Summary Of the Markets Today:

- The Dow closed up 10 points or 0.03%,

- Nasdaq closed down 0.56%,

- S&P 500 closed down 0.34%,

- Gold $2051 up $8.10,

- WTI crude oil settled at $72 down $0.30,

- 10-year U.S. Treasury 3.999% up 0.092 points,

- USD index $102.40 down $0.10,

- Bitcoin $44,179 up $1,441 (3.37%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

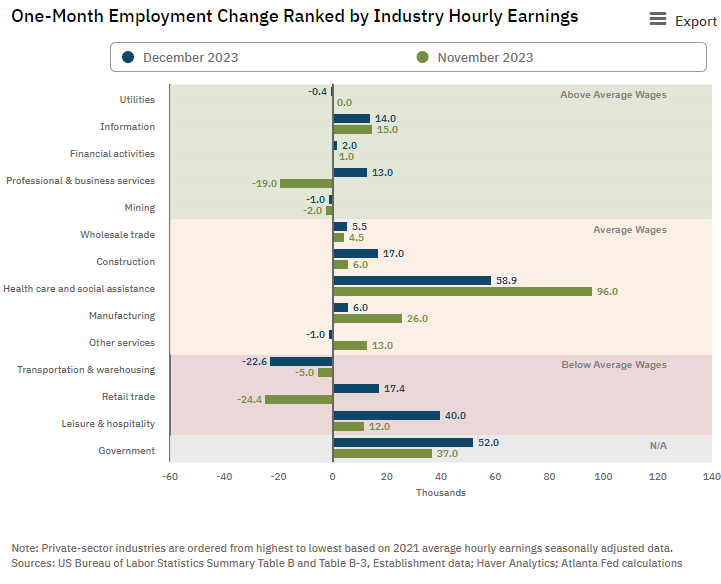

The ADP National Employment Report for December 2023 shows U.S. private employment rose 164,000 led by a healthy bump in leisure and hospitality hiring. Construction held strong in the face of high-interest rates, but manufacturing continued to struggle, notching another month of losses. This is the highest growth since August. According to Nela Richardson

Chief Economist, ADP:

We’re returning to a labor market that’s very much aligned with pre-pandemic hiring. While wages didn’t drive the recent bout of inflation, now that pay growth has retreated, any risk of a wage-price spiral has all but disappeared.

In the week ending December 30, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 207,750, a decrease of 4,750 from the previous week’s revised average. The previous week’s average was revised up by 500 from 212,000 to 212,500.

U.S.-based employers announced 34,817 job cuts in December 2023, down 24% from the 45,510 cuts announced in November. It is down 20% from the 43,651 cuts announced in the same month one year prior, according to a report released Thursday from Challenger, Gray & Christmas, Inc.

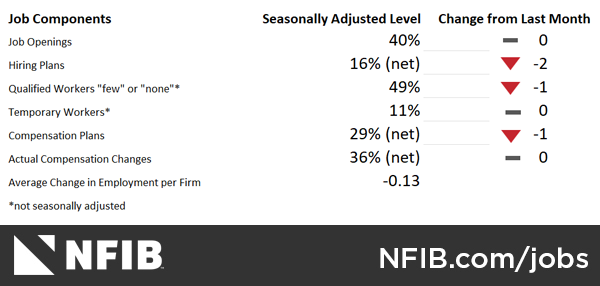

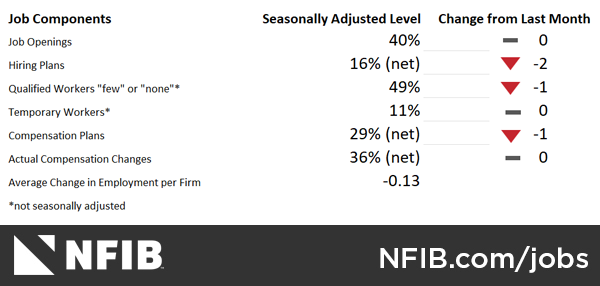

The percent of small business owners reporting labor quality as their top small business operating problem remains elevated at 20%, according to NFIB’s monthly jobs report. However, forty percent of owners have job openings they could not fill. Labor costs reported as the single most important problem for business owners increased one point to 9%, four points below the highest reading of 13% reached in December 2021. Per NFIB Chief Economist Bill Dunkelberg:

The tight labor market has been a consistent concern for small business owners throughout 2023. The level of job openings suggests a solid labor market will continue on Main Street for 2024, as owners raise compensation to attract qualified workers and consumers spend.

Here is a summary of headlines we are reading today:

- China in 2024: Economic Trials and Geopolitical Maneuvering

- Tech Trade War Looms as China Restricts Rare Earth Exports

- From Black Gold to Tech Marvel: Coal’s New Role in Electronics

- Average U.S. Natural Gas Prices Plunged by 62% in 2023

- Very Large Product Builds Push Oil Lower Despite Crude Draw

- U.S. Overtakes Qatar to Become World’s Top LNG Exporter

- Friday’s jobs report will be a big signal for a market looking for good news

- Walgreens stock plunges after drugstore chain slashes quarterly dividend nearly in half

- Bitcoin bounces back above $44,000 amid volatile start to 2024: CNBC Crypto World

- Magnificent Seven’s January Start Gives Clues To Market’s Year

- Nasdaq logs longest losing streak in over a year as the S&P 500 falls for a fourth day to extend the dismal 2024 start

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.