midweek temperatures to drop to around 10 to 20

degrees below average for the Great Lakes and Northeast, equating to high

temperatures ranging from the 40s in northern locations to 60s along the

northern Mid-Atlantic coastline.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The Chicago Fed National Activity Index three-month moving average, CFNAI-MA3, increased to –0.19 in March 2024 from –0.28 in February. The CFNAI-MA3 is used for economic forecasting – and is my favorite coincident index. A zero value for the CFNAI has been associated with the national economy expanding at its historical trend (average) rate of growth which the current values indicate soft growth. In March, Fifty indicators improved from February to March, while 35 indicators deteriorated.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Mon Apr 22 2024

Valid 12Z Mon Apr 22 2024 – 12Z Wed Apr 24 2024…Shower and thunderstorm chances stretch from the Upper Midwest and

Great Lakes to the Southern Plains over the next few days……Chilly and frosty start to Earth Day throughout the Ohio Valley and

Mid-Atlantic, while well above average temperatures remain in place across

much of the Southwest/Great Basin…Precipitation chances are expected to remain mostly scattered and light

throughout much of the Nation into midweek as atmospheric moisture content

remains sparse following the passage of a strong cold front into the Gulf

of Mexico and western Atlantic. A few thunderstorms are possible across

the central and southern Florida Peninsula today as the aforementioned

cold front makes it’s final exit. A few storms could turn severe and

produce damaging wind gusts and hail. Thus, the Storm Prediction Center

has issued a Marginal Risk (level 1/5) for severe weather across southeast

Florida. Otherwise, rain chances are forecast to progress eastward from

the northern Plains to the Upper Midwest today along a swiftly moving

Pacific cold front. By Tuesday, rain chances are anticipated to stretch

from the Great Lakes and Ohio Valley to the Southern Plains. The heaviest

rain associated with this system is possible across parts of

central/eastern Oklahoma and western Arkansas on Wednesday, but this

aspect of the forecast remains somewhat uncertain.Temperatures are expected to start off in the 30s throughout much of the

Midwest, Ohio and Tennessee valleys, Mid-Atlantic, and Northeast as strong

high pressure leads to clear skies and cold temperatures at ground-level.

Lows into the low 30s are likely to lead to frost/freeze conditions and

has prompted Frost Advisories and Freeze Warnings for much of the region

where the growing season has already begun. Warmer weather is forecast to

begin spreading eastward on Tuesday, but will be short-lived as the next

shot of cold air enters the Great Lakes Tuesday night. Warmer weather is

anticipated to remain throughout the Southwest, Great Basin, and parts of

the Southern Plains through midweek. Highs can be expected to reach into

the 70s and 80s, with 90s and low 100s in the typical warm spots

throughout the Desert Southwest.

The full data sets for the 56 years from 1966 to 2022 show no discernable association patterns (correlations) for federal deficit spending (FDS) and inflation changes.1 Thus, we started an analysis by looking specifically at the various regimes of inflation change during the 56-year timeline. The most recent post2 analyzed the seven time periods over 56 years with positive inflation surges. This article analyzes the association between CPI changes and FDS changes during the four periods from 1966 to 2022 with negative inflation (disinflation/deflation) surges.

Image by Nicolae Baltatescu from Pixabay.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Sun Apr 21 2024

Valid 12Z Sun Apr 21 2024 – 12Z Tue Apr 23 2024…Lingering showers and storms expected across the Southeast today and

Florida through Monday……Above average temperatures forecast throughout the Southwest, with

below average readings for most locations east of the Rockies…Strong high pressure over the central U.S. today is set to slide eastward

by early this week and will allow for mostly tranquil weather conditions

across the Nation. A lingering frontal boundary along the Southeast will

produce additional scattered showers and thunderstorms through tonight

across the Carolinas, Georgia, and northern Florida. Rainfall amounts are

expected to remain mostly light as the activity quickly races to the east,

with rainfall chances on Monday confined to the Florida Peninsula. As the

aforementioned frontal boundary crosses central Florida to start the new

workweek, a few storms could strengthen enough to contain damaging wind

gusts and hail. The Storm Prediction Center has issued a Marginal Risk

(level 1/5) for severe weather across parts of the central and southern

Florida Peninsula in order to highlight this potential.Outside of a few rain and snow showers across New England associated with

an approaching cold front on Sunday night, the only other areas with

notable precipitation will be linked to a low pressure system and attached

cold front stretching from the Upper Great Lakes to the central Plains

Monday night. Rainfall amounts are expected to remain meager and mostly

under a half inch through Tuesday as the system swings into Midwest and

Ohio Valley.Temperatures across the country will remain split today, with warmth in

the Southwest and cooler than average highs across the central and eastern

United States. As high pressure weakens and slides east, a gradual warm up

can be expected east of the Rockies. The greatest turnaround is

anticipated over the southern Plains, where highs in the 60s today could

be replaced by 80s on Tuesday. Meanwhile, lows into the 20s and 30s this

morning are likely to lead to frost/freeze concerns throughout the Midwest

and parts of the Ohio Valley. Chilly morning temperatures are also

expected to linger on Monday, before cool weather erodes to the Northeast

on Tuesday with portions the Appalachians, Mid-Atlantic, and Northeast

waking up to frosty temperatures in the 30s.

| I watch or receive a large number of webinars each month. They are all great. I was just blown away by Gary’s graphics so I could not resist publishing them. Katie’s presentation is also great since it deals with a very important subject. I will probably write an article on her work also but there are only so many hours in the day and the number of interesting weather and climate topics is quite large. What follows in this article are many of Gary’s slides and one additional NOAA graphic that I added. My comments are in boxes like this. I provide a link to both presentations and if you watch that recording you will hear Gary’s comments on his slides. If I recall correctly, his presentation runs for about twenty-five minutes. |