Summary Of the Markets Today:

- The Dow closed down 254 points or 0.82%,

- Nasdaq closed down 1.33%,

- S&P 500 closed down 0.88%,

- WTI crude oil settled at 105, down 3.44%,

- USD $105.09 down 0.01%,

- Gold $1807 down 0.20%,

- Bitcoin $18891 down 7.05% – Session Low 18853,

- 10-year U.S. Treasury 3.022% down 0.71%

Today’s Economic Releases:

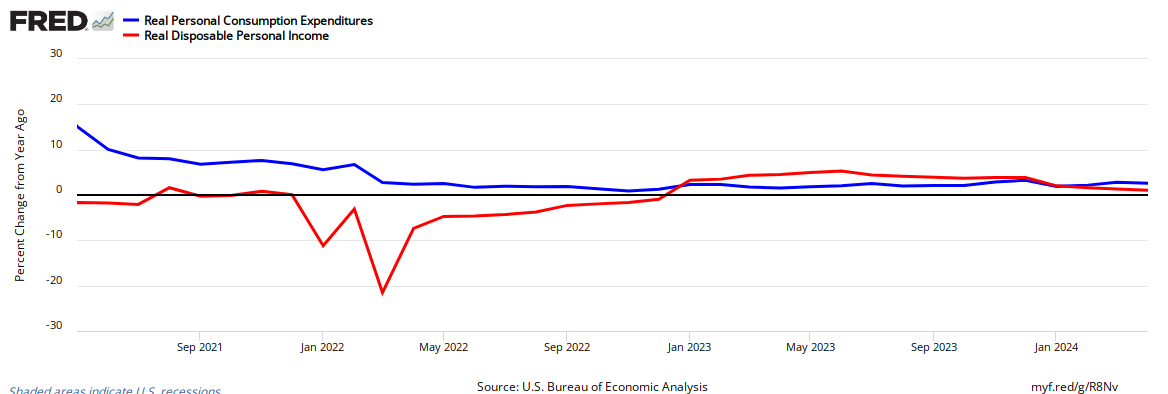

Blame it on inflation – real disposable personal income and outlays for May 2022 declined month-over-month. However, on a year-over-year basis, real disposable personal income declined but real expenditures insignificantly improved.

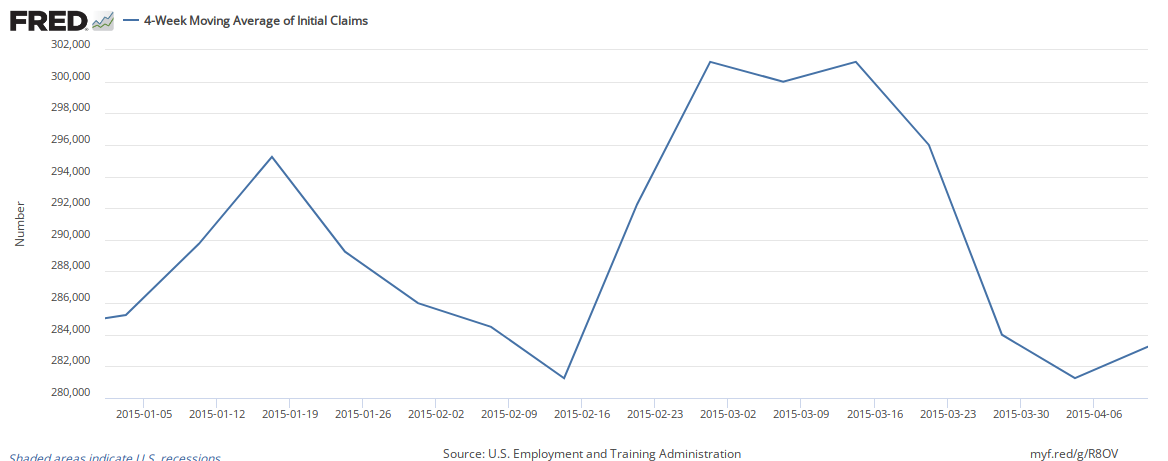

The four-week moving average for unemployment insurance claims continues to modestly grow.

