An immediate danger, the danger of nuclear holocaust, can be met with an efficacious solution, a grand design. President Biden, it is suggested, can offer the end of the dollar hegemony, a great desire of President Putin, for an end to the war in Ukraine. This bargain can be constructed out of the monetary policy that results from a New Neoclassical Synthesis extended to the creation of the Bancor International Order (BIO). Any nation that follows Three Rules for the creation and distribution of money, three rules of economic justice, can be certified by the IMF to become a member of BIO, provided it ceases any belligerent action.

Illustration 1. Nuclear Armageddon.

Image by Pete Linforth from Pixabay

Introduction

An immediate danger, the danger of nuclear holocaust that is in the air today, can be averted with an efficacious solution, a grand design. President Biden can offer the end of the dollar hegemony, a great desire of President Putin, for an end to the war in Ukraine.

This bargain can be constructed out of a combination of monetary policy that results from the New Neoclassical Synthesis and the creation of the Bancor International Order (BIO). Any nation that follows Three Rules for the creation and distribution of money, three rules of economic justice, can be certified by the IMF to become a member of BIO, provided it ceases any belligerent action.

The historical and intellectual background for this paper can be found in an article published by Stephen Kinzer in the Boston Globe October 16, 2022.1 For the economics background, see Gorga (2008/2015).2

The Grand Bargain

When I conceived of the Bancor International Order (BIO),3 I was not aware of President Vladimir Putin’s rage against the “unipolar” world of US dominance of world markets.4

President Putin’s words deserve to be known:

“When they won the Cold War, the US declared themselves God’s own representatives on earth, people who have no responsibilities — only interests. They have declared those interests sacred. Now it’s one-way traffic, which makes the world unstable.”5

Now that that rage is in the news, it might be easier to start an open discussion of these issues. President Putin is partially right. The United States has achieved dominance in world markets, but not since 1991 with the collapse of the Soviet Union, and not through the presence of military bases that encircle Russia today. The US dominance of world markets was established in 1944 through the Bretton Woods agreements to which Stalin was invited to participate and refused; that dominance was established by the obligation of every nation to carry out international trade (almost exclusively) in dollars.6

Benefits to Russia, the U.S., and the world

If the BIO is established and President Putin accepts the invitation to participate, peace in Ukraine will be at hand. A stop will be put to the waste of human, natural, and even military resources worldwide. The danger of a WWIII will be averted.

A hidden benefit will accrue to the United States: Through the intricacies of international trade, America is gradually losing control of her physical assets to foreign nations. This surreptitious development will come to a screeching halt if the BIO is established.

What Is the Bancor?

As pointed out on December 29, 2019 in TalkMarkets,7 in 1944 Lord Keynes came to the Bretton Woods Conference to present his idea of the Bancor, a unit of account to be created by an International Authority that would keep foreign exchange accounts always balanced so that trade could prosper among nations.

The co-convenor of the Conference, Harry Dexter White, had no ear for the Bancor. He was interested only in establishing the Dollar as the international reserve currency, a proposal that he was certain would be acceptable to the US Congress.

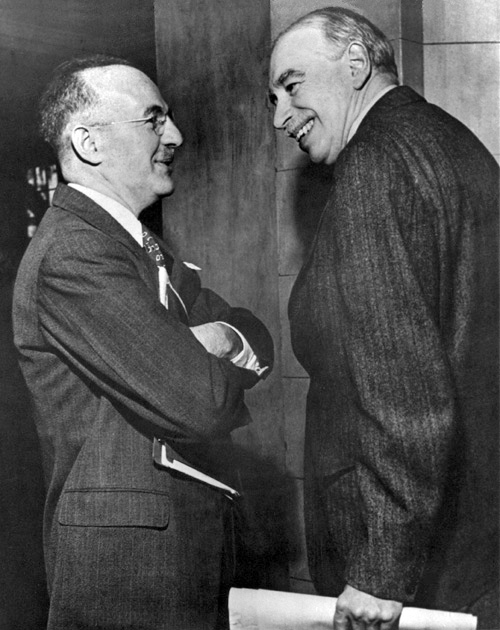

Illustration 2. Harry Dexter White (left) with John Maynard Keynes, honorary advisor to the U.K. Treasury at the inaugural meeting of the International Monetary Fund’s Board of Governors in Savannah, Georgia, U.S., March 8, 1946

