Summary Of the Markets Today:

- The Dow closed down 525 points or 1.35%,

- Nasdaq closed down 1.80%,

- S&P 500 closed down 1.37%,

- Gold $2,006 down $27.50,

- WTI crude oil settled at $78 up $0.83,

- 10-year U.S. Treasury 4.314% up 0.144 points,

- USD index $104.88 up $0.71,

- Bitcoin $49,393 down $552 (1.42%),

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

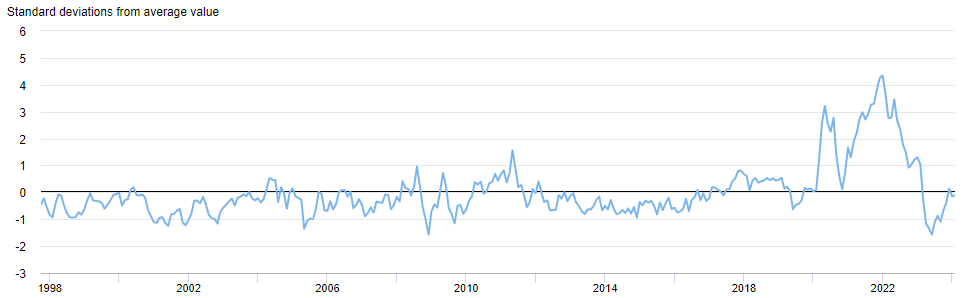

The Consumer Price Index for All Urban Consumers (CPI-U) in January 2024 increased 3.1% year-over-year – down from 3.3% in December 2023 but unchanged from 3.1% in November 2023. The all items less food and energy index rose 3.9% over the last 12 months, the same increase as for the 12 months ending December. The Federal Reserve uses the PCE inflation index to monitor inflation which the January data will be released at the end of February – and most likely it will be little changed. The market reaction to this release is surprising as I have been saying that inflation pressures are increasing – and the market mistakingly believed inflation has gone away.

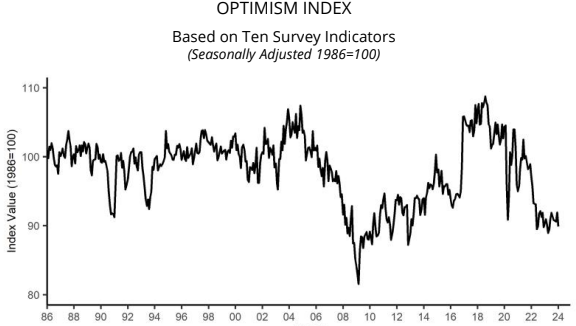

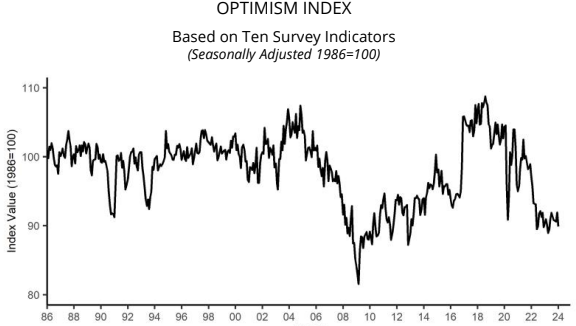

The NFIB Small Business Optimism Index decreased two points in January 2024 to 89.9, marking the 25th consecutive month below the 50-year average of 98. The net percent of owners who expect real sales to be higher declined 12 points from December to a net negative 16% (seasonally adjusted), a very negative shift in expectations. NFIB Chief Economist Bill Dunkelberg stated:

Small business owners continue to make appropriate business adjustments in response to the ongoing economic challenges they’re facing. In January, optimism among small business owners dropped as inflation remains a key obstacle on Main Street.

Here is a summary of headlines we are reading today:

- Why Are China’s Solar Panels So Cheap?

- Bearish Market Conditions Persist for Stainless Steel

- Oil Steady As Inflation Comes In Hotter Than Expected

- Mining Billionaire Slams Carbon Capture as ‘Falsehood’

- ETF Frenzy Pushes Bitcoin to Highest Levels Since 2021

- Diamondback Energy’s $26 Billion Endeavor Acquisition Shakes Up Permian Basin

- OPEC Sees Strong Long-Term Oil Demand

- Dow tumbles 500 points, posts worst day since March 2023 after hot inflation report: Live updates

- Here’s the inflation breakdown for January 2024 — in one chart

- Here’s what bitcoin’s chart says about its next moves after it breached $50,000 this week

- Prices rose more than expected in January as inflation won’t go away

- This stock-market predictor with a great record is even more bullish now than it was last year

- Treasury yields end at highest levels since at least December after hotter-than-expected CPI inflation report

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.