More potential concerning economic news, the GDPNow model released today estimates real GDP growth in the second quarter of 2022 at -1.0 percent, down from 0.3 percent on June 27. If this comes to pass – this would be the second quarter in a row with negative growth and a significant recession flag.

A summary of headlines we are reading today:

- Supreme Court Kills Climate Rules

- Former Apple, J.C. Penney exec Ron Johnson’s Enjoy Technology files for bankruptcy months after it went public

- Spirit delays shareholder vote on merger hours before meeting to continue deal talks with Frontier, JetBlue

- Winning ticket for Powerball’s $366.7 million jackpot sold in Vermont. Here’s the tax bite for the winner

- First-Half FUBAR: Stocks Worst In 60 Years, Bonds & Bitcoin Worst Ever

- Two million more people paying higher rate tax

- Distributed Ledger: Bitcoin to record the worst first half of a year in history. Here’s what to watch in crypto for the second half.

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Recession Fears Could Derail The Global Metals BoomMexico’s steel metal market recently saw a slowdown, leading experts to believe that Mexico’s industrial metal market may soon turn bearish. Flat steel prices, along with long steel prices, have been dropping over the past several weeks. In fact, Mexicos steel prices have been in a steady decline since April. However, in mid-May, prices dropped sharply and remain bearish. This is a dramatic change from March of 2022 when Mexico’s steel metal market was following an unquestionably-bullish path.m Experts note that the Mexican Read more at: https://oilprice.com/Metals/Commodities/Recession-Fears-Could-Derail-The-Global-Metals-Boom.html |

|

Uniper In Bailout Talks With German Government As Russia Cuts Gas SupplyGerman energy giant Uniper, one of the largest customers of Russia’s Gazprom, has initiated talks with the German government on possible measures to stabilize its finances amid low Russian gas deliveries and soaring gas prices. Uniper entered into discussions with the German government on possible stabilization measures for which a number of instruments could be considered, such as guarantees and collateral, increasing the current not yet drawn KfW credit facility, and equity investments, the company said in a statement. Uniper Read more at: https://oilprice.com/Latest-Energy-News/World-News/Uniper-In-Bailout-Talks-With-German-Government-As-Russia-Cuts-Gas-Supply.html |

|

Emerging Markets Are Scrambling For Solutions To Curb Plastic WasteMore than two years after the start of the Covid-19 pandemic, many emerging markets are still dealing with high levels of plastic waste. Amid numerous environmental and health challenges, countries and companies alike are working on solutions to combat the issue. Accounting for around 12% of global solid waste before the pandemic, according to the World Bank, plastic took on a more prominent role during the health crisis. Personal protective equipment (PPE) was seen as key to stopping the spread of the virus, while the single-use plastics employed Read more at: https://oilprice.com/The-Environment/Global-Warming/Emerging-Markets-Are-Scrambling-For-Solutions-To-Curb-Plastic-Waste.html |

|

UK Ready To Pay Companies To Cut Electricity ConsumptionThe UK’s National Grid is exploring the idea of paying companies in Britain to use less electricity next winter as part of measures to conserve gas and avoid blackouts, Bloomberg reported on Thursday, quoting a document it had seen. National Grid has sent requests to some companies, asking them how much money they would be willing to accept in order to reduce their power consumption from the national power grid this coming winter, Bloomberg reports. Possible payments could start from $121 (100) per megawatt-hour (MWh) to $7,274 Read more at: https://oilprice.com/Latest-Energy-News/World-News/UK-Ready-To-Pay-Companies-To-Cut-Electricity-Consumption.html |

