Alexis Salapatek: A champion in Smooth

Alexis placed 1st in Open Smooth (A) and 2nd in Open Rhythm (A) at OSB 2023, thus concluding her pro/am career on a high note. She is turning pro and has been looking for a pro partner in Smooth and/or Rhythm.

Alexis placed 1st in Open Smooth (A) and 2nd in Open Rhythm (A) at OSB 2023, thus concluding her pro/am career on a high note. She is turning pro and has been looking for a pro partner in Smooth and/or Rhythm.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

400 AM EDT Wed Apr 03 2024Valid 12Z Wed Apr 03 2024 – 12Z Fri Apr 05 2024

…Heavy snow over the Upper Great Lakes, Upstate New York, and Northern

New England on Wednesday; Heavy snow over the Sierra Nevada Mountains and

Central Appalachians on Thursday……There is a Slight Risk of excessive rainfall over parts of the

Mid-Atlantic and Southern New England on Wednesday……There is a Sight Risk of severe thunderstorms over parts of the

Mid-Atlantic Coast to the Southeast Coast and Florida peninsula on

Wednesday…A deep storm over the Great Lakes will move southeastward to the

Mid-Atlantic Coast by Thursday evening and northeastward to the Gulf of

Maine by Friday. The system will produce a late-season winter storm across

portions of the Great Lakes and the Northeast from Wednesday into Friday.

The western portion of the Upper Peninsula of Michigan is forecast to

receive heavy snow through Wednesday evening. Snowfall accumulations of as

much as 1 to 2 feet are expected in parts of northern Wisconsin and the

western portion of the Upper Peninsula of Michigan.The same storm will produce Northeast snow and wind Wednesday through

Friday. Heavy, wet snow and some sleet will spread into the Northeast on

Wednesday and continue into Friday. Portions of northern New York and

Northern New England will likely see significant snow accumulations of

over 12 inches.The system will create significant impacts from heavy snow and wind, and

the combination of heavy snow rates and gusty winds will lead to dangerous

travel conditions, with whiteout conditions and snow-covered roads. The

combination of wet snow, high snow load, and strong wind gusts could also

result in tree damage and power outages. On Thursday, heavy snow will

develop over parts of the Central Appalachians.Furthermore, prolonged onshore winds late Wednesday and continuing through

Thursday will result in moderate coastal flooding for portions of the

Northeast Coast. Impacts include widespread roadway flooding, coastal and

bayside flooding, impassable roads, and some damage to vulnerable

structures.Moreover, along the associated front extending from the Lower Great Lakes

to the Central Appalachians southward to the Central Gulf Coast will move

off most of the East Coast overnight Wednesday. The boundary will aid in

producing showers, and severe thunderstorms will develop over parts of the

Mid-Atlantic and Southeast Coast. Therefore, the SPC has issued a Slight

Risk (level 2/5) of severe thunderstorms over parts of the Mid-Atlantic

Coast to the Southeast Coast and Florida peninsula through Thursday

morning. The hazards associated with these thunderstorms are frequent

lightning, severe thunderstorm wind gusts, hail, and a few tornadoes.Showers and thunderstorms will produce heavy rain over parts of the

Mid-Atlantic and Northeast. Therefore, the WPC has issued a Slight Risk

(level 2/4) of severe thunderstorms over parts of the Mid-Atlantic and

Southern New England through Thursday morning. The associated heavy rain

will create mainly localized areas of flash flooding, with urban areas,

roads, and small streams the most vulnerable. The threat of severe

thunderstorms and excessive rainfall ends on Thursday.Meanwhile, a front moving inland over the Pacific Northwest into Northern

California will move eastward to the Northern Rockies to the Great Basin

and Southwest by Friday. On Wednesday, the system will create coastal rain

and higher-elevation snow over parts of the Pacific Northwest/ Northern

Intermountain Region, moving inland to the Northern Intermountain Region,

Great Basin, and Northern California overnight. The snow levels will lower

after the front passes by over the Northwest. The coast/lower elevation

rain and higher elevation snow will continue over the Pacific

Northwest/Northern Intermountain Region through Friday.On Thursday, rain and higher-elevation snow will move into Central

California and expand into the Great Basin. Overnight Thursday, rain will

move into Southern California. Heavy snow will develop over the Sierra

Nevada Mountains on Thursday into Friday.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured goods in February 2024 was up 3.6% year-over-year (versus the Federal Reserve’s IP which was down 0.5% year-over-year). Does this mean the manufacturing recession is ending – it will take a few months more of data to know for sure.

