Colonial America 1776-2030?

On this day of America’s 246th birthday, let’s clearly recognize what America truly is: the last big colonial power, collapsing!

On this day of America’s 246th birthday, let’s clearly recognize what America truly is: the last big colonial power, collapsing!

Here is what we are paying attention to this afternoon (Saturday) and the next two days from the Saturday afternoon NWS Forecast.:

...Tropical Storm Colin to track from the Southeast/southern Mid-Atlantic Coast today before moving offshore on Sunday... ...Wet weather, isolated Flash Flooding and Severe thunderstorms possible across the Southeast quarter of the nation and from the Central to Northern Plains into the Northern Rockies, Northwest and from portions of the Southwest into the Southern Rockies... ...Areas extending from the West Coast inland through the Great Basin and Northern Rockies will have cooler than average temperature while the Plains into the Ohio and Tennessee Valleys and Great Lakes will be warmer than average temperatures... ...Critical fire weather conditions to persist across the Great Basin this weekend..

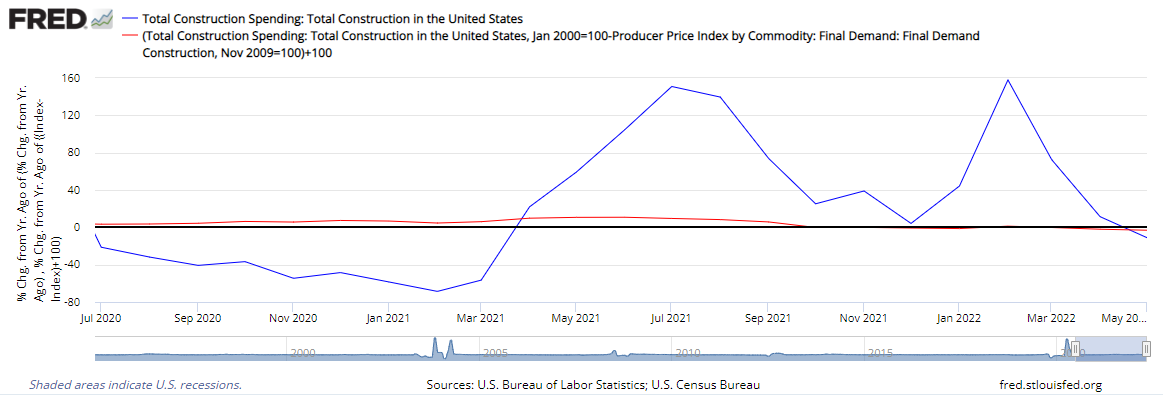

Headlines say construction spending declined insignificantly in May 2022 month-over-month. The year-over-year inflation adjusted (red line on chart below) and current dollar numbers (blue line on chart below) both show this sector is in contraction.

