Summary Of the Markets Today:

- The Dow closed up 177 points or 0.46%,

- Nasdaq closed up 1.19%,

- S&P 500 closed up 1.03%,

- Gold $2,333 up $24.00,

- WTI crude oil settled at $79 up $0.45,

- 10-year U.S. Treasury 4.494% down 0.006 points,

- USD index $105.12 up $0.090,

- Bitcoin $62,151 down $741 (1.20%)

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – May 2024 Economic Forecast: No Real Change So Expect The Economy To Continue To Plod Along

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

No releases today

Here is a summary of headlines we are reading today:

- New EPA Regulations on Fossil Fuel Emissions Could Lead to Power Shortages

- Shell To Exit Downstream South Africa Assets

- U.S. Continues to Tighten Grip on Russia’s Military and Industrial Sectors

- Belgium’s Ports Are Brimming With Unsold Chinese EVs

- Biden Administration Bans Fossil Fuels in Federal Buildings

- China’s Nuclear Capacity Continues to Surge

- Dow climbs more than 170 points to post 4th straight winning day, propelled by rate cut hopes: Live updates

- Social Security now expected to run short on funds in 2035, one year later than previously projected, Treasury says

- Hartford Total Return Bond ETF yields nearly 5% and prides itself on finding value across the market

- Trump trial: Porn star hush money reimbursements were made pursuant to agreement with Trump sons

- ‘Squeezey’ Stock Market Extends Gains; Bonds & Bullion Bid

- Social Security’s insolvency is expected in 2035, one year later than projected, amid higher labor productivity

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Will OPEC+ Extend Oil Production Cuts?By John Kemp, senior energy analyst at Reuters Saudi Arabia and its allies in OPEC? are likely to keep oil production unchanged for a further three months when ministers review output allocations on June 1. The tightening of petroleum supplies and depletion of inventories widely anticipated at the start of the year has failed to materialise so far. If OPEC+ officials had hoped to increase production into a tightening market characterised by rising oil prices they are likely to be frustrated. Crude stocks, futures prices and calendar spreads… Read more at: https://oilprice.com/Energy/Crude-Oil/Will-OPEC-Extend-Oil-Production-Cuts.html |

|

New EPA Regulations on Fossil Fuel Emissions Could Lead to Power ShortagesBy Mish Shedlock of MishTalk The lie of the day is from the EPA: Carbon capture will pay for itself (thanks to IRA subsidies). No, it won’t even with subsidies. Expect blackouts and a higher price for electricity. Suite of Standards to Raise Costs, Reduce Output Let’s take a dive into the EPA news release Biden-Harris Administration Finalizes Suite of Standards to Reduce Pollution from Fossil Fuel-Fired Power Plants “Today, EPA is proud to make good on the Biden-Harris Administration’s vision to tackle climate change and… Read more at: https://oilprice.com/Energy/Energy-General/New-EPA-Regulations-on-Fossil-Fuel-Emissions-Could-Lead-to-Power-Shortages.html |

|

Steel Producers Make Major Move to Improve Market TransparencyVia Metal Miner The Raw Steels Monthly Metals Index (MMI) moved sideways, with a modest 1.86% decline from April to May. U.S. flat-rolled steel prices found a bottom at the close of March and proceeded to move sideways. HRC prices saw a modest increase but ultimately closed the month at $838 per short ton. Meanwhile, HRC Midwest Futures saw a strong decline throughout April, which saw the delta between MetalMiner HRC prices and futures narrow to a mere $1 per short ton as of May 1. This signals that markets expect the sideways steel price trend… Read more at: https://oilprice.com/Metals/Commodities/Steel-Producers-Make-Major-Move-to-Improve-Market-Transparency.html |

|

Shell To Exit Downstream South Africa AssetsShell is preparing to divest from downstream operations in South Africa as a result of an internal portfolio review, Shell said in a statement on Monday reported by Reuters and confirmed in an interview with the Daily Maverick just hours later. Shell holds a majority share in Shell Downstream SA (SDSA), which was formed by the merger agreement between Shell South Africa and Thebe Investment Corporation a decade ago. The partnership was intended to merge Shell’s marketing and refining business, with Thebe, a black empowerment group,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Shell-To-Exit-Downstream-South-Africa-Assets.html |

