Summary Of the Markets Today:

- The Dow closed down 113 points or 0.34%,

- Nasdaq closed up 0.63%,

- S&P 500 down 0.08%,

- WTI crude oil settled at $75 up $1.04,

- USD $103.20 down $0.68,

- Gold $1876 up $5.80,

- Bitcoin $17,207 up $100 – Session Low 16,954,

- 10-year U.S. Treasury 3.532% down 0.037 points

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for January 2023

Today’s Economic Releases:

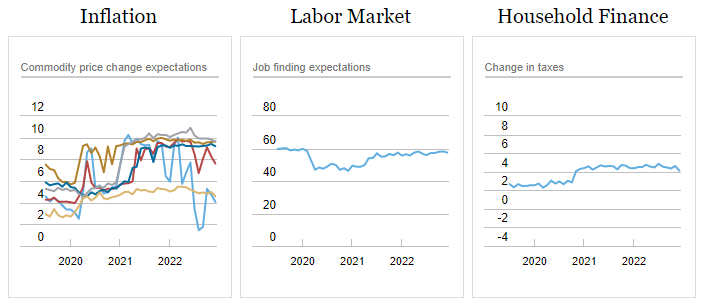

Median one-year-ahead inflation expectations declined to 5.0 percent, its lowest reading since July 2021, according to the December Survey of Consumer Expectations. Medium-term expectations remained at 3.0%, while the five-year-ahead measure increased to 2.4%. Household spending expectations fell sharply to 5.9% from 6.9% in November, while income growth expectations rose to a new series high of 4.6%.

A summary of headlines we are reading today:

- Washington Has Trouble Refilling The SPR After 220 Million Barrel Draw

- WTI Breaks $75 Barrier, But Traders Remain Cautious

- Rolls-Royce sees record sales in 2022, no slowdown in spending by the wealthy

- Tesla breaks into America’s bestselling cars list for 2022, but trucks still dominate

- US Stocks Prefer Big Bad Wolf Of Recession To Goldilocks

- Used-Car Prices Record “Largest Annualized Decline In Series’ History”

- Market Snapshot: Dow erases 300-point gain as S&P 500 struggles to extend ‘soft-landing’ rally

- The Tell: Why stock-market bulls are ‘woefully myopic’ about S&P 500 profit growth — even before the impact of a potential recession

These and other headlines and news summaries moving the markets today are included below.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Artificial Intelligence Will Be Critical For Renewable Energy GrowthThe digitalization of oil and gas has been well documented, with pretty much all energy majors adopting AI, machine learning, and other innovative technologies to improve their operations. But what role does artificial intelligence play in renewables? Just as in oil and gas, AI is being adopted for use in wind, solar, and other green energy projects to improve efficiency through greater automation. As energy firms look to digitalize their operations to a greater extent, AI will likely play a leading role in the energy transition of the future. Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Artificial-Intelligence-Will-Be-Critical-For-Renewable-Energy-Growth.html |

|

Washington Has Trouble Refilling The SPR After 220 Million Barrel DrawAfter drawing over 221 million barrels of oil from the Strategic Petroleum Reserve (SPR) in 2022, Washington is having a tough time refilling it in the New Year, with the Department of Energy (DoE) rejecting the first offers on the grounds that they failed to benefit taxpayers. The DoE has by now received several offers for February purchases to refill the SPR, according to both Bloomberg and Reuters. However, those offers have been rejected as too expensive or failing to meet other requirements. For February, the plan was to purchase Read more at: https://oilprice.com/Energy/Crude-Oil/Washington-Has-Trouble-Refilling-The-SPR-After-220-Million-Barrel-Draw.html |

|

Russian Lukoil To Sell Strategic Italian Refinery To Trafigura-Backed CompanyIn its first major overseas asset sale following Russia’s invasion of Ukraine and subsequent Western sanctions, Lukoil, Russia’s second-largest oil company, has agreed to sell its Italian ISAB refinery to a Cypriot company backed by Geneva-based commodities trader Trafigura. The deal will see Lukoils 100% subsidiary, Litasco S.A., sell the ISAB refinery to Cyprus-based G.O.I. Energy Limited, a private equity firm backed by Trafigura, according to a statement on Lukoil’s website. The deal value was not disclosed. Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Lukoil-To-Sell-Strategic-Italian-Refinery-To-Trafigura-Backed-Company.html |

