Summary Of the Markets Today:

- The Dow closed up 370 points or 0.97%,

- Nasdaq closed up 1.30%,

- S&P 500 closed up 1.25%,

- Gold $2,074 up $1.86,

- WTI crude oil settled at $73 down $2.03,

- 10-year U.S. Treasury 3.860% down 0.105 points,

- USD index $103.06 down $0.21,

- Bitcoin $42,900 up $287 (0.67%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Construction spending during December 2023 was is 13.9% above December 2022. Construction is one of the bright spots in the current economy.

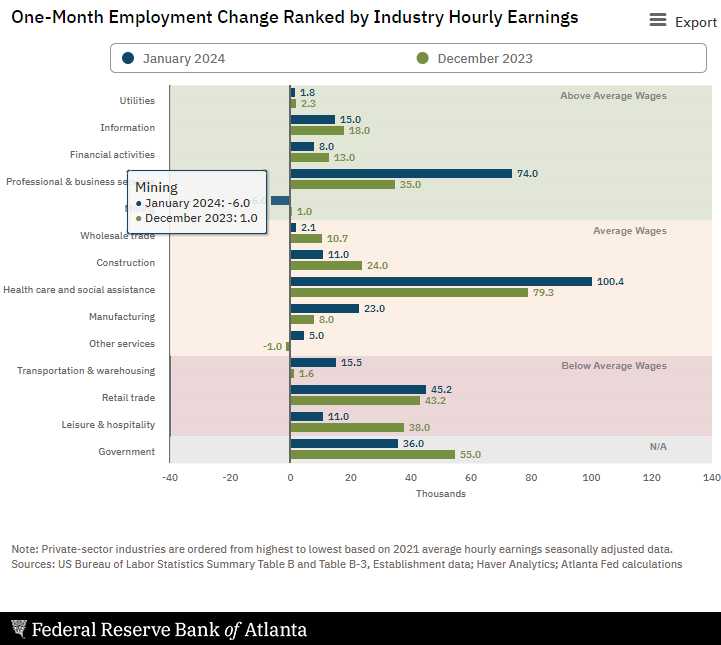

U.S.-based employers announced 82,307 job cuts in January, a 136% increase from the 34,817 cuts announced one month prior. It is down 20% from the 102,943 cuts announced in the same month in 2023. With the exception of last January’s total, this is the highest number of job cuts announced in January since January 2009, when 241,749 cuts were announced in the first month of that year.

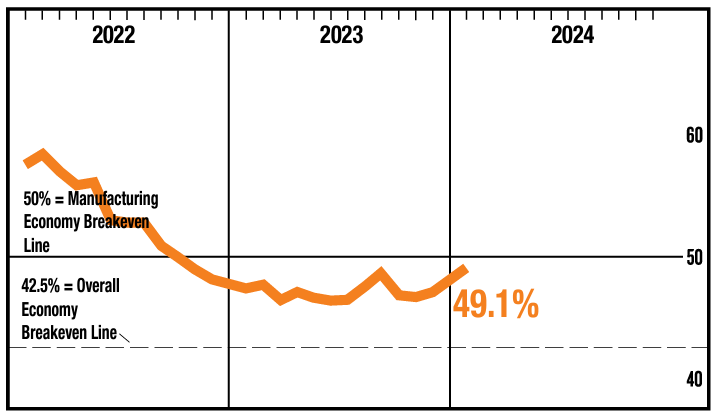

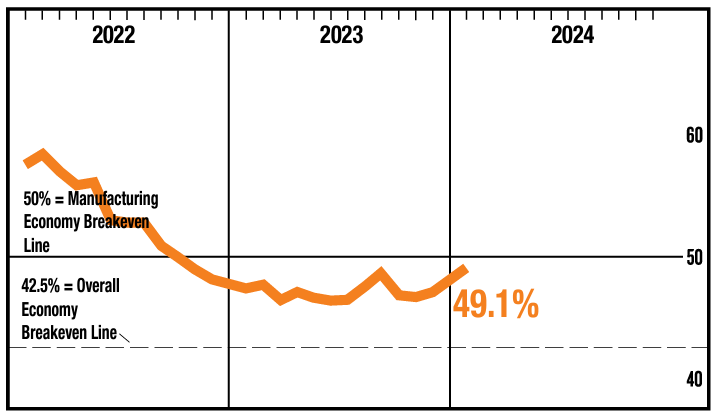

The ISM Manufacturing PMI registered 49.1 percent in January, up 2 percentage points from the seasonally adjusted 47.1 percent recorded in December. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index moved into expansion territory at 52.5 percent, 5.5 percentage points higher than the seasonally adjusted figure of 47 percent recorded in December.

4Q2023 nonfarm business sector labor productivity increased 2.7% year-over-year (blue line on the graph below) and unit labor costs increased 2.3% year-over-year (red line on the graph below). This is the second quarter that productivity growth has been slightly above the increase in labor costs.

In the week ending January 27, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 207,750, an increase of 5,250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 202,250 to 202,500.

According to NFIB’s monthly jobs report, a seasonally adjusted net 14% of small business owners plan to create new jobs in the next three months, down two points from December and the lowest level since May 2020. Thirty-nine percent of all owners (seasonally adjusted) reported job openings they could not fill in the current period, down one point from December and the lowest reading since January 2021. NFIB Chief Economist Bill Dunkelberg stated:

Although consumer spending remains strong, small business owners cannot find enough workers to fill their open positions,” said . “Owners continue to raise compensation to retain and attract workers with the skills and willingness to do the job, but hiring remains a struggle in the tight labor market.

Here is a summary of headlines we are reading today:

- Uranium Prices Soar As World Turns to Nuclear Power

- Oil Prices Drop, Recover on Gaza War Ceasefire Proposal Rumors

- U.S. Prepares for Multi-Day Strikes Against ‘Iranian Targets’

- U.S. Exports of Steam Coal Reached 5-Year High in 2023

- Dow closes more than 350 points higher, Nasdaq jumps 1% in rebound from Fed Day sell-off: Live updates

- Amazon earnings are out — here are the numbers

- Morgan Stanley names Ford its new top pick among U.S. automakers

- Peloton shares plummet 20% as fitness company gives dismal outlook

- U.S. regional banking shares tumble for second straight day

- January hiring was the lowest for the month on record as layoffs surged

- 10-year Treasury yield finishes at lowest level of year as traders weigh litany of risks

- Dow Jones rises 340 points in final hour of trading as U.S. stocks recover from two-day selloff ahead of Big Tech earnings

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.