“We cannot solve our problems with the same thinking we used when we created them.”

—Albert Einstein

“You never change things by fighting the existing reality. To change something, build a new model that makes the existing model obsolete.” — Buckminster Fuller

“Where there is no vision, the people perish.”

— Proverbs 29:18

Concordian economics discloses the dynamic nature of economic systems.

Introduction

Concordian economics is an integration of theory, policy, and practice. The theory integrates

- Production of real goods and services;

- Consumption or expenditure of financial assets to acquire real goods and services;

- Distribution of ownership rights over goods as well as money.

The policy integrates

- The right to participate in the economic process (participative justice);

- The right to a fair share of what one produces (distributive justice);

- The right to receive an equivalent value of what one gives (commutative justice).

The practice integrates economic rights and responsibilities in relation to the four modern factors of production.

A Bit of History

Concordian economics was born in 1965, when, after a summer of intense intellectual struggle with the General Theory, the writer inserted Hoarding into Keynes’ model of the economic system and found himself in a different cultural universe. The procedure is reproducible. We will all obtain the same result.

Once Upon a Time

Once upon a time economics was not a science; it was a practice. It was controlled by the principles of economic justice, principles that were enunciated by Aristotle and endorsed by Saint Thomas Aquinas. These principles remained undisputed for about two thousand years, basically until Adam Smith came along and gave us the “science” of economics. At the same time, from Moses, through Jesus of the Parable of the Talents, to the Doctors of the Church everyone knew about Hoarding.1

Today, without batting an eyelash, it is stated that “economics is what economists do.”

Trouble is economists do not seem able to agree what is that they do. A majority of them seem to be convinced that the science of economics is the study of the Market. Let us see.

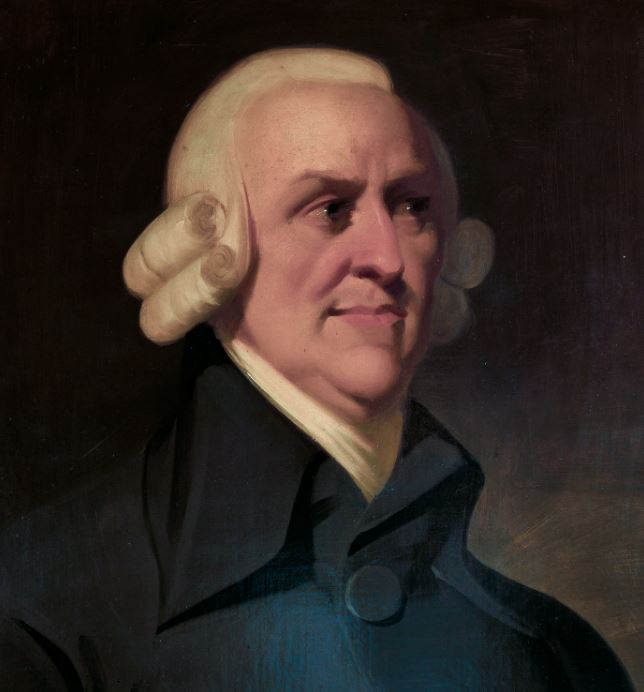

Illustration 1. Adam Smith (1723–1790) was a Scottish economist and philosopher who was a

pioneer of political economy and a key figure during the Scottish Enlightenment. Also known

as “The Father of Economics” or “The Father of Capitalism”, he wrote two classic works,

The Theory of Moral Sentiments (1759) and

An Inquiry into the Nature and Causes of the Wealth of Nations (1776).

Wikipedia

The Behavior of the Market

Why do most mainstream economists believe, as Adam Smith did, that the Market is ruled by an invisible hand leading us gently to a condition of equilibrium and well-being?

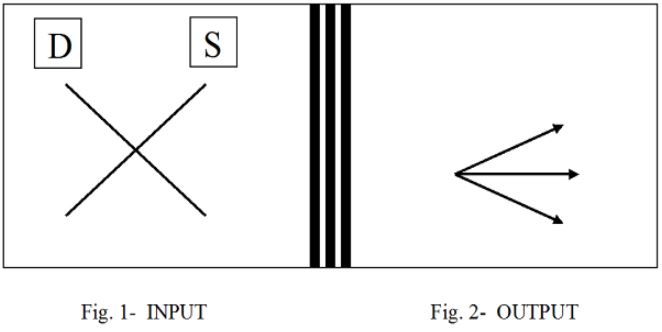

The reason is that for most economists, as they openly admit, economics is a black box.

MANIPULATING the laws of demand (D) and supply (S), economists develop theories of what should go in… and observe what comes out:

When analyzed in depth, the results of any theory, on the one hand, plausibly lead to growth; on the other, they lead to stability; and also they lead to decline. Economists do not know what happens within the box.

Why?

The fundamental reason is that Saving was substituted for Hoarding by Adam Smith—and made “equal” to Investment. The proposition that Saving equals Investment is at the foundation of all modern economic theory.2

The trouble is that Saving = Investment is a dogma. Neither Keynes nor any other economist has been able to explain why Saving = Investment.3

And no one ever will because Saving in its incarnation as money deposited in a bank is Investment: It is the lowest form of investment.

We Need a New Paradigm

As a result of fifty years of in-depth analysis, which started with the (re)introduction of Hoarding in economic analysis, the writer has designed a set of tools that allow us to look inside the black box. Professor Franco Modigliani, a Nobel laureate in economics at MIT, and Professor M. L. Burstein, among many other experts in a variety of disciplines, have assisted this research, respectively for 27 and 23 years.