|

WTI Breaks $75 Barrier, But Traders Remain CautiousAfter shedding 8% last week, crude oil prices are trading up over 1.7% midday Monday, driven by China’s reopening and a weaker U.S. dollar. West Texas Intermediate (WTI) was trading up 1.84% as of 1:31 p.m. EST on Monday, breaking the $75/barrel barrier, while Brent was trading up 1.55%, pushing towards the $80 mark. China’s reopening news was the key driver pushing against recession fears that commanded all the attention last week. Less hawkish sentiments coming from the Fed, combined with a softening dollar, also gave Read more at: https://oilprice.com/Energy/Crude-Oil/WTI-Breaks-75-Barrier-But-Traders-Remain-Cautious.html |

|

China Signals Surge In Oil Demand With Major Increase In Import QuotasChina issued a substantial increase in its crude imports quotas for this year, the clearest sign yet that Chinese refiners are set for a material increase in output – and a surge in demand for oil – as the nation finally moves away from its ridiculous Covid Zero policy. On Monday, China issued a second batch of 2023 crude oil import quotas, raising the total for this year by 20% compared to the same time last year, according to Reuters and Bloomberg. According to the document from the Ministry of Commerce,44 companies, Read more at: https://oilprice.com/Latest-Energy-News/World-News/China-Signals-Surge-In-Oil-Demand-With-Major-Increase-In-Import-Quotas.html |

|

Why Hydro Energy Storage Is Needed Despite Its ShortcomingsDepending on who you ask, pumped hydro energy storage is either the future of the clean energy industry and the key to decarbonizing the global economy, or it’s an ecological disaster that needs to be stopped. The truth, of course, lies somewhere in between but friends and enemies of pumped hydro tend to espouse either one narrative or the other with inadequate attention to the nuanced trade-offs and potential synergies that pumped hydro storage presents to the renewable energy industry. The issue is this: building dams is good for Read more at: https://oilprice.com/Energy/Energy-General/Why-Hydro-Energy-Storage-Is-Needed-Despite-Its-Shortcomings.html |

|

What’s ahead for Bed Bath & Beyond in wake of bankruptcy warningBed Bath’s turnaround plan called for cost-cutting and improved partnerships with vendors. But its sales have yet to improve. Read more at: https://www.cnbc.com/2023/01/09/bed-bath-beyond-bbby-whats-ahead-in-wake-of-bankruptcy-warning.html |

|

Bob Iger tells Disney employees they must return to the office four days a weekDisney CEO Bob Iger told hybrid employees on Monday they must return to corporate offices four days a week starting March 1. Read more at: https://www.cnbc.com/2023/01/09/disney-ceo-bob-iger-tells-employees-to-return-to-the-office-four-days-a-week.html |

|

Consumer confidence in housing finally rises, thanks to falling home pricesConsumer confidence in the U.S. housing market is improving slightly, as mortgage rates settle and home prices fall. Read more at: https://www.cnbc.com/2023/01/09/consumer-confidence-in-housing-rises-as-prices-fall.html |

|

SEC fines former McDonald’s CEO for misleading investors about his firingThe SEC filed charges against former McDonald’s CEO Steve Easterbrook for misrepresenting why he was fired in November 2019 and charged him a $400,000 fine. Read more at: https://www.cnbc.com/2023/01/09/sec-fines-mcdonalds-ex-ceo-steve-easterbrook-misled-investors-about-his-firing.html |

|

Used vehicle prices are falling but not enough to offset grossly inflated levelsCox Automotive expects wholesale used vehicle prices to end the year down 4.3% from December 2022. Read more at: https://www.cnbc.com/2023/01/09/used-vehicle-prices-are-falling-but-not-enough-to-offset-record-highs.html |

|

Rolls-Royce sees record sales in 2022, no slowdown in spending by the wealthyRolls-Royce sold a record number of cars in 2022 as demand for its $500,000 vehicles remained strong. Read more at: https://www.cnbc.com/2023/01/09/rolls-royce-2022-sales-soar-ceo-says-no-slowdown-in-spending-by-the-rich.html |

