25 May 2023 Market Close & Major Financial Headlines:NASDAQ, SP 500 Close sharply Higher, Dow Ends Session Fractionally In The Red

Summary Of the Markets Today:

- The Dow closed down 35 points or 0.11%,

- Nasdaq closed up 1.71%,

- S&P 500 closed up 0.88%,

- Gold $1,940 down $24.40,

- WTI crude oil settled at $72 down $2.41,

- 10-year U.S. Treasury 3.823% up 0.104 points,

- USD Index $104.25 up $0.36,

- Bitcoin $26,486 up $229,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for May 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

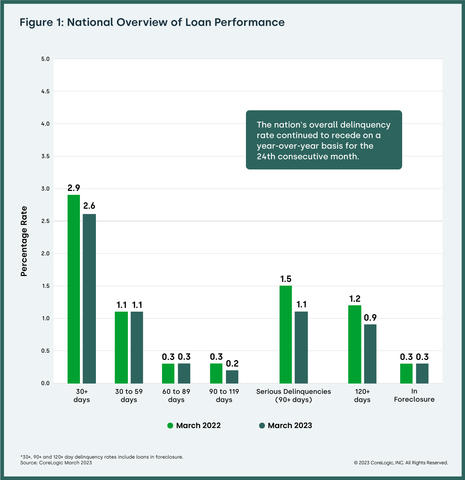

Overall US Mortgage Delinquency Rate Drops to All-Time Low in March according to CoreLogic. For the month of March, 2.6% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 0.3 percentage point decrease compared with 2.9% in March 2022 and a 0.4 percentage point decrease compared with 3% in February 2023.

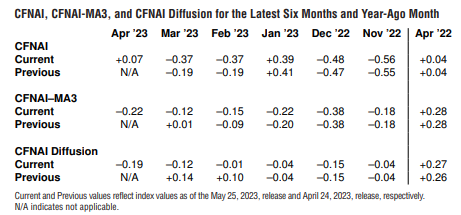

Although the Chicago Fed National Activity Index for April improved, it is the 3-month moving average that is used for economic forecasting. The index’s three-month moving average, CFNAI-MA3, decreased to –0.22 in April from –0.12 in March. This index is the best of the coincident indicators – and generally, the trend lines are used for forecasting. Since the trend is down, it indicates the economy is slowing but the level indicates it is not close to recession levels.

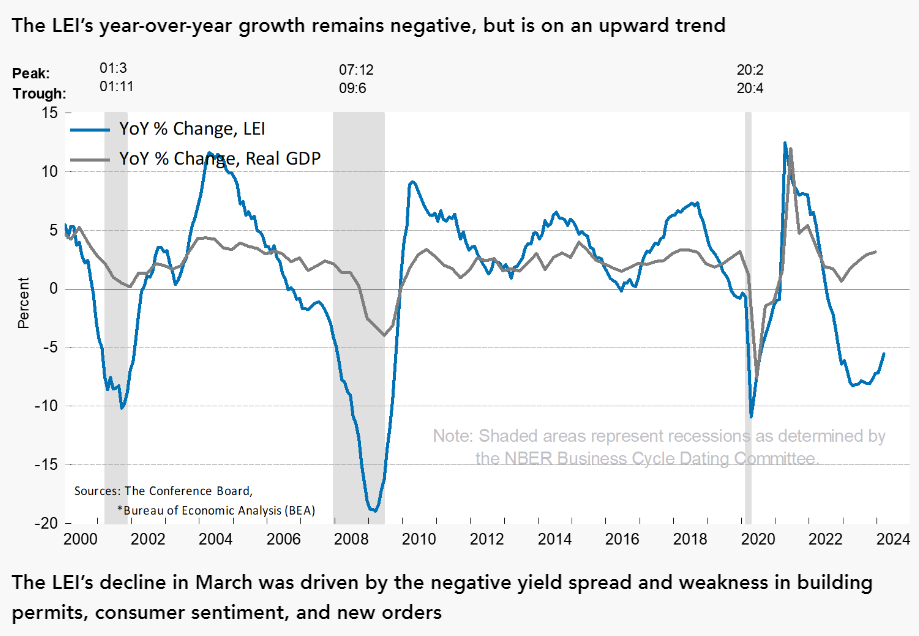

Real GDP increased at an annual rate of 1.3% in the first quarter of 2023 – up from the advance estimate of 1.1%. This was down from an increase of 2.6% in the fourth quarter of 2022. The slowdown in GDP growth was due to a number of factors, including:

-

- A decline in inventory investment.

- A slowdown in business investment.

- A smaller decrease in housing investment.

- An upturn in exports.

- Imports also turned up.

Note that the growth from the quarter one year ago is 1.6% – up from last quarter’s 0.9% (blue line on graph below). The inflation price index was 5.4% (down from last quarter’s 6.4% – red line on graph below). This continues to show inflation is moderating (but not very fast).