|

U.S. Continues to Tighten Grip on Russia’s Military and Industrial SectorsThe U.S. Treasury Department on May 1 imposed new sanctions on hundreds of companies and people tied to Russia’s weapons development program as part of its continuing effort to limit Russia’s ability to access the materials it needs to “prosecute its illegal war against Ukraine.” The department said in a news release that the goal of the sanctions was to “further degrade Russia’s ability to sustain its war machine.” The Treasury Department imposed sanctions on nearly 200 targets, while the State Department designated more than… Read more at: https://oilprice.com/Geopolitics/International/US-Continues-to-Tighten-Grip-on-Russias-Military-and-Industrial-Sectors.html |

|

Saudi Arabia’s Price Increase Could Indicate Oil Price FloorOne of the recent positives for bonds and non-energy stocks could have run its course after Saudi Arabia raised the price of its flagship crude to Asia for a third consecutive month, according to Bloomberg markets live reporter Garfield Reynolds Over the weekend, state-owned Saudi Aramco raised the June official selling price of Arab Light crude for customers in Asia by 90 cents to $2.90 a barrel above the regional Oman-Dubai benchmark, Bloomberg reported. It compares with an increase of 60 cents forecast in a Bloomberg… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Arabias-Price-Increase-Could-Indicate-Oil-Price-Floor.html |

|

Belgium’s Ports Are Brimming With Unsold Chinese EVsTen years ago this week, we posted one of out most viral stories, highlighting the over-capacity in the auto industry: “Where the World’s Unsold Cars Go To Die,” which highlighted the ‘endgame’ of automakers’ ‘channel stuffing’ efforts to disguise the sudden lack of demand for all the exciting new models that they had forecast would boom to the moon… And now, as MishTalk’s Mike Shedlock reports, we are seeing similar pictures across Europe… “Some are parked here for a year, sometimes more.” Le… Read more at: https://oilprice.com/Energy/Energy-General/Belgiums-Ports-Are-Brimming-With-Unsold-Chinese-EVs.html |

|

Saudi Aramco in Talks to Buy Shell Gas Stations in MalaysiaFour unnamed sources have told Reuters that Saudi state-run oil giant Aramco is in talks to potentially acquire Shell’s billion-dollar gas station business in Malaysia, where the Dutch supergiant owns a network of nearly 1,000 fuel stations. Neither Shell nor Aramco would comment on the rumor of the talks for Reuters; however, one source told the news agency that talks began late last year and could be finalized in a matter of months. A second source told Reuters that the deal could be worth over $1 billion. While Shell… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Saudi-Aramco-in-Talks-to-Buy-Shell-Gas-Stations-in-Malaysia.html |

|

Biden Administration Bans Fossil Fuels in Federal BuildingsThe U.S. Department of Energy has finalized a rule banning fossil fuels from new and renovated federal buildings. The Clean Energy for New Federal Buildings and Major Renovations of Federal Buildings Rule, mandated by the Energy Independence and Security Act (EISA) of 2007, mandates a phased reduction in fossil fuel usage in these buildings. The law requires federal buildings and major renovations to phase out fossil fuel-generated energy consumption by 2030. This provision had been pending due to regulatory delays until now. Energy Secretary Jennifer… Read more at: https://oilprice.com/Energy/Energy-General/Biden-Administration-Bans-Fossil-Fuels-in-Federal-Buildings.html |