|

The Earth’s ozone layer is slowly recovering, UN report findsThe upper atmosphere ozone layer protects the Earth from harmful ultraviolet radiation, which is linked to skin cancer, eye cataracts and agricultural damage. Read more at: https://www.cnbc.com/2023/01/09/the-earths-ozone-layer-is-slowly-recovering-un-report-finds-.html |

|

Everyone’s elite, but not for long. Airlines make travel perks harder to earn this yearAirlines are scaling back perks for frequent flyers and big spenders as travel roars back. Read more at: https://www.cnbc.com/2023/01/08/airlines-scale-back-frequent-flyer-perks.html |

|

Biden declares emergency in California as more winter storms advanceNational Weather Service forecasters have warned of a “relentless parade of cyclones” over the coming days in central and Northern California. Read more at: https://www.cnbc.com/2023/01/09/biden-declares-emergency-in-california-as-more-winter-storms-advance-.html |

|

Stocks making the biggest moves midday: Tesla, Nvidia, Lululemon, and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2023/01/09/stocks-making-the-biggest-moves-midday-tesla-nvidia-lululemon-and-more.html |

|

Jim Cramer’s Investing Club meeting Monday: Consumer prices, overvalued tech stocks, oilThe Investing Club holds its “Morning Meeting” every weekday at 10:20 a.m. ET. Read more at: https://www.cnbc.com/2023/01/09/jim-cramers-investing-club-meeting-monday-consumer-prices-tech-.html |

|

Vince McMahon is back at WWE to ensure a smooth sale process. Here’s who might want to buy itComcast, Endeavor Group Holdings, and Netflix are among the companies that could have an interest in acquiring WWE. Read more at: https://www.cnbc.com/2023/01/07/who-would-buy-wwe-as-mcmahon-returns-to-board-to-pursue-sale.html |

|

Tesla breaks into America’s bestselling cars list for 2022, but trucks still dominatePickup trucks continued to lead America’s top-selling vehicles in 2022, but Tesla broke into the top 10 for the first time amid a shakeup among other models. Read more at: https://www.cnbc.com/2023/01/07/americas-top-10-bestselling-cars-of-2022-tesla-makes-the-cut.html |

|

US Stocks Prefer Big Bad Wolf Of Recession To GoldilocksBy Mark Cudmore, Bloomberg Markets Live reporter and analyst US stocks are trading positively since Friday’s US data due to raised hopes for rate cuts, not on some Goldilocks narratives. It’s important the driver is clear as there are different implications. The NFP jobs data was indeed a so-called Goldilocks report: an increase in the labor force and lots of new jobs added, particularly in the private sector. Wage inflation not only fell sharply, but with the bonus of revisions lower to prior wage increases. For those who believe that the US can bring inflation back down to target without a hard landing, it was about as good as you could get. It suggests that the economy can cope with the policy-tightening seen, so it should have resulted in curve-steepening and equities getting a bid. And that’s exactly what we got… BOOM! All makes sense. But wait… We then got the big bad wolf of the ISM report. It was horrible data. The headline came in at 49.6 (recession territory) versus 55 forecast, and 56.6 prior. The new orders component was even more traumatic at 45.2 versus 56 prior. Not helped by the fact that the more backward-looking factory orders data released at the same time missed expectations and revised the prior figures lower too. Oh, and the final durable good print was slightly softer, as well. Recession alarm bells blaring loudly. The bit of the ISM report that stayed very high was the prices paid component — uh-oh, stagflation sounds? Read more at: https://www.zerohedge.com/markets/us-stocks-prefer-big-bad-wolf-recession-goldilocks |

|

Controvery Swirls Over Mystery ‘3-Page Addendum’ To House Rules PackageUpdate (1445ET): There’s word of a ‘much-fabled 3-page House rules addendum’ circulating throughout certain GOP offices in which McCarthy reportedly agrees on everything from the 20-holdout demands on everything from the strategy on the debt ceiling to committee assignments. Via Axios’ Andrew Solender:

According to Punchbowl News,

|

|

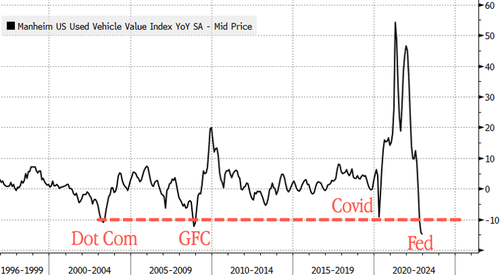

Used-Car Prices Record “Largest Annualized Decline In Series’ History”Cox Automotive reported that its Manheim Used Vehicle Value Index (MUVVI), which tracks the auction prices of used cars, plunged the most on record in December from a year ago as the auto market cools. MUVVI increased 0.8% in December from November and rose slightly to 219.3, but was down 14.9% from a year ago. “This was the largest annualized decline in the series’ history,” Manheim wrote in a statement.