The number of job openings changed little at 8.8 million on the last business day of February 2024 – and as this number has been little changed over the last 5 months, one would expect little change in the rate of growth for employment. Over the month, the number of hires and total separations were little changed at 5.8 million and 5.6 million, respectively. Within separations, quits (3.5 million) and layoffs and discharges (1.7 million) changed little.

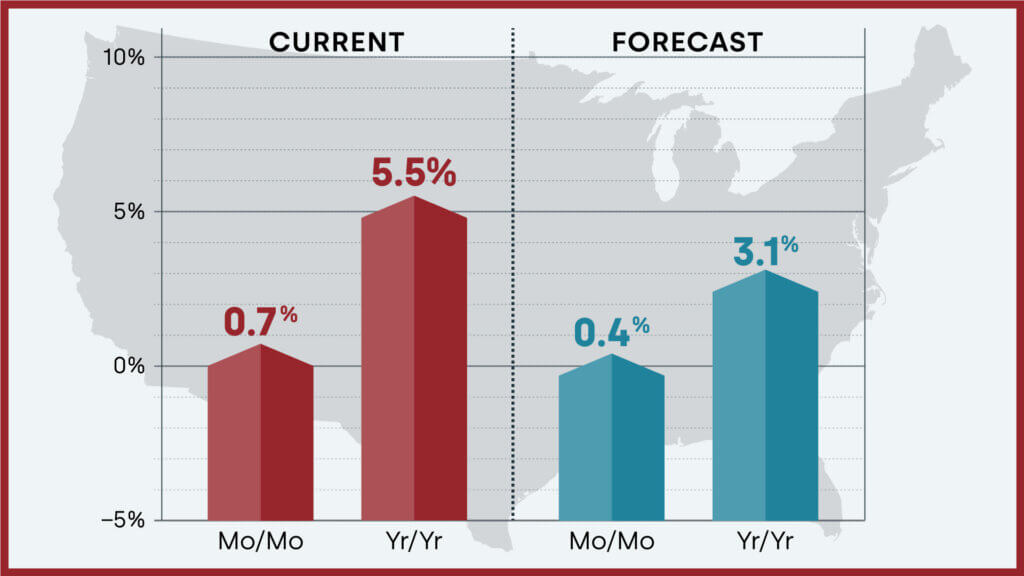

U.S. annual home price growth remained mostly consistent with numbers seen since last fall in February but finally slowed as the residual impact of comparing gains with weak 2022 home prices wore off. CoreLogic projects that year-over-year home price gains will continue to rise at a slower pace for the rest of 2024, which suggests more certainty for potential homebuyers who have been waiting to get a foot in the door. Dr. Selma Hepp, chief economist for CoreLogic noted:

Home price growth pivoted in February, as the impact of the January 2023 Home Price Index bottom finally faded. As a result, the U.S. should begin to see slowing annual home price gains moving forward. Nevertheless, with a 0.7% increase from January to February 2024, which is almost double the monthly increase recorded before the pandemic, spring home price gains are already off to a strong start despite continued mortgage rate volatility. That said, more inventory finally coming to market will likely translate to more options for buyers and fewer bidding wars, which typically keeps outsized price growth in check. Still, despite affordability challenges, homebuyer demand appears to favor already expensive, coastal markets with a limited availability of properties for sale.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Tue Apr 02 2024

Valid 12Z Tue Apr 02 2024 – 12Z Thu Apr 04 2024…Heavy snow over the Upper Great Lakes/Upper Mississippi Valley on

Tuesday and Wednesday; Heavy snow over Upstate New York and Northern New

England on Wednesday……There is a Moderate Risk of severe thunderstorms over parts of the Ohio