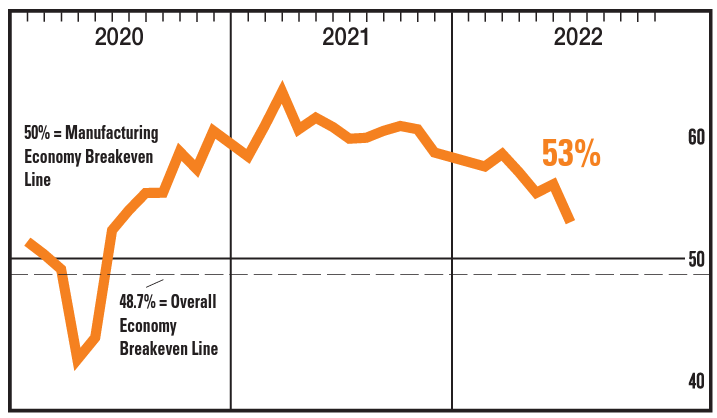

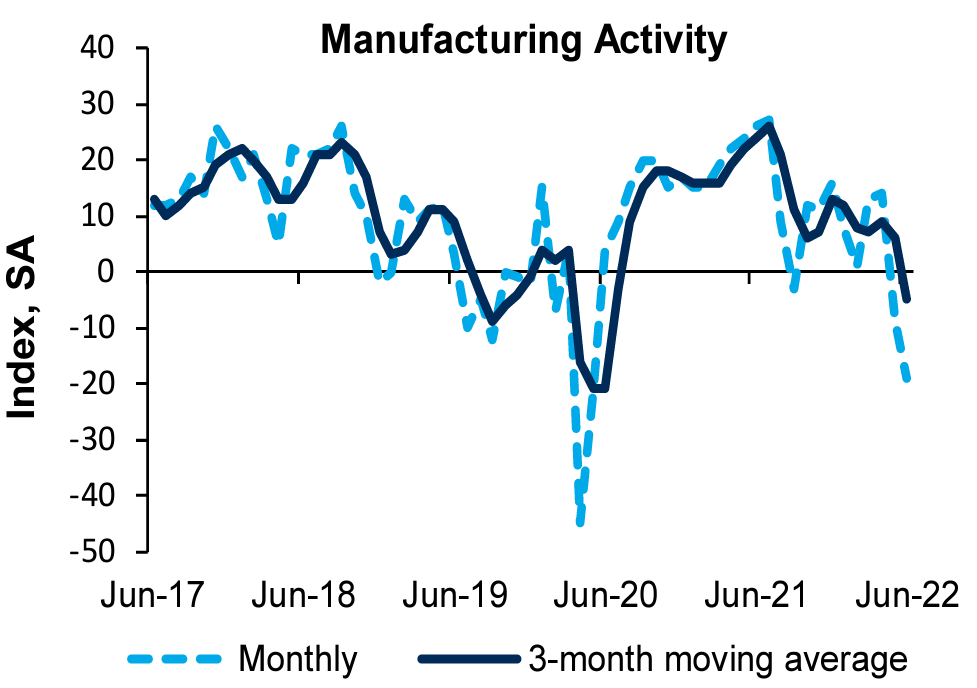

The Institute For Supply Management (ISM) says manufacturing grew in June 2022 but declined relative to the previous month.

These and other headlines and news summaries moving the markets today are included below.

At the end of every month, NOAA updates their Mid-Month Outlook for the following month which in this case is July. They also issue a Drought Outlook for the following month and update the three-month Drought Outlook. We are reporting on that tonight. The updated Outlook is very similar to the Mid-Month Outlook. This is surprising since the Mid-Month Outlook was issued two weeks ago and there usually are more changes in that period of time.

For temperature, the shape and location of the large dry anomaly have changed a bit. The cool anomaly in the Northwest is now slightly larger. For precipitation, the area where an above-average Monsoon is forecasted is a little larger and shifted a bit to include more of New Mexico. there is a new small dry anomaly

We provide partial-month Outlooks for the first 22 days of July which allows us to somewhat assess if the Monthly Outlook is consistent with the partial-month Outlooks and it generally is. But we will not be able to answer that question definitively until the Week 3-4 Outlook is issued tomorrow. We will provide an update at that time.

We also provide enough information for readers to understand any changes from the Mid-Month Outlook and we try to figure out why these changes were made. Many of the changes are explained in the NOAA discussion which is included in the article. The partial-month forecasts that we have provided show how NOAA thinks this will play out as the weather pattern evolves during July.

There is also a discussion of the ENSO condition which is ever so slightly different than what NOAA used to develop the Mid-Month Outlook. But there is a fairly strong signal that this La Nina will end in late winter 2022/2023. The impacts on weather may not be noticed until Spring. But that is just the current forecast and can change.

We have also begun our tropical storm coverage. Yes, it is that time of the year. We are also providing special coverage of the Monsoon by providing the links to those daily updates.

