Summary Of the Markets Today

- The Dow down 0.3%,

- Nasdaq down 1.4%,

- S&P 500 down 0.6%,

- WTI crude oil up $2.32 to $110.56,

- Gold up $7.40 to $1,883,

- Bitcoin down 1.7% to $35,902,

- 10-year U.S. Treasury up 6 basis points to 3.13%

Today’s Economic Releases

A summary of today’s April 2022 employment report:

- total non-farm employment rose 428,000, total private up 406,000, and the unemployment rate remained at 3.6%

- the household survey, on the other hand, showed a decline of employment of 363,000 (the unemployment rate comes from the household survey whilst the headline employment numbers come from the establishment survey.

- the U-6 total unemployment rate rose from 6.9% to 7.0%

- largest jobs growth this month came from accommodation and food services (66.1K), health care and social assistance (40.9K), transport and warehousing (52.0K), and manufacturing (55.0K).

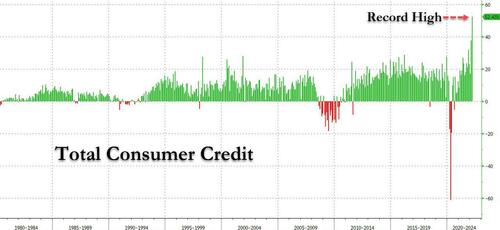

Consumer Credit increased at a seasonally adjusted rate of 9.7% month-over-month in 1Q2022.

Here are the top 10 boys and girls names for 2021 according to U.S. Social Security:

| Boys | Girls |

|---|---|

| 1. Liam | 1. Olivia |

| 2. Noah | 2. Emma |

| 3. Oliver | 3. Charlotte |

| 4. Elijah | 4. Amelia |

| 5. James | 5. Ava |

| 6. William | 6. Sophia |

| 7. Benjamin | 7. Isabella |

| 8. Lucas | 8. Mia |

| 9. Henry | 9. Evelyn |

| 10. Theodore | 10. Harper |

Other Economic News

As usual, we have included below the headlines and news summaries moving the markets today including:

- Oil Markets Are Bracing For Further Supply Disruptions

- Shocking Consumer Credit Numbers: Everyone Is Maxing Out Their Credit Card Ahead Of The Recession

- Used-car prices are down from record highs, easing the impact of inflation

- Stocks Suffer Longest Losing Streak In 10 Years, Long-Bond Battered As Fed-Cred Crumbles

- Nationwide Baby Formula Shortage Hits “Shocking” Levels, Sparking Panic Among Parents

- Nifty50 weekly chart signals more weakness ahead

- 10-year Treasury yield trades at nearly 3 1/2-year high as inflation outlook remains in focus after April jobs data

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Russia’s Victory Day Could Be A Crucial Moment For OilWhile the Kremlin has publicly stated that it wont be declaring war on Ukraine or announcing a military mobilization on Victory Day on May 9, the markets are jittery heading into the weekend, with speculation that Russian President Vladmir Putin will announce a doomsday scenario that indicates a war not just with Ukraine, but with NATO at large. Russian Victory Day celebrations are high-level affairs commemorating the Soviet Unions victory over Nazi Germany in World War II. This year, the celebration is more important than ever Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Victory-Day-Could-Be-A-Crucial-Moment-For-Oil.html |

|

Oil Markets Are Bracing For Further Supply DisruptionsOil markets are once again on edge about potential supply disruptions. The continued efforts by the EU to ban Russian oil imports and the renewed efforts by the U.S. Senate to pass the NOPEC bill would both result in supply disruptions.Global Energy Alert: Do you know why May 9th is such an important deadline for Russia’s war in Ukraine? Do you think energy markets will continue to outperform in the coming month? Do you know how the British Government is attempting to influence Libya’s election? All these questions and more are answered in today’s Read more at: https://oilprice.com/Energy/Energy-General/Oil-Markets-Are-Bracing-For-Further-Supply-Disruptions.html |

|

Oil Prices Underpinned By Supply JittersU.S. West Texas Intermediate crude oil futures are up over 3% for the week with most of the gains attributed to the European Commissions decision to place an embargo on Russian crude oil. This move is perceived as bullish because it lowers the available supply. Demand is still a concern due to Chinas COVID-related shutdowns, but conditions seem to be holding steady, which brings the country closer to gaining control of the situation and perhaps lifting restrictions sooner than expected. Nonetheless, the lockdowns have taken their Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Underpinned-By-Supply-Jitters.html |

