03 October 2022 Market Close & Major Financial Headlines: Dow Rallies. Ocean Freight Orders Suggesting Big Drop In Consumer Demand.

Summary Of the Markets Today:

- The Dow closed up 765 points or 2.66%,

- Nasdaq closed up 2.27%,

- S&P 500 up 2.59%,

- WTI crude oil settled at $83 up $3.57

- USD $111.85 down $0.25,

- Gold 1701 unchanged,

- Bitcoin $19,547 up 1.45% – Session Low 18,948,

- 10-year U.S. Treasury 3.659% down 0.145%

*Stock data, cryptocurrency, commodity prices as of market close.

Today’s Economic Releases:

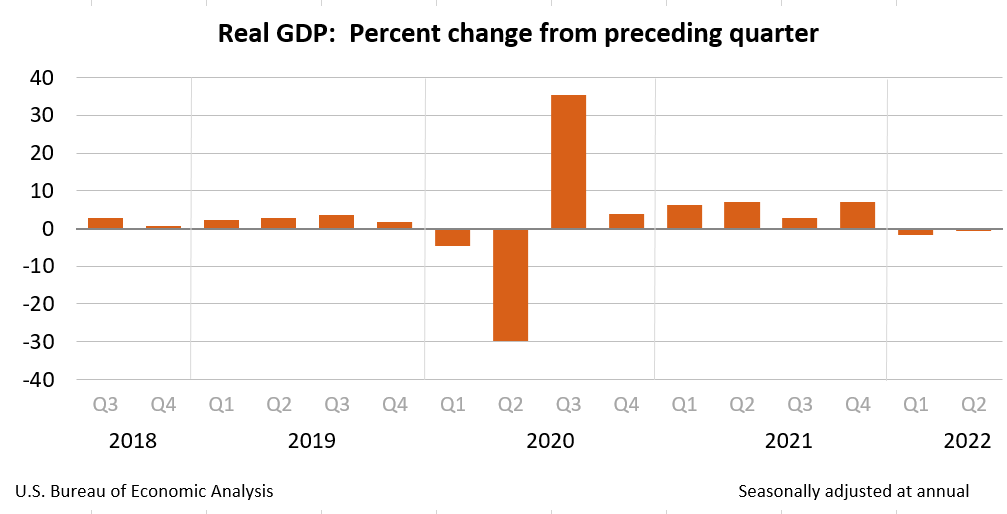

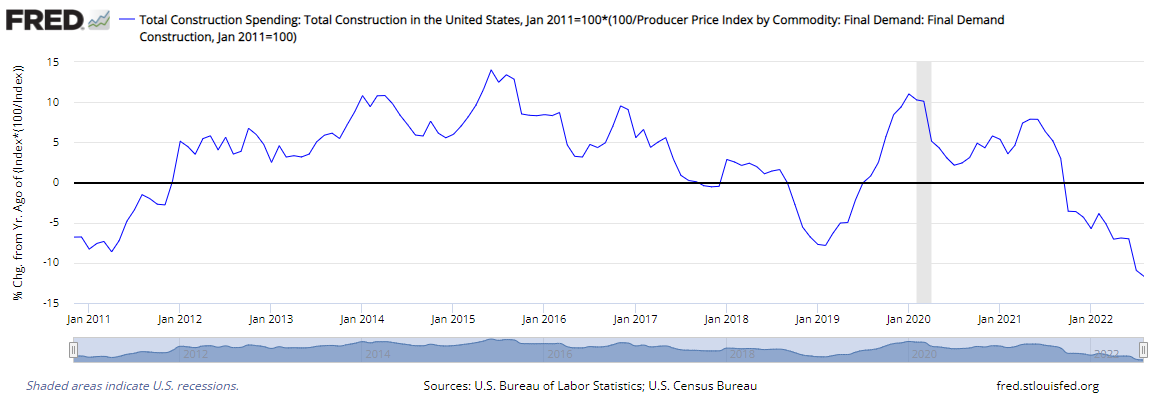

Construction spending during August 2022 was down 0.7% month-over-month and up 8.5% year-over-year. During the first eight months of this year, construction spending increased 10.9%. Inflation adjusted construction spending declined 11.7% year-over-year as inflation in this sector exceeds 22% (see graph below)