Valleys on Tuesday and two areas of Slight Risk over parts of the

Mid-Atlantic and Florida peninsula on Wednesday……There is a Sight Risk of excessive rainfall over parts of the Lower

Great Lakes, Ohio/Tennessee Valleys, and Central Appalachians on Tuesday…A deep storm over the Middle Mississippi and Ohio Valleys will move to

Southern New England by Thursday. The system will produce a large,

long-duration winter storm, producing gusty winds and late-season heavy

snow across portions of the Great Lakes and the Northeast from Tuesday

into Friday. The Upper Great Lakes are forecast to receive heavy snow.

Heavy snow will have a 60 to 70 percent likelihood of developing over

Wisconsin by Tuesday evening and expanding into the Upper Peninsula of

Michigan overnight Tuesday. Snow will continue over much of the region

through Wednesday, with additional heavy snow across the Upper Peninsula

of Michigan, before ending on Thursday.The same storm will produce Northeast snow and wind Wednesday-Friday.

Secondary low-pressure development along the Mid-Atlantic coast will have

a 60 to 70 percent likelihood of bringing heavy, wet snow and some sleet

to the Northeast Wednesday afternoon through Friday. Significant snow

accumulations are likely over Upstate New York and Northern New England.

The system will create significant impacts from heavy snow and wind, and

the combination of heavy snow rates and gusty winds will create a 60 to 70

percent likelihood of hazardous travel due to low visibility and

snow-covered roads. The wet snow and high snow load may also damage trees

and impact infrastructure.Moreover, along the associated front extending from the Mid-Atlantic to

the Ohio/Middle Mississippi Valleys, showers and severe thunderstorms will

develop over parts of the Ohio/Tennessee Valleys. Therefore, the SPC has

issued a Moderate Risk (level 4/5) of severe thunderstorms over parts of

the Ohio Valley through Wednesday morning. The hazards associated with

these thunderstorms are frequent lightning, severe thunderstorm wind

gusts, hail, and a few tornadoes. In addition, there is an increased

threat of EF2 � EF5 tornados over parts of the Ohio/Tennessee/Lower

Mississippi Valleys. Additionally, there is an increased threat of severe

thunderstorm wind gusts of 65 knots or greater over parts of the Ohio

Valley and a small portion of the Tennessee Valley. Further, there is an

increased threat of two-inch or greater hail over parts of the Ohio Valley.The storms will also produce heavy rain. Therefore, the WPC has issued a

Slight Risk (level 2/4) of excessive rainfall over parts of the Lower

Great Lakes, Ohio/Tennessee Valleys, and Central Appalachians through

Wednesday morning. The associated heavy rain will create mainly localized

areas of flash flooding, with urban areas, roads, and small streams the

most vulnerable.Showers and severe thunderstorms will develop over two areas as the front

moves across the Mid-Atlantic and parts of the Southeast. Therefore, the

SPC has issued a Slight Risk (level 2/5) of severe thunderstorms over

parts of the Mid-Atlantic and a second area over the Florida peninsula

from Wednesday into Thursday morning. The hazards associated with these

thunderstorms are frequent lightning, severe thunderstorm wind gusts,

hail, and a few tornadoes.However, the threat of excessive rainfall will be limited to a Marginal

Risk over parts of northern Mid-Atlantic and Southern New England from

Wednesday through Thursday morning.Meanwhile, a front over the Eastern Pacific will move onshore over the

Pacific Northwest by late Tuesday afternoon and move eastward to the

Northern Rockies to the Great Basin and Southern California by Thursday.

The system will create coastal rain and higher-elevation snow moving

inland to the Northern Intermountain Region, Great Basin, and Northern

California overnight Wednesday into Thursday.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Construction spending during February 2024 was 10.7% above February 2023. Construction has been one of the bright spots in the economy.

