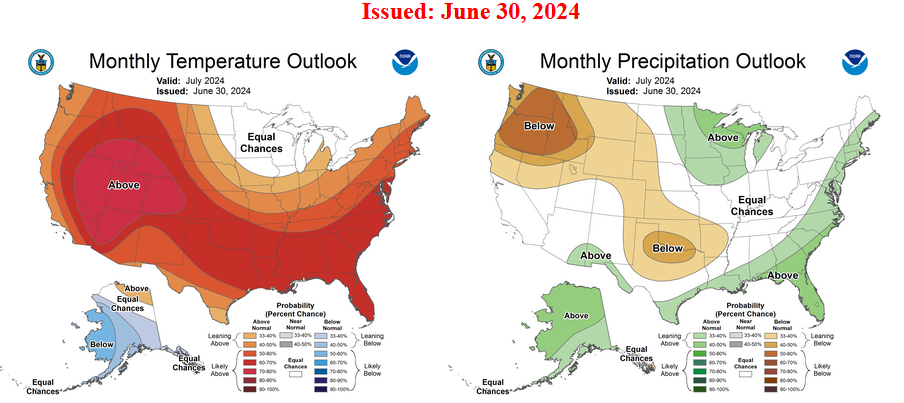

Today Through the Fourth Friday (22 to 28 days) Weather Outlook for the U.S. and a Six-Day Forecast for the World: posted July 2, 2024

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks and a six-day World weather outlook which can be very useful for travelers.

First the NWS Short Range Forecast. The afternoon NWS text update can be found here after about 4 p.m. New York time but it is unlikely to have changed very much from the morning update. The images in this article automatically update.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Tue Jul 02 2024

Valid 12Z Tue Jul 02 2024 – 12Z Thu Jul 04 2024…Dangerously hot conditions to impact much of the southern Plains, lower

Mississippi Valley, and western U.S. this week……Severe thunderstorms and flash flooding possible over portions of the

Midwest through midweek……Unsettled weather with localized flash flooding chances continue across

the Southeast and southern Rockies…Over 60 million residents are currently under heat-related watches,

warnings, and advisories this morning as early-July heat swelters much of

the south-central and western United States. The weather pattern

responsible for the potentially record-breaking heat includes upper-level

ridging just off the West Coast and and a separate upper ridge over the

south-central U.S. today before sliding to the east by midweek. For the

southern Plains, high temperatures are forecast to soar into the upper 90s

and low 100s. When combined with elevated humidity levels, heat indices

are forecast to rise into the 110s across the lower Mississippi Valley and

Gulf Coast. Excessive Heat Warnings and Heat Advisories currently span

from Kansas/Missouri to the Gulf Coast States. After enjoying a refreshing

start to the workweek, the Midwest and East Coast can expect a gradual

return to muggy summer warmth by Wednesday as surface high pressure

reorients itself off the East Coast and ushers in southerly flow. Extreme

heat building throughout the West Coast and more specifically interior

California this week will be particularly dangerous for those without

effective cooling. High temperatures away from the immediate coastline are

forecast to reach into the 105-115F range, which could break numerous

daily records in the San Joaquin and Sacramento Valleys. Heat begins to

build northward on Independence Day as highs into the 90s reach Oregon and

interior Washington. Excessive Heat Warnings, Watches, and Heat Advisories

go into effect today for some and stretch from southwest Washington to the

Desert Southwest. The duration of this heat wave is concerning as the

current forecast keeps scorching conditions in place through at least the

end of the week. This magnitude and duration of heat could pose a danger

to the public if proper heat safety is not followed. This includes staying

hydrated, out of direct sunlight, and in properly air-conditioned

buildings. Additionally, it is very important to check on vulnerable

friends, family, and neighbors to confirm their safety.Active and stormy weather associated with a few storm systems progressing

from the northern Rockies to the Midwest this week will create fireworks

of their own this holiday week. Initially, a cold front swinging from the

upper Midwest to the Great Lakes by early Wednesday is forecast to spark

numerous thunderstorms from northeast Kansas to central Wisconsin. Some

storms could turn severe and produce damaging wind gusts, a few tornadoes,

and large hail from northeast Kansas to southern Iowa. This area is

highlighted by the Storm Prediction Center as having an Enhanced Risk

(level 3/5) of severe weather. Thunderstorms are also expected to contain

intense rainfall rates as elevated levels of atmospheric moisture content

remain in place. Flood Watches have been issued for much of Iowa, with the

threat of scattered flash floods also encompassing much of the Midwest

today. For areas experiencing swollen rivers from prior rainfall, any

additional heavy rain could exacerbate flooding concerns. By Wednesday, a

cold front is forecast to stretch from the lower Great Lakes to the

central/southern Plains and provide a focus for additional potent

thunderstorms across the mid-Mississippi Valley. Once again thunderstorms

are expected to produce the potential for damaging wind gusts and flash

flooding. A separate area of potentially organized convection may impact

the central High Plains, where a greater threat for large hail and

tornadoes exists. The Fourth of July will feature the aforementioned

frontal boundary lingering over the Ohio Valley and lifting as a warm

front over the central Plains as an area of low pressure ejects off the

High Plains. This will lead to shower and thunderstorm chances from the

northern Plains and Midwest to the Ohio Valley and Mid-Atlantic, with the

highest chances for severe weather extending from eastern Kansas to

central/southern Missouri.Continued sufficient moisture content over the Southwest and southern

Rockies will also aid in the development of daily showers and

thunderstorms capable of producing localized instances of flash flooding

through midweek. Regions most likely to be affected by scattered downpours

include southeast Arizona and New Mexico, with burn scars and sensitive

terrain the most at risk for flash flooding. Meanwhile, a dying stationary

front entering the Southeast from the western Atlantic will also aid in

daily widely scattered thunderstorms across the Gulf Coast, Florida, and

the Southeast coastline/southern Georgia.