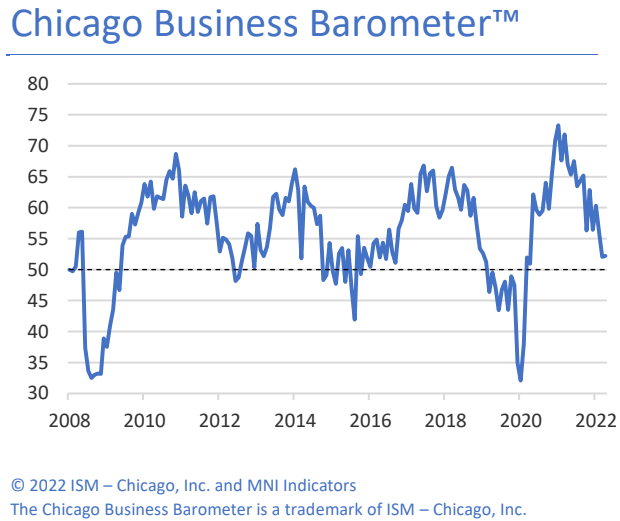

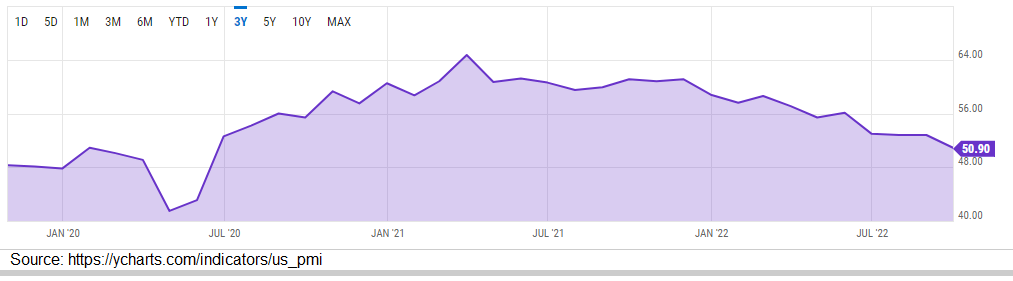

The September 2022 Manufacturing PMI registered 50.9% which is lower than the 52.8% last month. Any number above 50% represents expansion but this is the lowest since May 2020, when it registered 43.5%. This suggests that this manufacturing sector is barely growing.

A summary of headlines we are reading today:

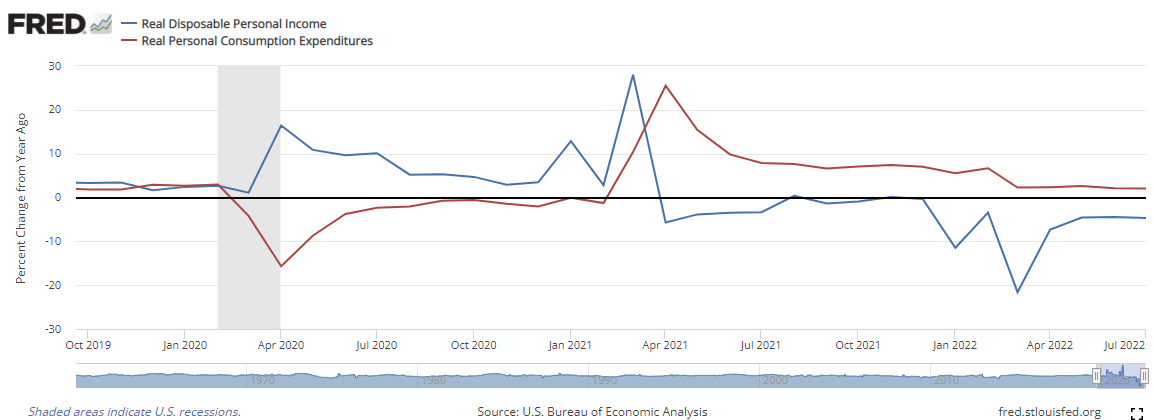

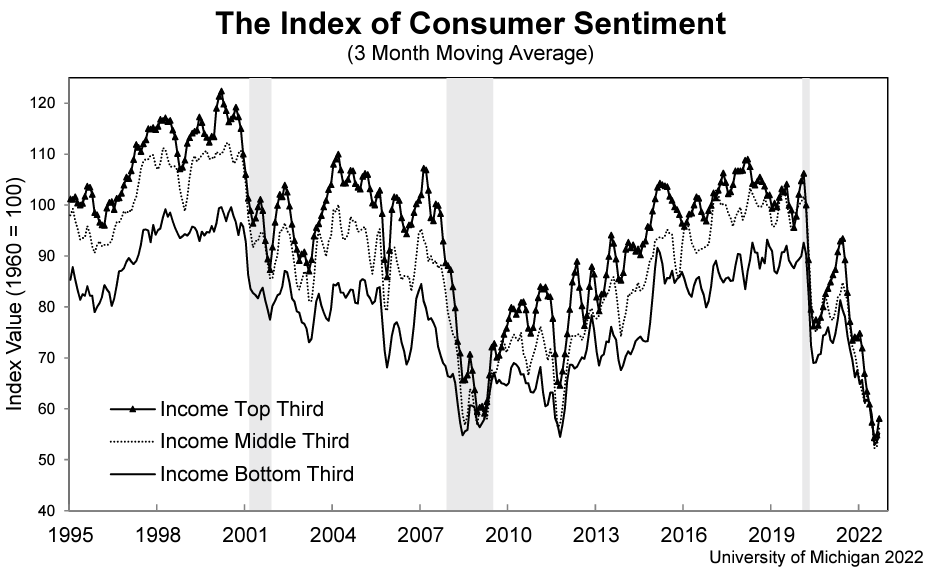

- Ocean freight orders are signaling a big drop in consumer demand

- The Middle East Is At The Forefront Of Low-Carbon Desalination Technology

- China Is Reselling U.S. LNG To Europe For Big Profits

- General Motors says sales rose 24% in the third quarter

- Who needs another subscription service? Walmart is betting its millions of customers do

- “2023 Will Be Year From Hell” – Martin Armstrong Warns Europe ‘Could Suck The Rest Of The World Down The Tubes’

- Credit Suisse, Citi cut 2022 year-end target for S&P 500

These and other headlines and news summaries moving the markets today are included below.