|

ADNOC Terminates Talks to Buy Into Brazilian Petrochemicals FirmThe Abu Dhabi National Oil Company (ADNOC) has terminated talks to buy a stake in Brazil’s petrochemicals company Braskem from its controlling company Novonor, Braskem said on Monday. At the end of last year, the state oil giant of the United Arab Emirates (UAE) proposed a non-binding offer to buy a stake in Braskem, in an offer implying an equity value of $2.14 billion (10.5 billion Brazilian reals) for Novonor’s 38.3% stake in the Brazilian company. The non-binding offer from November was conditional on a satisfactory… Read more at: https://oilprice.com/Latest-Energy-News/World-News/ADNOC-Terminates-Talks-to-Buy-Into-Brazilian-Petrochemicals-Firm.html |

|

Russia’s Oil Revenues Doubled in April Compared to a Year EarlierRussia’s oil and gas revenues hit $13.5 billion (1.23 trillion Russian rubles) in April, Russian finance ministry data showed on Monday. The Kremlin received nearly double the oil income for the Russian budget that it did in the same month of 2023, per Bloomberg’s estimates. The weaker Russian ruble and the higher price of Russia’s flagship Urals crude amid higher international oil prices contributed to higher revenues from oil-related taxes and from all total oil and gas sales, per Bloomberg’s calculations. The Russian… Read more at: https://oilprice.com/Energy/Energy-General/Russias-Oil-Revenues-Doubled-in-April-Compared-to-a-Year-Earlier.html |

|

China’s Nuclear Capacity Continues to SurgeChina has added more than 34 gigawatts (GW) of nuclear power capacity over the past decade as new installations surge, the U.S. Energy Information Agency (EIA) said in an analysis on Monday. As of April 2024, China had 55 operating nuclear reactors with a total net capacity of 53.2 GW, while another 23 reactors are currently under construction. The United States still has the largest nuclear fleet in the world, with 94 reactors, but it took nearly 40 years to add the same nuclear power capacity as China added in 10 years, the EIA noted. … Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinas-Nuclear-Capacity-Continues-to-Surge.html |

|

TotalEnergies Investigated for Involuntary Manslaughter in Mozambique LNG AttackFrench prosecutors have opened an investigation into supermajor TotalEnergies for possible involuntary manslaughter for failing to protect its subcontractors during a deadly attack in Mozambique close to a planned LNG project. TotalEnergies holds a 26.5% stake in the Mozambique LNG project, which was put on hold in 2021 following Islamist militant attacks in towns close to the site. The project site is close to Palma in the Cabo Delgado province, where Islamic State-affiliated militants have been active for a few years. In the spring… Read more at: https://oilprice.com/Latest-Energy-News/World-News/TotalEnergies-Investigated-for-Involuntary-Manslaughter-in-Mozambique-LNG-Attack.html |

|

Chinese Giant Sinopec Eyes Stake in Canadian Cedar LNG ProjectChina’s state-owned energy giant Sinopec is in talks with Pembina Pipeline Corporation over buying a stake in a planned Canadian LNG project and an offtake agreement for LNG from the facility on the Pacific coast, Reuters reported on Monday, quoting unnamed sources familiar with the development. Pembina is a partner in the proposed Cedar LNG floating LNG export facility in Kitimat, British Columbia, alongside the Haisla Nation. Cedar LNG is the world’s first Indigenous majority-owned LNG project and is planned… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chinese-Giant-Sinopec-Eyes-Stake-in-Canadian-Cedar-LNG-Project.html |

|

BP Expected to Reverse Its Pledge to Cut Oil and Gas ProductionBP is expected to reverse a previous commitment to reduce oil and gas production by the end of the decade amid a broader pivot in the industry to continue providing the hydrocarbons the world needs, some of the biggest shareholders in the UK-based supermajor told the Financial Times. BP’s peer Shell has already eased its carbon intensity target for 2030 as it has shifted away from clean power sales to retail customers. While keeping their 2050 net-zero targets intact, Europe’s major oil companies have started to… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BP-Expected-to-Reverse-Its-Pledge-to-Cut-Oil-and-Gas-Production.html |

|

Dow climbs more than 170 points to post 4th straight winning day, propelled by rate cut hopes: Live updatesU.S. stocks rose Monday, with Wall Street looking to build on the previous session’s strong gains. Read more at: https://www.cnbc.com/2024/05/05/stock-futures-inch-higher-sunday-after-weaker-than-expected-jobs-report-left-investors-looking-up-live-updates.html |

