Summary Of the Markets Today

- The Dow down 1.99% or 654 points

- Nasdaq down 3.20%,

- S&P 500 down 4.29%,

- WTI crude oil down $7.81 to 102.72

- gold down from $1953 on Apr22 to $1853,

- Bitcoin down 21% over the past 5 days to $31,321,

- 10-year U.S. Treasury down -0.086% to 3.038%

Today’s Economic Releases

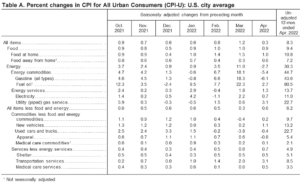

Fed Bostic Speech – The Federal Reserve raised the target for the fed funds rate by half a point to 0.75%-1% during its May 2022 meeting, the second consecutive rate hike and the biggest rise in borrowing costs since 2000, aiming to tackle soaring inflation. The central bank added that ongoing increases in the target range will be appropriate, with Chair Powell pointing to 50bps hikes in the next couple of meetings. The Fed will also begin reducing asset holdings on its $9 trillion balance sheet on June 1st. The plan will start with a monthly roll-off of $30 billion of Treasuries and $17.5 billion on mortgage-backed securities for 3 months and will then increase to $60 billion and $35 billion for mortgages per month. On the economic front, policymakers noted that the invasion of Ukraine and related events are creating additional upward pressure on inflation and are likely to weigh on economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. source: Federal Reserve

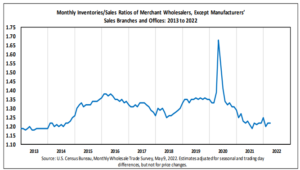

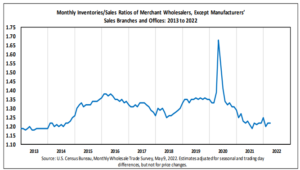

Wholesale Inventories – The headlines say wholesale sales were up month-over-month. Year-over-year change in the inventory-to-sales ratio is what is important. A jump in the ratio could indicate a slowing economy (one month of data is not a trend). A flat trend would indicate an economy that was neither accelerating or decelerating. A decelerating trend would indicate an improving economy. Wholesale sales, therefore, are indicating an improving economy.

A summary of headlines we are reading today:

- Gasoline Prices May Have Finally Peaked

- Stocks making the biggest moves midday: Palantir, Rivian, Uber and more

- Bitcoin drops below $30,000 to hit its lowest level since July 2021 after stock sell-off

- Retail Is Puking: “This Is The 5th Biggest Sell Day On Record”

- US faces baby formula ‘crisis’ as shortage worsens

- Mark Cuban: ‘Crypto is going through the lull that the internet went through’

- Yellen says financial system working well despite ‘potential for continued volatility’

These and other headlines and news summaries moving the markets today are included below.