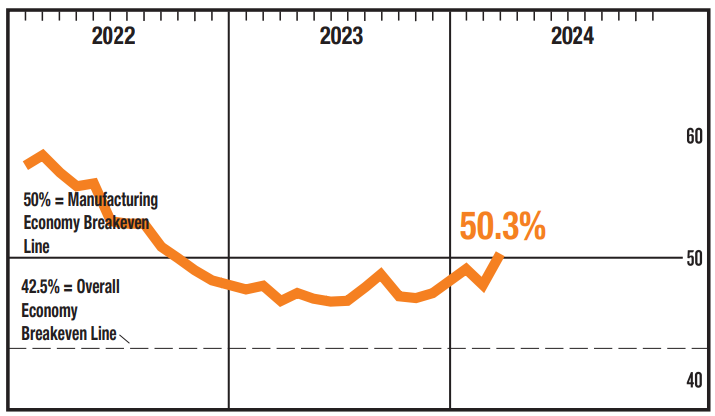

The ISM Manufacturing PMI® registered 50.3 percent in March, up 2.5 percentage points from the 47.8 percent recorded in February. This is the first time in over 18 months that manufacturing has been in positive territory. Could it be that the manufacturing recession is over? Timothy R. Fiore, CPSM, C.P.M., Chair of the Institute for Supply Management® (ISM®) Manufacturing Business Survey Committee stated:

The Supplier Deliveries Index figure of 49.9 percent is 0.2 percentage point lower than the 50.1 percent recorded in February. (Supplier Deliveries is the only ISM® Report On Business® index that is inversed; a reading of above 50 percent indicates slower deliveries, which is typical as the economy improves and customer demand increases.) The Inventories Index increased 2.9 percentage points to 48.2 percent following a reading of 45.3 percent in February. The New Export Orders Index reading of 51.6 percent is the same reading as registered in February. The Imports Index continued in expansion territory, registering 53 percent, the same figure as in February. Both indexes repeated their highest readings since July 2022, when the New Export Orders Index registered 52.6 percent and the Imports Index registered 54.4 percent.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