|

‘Twist’ in Warren Buffett’s succession plan raises eyebrows among Berkshire’s Omaha faithfulMany Berkshire Hathaway shareholders left last weekend’s annual meeting pondering Warren Buffett’s big revelation about succession. Read more at: https://www.cnbc.com/2024/05/06/twist-in-succession-plan-raises-eyebrows-among-buffetts-omaha-faithful.html |

|

Social Security now expected to run short on funds in 2035, one year later than previously projected, Treasury saysA brighter economic outlook has helped push Social Security’s projected trust fund depletion date one year later. But there’s still urgency for Congress to act. Read more at: https://www.cnbc.com/2024/05/06/social-security-expected-to-run-short-on-funds-in-2035-government-says.html |

|

Citigroup CEO Jane Fraser says low-income consumers have turned far more cautious with spendingCitigroup CEO Jane Fraser joined CNBC’s Sara Eisen on Monday for an interview on the economy. Read more at: https://www.cnbc.com/2024/05/06/citigroup-ceo-jane-fraser-says-low-income-consumers-are-more-cautious.html |

|

Hartford Total Return Bond ETF yields nearly 5% and prides itself on finding value across the marketHTRB saw a total return last year of 7.15%, and ranked in the 23rd percentile among its peers, according to Morningstar. Read more at: https://www.cnbc.com/2024/05/06/this-bond-etf-yields-nearly-5percent-and-prides-itself-on-find-value-across-the-market.html |

|

Hamas says it accepts cease-fire proposal from Egyptian, Qatari mediators, as U.S. and Israel review details of planCIA Director William Burns helped facilitate negotiations as the talks heated up over the weekend. Read more at: https://www.cnbc.com/2024/05/06/hamas-says-it-accepts-ceasefire-proposal-from-egyptian-qatari-mediators.html |

|

Ex-CEO Howard Schultz says Starbucks needs to revamp its stores after big earnings missIn its latest quarter, Starbucks reported a surprise decline in same-store sales and slashed its full-year forecast. Read more at: https://www.cnbc.com/2024/05/06/howard-schultz-weighs-in-on-starbucks-earnings-miss.html |

|

Robinhood discloses SEC letter warning of potential enforcement actions: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Chris Kline, co-founder and COO of Bitcoin IRA, discusses what’s moving crypto markets after a weekend rally. Read more at: https://www.cnbc.com/video/2024/05/06/robinhood-discloses-sec-letter-warning-potential-enforcement-actions-crypto-world.html |

|

Renters’ hopes of being able to buy a home have fallen to a record low, New York Fed survey showsThe share of renters who believe that they one day will be able to afford a home, fell to a record low 13.4%. Read more at: https://www.cnbc.com/2024/05/06/renters-hopes-of-being-able-to-buy-a-home-have-fallen-to-a-record-low-new-york-fed-survey-shows.html |

|

Exxon CEO says dispute with Chevron over Hess Guyana oil assets could drag into 2025Exxon claims right of first refusal on Hess’ assets in Guyana under an agreement that governs a consortium developing the country’s oil resources. Read more at: https://www.cnbc.com/2024/05/06/exxon-says-chevron-dispute-over-hess-guyana-assets-could-drag-into-2025.html |

|

Americans can’t stop ‘spaving’ — here’s how to avoid this financial trap“Spaving,” or spending more to save more, can lead to excessive spending and high-interest credit card debt if you aren’t careful, experts say. Read more at: https://www.cnbc.com/2024/05/06/americans-cant-stop-spaving-heres-how-to-avoid-this-financial-trap.html |

|

Trump trial: Porn star hush money reimbursements were made pursuant to agreement with Trump sonsThe New York criminal hush money trial of Donald Trump resumed with witness testimony from former Trump Organization controller Jeff McConney. Read more at: https://www.cnbc.com/2024/05/06/trump-trial-resumes-after-week-of-tears-gag-order-threats.html |

