Summary Of the Markets Today:

- The Dow closed down 217 points or 0.55%,

- Nasdaq closed up 0.59%, (Closed at 17,020, New Historic high 17.033)

- S&P 500 closed up 0.02%,

- Gold $2,358 up $24.40,

- WTI crude oil settled at $80 up $2.45,

- 10-year U.S. Treasury 4.542 up 0.069 points,

- USD index $104.60 up $0.001,

- Bitcoin price is $68,354.36, a change of -1.45% over the past 24 hours as of 4:05 p.m.

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

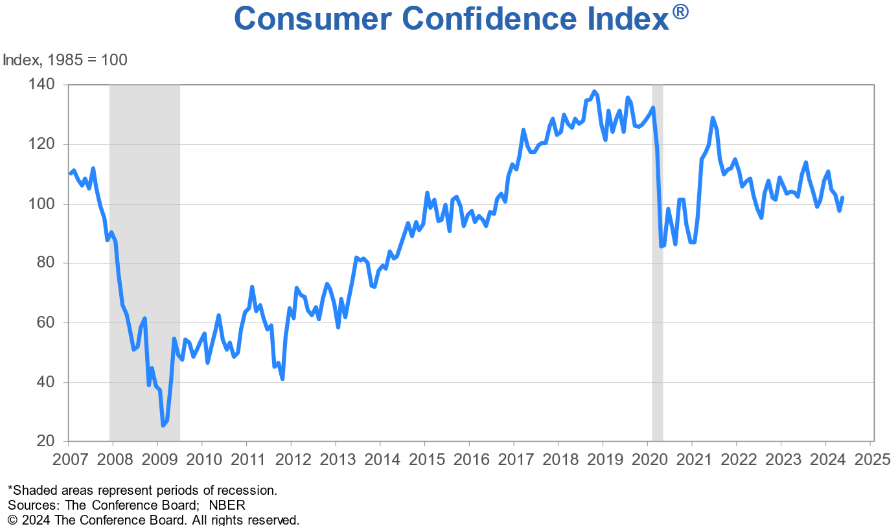

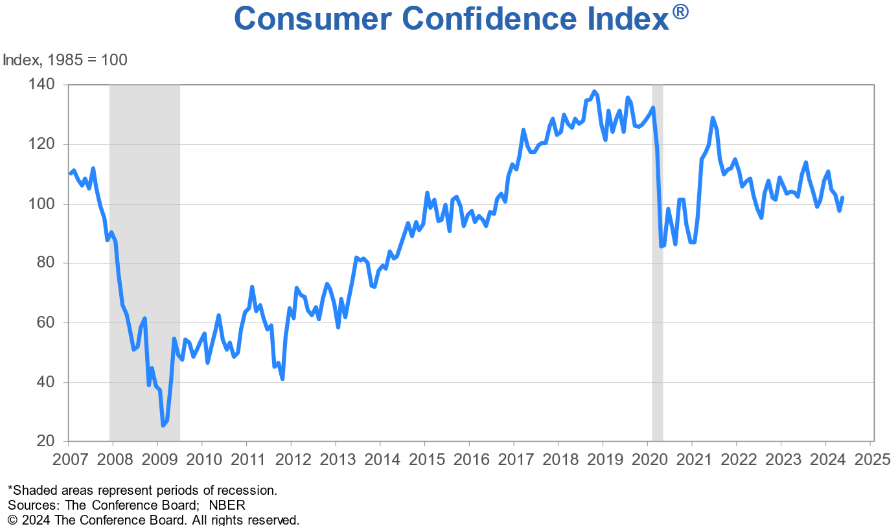

The Conference Board’s Consumer Confidence Index rose in May to 102.0 (1985=100) from 97.5 in April. It is interesting that the University of Michigan Consumer Sentiment remains well below 1985 levels whilst this Consumer Confidence Index is now above that level. The Consumer Confidence Survey reflects prevailing business conditions and likely developments for the months ahead. Dana M. Peterson, Chief Economist at The Conference Board stated:

Confidence improved in May after three consecutive months of decline. The survey also revealed a possible resurgence in recession concerns. The Perceived Likelihood of a US Recession over the Next 12 Months rose again in May, with more consumers believing recession is ‘somewhat likely’ or ‘very likely’. This contrasts with CEO assessments of recession risk: according to our CEO Confidence survey, only 35 percent of CEOs surveyed in April anticipated a recession within the next 12 to 18 months. Consumers were nonetheless upbeat about the stock market, with 48.2 percent expecting stock prices to increase over the year ahead, compared to 25.4 percent expecting a decrease and 26.4 expecting no change.