|

Supreme Court Kills Climate RulesOn June 30, by a six to three vote, the US Supreme Court issued its long-awaited ruling for West Virginia vs the Environmental Protection Agency. Lawsuits filed mainly by US coal companies challenging the EPAs regulatory authority were consolidated into this one case. The narrow legal issue here, simply stated, is whether the Environmental Protection Agency (EPA ) had the authority to regulate carbon emissions from so-called stationary sources, such as coal-fired power plants, or whether this regulation constituted an excessive Read more at: https://oilprice.com/Energy/Energy-General/Supreme-Court-Kills-Climate-Rules.html |

|

NATO Chief: Ukraine Invasion Is Biggest Security Crisis Since World War IINATO has declared Russia the “most significant and direct threat to its member’s peace and security amid Moscow’s unprovoked invasion of Ukraine. The Western military alliance made the declaration in a statement as its leaders met in Madrid on June 29 to confront what NATO chief Jens Stoltenberg called the biggest security crisis since World War II. NATO’s declaration underscores how dramatically Russia’s invasion of Ukraine has unsettled Europe’s post-Cold War security order. The alliance also promised to step up Read more at: https://oilprice.com/Geopolitics/International/NATO-Chief-Ukraine-Invasion-Is-Biggest-Security-Crisis-Since-World-War-II.html |

|

Housing shortage starts easing as listings surge in JuneThe historic housing shortage brought on by slow construction and strong demand from buyers in the pandemic is finally starting to ease. Read more at: https://www.cnbc.com/2022/06/30/housing-shortage-starts-easing-as-listings-surge-in-june.html |

|

Walgreens profits squeezed as Covid vaccine wanes, health-care investment risesThe drugstore reiterated its forecast for the year after seeing online purchases jump and retail sales bounce back in the quarter. Read more at: https://www.cnbc.com/2022/06/30/walgreens-wba-q3-2022-earnings-.html |

|

Captain Minnie Mouse, ‘Frozen’ and a $5,000 Star Wars cocktail: Disney pins big hopes on new Wish cruise shipDisney’s newest cruise ship sets sail at a time of transition and recovery for the cruise industry, which was battered by the pandemic. Read more at: https://www.cnbc.com/2022/06/30/5000-star-wars-cocktail-and-minnie-mouse-disney-to-launch-wish-cruise-ship.html |

|

Former Apple, J.C. Penney exec Ron Johnson’s Enjoy Technology files for bankruptcy months after it went publicEnjoy Technology, a retail startup founded by former Apple and J.C. Penney exec Ron Johnson, filed for Chapter 11 bankruptcy protection on Thursday. Read more at: https://www.cnbc.com/2022/06/30/ex-apple-exec-ron-johnsons-enjoy-technology-files-for-bankruptcy.html |

|

Spirit delays shareholder vote on merger hours before meeting to continue deal talks with Frontier, JetBlueSpirit Airlines said Wednesday that it would delay a shareholder vote on its proposed merger with Frontier Airlines scheduled for tomorrow until July 8. Read more at: https://www.cnbc.com/2022/06/29/spirit-airlines-delays-shareholder-vote-on-frontier-deal-to-july-8.html |

|

Bed Bath & Beyond says it’s still open to selling its Buybuy Baby divisionThe baby gear banner has been a focal point in a dispute with activist investor, Ryan Cohen. Read more at: https://www.cnbc.com/2022/06/29/bed-bath-beyond-says-its-still-open-to-selling-its-buybuy-baby-division.html |

|

Winning ticket for Powerball’s $366.7 million jackpot sold in Vermont. Here’s the tax bite for the winnerFor this jackpot, a required federal tax withholding of 24% would reduce the $208.5 million cash option by about $50 million. More would likely be due, as well. Read more at: https://www.cnbc.com/2022/06/30/tax-bill-for-vermont-winner-of-powerball-366point7-million-jackpot.html |

|

Nikola still short of shareholder support to issue new stock – hampered by founder Trevor MiltonThe company has spent the past month rallying shareholders to vote for the proposal in sufficient numbers to overcome objections from founder Trevor Milton. Read more at: https://www.cnbc.com/2022/06/30/nikola-shareholder-vote-to-issue-new-stock-seeks-to-outweigh-founder-trevor-milton.html |