Despite the most significant yearly decline on record, used car prices at auction houses remain 14% below record highs.

|

|

Rep. Rogers Says He Regrets Tense Confrontation With Rep. Gaetz During Speaker VoteAuthored by Rita Li via The Epoch Times, Rep. Mike Rogers (R-Ala.) offered his regrets to Rep. Matt Gaetz (R-Fla.) on Jan. 8 for a tense confrontation during the heated House speaker vote on Friday evening.

Read more at: https://www.zerohedge.com/political/rep-rogers-says-he-regrets-tense-confrontation-rep-gaetz-during-speaker-vote |

|

Energy bill support for firms to be reduced from AprilThe government says the current level of support for firms was “unsustainably expensive”. Read more at: https://www.bbc.co.uk/news/business-64211744?at_medium=RSS&at_campaign=KARANGA |

|

McDonald’s: Former boss Easterbrook fined after staff relationshipStephen Easterbrook was fired in 2019 after the firm found he had had a consensual relationship with an employee. Read more at: https://www.bbc.co.uk/news/business-64211747?at_medium=RSS&at_campaign=KARANGA |

|

Rents rising at fastest rate for seven yearsRenters are being hit harder than owners by rising housing costs, official data shows. Read more at: https://www.bbc.co.uk/news/business-64209861?at_medium=RSS&at_campaign=KARANGA |

|

TCS looks well-placed to sail through turbulent macroeconomic scenarios in key marketsWhile the management has expressed confidence over the demand momentum, caution is in the air given that over three-fourths of its revenue is generated in the US and Europe, the regions that are likely to be affected due to macroeconomic challenges. Read more at: https://economictimes.indiatimes.com/markets/stocks/earnings/tcs-looks-well-placed-to-sail-through-turbulent-macroeconomic-scenario-in-key-markets/articleshow/96863876.cms |

|

How does Nifty behave in January? Check out the leaders & laggards of last 10 yearsWithin the Nifty 50 index, certain sectoral outperformers and laggards within the 10-year period. Nifty IT performed well in January for the most number of years (about six), while Nifty Metal was under pressure three times in the analyzed time frame. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/how-do-markets-behave-in-january-leaders-laggards-of-nifty-of-last-10-years/articleshow/96847980.cms |

|

DIIs’ clout in domestic equities continued to increase in Dec amid sustained inflowDIIs include local mutual funds, insurance companies, pension funds, and banks. Their increased participation has reduced the effect of higher market volatility on Indian equities compared with their peers in emerging markets Read more at: https://economictimes.indiatimes.com/markets/stocks/news/diis-clout-in-domestic-equities-continued-to-increase-in-dec-amid-sustained-inflow/articleshow/96852098.cms |

|

The Tell: Forget the old playbook. How investors should be ‘pricing in the damage’ of recession, says BlackRockThe way investors can protect portfolios in 2023 isn’t by relying on the same tactics that worked in past recessions, according to BlackRock. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7179-9536650CBB06%7D&siteid=rss&rss=1 |

|

Market Snapshot: Dow erases 300-point gain as S&P 500 struggles to extend ‘soft-landing’ rallyThe Dow Jones Industrial Average fumbles a big gain, while the S&P 500 struggles to build on last week’s rise. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7179-37980C46A108%7D&siteid=rss&rss=1 |

|

The Tell: Why stock-market bulls are ‘woefully myopic’ about S&P 500 profit growth — even before the impact of a potential recessionWall Street forecasts for the S&P 500 to see single-digit profit growth in 2023-24 seem ‘woefully myopic,’ warns Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-7179-BE312FADAFD9%7D&siteid=rss&rss=1 |