From http://www.imf.org/, public domain

The idea of the Bancor has been kept in subdued conversation among economists. Until recently. Currently, that idea appears to be the core of a proposal that is presumed to be implemented any time soon by the International Monetary Fund. Insider consultants and financial writers have been warning that a “Global Financial Elite” has the support of the IMF to a plan to replace the US currency with a new “Distributed Ledger System” using the IMF’s “Special Drawing Rights” as a new “global reserve currency.”8 The infamous New World Order would thus be established.

This plan is a perversion of Keynes’ thought about the Bancor.

The Bancor was supposed to be a unit of account, with no implicit exchange value.

How to Set Things Right

With three clarifications, the spirit of the Bancor may be revivified.9 First, taking a leaf from experience rather than abstract theory, as it was finally incorporated into the IMF’s “Special Drawing Rights” and as wanted by proponents of the New World Order, the Bancor would have exchange value, a value ultimately determined by international financial markets.

Second important clarification is that the Bancor ought to be created, not by the International Monetary Fund, but by each national Central Bank, so that we would have the American Bancor, the Russian Bancor, the Chinese Bancor, the Swiss Bancor, etc. Let us temporarily call it the xBancor. Today’s computers’ power will easily let us ascertain the value of each Bancor at each moment in time.

The third clarification is most important. Each national Bancor would have to be created and distributed in accordance with three rules developed within the context of the monetary policy that results from the New Neoclassical Synthesis.10 The Bancor should be issued:

- as a loan, only to create real wealth of tables and chairs, not to purchase financial instruments;

- for loans to individual entrepreneurs, cooperatives, corporations with ESOPs and/or CSOPs in their constitutions, and public agencies with taxing power so that the loan can be repaid;

- as a loan at cost.

When Should xBancors Be Created?

Implementing these three rules each Central Bank creates and distributes new money. These financial instruments might as well be called Bancors. Bancors should be created as soon as possible; as soon as a national—and international—discussion occurs to gain acceptance of this financial instrument. But not later than a few hours after the next Wall Street crash occurs.11

What Value Should Be Assigned to the xBancor?

Each xBancor should be created at par value with each existing national currency: thus, 1 US Bancor = $1.00; 1 Russian Bancor = 1 Ruble; 1 Chinese Bancor = 1 Renminbi.

Yes, the value of each Bancor would be allowed to fluctuate as the value of today’ currencies fluctuates.

Yes, we would then have a world currency—but it would be wholly controlled by each national government.

What Is the Role of the IMF or the World Bank in a Bancor Regimen?

The Role of the IMF or the World Bank in a Bancor regimen remains precisely as it is today. Indeed, if the IMF should feel the need to use its privilege to create Special Drawing Rights, it could continue to do so. It would appear that there would be no need to even change the name of its financial operations. The IMF would continue to create SDRs. There might not even be the need to call these financial instruments IMF Bancors or any other such denomination.

What Are the Benefits of Creating Bancors?

As pointed out on various occasions, to probe the value of creating a Bancor regimen we have to determine the timing of its creation. The major distinction is creation before the next Stock Market crash or after the Stock Market crash.

Before the crash. If the Bancor regimen is created before the crash, there would be ample opportunity to fully explain and to plan ahead each and every detail of this regimen; ample opportunity to avoid potential pitfalls; ample opportunity to debate pros and cons.

After the crash. If the Bancor regimen is established soon after the crash, what will be avoided is the catastrophic collapse of the value of, likely, all national currencies—as well as the collapse of the value of all financial instruments.

Short-term Effects

Short-term effects can be rather easily determined. The opening of the national credit flow to satisfy the needs of the agricultural, commercial, and industrial world implies that, provided the Bancor regimen is established in a truly timely fashion, a collapse of the financial world will not affect the world of the real economy one iota.12

Another Great Depression will be avoided. And this disaster will be avoided without shifting the burden on to exhausted taxpayers and/or unexpectant bank depositors. Or more simply, but perhaps more insidiously, without shifting the burden on the over-inflated accounts of Central Banks.