|

Starz could turn into an ‘acquisition machine’ after Lionsgate spins it offA publicly traded Starz may look to increase in size by targeting other subscale media and entertainment companies. Read more at: https://www.cnbc.com/2022/06/29/starz-could-turn-into-acquisition-machine-after-spinoff-from-lionsgate.html |

|

RH shares slide after company lowers its outlook for the yearHigh-end furniture chain RH on Wednesday slashed its outlook for 2022 revenue. Read more at: https://www.cnbc.com/2022/06/29/rh-shares-slide-after-company-lowers-its-outlook-for-the-year.html |

|

Unilever reaches deal to keep selling Ben & Jerry’s ice cream in IsraelUnilever said it sold the Israeli branch of Ben & Jerry’s to Avi Zinger, whose American Quality Products already licenses the ice cream for sale in the country. Read more at: https://www.cnbc.com/2022/06/29/unilever-reaches-deal-to-keep-selling-ben-jerrys-ice-cream-in-israel.html |

|

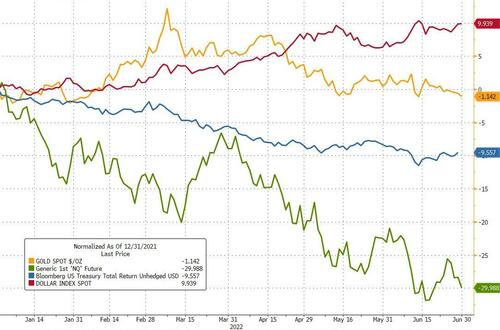

First-Half FUBAR: Stocks Worst In 60 Years, Bonds & Bitcoin Worst EverIt appears the world’s investors were ‘over-stuffed’ full of liquidity just as 2021 ended… …which meant the first half of 2022 was a bloodbath for most. Stocks were clubbed like a baby seal, bonds were battered, there was carnage in crypto as the dollar soared and gold was steady…

S&P was down 21.01% in 1970 H1, we are currently down 21.22% H1… so, according to Bloomberg data, this would be worst since 1962… 60 years ago Read more at: https://www.zerohedge.com/markets/first-half-fubar-stocks-worst-60-years-bonds-bitcoin-worst-ever |

|

The Jaws Of Trade Squeezing The Supply ChainBy FreightWaves The jaws of the supply chain vise are squeezing trade so tight that the headache it is creating will be a whopper for logistics managers this peak season. Port congestion is growing again as a result of labor and equipment inefficiencies. Trade requires people, and what we see in the CNBC Supply Chain Heat Maps is the people component in trade is behind this latest squeeze.

Shanghai is still in the process of reopening, and while there are more green lights on the screen, the supplying of drivers and people to move and make the product is slower than normal. This is affecting the delivery of critical medical devices. “The manufacturing plant in Shanghai was down for 75 days because of the ‘zero-COVID’ restrictions,” explained Gerry LoDuca, president of Dukal, which sells infection-control products and ha … Read more at: https://www.zerohedge.com/markets/jaws-trade-squeezing-supply-chain |

|

Nvidia GPU Prices Plummet As Crypto Mining CratersNvidia GPU Prices Plummet As Crypto Mining CratersBetween the recent crash in cryptos and an upcoming protocol change that will make it more difficult to mine Ethereum, the price of video cards has plummeted more than 50% in the used market, according to Bloomberg, citing RW Baird & Co. analyst Tristan Gerra.