|

Disney reports earnings before the bell Tuesday. Here’s what Wall Street is watchingWalt Disney will puts its top-tier streaming dominance to the test when it reports results before the bell Tuesday. Read more at: https://www.cnbc.com/2024/05/06/disney-reports-earnings-tuesday-heres-what-wall-street-is-watching.html |

|

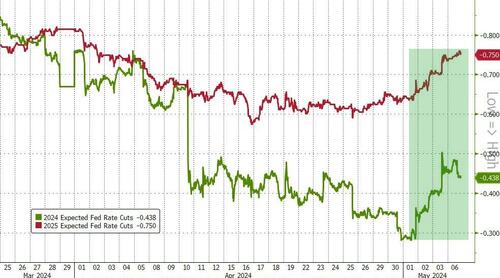

‘Squeezey’ Stock Market Extends Gains; Bonds & Bullion BidMore of the same today after last week’s tepid payrolls and dovish Powell with gold, stocks, and bonds bid as rate-cut hopes inched higher. The market is now pricing in two rate-cuts in 2024 and three more cuts in 2025…

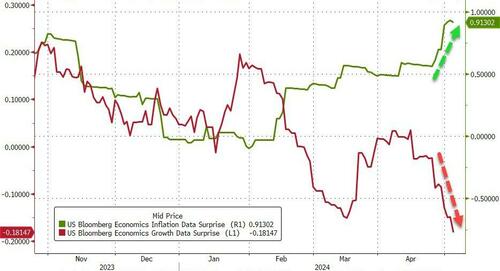

Source: Bloomberg For now the market appears to prefer the ‘bad news’ from declining growth expectations to the ‘bad news’ from soaring inflation prints…

Source: Bloomberg But, hey … Read more at: https://www.zerohedge.com/markets/squeezey-stock-market-extends-gains-bonds-bullion-bid |

|

Florida Bans ‘Indoctrination’ In Teacher-Training ProgramsAuthored by Patricia Tolson via The Epoch Times, Florida Republican Gov. Ron DeSantis has signed a bill into law on May 2 banning “indoctrination” programs for teachers.

The measure, HB 1291, prohibits programs, courses, and curricula in teacher training from “distorting” historical events or promoting political ideologies regarding race, sex, and gender. Accredited postsecondary institutions can seek Florida Department of Education approval to create institutes to educate teachers on improving classroom instruction and meeting requirements for certification or recertification. They can also seek approval for instruction on educating existing and potential substitute teachers on how to perform classroom duties and to teach those with baccalaureate degrees how to … Read more at: https://www.zerohedge.com/political/florida-bans-indoctrination-teacher-training-programs |

|

Where Is “Growth” Coming From? Fed Says Banks Tighten Credit Standards While Loan Demand Drops FurtherThe first quarter Fed’s Senior Loan Officer Opinion Survey (SLOOS) – the one place where every three months investors go to find information on changes to both loan demand and bank lending tightness – was released and revealed more of the same: despite daily propaganda of economic improvement, the SLOOS found that more US banks reported stricter credit standards in the first quarter, while loan demand declined. As a reminder, without ease credit and without rising loan demand, it is virtually impossible for an economy – especially one that is as financialized as the US – to grow; and yet we are bombarded day after day with lies to the contrary. Taking a closer look at the SLOOS survey which was conducted between March 25 and April 8, we find that the net share of US banks that tightened standards on the all important C&I (commercial and industrial) loans for mid-sized and large businesses rose to 15.6% in the first three months of the year, from 14.5% in the fourth quarter. Other types of loans that saw tightening lending standards include New and Used Auto Loans (tighter standards at 9.8% from 6.3%), and small firm credit (19.7% from 18.6%). At the same time credit eased modestly – even if it was still tighter relatively to baseline – for Consumer Credit Card loans, Construction loans, Multifamily residential loans and nonfarm residential loans. Read more at: https://www.zerohedge.com/economics/where-growth-coming-fed-says-banks-tighten-credit-standards-while-loan-demand-drops |

|

FAA Opens New Probe Into Boeing Over Potentially Falsified Records, 787 InspectionsUpdate (1508ET): Federal air-safety regulators have launched a new probe into Boeing related to the company’s inspections of its 787 Dreamliner – and potentially falsified records.