Unless a Debt Jubilee is proclaimed in accordance with Moses’ injunctions,13 the least damage that we are inflicting upon the real economy by overburdening the accounts of Central Banks is an opportunity cost. We have no appetite; we have no resources for maintaining our public infrastructure in order. Even after the recent $2.9 billion influx of federal funds14 and during the current ravages of inflation, the United States of America is fast plunging the maintenance of its public infrastructure to a level that used to be the shame of developing countries.

The avoidance of a collapse of the financial world would, of course, have some major implications for both the workers within that world and the stockholders and bondholders depending on that world. These are people who might otherwise see the value of their portfolios reduced even to zero.

Long-term Effects

Long-term effects of a Bancor regimen are much more difficult to pinpoint. Given that the creation of Bancors is determined in accordance with firm needs of the people requesting Bancor-denominated loans, the overall economy is set on a steady course.

Given that the distribution of Bancors is determined in accordance with the value people contribute for the creation of wealth, the overall economy is set on a just course.

Being set on a steady and just base, the overall economy is set on a lasting course. The country will be unified by pursuing common goals for the benefit of everyone.15

Is There an Ecological Side to this Proposal?

The ecological benefits of this proposal are quite numerous but rather imperceptible at first sight. To evaluate them, one needs to be clear-sighted as to the dangers of world-wide financialization. How many trees are felled world-wide, not to create real wealth, but to pay outstanding debt? How many necessary public works are not installed because their financial cost is too high? In between, how many products are consumed, not because of physical need, but psychological irrepressible urge? Only waste dumps know.

An Overall Evaluation

The overall assessment of creating and distributing Bancors following rules determined within the context of the monetary policy that results from the New Neoclassical Synthesis is this: We shall pass from a world in which money controls people to a world in which people control money.16

Let such a Bancor regimen come: The sooner the better. Let the collapse of the modern financial world come: The sooner the better.

We are tired of waiting for a just and steady world of economic affairs.

In-depth Function of the Bancor: An Instrument of National and International Peace

As pointed out above,17 the Bancor can—ought? must?—be used as an instrument of national and international peace. Peace follows justice, especially economic justice. The Three Rules for the creation and distribution of money are eminently rules of economic justice.

The First Rule

Financialization has been the creator of many injustices. Following the first Rule for the creation of Bancors, i.e., “creating and distributing money only for the creation of real wealth,” the Fed and other Central Banks will abate the deficiencies of financialization: creating money to create money. Wall Street can continue to thrive borrowing private money, namely by accessing the private loan market.

Following this Rule, public money will be diverted from Wall Street to Main Street. All the benefits of decentralization will be reaped by the country as a whole. Local Banks, being the ultimate originators and administrators of public money on behalf of their clients, will reacquire their traditional roles of sensitivity to the local needs of local entrepreneurs.

In addition, directing public money toward Main Street immunizes the country against any calamitous collapse of Wall Street.18

The Second Rule

Following the second Rule, the Fed will accomplish a number of goals at the same time. The Fed will favor the creativity and initiative of the people, all the people of a nation; the Fed will spread the currently concentrated ownership of the corporations among all their workers and employees; spreading the ownership of tools, gadgets, and robots among the people, the Fed will favor the industrialization, rather than the financialization of the nation.

Following this Rule, the Fed will consolidate the power of the ESOP Movement. A few years ago, the number of people belonging to an ESOP in the United States became larger than the number of people belonging to Labor Unions.19 Unions should be encouraged to tie their membership dues, no longer to higher wages, but to a fair distribution of ownership of the corporation in which their members work.

The call for higher wages is a self-defeating strategy. Higher wages are followed by higher prices. Workers do not gain much in the process; yet people on fixed income are squeezed by inflation. Unintended cruelty is imposed upon the poor. The only beneficiaries of the policy of higher wages tend to be local and foreign competitors. Thus, workers even lose their jobs.