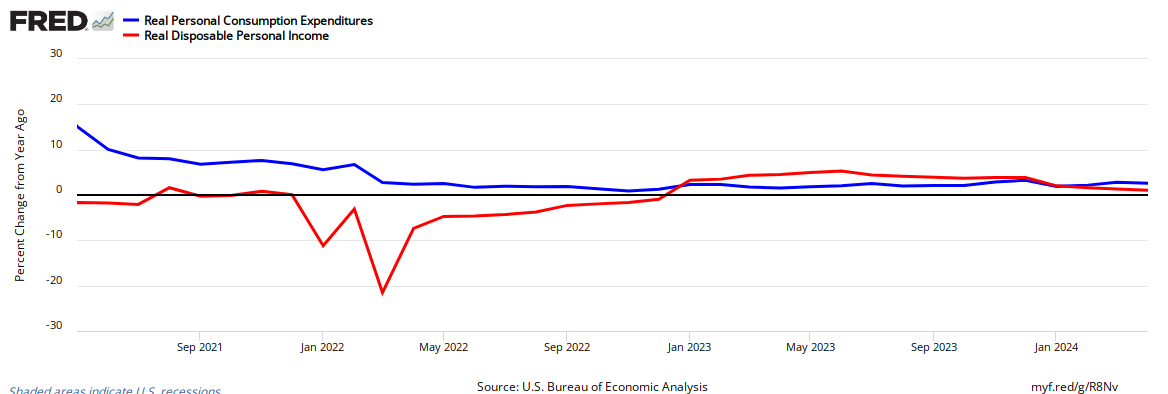

Blame it on inflation – real disposable personal income and outlays for May 2022 declined month-over-month. However, on a year-over-year basis, real disposable personal income declined but real expenditures insignificantly improved.

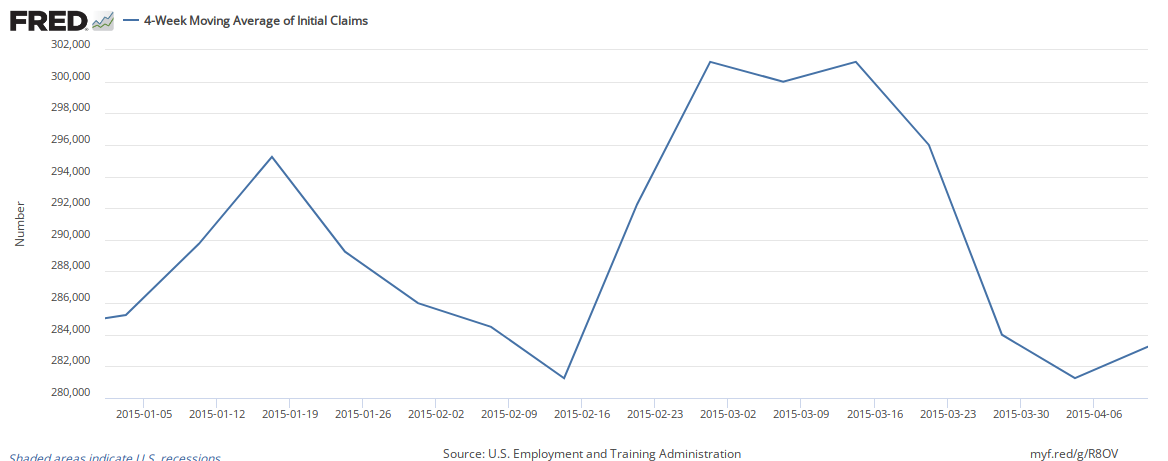

The four-week moving average for unemployment insurance claims continues to modestly grow.

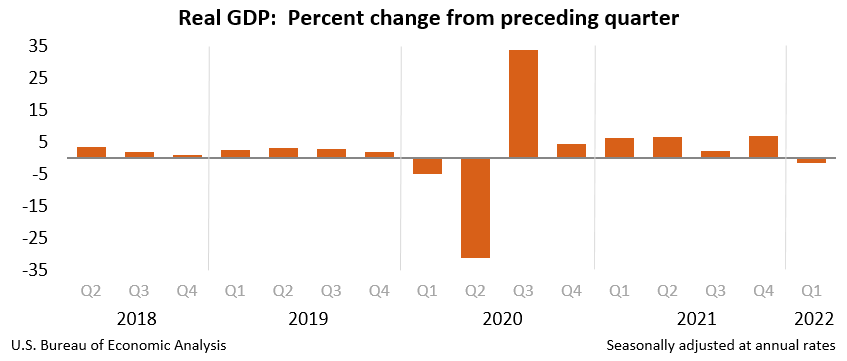

More potential concerning economic news, the GDPNow model released today estimates real GDP growth in the second quarter of 2022 at -1.0 percent, down from 0.3 percent on June 27. If this comes to pass – this would be the second quarter in a row with negative growth and a significant recession flag.

These and other headlines and news summaries moving the markets today are included below.

In a previous post we saw how Concordian economics offers a paradigm through which we can, not only talk of the importance of the Principle of Subsidiarity, but even automatically implement the important recommendations advocated by this principle.

Here we will see how Concordian economics automatically implements the content of two more principles that are an important outgrowth of Subsidiarity: Solidarity and Sustainability.

Views on the economy among CFOs have worsened for 2022, according to the latest results of The CFO Survey, a collaboration of Duke University’s Fuqua School of Business and the Federal Reserve Banks of Richmond and Atlanta.

