Summary Of the Markets Today:

- The Dow closed up 138 points or 0.36%,

- Nasdaq closed up 0.32%,

- S&P 500 closed up 0.22%,

- Gold $2,022 down $7.20,

- WTI crude oil settled at $75 up $1.60,

- 10-year U.S. Treasury 4.103% down 0.043 points,

- USD index $103.33 up $0.05,

- Bitcoin $40,123 down $1,504 (3.61%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

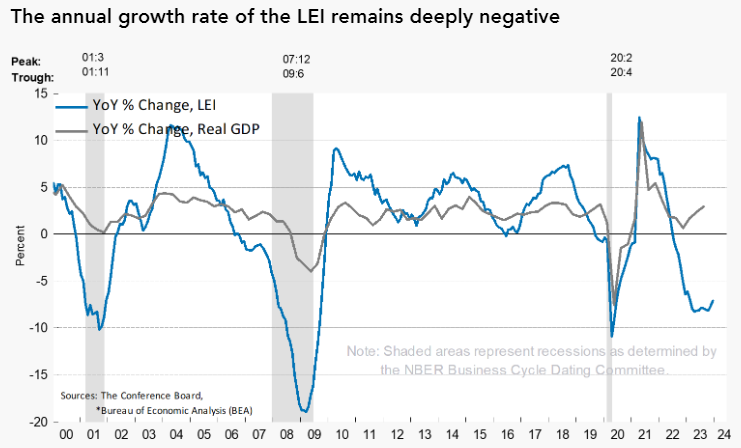

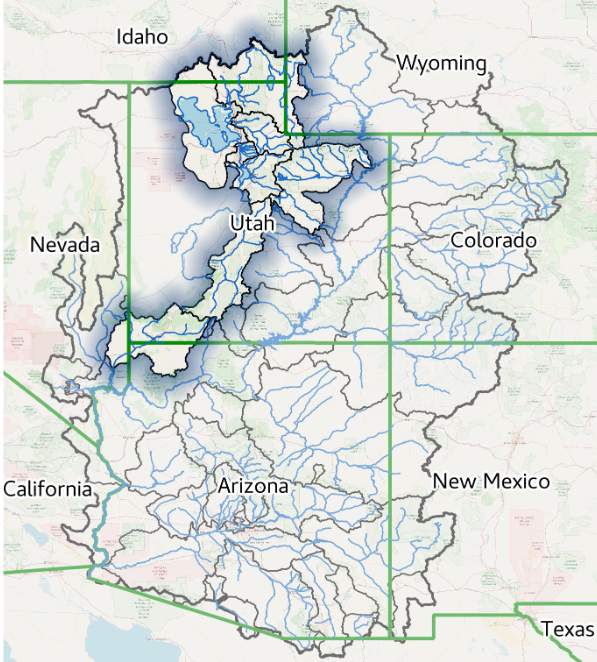

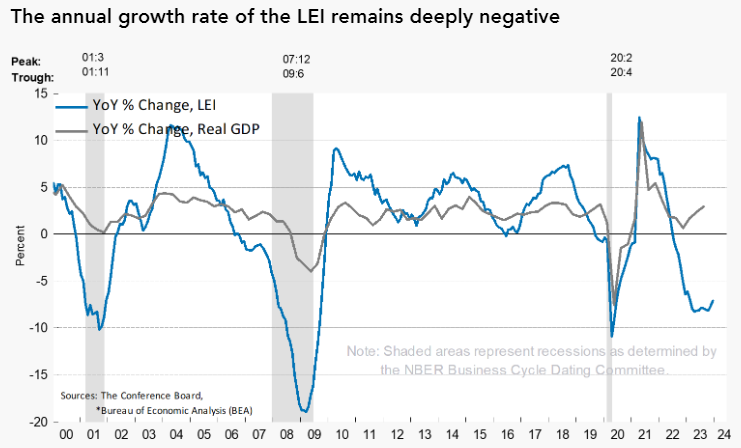

The Conference Board Leading Economic Index (LEI) for the U.S. fell by 0.1 percent in December 2023 to 103.1 (2016=100), following a 0.5 percent decline in November. The LEI contracted by 2.9 percent over the six-month period between June and December 2023, a smaller decrease than its 4.3 percent contraction over the previous six months. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board stated:

The US LEI fell slightly in December, continuing to signal underlying weakness in the US economy. Despite the overall decline, six out of ten leading indicators made positive contributions to the LEI in December. Nonetheless, these improvements were more than offset by weak conditions in manufacturing, the high interest-rate environment, and low consumer confidence. As the magnitude of monthly declines has lessened, the LEI’s six-month and twelve-month growth rates have turned upward but remain negative, continuing to signal the risk of recession ahead. Overall, we expect GDP growth to turn negative in Q2 and Q3 of 2024 but begin to recover late in the year.

Here is a summary of headlines we are reading today:

- Canada’s Uranium Is Fueling the World’s Nuclear Energy Boom

- Gasoline Shipping Day Rates Triple Under Houthi Attack

- The Strategic Implications of Iran’s Recent Missile and Drone Attacks

- WTI Oil Soars Nearly 2.6% as Geopolitics Overtakes Fundamentals

- Copper and Gold: Key Indicators for Predicting Economic Trends

- Russia And Iran Finalize 20-Year Deal That Will Change The Middle East Forever

- Sunoco to Buy NuStar Energy in $7.3 Billion Deal

- Dow rises more than 100 points to close above 38,000 for the first time ever: Live updates

- Spirit Airlines shares extend rebound after it appeals ruling blocking JetBlue merger

- Terraform Labs files for Chapter 11 bankruptcy protection in the U.S.: CNBC Crypto World

- Bitcoin was up 155% in 2023—but should you invest? Here’s what experts say

- Dow closes above 38,000 for first time as S&P 500 scores back-to-back records

- 2- and 10-year Treasury yields slip from 2024 highs as Fed’s blackout period gets under way

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.