The Third Rule

Following the third Rule (loans at cost), the Fed, a public agency, will reduce the cost of the production of real wealth and thus influence the inflation of prices of capital and consumer goods.

Mirabile dictu, in 2015 I presented these proposals to the Fed,20 and the Fed responded:

“Given your proposal, I suggest that you contact your state and federal representatives.”21

Scarcity of time and financial resources has allowed me to follow this suggestion only haltingly.

The dollar bill created following these Three Rules can become a digital currency and can properly be called the Bancor.

The Bancor as an Instrument of National Peace

As an explicit conveyor of economic justice, the Bancor will instantaneously become an instrument of domestic peace. Much has been said about inequality and poverty and political instability. A few years ago, I distilled the issues in a few paragraphs22 that I am paraphrasing here.

There is a whole array of injustices that must be set aright. Set these injustices right and you solve many problems of inequality and poverty and political instability.

We have to understand that the affections that hold MAGA (Make America Great Again) People together are the resentments and the afflictions that society inflicts upon them.

- First, owners of large tracts of land are strangling the cities and corralling large masses of (MAGA) people into overcrowded lots.

- Next, MAGA People’s lives are being eviscerated when money is lent to people with money on easy terms and the people without money are left to pay outrageous interest.

- Third, MAGA People’s lives are being eviscerated by robots that take their jobs, their livelihood, away.

- Lastly, MAGA People’s lives are being eviscerated whenever two mega corporations are glued together; then the few gain more power and the people within and without both corporations suffer many afflictions.

The Bancor, created and distributed in accordance with the Three Rules of the monetary policy that result from the New Neoclassical Synthesis, will do much to alleviate problems of inequality, poverty, and political instability. Social unrest will gradually become a thing of the past.

The Bancor as an Instrument of International Peace

An injection of moral fortitude in our political discourse will automatically transfer the benefits to be obtained pursuing the creation and distribution of the Bancor from the national to the international scene, the area for which the Bancor was originally conceived.

If the institution of the Bancor is indeed going to create domestic peace in the United States, it is reasonable to expect similar results when the Bancor is instituted in other countries of the world.

All that is required is the application by each National Bank of the Three Rules of the monetary policy that result from the New Neoclassical Synthesis. Thus, we may have the Dollar-Bancor, the Yen-Bancor, the Renminbi-Bancor, whose relative values can be instantaneously discovered at any moment in time thanks to the power of modern computing technology.

Bancors ought to be free to be exchanged for real wealth in any part of the world, thus the hegemony of the dollar, which is decreasing in any case, will come to an automatic end.

And the silent, relentless, often destructive competition between the Dollar and the Renminbi will be transformed into a healthy competition along positive paths, with benefits to be enjoyed by all.

Somehow, we have to wake up to the reality that competition leads to violence; that self-reliance leads to violence; that Rationalism leads to violence: I AM NUMBER ONE.

Bancor International Order

The creation of the Bancor International Order (BIO) may be institutionalized under the supervision of the International Monetary Fund, whose function will be limited to certifying that each national Bancor has indeed been created following the Three Rules of the monetary policy that result from the New Neoclassical Synthesis.

Participation in the BIO ought to be automatic, but as any other organization in the world, BIO might want to establish its own internal rules. Thus, countries could be invited to participate, provided they meet certain requirements.

Russia regretted her decision not to participate in the Bretton Woods Agreement that established the International Monetary Fund and the World Bank. Under the guidance of President Putin, Russia today might not miss a second chance to become a full partner in international financial agreements.

Stalin might have ultimately been hampered from participating in the Bretton Woods Agreement by a churlish Marxist bias against money.

Mr. Putin seems to be free of such a bias. He clearly loves money for himself and his friends.

Illustration 3. War damage in Ukraine

Image by Wilfried Pohnke from Pixabay

But one condition to enter BIO ought to be imposed on Russia, as on any other belligerent country: Russia must end the war in Ukraine.

The Bancor International Oder might then become an instrument of immediate peace, peace where it is most urgently needed, in Ukraine.

