07 May 2023 Market Close & Major Financial Headlines: Fourth Session Opening In The Green, Then Trended Higher, But Closed Mixed

Summary Of the Markets Today:

- The Dow closed up 32 points or 0.08%,

- Nasdaq closed down 0.10%,

- S&P 500 closed up 0.13%,

- Gold $2,323 down $8.60,

- WTI crude oil settled at $78 down $0.02,

- 10-year U.S. Treasury 4.455% down 0.034 points,

- USD index $105.37 up $0.032,

- Bitcoin $63,073 up $26 (0.04%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

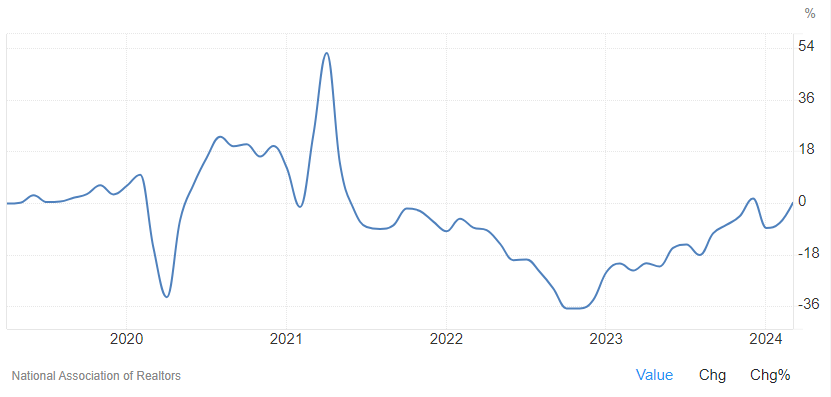

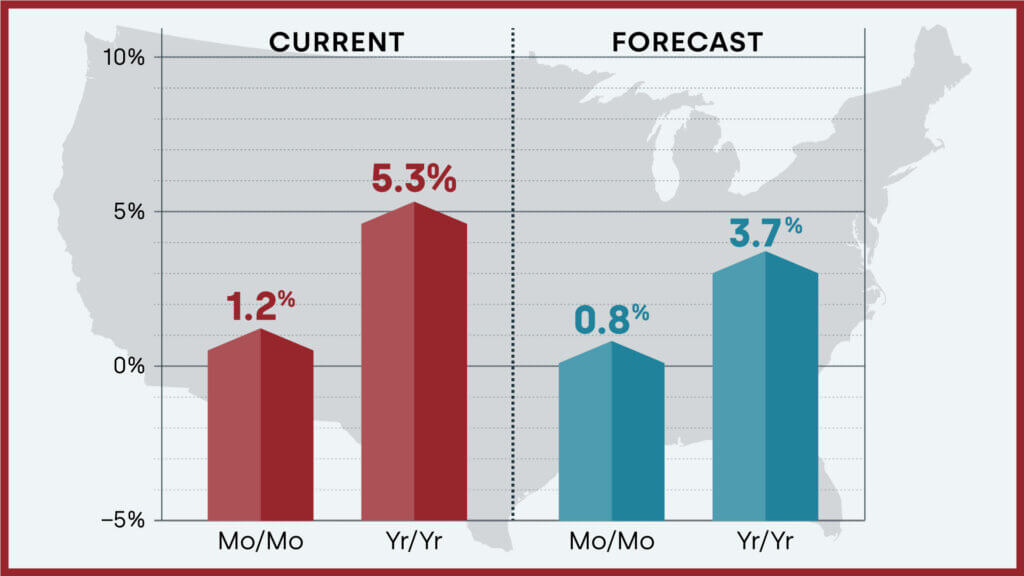

Home prices nationwide, including distressed sales, increased year over year by 5.3% in March 2024 compared with March 2023. The CoreLogic HPI Forecast indicates that home prices will rise by 0.8% from March 2024 to April 2024 and increase by 3.7% on a year-over-year basis from March 2024 to March 2025.

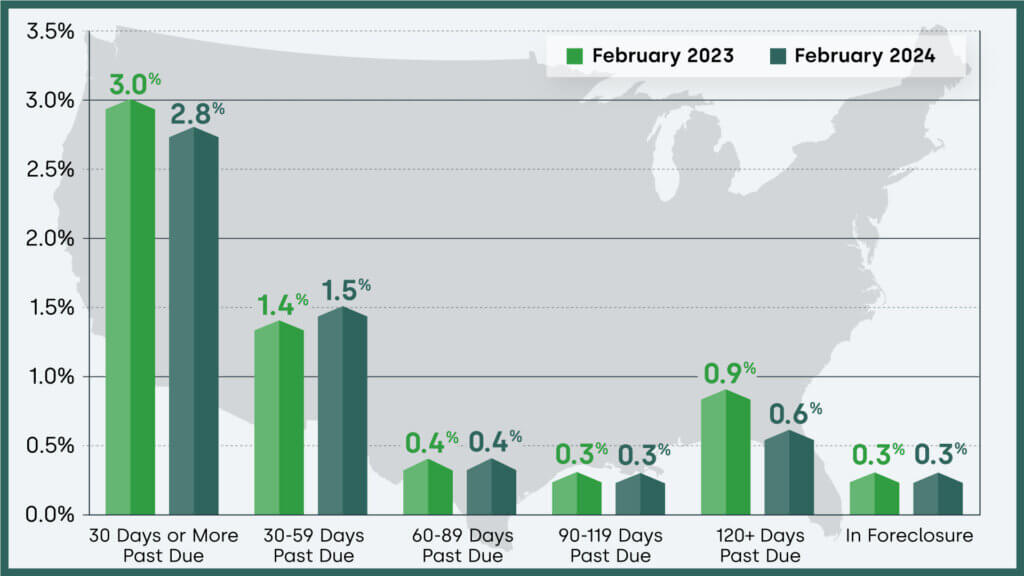

Consumer credit increased 2.4% year-over-year in March 2024 – but only up 0.0% inflation-adjusted. Revolving credit portion (like credit cards) was up 8.3% year-over-year whilst non-revolving credit (like car loans or student loans) was up 0.5% year-over-year. The use of credit is definitely trending down – and credit has been a major driver of the economy.

Here is a summary of headlines we are reading today:

- Will Central Bank Digital Currencies Undermine Gold’s Value?

- U.S. Power and NatGas Prices Plummet to Below Zero

- U.S. Dept. of Energy To Purchase Crude for Strategic Petroleum Reserve

- Innovative New Tech is Transforming the Battery Market

- Oil Prices Under Pressure Despite Israel Sending Troops Into Rafah

- Dow closes slightly higher and posts longest winning streak since December: Live updates

- Disney says streaming is nearly breakeven, but shares sink 10% on soft guidance

- SEC Chair Gensler says investors don’t get ‘needed disclosures’ for crypto assets: CNBC Crypto World

- Title IX Rule Change On Gender Triggers Lawsuits From 15 States

- Here’s how much income it takes to rent an apartment in New York City, Boston and other big cities

- 10-year Treasury yield ends at four-week low in quiet trading session

- U.S. consumers pull back sharply on credit-card use in March

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.