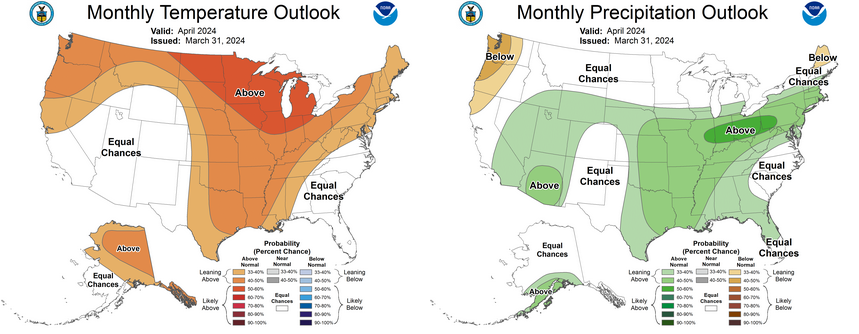

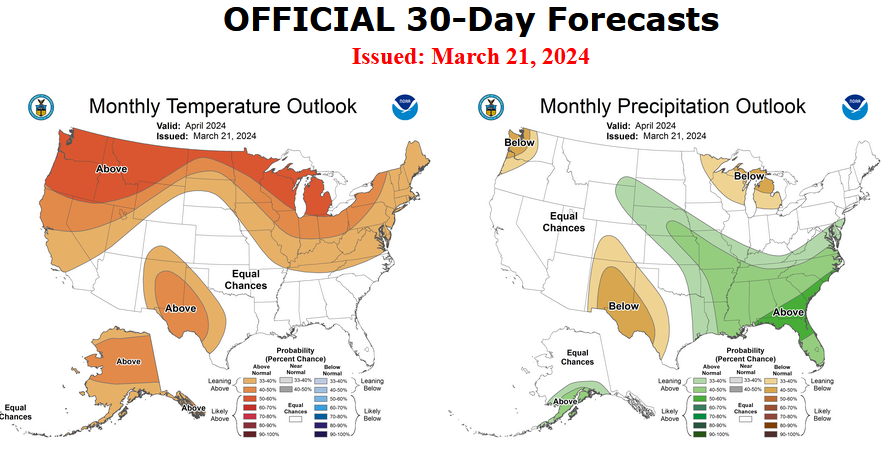

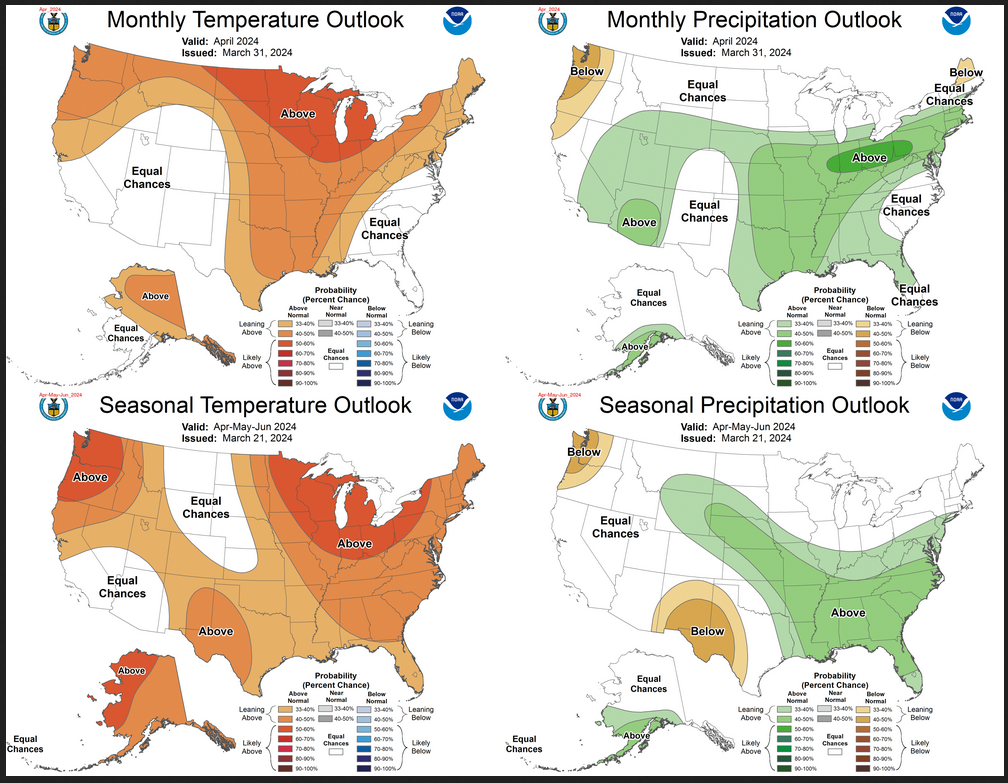

There have been some significant changes in the Outlook for April and these are addressed in the NOAA Discussion so it is well worth reading. We provided the prior Mid-Month Outlook for April for comparison. It is easy to see the changes by comparing the Mid-Month and Updated Maps.

The article includes the Drought Outlook for April. NOAA also adjusted the previously issued Seasonal (AMJ) Drought Outlook to reflect the changes in the April Drought Outlook. We have included a map showing the amount of water in the snowpack waiting to be released in the Spring. We also provide the Week 2/3 Tropical Outlook for the World. We also include a very interesting CLIMAS Discussion.

The best way to understand the updated outlook for April is to view the maps and read the NOAA discussion. I have highlighted the key statements in the NOAA Discussion.

| There have been some significant changes. Remember, it is the top set of maps that are the current outlook for April. |

| The top row is the Updated Outlook for the new month. There is a temperature map and a precipitation map. The second row is a three-month outlook that includes the new month. I think the outlook maps are self-explanatory. What is important to remember is that they show deviations from the current definition of normal which is the period 1991 through 2020. So this is not a forecast of the absolute value of temperature or precipitation but the change from what is defined as normal or to use the technical term climatology. |

| The three-month map was issued on March 21, 2024. One expects some changes 10 days later. But the changes to both maps are fairly dramatic. This then gives us some reason to question the three-month AMJ temperature and precipitation Outlooks. |

This article concludes the analysis of the correlation patterns between Financial Sector Debt (FSD) and Consumer Inflation (CPI). The last of the three types of inflation patterns (time periods with no significant inflation trends) is the subject of analysis here. The other two types of patterns (inflation surges1 and disinflation/deflation surges2) were analyzed previously. The conclusion discusses the correlation patterns for all time periods, looks for any common threads, and identifies important differences across time periods and types of correlation patterns.