The Bancor International Order as the End of the Unipolar World

Peace in Ukraine might be achieved because it satisfies President Putin’s rage about the complexities of unipolar word of U.S. dominance of international trade.

When I conceived of the Bancor International Order (BIO), I was not aware of President Putin’s rage against the “unipolar” world of U.S. dominance of world markets.

Now that that rage is in the news, it might be easier to start an open discussion of these issues.

For the Bancor International Order (BIO) to become an instrument of peace in Ukraine, it means that the United States, more specifically, the U.S. Congress, must make peace with relinquishing the dominance of world markets that it achieved in 1944.

Before rushing into judgments, the U.S. Congress and the American people ought to become acquainted with the price of this dominance. This price, for some obvious but devious reasons has been carefully kept under wrap.

An open discussion of this issue might make clear, not so much the benefits, but the hidden price paid from that dominance. If we follow some of the intricacies of international trade, we realize that America is suffering from a dangerous trend: the gradual transfer of the control of her physical assets to foreign nations.

The Price of U.S. Dominance of World Markets

As pointed out on March 25, 2019 also in TalkMarkets, we must talk about two crucial issues in foreign trade.23 They are not examined because they do not exist in modern economic theory. The concern is about hoarding and ownership of wealth. They are hidden in plain sight. Until they are settled, all conversations about foreign trade create heat but not much light.

Much of the conversation about foreign trade is concentrated on three controversial points: Who pays the tariffs? Who benefits from foreign trade imbalances? Who cheats?

The last question is most fascinating, but least relevant.

Apart from concerns about hoarding and ownership, not much new can be added to the fourth traditional question, “Who benefits from foreign trade?” In ideal, textbook conditions, if two nations engage in trade, they both benefit. Empirically, it is even possible to determine whether both nations benefit equally.

Who Pays for the Tariffs?

It is the citizens of the nation that imposes tariffs who pay the tariffs. It is they who are penalized. The goods they buy are more expensive than they would otherwise be.

Who Benefits?

Who benefits from tariffs? Once one goes beyond the simple fact that the government that imposes tariffs benefits, at least in the short run, the answer is complicated.

If national producers of goods imported are capable of exploiting the rise in prices of foreign products and are capable of producing goods of the same quality as imported goods, that nation clearly benefits, because tariffs create income and growth opportunities for locals. Yet, there are qualifications. If newly employed resources could be more effectively engaged producing different things, the advantage turns out to be illusory.

The damage inflicted upon the foreign country depends on the importance that foreign trade has in that nation. It also depends on their assumed inability to produce at lower cost, so to nullify the benefit to local nationals of the country imposing tariffs.

Long Run Issues

Long run consequences are hard to identify, because they depend on various sets of movable parts. If tariffs on our products are imposed in retaliation, who among our exporters is penalized? Do we grant an incentive to our foreign competitors to leap-frog current technology—so they might be encouraged to create entirely new technologies fit for the next stage of development?

Tariffs, in other words, can produce much churning within the two nations involved in trade. That is why wise economists have always opted for free trade: no tariffs; no trade wars.

The remaining issue then is: What are the effects of tariffs on the balance of payments?

Effects on the Balance of Payments

Effects of tariffs on the balance of payments can be positive or negative. The most interesting case to analyze is that of negative effects, because this effect immediately bifurcates—depending on the international status of currency used. To be specific, is the negative balance in “dollars”?

This is a crucial question. Most international trade is carried out in dollars. This is a huge issue. It has nothing to do with economic science; it is an issue of pure political and military power.

Crudely stated, when people of the world export their goods to the United States, the creator of dollars, countries of the world send us real goods produced by the sweat and tears of their workers—and the exhaustion of their natural resources.

We, in the United States, send them paper money and digital money.

This is a condition of enormous importance. It clearly explains the efforts of China trying to have their currency, the renminbi, accepted in international trade.

Two Crucial, Hidden Issues

There are two crucial issues that are absent from the current discussion on imbalances in foreign trade. Since we in the United States exchange paper and digital money for real goods, we are letting our negative balances grow so large that we periodically have to change the scale of our graphs to see those imbalances.