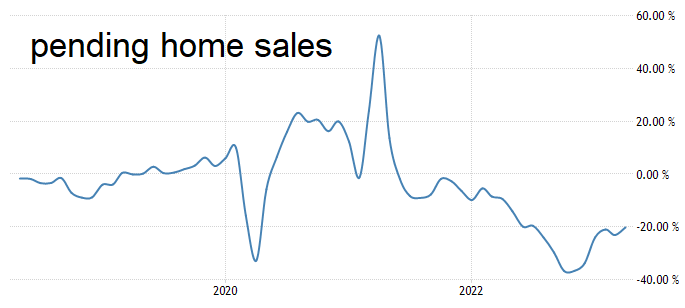

The Pending Home Sales Index (PHSI) – a forward-looking indicator of home sales based on contract signings – remained at 78.9 in April, posting no change from the previous month. Year over year, pending transactions dropped by 20.3%.

In the week ending May 20, the advance figure for seasonally adjusted initial unemployment claims was 229,000, an increase of 4,000 from the previous week’s revised level. The previous week’s level was revised down by 17,000 from 242,000 to 225,000. The 4-week moving average was 231,750, unchanged from the previous week’s revised average. The previous week’s average was revised down by 12,500 from 244,250 to 231,750.

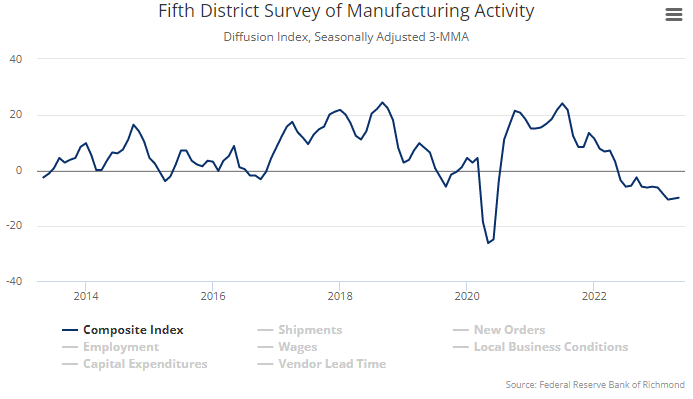

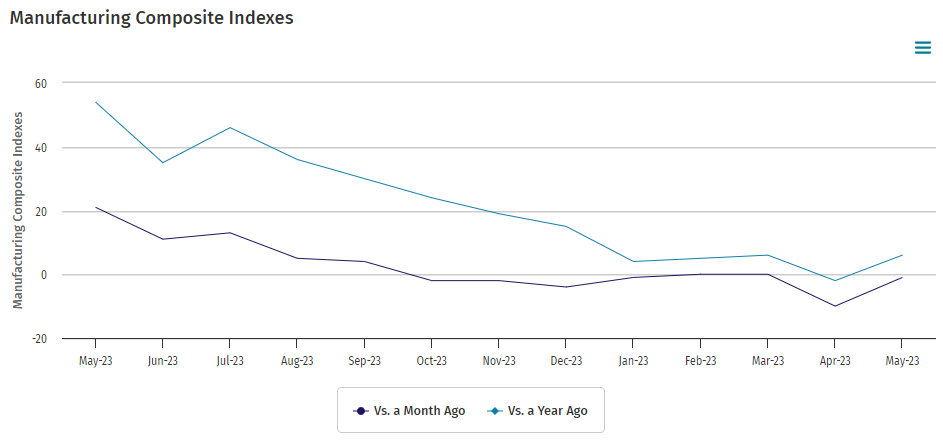

Kansas City Fed manufacturing activity remained mostly steady in May 2023. The month-over-month composite index was -1 in May, up from -10 in April and down from 0 in March. Manufacturing appears very weak across all of the Federal Reserve districts.

Here is a summary of headlines we are reading today:

- Finnish Nuclear Power Plant Cuts Output After Prices Go Negative

- Aker BP Makes Big Oil Discovery In The North Sea

- Billionaire Mining Investor Says Copper Price Plunge Won’t Last

- Solar Power Investment Is Set To Eclipse That Of Oil Production In 2023

- Debt ceiling talks enter crunch time as negotiators get closer to a deal

- Nasdaq closes about 1.7% higher Thursday as Nvidia’s surge powers tech rally: Live updates

- Nasdaq closes about 1.7% higher Thursday as Nvidia’s surge powers tech rally: Live updates

- Ukraine war live updates: Ukraine set to get F-16 fighter jets; Russian mercenaries pull out of Bakhmut

- Almost Two Thirds Of Americans View Media As “Truly The Enemy Of The People”; New Poll Finds

- Market Snapshot: Dow struggles for direction, S&P 500 and Nasdaq jump as debt-ceiling talks drag on

- Bond Report: Two-year Treasury yield rises for 11th straight session on higher chance of June, July Fed rate hikes

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.