Gerra estimates that over 1/3 of the consumer GPU market could disappear as crypto mining enthusiasts ditch their plans, resulting in a flood of inventory on Ebay and other marketplaces. “People don’t want to buy GPUs knowing it’s potentially going to be obsolete in two quarters,” he said, adding “We believe that crypto-related purchases have steadil … Read more at: https://www.zerohedge.com/crypto/nvidia-gpu-prices-plummet-crypto-mining-craters |

|

Biden Energy Secretary Violated Federal Hatch Act When She Promoted Democrats: Special CounselAuthored by Jack Phillips via The Epoch Times, U.S. Energy Secretary and former Michigan Gov. Jennifer Granholm violated the Hatch Act when she endorsed the Democratic Party in her capacity as a federal official during an interview last year, said the U.S. Office of Special Counsel (OSC) this week.

Granholm, the OSC said, explicitly endorsed Democrats during an Oct. 6 interview in her official capacity as Secretary of Energy with Marie Clare. “OSC has concluded that Secretary Granholm engaged in political activity when she gave this response promoting the electoral success of the Democratic Party,” Erica … Read more at: https://www.zerohedge.com/political/biden-energy-secretary-violated-federal-hatch-act-when-she-promoted-democrats-special |

|

Bulb boss Hayden Wood to step down from collapsed energy firmHayden Wood had stayed on with a £250,000 salary after the government put the company into administration. Read more at: https://www.bbc.co.uk/news/business-62003484?at_medium=RSS&at_campaign=KARANGA |

|

Two million more people paying higher rate taxThe number of workers in higher income tax bands has risen by almost two million in three years, says HMRC. Read more at: https://www.bbc.co.uk/news/business-61996117?at_medium=RSS&at_campaign=KARANGA |

|

Thousands of BT workers vote to strike over payStrike action would disrupt broadband rollout and cause issues with working from home, a union says. Read more at: https://www.bbc.co.uk/news/business-62000848?at_medium=RSS&at_campaign=KARANGA |

|

Fed U-turn likely if US enters recession but risk-appetite may rise only graduallyReligare Securities hopes the recessionary environment may address inflation concerns. This will address the Fed’s primary concern of maintaining price stability, it said, adding that interest rates will not increase in that case to an extent participants expect in the current scenario. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/fed-u-turn-likely-if-us-enters-recession-but-risk-appetite-may-rise-only-gradually/articleshow/92579855.cms |

|

Tech View: Nifty forms Doji candle; consolidation underway“After the formation of false upside breakout at 15,800 levels on June 27, the absence of any sharp weakness from near the hurdle in the last three sessions could be in favour of the bulls to make a comeback from the lows. But, any decisive move below 15,600 levels is likely to negate the bullish bet and could result in sharp weakness down to 15,200 level,” Shetti said. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty-forms-doji-candle-consolidation-underway/articleshow/92575126.cms |

|

Midyear Wrap: 4 out of every 5 BSE500 stocks settle with deep cutsAccording to the data from AceEquity, 392 stocks out of the BSE 500 index have delivered negative returns between January to June 2022. It means that four out of every five stocks are down on a year-to-date (YTD) basis as of June 29.About 210 stocks have dropped more than 20 per cent in the first half of 2022, while 40 stocks have tanked between 40-72 per cent, highlighting painful six months for investors. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/midyear-wrap-4-out-of-every-5-bse500-stocks-settle-with-deep-cuts/articleshow/92571849.cms |

|

Bond Report: 2- and 10-year Treasury yields fall below 3% as recession fears dominate financial marketsBond yields tumble on Thursday as investors flock to government debt and the odds of a technical U.S. recession appear to be growing. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F24-8575E7E4A349%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil prices post a loss for the month, but log strong first-half gainsOil futures fell on Thursday, as a weekly increase in U.S. gasoline and distillate supplies raise worries over the demand outlook and major oil producers pledge to boost production in August, as expected. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F24-B1090C7B9E82%7D&siteid=rss&rss=1 |

|

Distributed Ledger: Bitcoin to record the worst first half of a year in history. Here’s what to watch in crypto for the second half.A weekly look at the most important moves and news in crypto and what’s on the horizon in digital assets. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7F26-1F28443E50FD%7D&siteid=rss&rss=1 |