Who cares? Let them eat paper and digital money is the general posture. This is such a natural tendency; we are having such a free ride. Who would not exchange pieces of paper for real goods?

Those who are concerned about outrageous imbalances in foreign trade instinctively know that there is something rotten in Denmark.

Hoarding Money

Here is the rot: Hoarding of money in this country or, worse, abroad is extremely dangerous because its behavior is unpredictable. One thing is constant: It responds to the herd mentality. Once a leader sprouts, followers follow. Thus, it is just like in snow avalanches. The last snowflake that turns into ice, an ice crystal, creates an imbalance that sends a mass of snow downhill.

Ownership

The second effect is the issue of ownership. When Americans hear that the Rockefeller Plaza is in foreign hands, they gasp. Many other properties are in the hands of German, Japanese, and Chinese people. Even the Italians have acquired control of Chrysler.

That is the issue: control. Control over peoples’ lives—through control of their property. Control can take one hundred subtle forms that go much beyond the scope of this presentation. This effect ought to concern each one of us greatly.

The fear of God might finally enter our psyche if we will ever notice this possibility: Because of their relatively small military and political power, Chinese people are still reluctant to use their economic power. They are hoarding dollars and are the major buyers of American bonds. What happens the day in which they say, “Enough already; either you do such and such (about foreign trade, for instance), or we demand an immediate exchange of bonds for dollars and our dollars for real estate and capital goods.”

Yes, let us trade the existence of the unipolar word for peace in Ukraine

Louis D. Brandeis on Compromise

Louis D. Brandeis said this on compromise:

“I don’t believe in compromises — but I do believe in the full play of forces and in giving my opponent what he wants if not inconsistent with what I want, and particularly if what he wants is something I want to get rid of.”

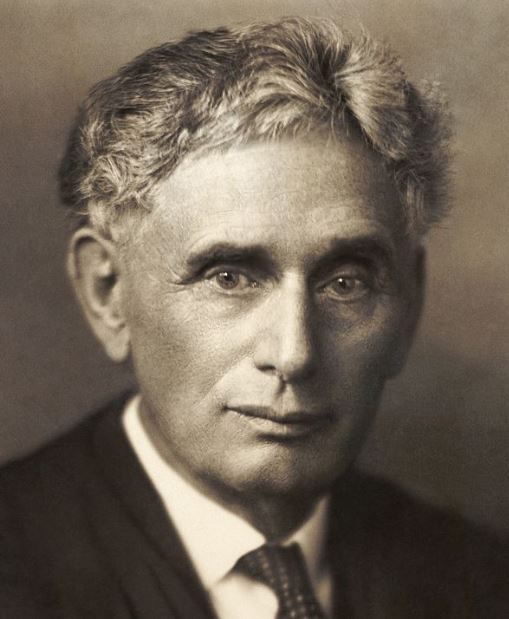

Illustration 4. Louis Brandeis (1856-1941) Wikipedia, Public Domain.

Brandeis’ book entitled Other People’s Money and How the Bankers Use It,

suggested ways of curbing the power of large banks and money trusts.

He fought against powerful corporations, monopolies, public corruption,

and mass consumerism, all of which he felt were detrimental to American

values and culture. He served as Associate Justice of the Supreme Court of the United States from 1916-1939.

Let us get peace in Ukraine and let us give President Putin the end of the unipolar world.

The world will get a fervently desired peace in Ukraine; the United States will get rid of two hidden, dangerous forces unleashed by the practices of the unipolar world: great hoards of dollars in foreign hands and the insidious habit of selling the ownership of our assets to foreigners.24

Conclusion

Can the Bancor International Order (BIO) be created? Yes, it should be created. But it will not be created without intense scrutiny.

The sooner the scrutiny starts the better.