The third estimate of 1Q2022 Real GDP was -1.6% (quarter-over-quarter) – down from the second estimates -1.5%. Still, year-over-year Real GDP growth was 3.5% over 1Q2021 – down from 4Q2021’s 5.5%.

These and other headlines and news summaries moving the markets today are included below.

In this post, I will clearly define China’s state capitalism as communism + capitalism. This will help my fellow Americans best understand China, as well as the world.

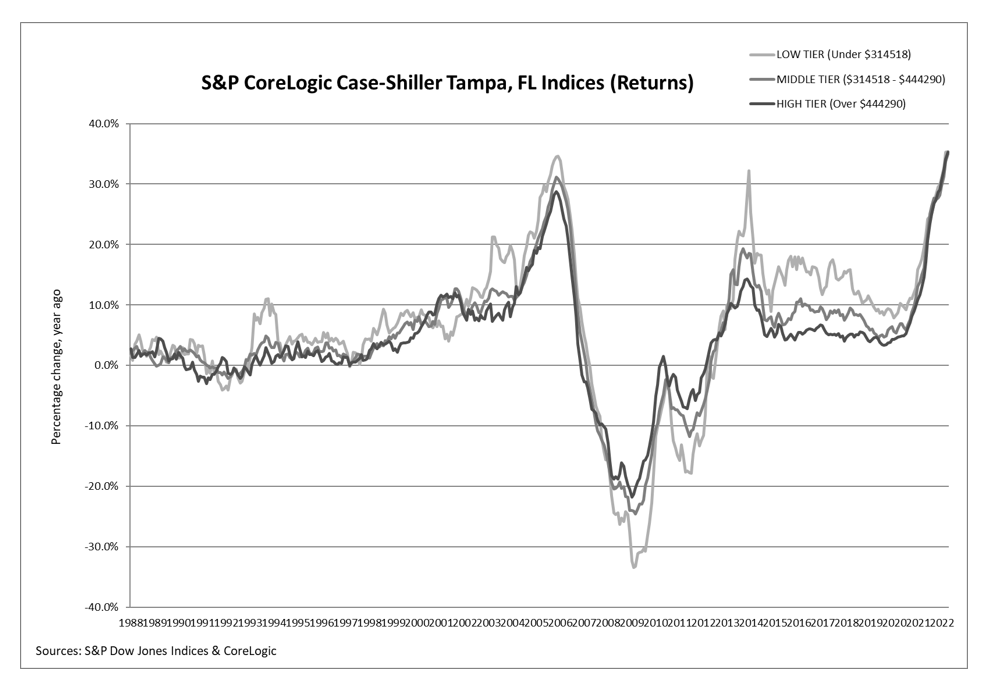

Home prices are still surging in April 2022 according to the S&P CoreLogic Case-Shiller National Home Price Index. CoreLogic Deputy Chief Economist Selma Hepp stated:

While still surging at a 20.4% pace in April, the S&P CoreLogic Case-Shiller Index finally took a turn again in April and slowed from March’s peak increase of 20.6%. The slowing of monthly gains, which were up 2.1%, also suggest further deceleration ahead. Signs of a tipping point toward a greater balance between buyers and sellers are increasing, albeit only compared to some of the most competitive conditions since the early 2000s. In particular, there is a buildup in overall active inventory as fewer buyers are rushing to make offers, resulting in an increase in the share of homes that have reduced their prices from the original list price. Also, there is a notable deceleration of monthly gains in the Western markets where a rush to lock in favorable mortgage rates pushed home price growth higher in prior months.

The Richmond Fed (Fifth District) manufacturing declined again in June 2022. Manufacturing across the U.S. is slowing.

These and other headlines and news summaries moving the markets today are included below.

The National Association of Realtors announced that their May 2022 pending home sales index declined 13.6% year-over-year – although there was a modest increase month-over-month. According to NAR Chief Economist Lawrence Yun:

Despite the small gain in pending sales from the prior month, the housing market is clearly undergoing a transition. Contract signings are down sizably from a year ago because of much higher mortgage rates.

New orders for May 2022 durable goods increased according to US Census – and is up 10.9% year-over-year, Unfortunately, inflation in durable goods is running at 8.5% which reduces the growth substantially. Still, there are no signs of slowing in durable goods.

These and other headlines and news summaries moving the markets today are included below.