|

The Slow Rebound Of Upstream Oil Investment1. Disregarding Supply Shocks, OPEC+ Sticks to Conservative PolicyOPEC+ approved another 432,000 b/d increase in production quotas for June 2022, sticking to its conservative attitude despite falling output levels from one of the oil groups key member, Russia. Brushing aside risks of Russian output plummeting, OPEC+ indicated that supply/demand indicators point to a balanced market, rubberstamping the decision in 13 minutes. According to S&P Global Platts, there remain only two countries capable of bringing more idled production back Read more at: https://oilprice.com/Energy/Energy-General/The-Slow-Rebound-Of-Upstream-Oil-Investment.html |

|

Is Now The Time For The NOPEC Bill?Politics, Geopolitics & Conflict NOPEC legislation is a dangerous provocation. Passed by a Senate panel on Thursday after being bandied about for some 20 years and rejected time and again, its suddenly gained more impetus because of soaring oil prices and pain at the American gas pumps. The legislation, if signed into law by Biden (which is far from a certainty) would give the U.S. a pathway to sue the cartel for price-fixing and market manipulation. That may have made more sense back in the days before American shale burst on the scene Read more at: https://oilprice.com/Energy/Energy-General/Is-Now-The-Time-For-The-NOPEC-Bill.html |

|

Can The Energy Sector Continue To Outperform?Until recently, revealing to people that I wrote about and traded in the energy sector invariably provoked the same response. Their jaws would drop, and they would look at me in disbelief, asking whether or not I was completely sane. That was understandable, I guess, if somewhat insulting, and despite the fact that it demonstrated complete ignorance of the difference between trading and investing. After all, energy was a sector that had underperformed the market for a decade or more, and, as recently as a year and a half ago, didnt Jim Cramer Read more at: https://oilprice.com/Energy/Energy-General/Can-The-Energy-Sector-Continue-To-Outperform.html |

|

Over 60 million tax returns could be completed automatically, study showsThe IRS could automate over 60 million tax returns, saving filers time and money, according to a study. Read more at: https://www.cnbc.com/2022/05/06/over-60-million-tax-returns-could-be-completed-automatically-study-says.html |

|

CDC investigating 109 cases of severe hepatitis in kids across two dozen states, including 5 deathsThe cases of severe hepatitis are across 25 states and territories. Read more at: https://www.cnbc.com/2022/05/06/cdc-investigating-severe-hepatitis-in-children.html |

|

Starbucks criticizes Biden’s visit with union leaders, requests White House meetingStarbucks is asking the White House for a meeting after President Joe Biden met with an organizer who is helping its coffee shops unionize. Read more at: https://www.cnbc.com/2022/05/06/starbucks-criticizes-biden-visit-with-union-leaders-requests-white-house-meeting.html |

|

Kentucky Derby owner Churchill Downs moves away from online gambling, doubles down on horse bettingChurchill Downs says it is switching its strategy because online sports betting became too costly. Read more at: https://www.cnbc.com/2022/05/06/kentucky-derby-owner-churchill-downs-doubles-down-on-horse-race-betting.html |

|

Stocks making the biggest moves midday: Peloton, Under Armour, Monster Beverage and moreThese are the stocks posting the largest moves in midday trading. Read more at: https://www.cnbc.com/2022/05/06/stocks-making-the-biggest-moves-midday-peloton-under-armour-monster-beverage-and-more.html |

|

Elon Musk denies claim by Truth Social boss that Trump encouraged him to buy TwitterDevin Nunes, head of Donald Trump’s social media company, told Fox Business News that the ex-president urged Tesla chief Elon Musk to buy Twitter. Read more at: https://www.cnbc.com/2022/05/06/elon-musk-denies-claim-trump-encouraged-him-to-buy-twitter.html |

|

Nvidia didn’t tell investors enough about effects of crypto mining on its business, SEC saysIn 2017, ETH rose from $10 to $800, driving demand for Nvidia graphics cards. Read more at: https://www.cnbc.com/2022/05/06/nvidia-sec-reach-deal-on-cryptocurrency-disclosures-in-2017.html |