The advantages of a Bancor International Order are too intense to be left unexplored.25

ACKNOWLEDGMENTS

Special thanks, in addition to Franco Modigliani and Meyer L. Burstein, go to Vittorio de Caprariis, Robert A. Mundell, Mitchell S. Lurio, Norman G. Kurland, Michael Emmett Brady, Stefano Zamagni, William J. Baumol, Laurence J. Kotlikoff, Michele Boldrin, Mark Friedman, Steven Hickerson, Jason Kesler, E. Dale Peterson, Donald Renner, Richard Schiming, Robert Simonson, Gerald Alonzo Smith, Peter Otto, Jeroen Struben, Jeroen C.J.M. van den Bergh, Kevin P. Gallagher, William J. Toth, William R. Collier, Jr., Damon Cummings, David S. Wise, and Veljko Milutinovic. Selective portions of this research have also been endorsed by John K. Galbraith, Otto Eckstein, Steve H. Hanke, Mark Perlman, Francesco Forte, Augusto Graziani, Alberto Tarchiani, Aldo Garosci, Giorgio Spini, Charles T. Wood, Norman A. Bailey, Buckminster Fuller, Rosanna Marini, Gordon Richards, Alan Reynolds, Rudy Oswald, Steve Kurtz, Ernest Kahn, Louis J. Ronsivalli, Howard Zinn, Robert F. Drinan, Thomas J. Marti, Cassian J. Yuhaus, James E. Hug, Richard John Neuhaus, John J. Neuhauser, Irving Kristol, Michael J. Naughton, L. Joseph Hebert, Virgil A. Wood, John C. Rao, and Peter J. Bearse among others. Last but not least, Laurence Katz.

FOOTNOTES

1 Kinzer (2022).

2 Gorga (2008). The roots of the New Neoclassical Synthesis were laid in 1965 during a summer of intense intellectual struggle with Keynes’ General Theory (1936). It all started by defining Saving as all nonproductive wealth, or Hoarding. Hoarding was discovered to be in a relation of complementarity with Investment – from which three consequences ensue: a. Less growth; b. More inflation (money to buy goods hoarded remains in the system and favors prices rising); c. More poverty.

Three models were created on the basis of this new relationship: 1. A model of Production of real wealth, 2. Another model of Distribution of the value of property rights over created wealth, and 3. A model of Consumption, namely expenditure of money to purchase real wealth.

As elaborated in Gorga (2002, 2009. and 2016), the integration of these three models yields an understanding of the economic process as a whole. The book was annotated twice in JEL and has received many rave reviews but was panned in two influential journals. One reviewer based his position on two statements, one (I = S) that does not exist in the General Theory and the other (I = H) that does not exist in the Economic Process (Gorga (2002, 2009, and 2016). The second reviewer was dissatisfied with the title of the book; the book should have been titled “The Cost of Hoarding.” And, since he did not find any hoarding in society, he attributed no value to the book. All reviews are posted at https://www.new-economic-atlas.com/p/review-of-ep.html. All work done so far under the heading of Concordian economics has to be seen as an effort to reach for a New Neoclassical Synthesis.

3 Gorga (2022).

4 Kottasová, Pokharel and Gigova (2022).

5 I Ibid.

6 Steil (2013).

7 Gorga (2019a).

8 See, e.g., Adrian and Mancini-Griffoli (2019).

9 See Footnote 7 above.

10 Gorga (2015).

11 Gorga (2017a).

12 Gorga (2017b)

13 Gorga (2009).

14 U.S. Department of Transportation (March 23, 2022).

15 Gorga (2022).

16 Gorga (2016).

17 See Footnote 3 above.

18 Gorga (2017b).

19 Rodrick (2920).

20 See Footnote 10 above.

21 Durr (2016).

22 Gorga (2021).

23 Gorga (2019b).

24 In addition to the right of access to national credit that has essentially been treated here, the full project of economic justice includes the treatment of 1. the right of access to land and natural resources, 2. The right to the fruit of one’s labor, and 3. The right to the enjoyment of one’s property. See, e.g., Gorga (2008).

25 The project of economic justice is capped by the acceptance of the wisdom of a systematic Mosaic debt jubilee. See, e.g., Gorga (2009).

REFERENCES

Adrian, Tobias and Tommaso Mancini-Griffoli, “Central Bank Digital Currencies: 4 Questions and Answers.” IMFBlog, December 12, 2019. Available at https://blogs.imf.org/2019/12/12/central-bank-digital-currencies-4-questions-and-answers/.