The FAA says Boeing notified them in April that it may not have completed required inspections related to ‘electrical safeguards of bonding and grounding’ where the wings and the fuselage meet on certain aircraft, the Wall Street Journal reports. According to the agency, Boeing will reinspect all 787 airplanes currently in production, and must create a plan to address the in-service fleet. Needless to say, shares of Boeing have taken a hit on the news. Read more at: https://www.zerohedge.com/political/boeing-faces-10-more-whistleblowers-after-mysterious-deaths |

|

Heineken to reopen more than 60 closed pubsInvestment by the Dutch brewing giant will create 1,000 new jobs and reopen dozens of closed pubs. Read more at: https://www.bbc.com/news/articles/cj5lvgyy5y1o |

|

Rathlin’s only shop avoids closure after £12k fraudCyber criminals stole thousands from Rathlin’s Co-Op Shop, putting its future in doubt. Read more at: https://www.bbc.com/news/articles/c88z1998y4mo |

|

Train strikes: How May’s disruption affects youTrain drivers are staging an overtime ban and strikes around the May Bank Holiday. Read more at: https://www.bbc.co.uk/news/business-61634959 |

|

ETMarkets Fund Manager Talk: Earnings risk can disrupt stock boom, says Vinit Sambre of DSP Mutual FundVinit Sambre highlights risks to earnings growth from weak consumption trends and potential reduced government spending, impacting the market. Retail liquidity drives smallcaps rally, with investors optimistic about sustained growth amid election sentiments and FOMO. Sambre says: “Any potential downward revisions in earnings forecasts could pose a risk of corrections in the market over the next 2-3 quarters.” Read more at: https://economictimes.indiatimes.com/markets/expert-view/etmarkets-fund-manager-talk-earnings-risk-can-disrupt-stock-boom-says-vinit-sambre-of-dsp-mutual-fund/articleshow/109870801.cms |

|

Vijay Kedia’s Portfolio: 4 stocks surge 25-60% in CY24; do you own any?According to the latest data from the March quarter, Kedia has publicly disclosed stakes in approximately 17 companies, totaling around Rs 1,623 crore as of May 03. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/vijay-kedias-portfolio-4-stocks-surge-25-60-in-cy24-do-you-own-any/slideshow/109877697.cms |

|

Marico Q4 Results: Consolidated PAT rises 5% YoY to Rs 320 croreMarico Q4 Results: Marico reported a 5% YoY rise in Q4 net profit to Rs 320 crore. Revenue increased by 1.7% to Rs 2,278 crore. Full-year net profit grew 16% YoY to Rs 1,502 crore. Standalone PAT was at Rs 229 crore. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/marico-q4-results-consolidated-pat-rises-5-yoy-to-rs-320-crore/articleshow/109883245.cms |

|

This chart shows why Social Security is in crisisThe surprising thing about the Social Security trust fund is that it has any money left at all. Read more at: https://www.marketwatch.com/story/this-chart-shows-why-social-security-is-in-crisis-239bad0f?mod=mw_rss_topstories |

|

Sorry, Elon: Warren Buffett won’t be buying Tesla stockTesla doesn’t fit the Berkshire Hathaway formula. Read more at: https://www.marketwatch.com/story/sorry-elon-warren-buffett-wont-be-buying-tesla-stock-84f82022?mod=mw_rss_topstories |

|

Social Security’s insolvency is expected in 2035, one year later than projected, amid higher labor productivityThe improved forecast was due to high levels of labor productivity and lower long-term disability incidence rate. Read more at: https://www.marketwatch.com/story/social-securitys-insolvency-is-expected-in-2035-one-year-later-than-projected-amid-higher-labor-productivity-9133627c?mod=mw_rss_topstories |