|

How college athletes line up tens of thousands of dollars in name, image and likeness dealsThe NCAA enacted an interim name, image and likeness policy almost a year ago, allowing athletes to strike deals with local car dealerships to major brands. Read more at: https://www.cnbc.com/2022/05/06/how-college-athletes-line-up-tens-of-thousands-of-dollars-in-nil-deals.html |

|

Used-car prices are down from record highs, easing the impact of inflationWholesale vehicle prices have dropped 6.4% since the January record. Read more at: https://www.cnbc.com/2022/05/06/used-car-prices-are-down-from-record-highs-easing-the-impact-of-inflation.html |

|

Couples cut wedding expenses as inflation and demand make walking down the aisle pricierCouples are getting creative to save money, while wedding vendors continue to face supply chain headwinds leading to shortages. Read more at: https://www.cnbc.com/2022/05/06/wedding-costs-surge-as-pent-up-demand-inflation-force-couples-to-cut.html |

|

SpaceX splashes down NASA’s Crew-3 mission, completing its sixth astronaut flightSpaceX returned the astronauts of NASA’s Crew-3 mission to Earth early Friday morning. Read more at: https://www.cnbc.com/2022/05/06/spacex-nasa-crew-3-mission-splashes-down-completing-its-6th-astronaut-flight.html |

|

Peloton shares hit all-time low as pressure mounts under new CEO Barry McCarthyPeloton shares tumbled to an all-time low Friday as investors lose hope that the connected fitness equipment maker can turn itself around. Read more at: https://www.cnbc.com/2022/05/06/peloton-shares-hit-all-time-low-as-pressure-mounts-ahead-of-earnings.html |

|

DSW is testing a store layout that puts the spotlight on brands like Adidas, Crocs and BirkenstockDSW is trying out a new store look and layout at a location opening this weekend in Houston, in an attempt to focus customers’ attention on key brands. Read more at: https://www.cnbc.com/2022/05/06/dsw-tests-layout-to-spotlight-brands-like-adidas-crocs-birkenstock.html |

|

Stocks Suffer Longest Losing Streak In 10 Years, Long-Bond Battered As Fed-Cred CrumblesStocks Suffer Longest Losing Streak In 10 Years, Long-Bond Battered As Fed-Cred CrumblesAbsolute chaos intraday in stocks this week… and for a brief period today, there was hope that things would ‘get back to even’ magically on the week… But all that hope evaporated after Kashkari’s comments (which briefly lifted stocks back to unch) faded into the ether and stocks pushed back towards the lows of the day and week (before a late buying panic)…

The machines worked extremely hard in the last few minutes of the day to try and get the S&P into the green for the week – anything to avoid “the worst losing streak since 2011” Read more at: https://www.zerohedge.com/markets/stocks-suffer-longest-losing-streak-10-years-long-bond-battered-fed-cred-crumbles |

|

Shocking Consumer Credit Numbers: Everyone Is Maxing Out Their Credit Card Ahead Of The RecessionShocking Consumer Credit Numbers: Everyone Is Maxing Out Their Credit Card Ahead Of The RecessionWhile it is traditionally viewed as a B-grade indicator, the March consumer credit report from the Federal Reserve was an absolute shocked and confirmed what we have been saying for month: any excess savings accumulated by the US middle class are long gone, and in their place Americans have unleashed a credit-card fueled spending spree. Here are the shocking numbers: in March, one month after the February print already came in more than double the $18 billion expected, consumer credit exploded to an absolutely blowout $52.435 billion, again more than double the expected $25 billion print, and the highest on record!