Durr, Jean. Personal communication to Carmine Gorga, September 14, 2016. Public Affairs Office of Board of Governors of the Federal Reserve System. https://1drv.ms/w/s!AgFxYQBpjmMFj06wiz_G_fkJWeWO.

Gorga, Carmine. The Economic Process: An Instantaneous Non-Newtonian Picture. Lanham, MD. and Oxford: University Press of America, 2002 and 2009. Third edition by The Somist Institute, 2016.

Gorga, Carmine, “Concordian Economics: Tools to Return Relevance to Economics.” Forum for Social Economics, May 2008. Reprinted, with a new Introduction, in Mother Pelican: A Journal of Solidarity and Sustainability, Vol. 11, No. 2, February 2015. Available at http://www.pelicanweb.org/solisustv11n02page4.html.

Gorga, Carmine, “The Economics of Jubilation – Blinking Adam’s Fallacy Away.” Social Science Research Network (SSRN), October 15, 2009. Available at The Economics of Jubilation – Blinking Adam’s Fallacy Away by Carmine Gorga :: SSRN.

Gorga, Carmine, “Two Proposals in the Form of Two Petitions Designed to Stabilize the Monetary System.” The Somist Institute, December 3, 2015. Available at The Somist Institute: Two Proposals.

Gorga, Carmine. “From Money Controls People to People Controlling Money.” Mother Pelican: A Journal of Solidarity and Sustainability, Vol. 12, No. 5, May 2016. Available at http://www.pelicanweb.org/solisustv12n05page4.html.

Gorga, Carmine, “What To Do If The Stock Market Crashes?” TalkMarkets, March 14, 2017a. Available at https://talkmarkets.com/content/us-markets/what-to-do-if-the-stock-market-crashes?post=126594.

Gorga, Carmine, “Three Trillion Worth Of Zeros.” TalkMarkets, March 2, 2017b. Available at https://talkmarkets.com/content/us-markets/three-trillion-worth-of-zeros?post=124215.

Gorga, Carmine, “Return to Economic Justice: From Entitlements to Rights.” Catholic Social Science Review Vol 22 (2017c): 203-217.

Gorga, Carmine, “Let Us Not Pervert Keynes’ Thought.” TalkMarkets, December 29, 2019a. Available at https://talkmarkets.com/content/economics–politics/let-us-not-pervert-keynes-thought?post=245291.

Gorga, Carmine, “Two Crucial Issues In Foreign Trade.” TalkMarkets, March 25, 2019b. Available at Carmine Gorga Blog | Two Crucial Issues In Foreign Trade | Talkmarkets.

Gorga, Carmine, “Three Steps To Unify The Country.” EconIntersect, September 6, 2021. Available at Three Steps To Unify The Country – Global Economic Intersection (econintersect.com).

Gorga, Carmine, “The Bancor as an Instrument of National and International Peace,” A piece in search of a publisher, August 2022. Available at Bancor as an Instrument of National and International Peace.docx – Microsoft Word Online (live.com).

Keynes, John Maynard. The General Theory of Employment, Interest, and Money, 1936. NY: Harcourt.

Kinzer, Stephen. “The most important lesson of the Cuban Missile Crisis. Boston Globe, Ocober 16, 2022.

Kottasová, Ivana, Pokharel, Sugam and Radina Gigova, CNN, “Putin lambasts the West and declares the end of ‘the era of the unipolar world.’” – CNN, June 18, 2022.

Rodrick, Scott, An Introduction to ESOPs, NCEO, National Center for Employee Ownership, 19th Edition, April 2020. Available at An Introduction to ESOPs | NCEO.

Steil, Benn, The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order. Princeton University Press, 2013.

U.S. Department of Transportation, “President Biden, U.S. DOT Announce $2.9 Billion of Bipartisan Infrastructure Law Funding for Major Infrastructure Projects of Regional or National Significance,” US Department of Transportation, March 23, 2022. Available at President Biden, U.S. DOT Announce $2.9 Billion of Bipartisan Infrastructure Law Funding for Major Infrastructure Projects of Regional or National Significance | US Department of Transportation