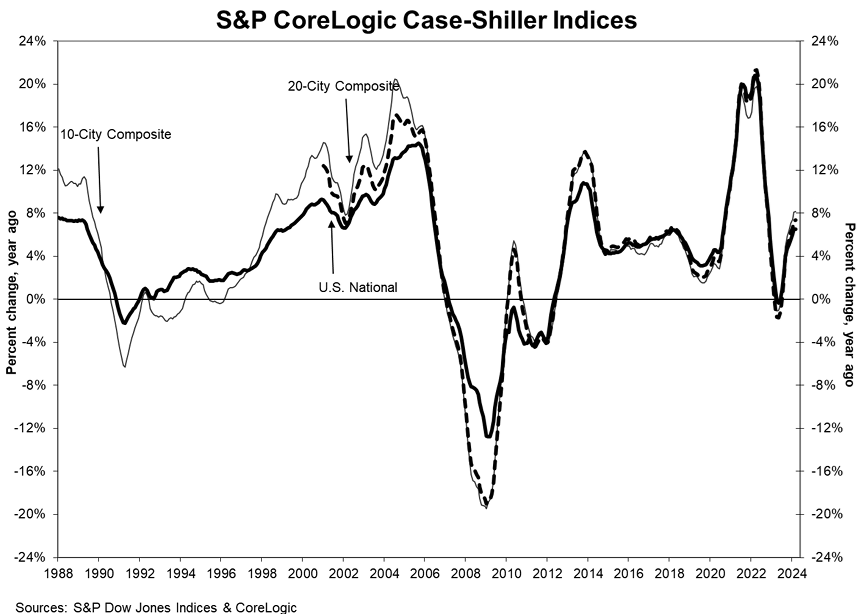

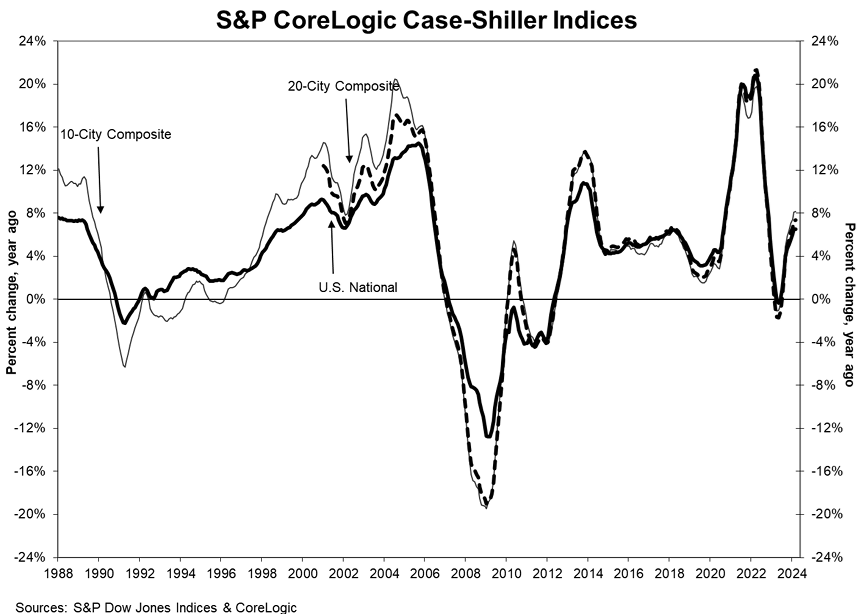

The S&P CoreLogic Case-Shiller 20-City Composite Home Price Index posted a slight year-over-year in March 2024 increase to 7.4%, up from a 7.3% increase in the previous month. San Diego continued to report the highest year-over-year gain among the 20 cities. Denver, holds the lowest rank this month for the smallest year-over-year growth, with a 2.1% annual increase in March. CoreLogic Chief Economist Dr. Selma Hepp added:

Continued home price resiliency amid surging borrowing costs highlights headwinds for the housing market reflected in slow sales activity, namely affordability challenges for potential homebuyers as cost of homeownership continue to skyrocket, particularly homeowners’ insurance and property tax increases. While these costs are driving some sellers and investors to let go of homes, and improving inventory shortages, buyers are maintaining the wait-and-see approach in anticipation of lower rates down the road. Nevertheless, it will be important to see how these non-mortgage costs affect potential homebuyers and existing homeowners longer term, particularly homeowners with fixed incomes. Weakness in low tier home prices in Tampa highlight some of the potential challenges. In contrast, markets in proximity to major employment centers, such as Seattle, Boston, and New York which have benefited from strong labor markets and ensuing wage and wealth gains are helping drive the demand while lack of homes for sale and new construction are putting pressure on prices in these markets.

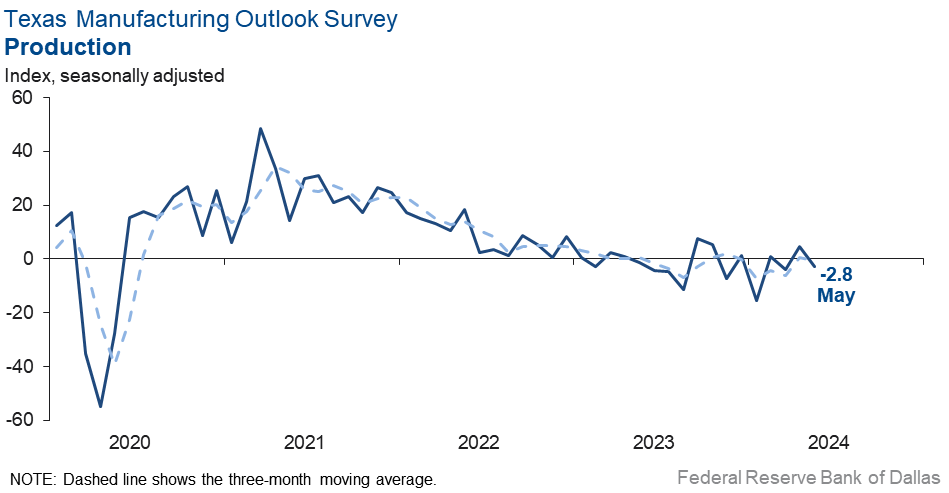

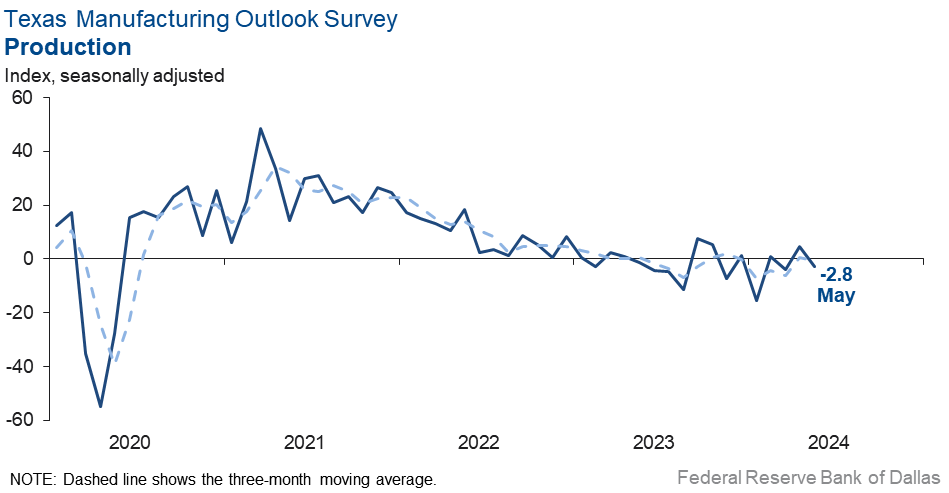

Texas Manufacturing Outlook Survey edged down in May 2024. The production index, a key measure of state manufacturing conditions, slipped from 4.8 to -2.8. The negative reading signals a slight decline in output from April. Other measures of manufacturing activity also suggested weaker activity this month. The new orders index remained negative, though it inched up to -2.2. The capacity utilization and shipments indexes slipped back into negative territory after turning positive last month, coming in at -2.0 and -3.0, respectively. My position remains that manufacturing in the U.S. continues in a recession.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.