Image by Gerd Altmann from Pixabay.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Sun Mar 31 2024

Valid 12Z Sun Mar 31 2024 – 12Z Tue Apr 02 2024…Heavy snow over parts of the higher elevations of Wyoming, Nevada,

Colorado, Utah, and Arizona……There is a Sight Risk of excessive rainfall over parts of over parts of

the Middle Mississippi and Ohio Valleys on Monday……There is a Slight Risk of severe thunderstorms over parts of the Middle

Mississippi and Ohio Valleys on Sunday; there is an Enhanced Risk of

severe thunderstorms over parts of the Southern Plains, Middle

Mississippi, and Ohio Valleys on Monday…A front extending from the Mid-Atlantic to the Central Plains will be

quasi-stationary through Monday morning. Moisture from the Western Gulf of

Mexico will pool along the boundary, creating showers and severe

thunderstorms over parts of the Middle Mississippi and Ohio Valleys.

Therefore, the SPC has issued a Slight Risk (level 2/5) of severe

thunderstorms over parts of the Middle Mississippi and Ohio Valleys

through Monday morning. The hazards associated with these thunderstorms

are frequent lightning, severe thunderstorm wind gusts, hail, and a few

tornadoes. Farther east along the boundary, showers and thunderstorms will

develop over parts of the Central Appalachians and Mid-Atlantic on Sunday.On Monday, the threat of severe thunderstorms increases over parts of the

Southern Plains, Middle Mississippi, and Ohio Valleys. Therefore, the SPC

has issued an Enhanced Risk (level 3/5) of severe thunderstorms over the

parts of the Southern Plains, Middle Mississippi, and Ohio Valleys from

Monday into Tuesday morning. The hazards associated with these

thunderstorms are frequent lightning, severe thunderstorm wind gusts,

hail, and a few tornadoes. Moreover, there is an increased threat of EF2

to EF5 tornados over parts of the Middle Mississippi Valley into the

Western Ohio Valley. In addition, there is an increased threat of hail two

inches or greater in size over parts of the Southern Plains/Middle

Mississippi Valley.Furthermore, the showers and thunderstorms will produce heavy rain over

parts of the Middle Mississippi and Ohio Valleys. Therefore, the WPC has

issued a Slight Risk (level 2/4) of excessive rainfall over parts of the

Middle Mississippi and Ohio Valleys from Monday to Tuesday morning. The

associated heavy rain will create mainly localized areas of flash

flooding, with urban areas, roads, and small streams the most vulnerable.

Likewise, showers and thunderstorms will extend into the Central

Appalachian and Mid-Atlantic on Monday.Meanwhile, the threat of excessive rainfall is a Marginal Risk over parts

of Southern California and Arizona on Sunday. The associated heavy rain

will create localized areas of flash flooding, affecting areas that

experience rapid runoff and burn scars. In addition, the moisture streamed

inland due to the upper-level low off the Southern California Coast will

aid in creating heavy snow over the higher elevations of Wyoming, Nevada,

Colorado, Utah, and Arizona through Monday. Moderate to heavy snow will

linger over parts of Utah, Arizona, Colorado, and New Mexico from Monday

evening into Tuesday. Rain will develop over lower elevations of the

Southwest and Southern Rockies, ending on Tuesday. Additionally, light to

moderate snow will develop over parts of the Northern/Central Plains on

Sunday. The snow will linger over the area on Monday and end overnight on

Monday.

Authored by Steven Hansen

EconCurrent‘s Economic Index again modestly improved and is slightly in positive territory. This does not mean the economy is going gangbusters but is continuing to plod along. There remain three major indicators that suggest a recession is coming. Read on to understand the currents affecting our economic growth.