And while non-revolving credit (student and car loans) rose by a relatively pedestrian 21.1 billion (which was still the 6th highest on record … Read more at: https://www.zerohedge.com/economics/shocking-consumer-credit-numbers-everyone-maxing-out-their-credit-card-ahead-recession |

|

Nationwide Baby Formula Shortage Hits “Shocking” Levels, Sparking Panic Among ParentsNationwide Baby Formula Shortage Hits “Shocking” Levels, Sparking Panic Among ParentsAuthored by Jack Phillips via The Epoch Times, A nationwide shortage in baby formula is worsening, according to a new analysis, as parents have expressed alarm over the worrying trend. At retail locations across the United States, about 40 percent of the top-selling infant formula products were not in stock for the week ending April 24, said Datasembly. The company said that it tracked baby formula stock at more than 11,000 stores nationwide.

|

|

Nomura: “I’m Talking Full-Blown, Game Of Thrones ‘Red Wedding’-Style Liquidation Death”Nomura: “I’m Talking Full-Blown, Game Of Thrones ‘Red Wedding’-Style Liquidation Death”Nomura’s Charlie McElligott was spot on in his explanation for why the market broke yesterday, yet even he is concerned about what is going on today, and writes that in addition to the potential shock of the aforementioned six Fed speakers today (“culminating in tonight’s Hawk-led Bullard / Waller double-banger, where there’s some Delta they could again try to talk-up 75bps hikes”), the week’s crash – which sees the S&P on track for the longest weekly losing streak since 2011 – is also “an Earnings and Valuation story, which is bearing-out again in more “rich” names and (former) favorites of the Growth crowd, and culminating in “absolute scenes” in Growth portfolios, as “obvious liquidations ripple-through the market, with outrageous -2.5- to -3.5-sigma 1-day selloffs yday in bunches of these names, full capitulation.” Here are the summary highlights from McElligott’s latest note (the full note is available to ZH professional subscribers in the usual place):

|

|

McColl’s: Billionaire Issa brothers near deal to rescue chainThe struggling convenience store chain, which has 16,000 staff, is set to enter administration. Read more at: https://www.bbc.co.uk/news/uk-61351412?at_medium=RSS&at_campaign=KARANGA |

|

Amazon targets review firms with legal actionThe tech giant has accused four companies of flooding its shopping sites with fake reviews. Read more at: https://www.bbc.co.uk/news/technology-61348521?at_medium=RSS&at_campaign=KARANGA |

|

New energy firms took high risk strategy – reportA report into regulation when 30 energy companies went bust exposes failures by Ofgem. Read more at: https://www.bbc.co.uk/news/business-61353794?at_medium=RSS&at_campaign=KARANGA |

|

This large FPI holds 8 stocks worth Rs 82,000 crore. Do you own any?The fund owned over 1 per cent stake in eight domestic stocks, as per the data compiled with Trendlyne. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/this-large-fpi-holds-8-stocks-worth-rs-82000-crore-do-you-own-any/articleshow/91375000.cms |

|

Market Movers: Axis Bank gets a shocker from its mutual fund arm; ITC sees buyingMedia reports said the mutual fund arm of the lender removed Viresh Joshi, head trader and fund manager, from the fund management team of seven of its equity schemes. Deepak Agrawal, equity research analyst and fund manager, has also been removed from the management team of three funds. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/market-movers-axis-bank-gets-a-shocker-from-its-mutual-fund-arm-itc-sees-buying/articleshow/91380598.cms |

|

Tech View: Nifty50 weekly chart signals more weakness ahead The index has been trading below its key moving averages now. Analysts said that while a small bounce can’t be ruled out, the ongoing pain in the market is unlikely to ease in the near future. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/tech-view-nifty50-weekly-chart-signals-more-weakness-ahead/articleshow/91379228.cms |

|

The Conversation: Russia-Ukraine war: How Putin could use May 9 celebrations to rally support for a longer fightRussia could use Victory Day — its anniversary of the end of World War II — to formally declare war on Ukraine. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7CF4-6793E02BFEFC%7D&siteid=rss&rss=1 |

|

Bond Report: 10-year Treasury yield trades at nearly 3 1/2-year high as inflation outlook remains in focus after April jobs dataMost Treasury yields move higher on Friday, pushing 5- to 30-year rates further above 3%. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7CEA-5E32B9B34EB1%7D&siteid=rss&rss=1 |

|

Tim Ryan, Democrats’ Senate nominee in Ohio, skips Biden’s events in the Cincinnati areaPresident Joe Biden on Friday is visiting the Cincinnati area to talk up priorities such as a China competition bill and a new 3D printing program, but a key fellow Democrat — the party’s Senate nominee in Ohio, Tim Ryan — wasn’t expected to take part in Biden’s events. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C05575-04D4-B545-7CF1-6786B7EC3A65%7D&siteid=rss&rss=1 |