Inside the black box, one finds, not an economic theory but the operations of the Economic Process.

Illustration 2. Franco Modigliani (1918-2003) Wikipedia, www.nobelprize.org/.

Modigliani was awarded the 1985 Nobel prize in Economics

for his pioneering analyses of saving and of financial markets.

The Economic Process

As pointed out in a book4, which is now in its third edition, and in numerous papers published in peer-reviewed (albeit rather obscure) journals5, the central understanding of the Economic Process results from the integration of the Production of real goods and services, the Distribution of ownership rights over real and monetary wealth, and Consumption or expenditure of monetary wealth to acquire real wealth. Even in the sale of a car, we have these three items: car, money, and deed of ownership. This is true theory: It is an accurate description of facts.

Logically, these elements are tied together in a relation of equivalence:

Production ↔ Distribution ↔ Consumption

Production, Distribution, and Consumption are not single words. They are concepts. They form processes of their own. Their integration can be seen at a glance in the following figure—and its mirror image that represents economic policy:

Figure 3 catches the economic process at the moment of the exchange. It indicates that a cycle of the economic process is completed when the entire production of the period is sold. Then an exchange has occurred between money and goods. For the exchange to take place, both the producer and the buyer, in an ordered society, must be legal owners of the wealth they exchange.

Figure 3 catches the economic process at the moment of the exchange. It indicates that a cycle of the economic process is completed when the entire production of the period is sold. Then an exchange has occurred between money and goods. For the exchange to take place, both the producer and the buyer, in an ordered society, must be legal owners of the wealth they exchange.

Placing Figure 4 next to Figure 3, we realize that this construction of the economic process is nothing new! It is simply a return to the millenarian concern with economic justice, which from Aristotle to the present has been understood as composed of “distributive” justice and “commutative” justice. Concordian economics allows us to put the capstone on this construction: “Participative” justice. The economic process is nothing but the mirror image of the complete description of three essential principles of economic justice.

- Participative Justice offers a one-to-one correspondence with the production process;

- Distributive Justice is a one-to-one correspondence with the process of distribution of ownership rights over real and monetary wealth;

- Commutative Justice gives us a one-to-one correspondence with the consumption process or the process of expenditure of monetary wealth to acquire real wealth.

Economic justice keeps the economic process in equilibrium to the benefit of all. Economic injustice keeps the market in disequilibrium to the detriment of all. Short-term benefits to the few from injustice are ephemeral. An overview of long-term trends makes these relationships quite clear.

A Geometric Representation of Economic Dynamics

Starting from an equilibrium condition at time zero, the geometric representation of economic dynamics of Production, Distribution, and Consumption. These are here represented respectively as values of real wealth (RW), values of distribution of ownership (DO) rights, and values of monetary wealth (MW)—is as follows:

This figure suggests that, since they are relatively easier to create, the rate of growth of assets composing monetary wealth (MW) is faster than the rate of growth of assets composing the category of real wealth (RW). And then there is the problem of the accelerating pace of concentration of the distribution of ownership (DO) rights into a few hands. This phenomenon, first cut, is here assumed to be constant. Clearly, when monetary wealth is concentrated in a few hands, not enough money will be available to the majority of the population. The necessary equilibrium conditions implied in the P ↔ D ↔ C equivalence for the economic process as a whole, as represented in Figure 3, is broken. The process will not proceed forward organically.

Indeed, a bubble is created. The economic bubble is clearly visible in Figure 5: A bubble is a separation of monetary wealth from real wealth and is measured by the area between MW and RW. As pointed out elsewhere, in Concordian economics these values are kept separate and distinct from each other. We define them respectively as p-values (for values of the real economy), c-values (for values of the monetary economy), and d-values (for values of the legal economy, ie values of ownership rights).

How can equilibrium be restored?

Let us Look at Market Governance—Again

Following the dynamics implicit in Figure 5, it is possible to see how the Market might not always be ruled by a benign invisible hand. On occasion, the Market, left to the natural inclinations of ordinary human beings, is governed by another dictum by Adam Smith that is also in the Wealth of Nations. This is a less famous observation, but more pertinent to our situation today:

“All for ourselves and nothing for other people, seems, in every age of the world, to have been the vile maxim of the masters of mankind.”

If we are not misled by reductionist thinking of minds accustomed to analyzing linear trends only, we discover not one but four horses of inequality wandering all over the lot and leaving behind, instead of simple geometric patterns, a filigree of incredibly subtle interrelationships.

Four Horses of Inequality

Four horses of inequality raise their demanding heads as soon as one looks into the component elements of the Production Process. To produce anything, in a modern economy, one needs control over:

- Land and natural resources;

- Tools in the form of physical capital as in plants and equipment;

- Money in the form of financial capital; and,

- Labor in its variegated manifestations of manual labor, intellectual labor, and (spiritual?) labor as in entrepreneurial leadership.

These are the modern factors of production. It is only natural that human beings should attempt to get as much control as they can over each one of these factors. Inequality ensues.

Control over the factors of production has never been and never will be distributed equally among all human beings. That is a false, misleading, and dangerous ideal.

Within limits, inequality is natural. No two snowflakes are alike. Human beings, as well as specific plots of land, are endowed by our Creator with different measures of qualities and quantities. It is natural that we are going to get unequal results.

What we need, and what the world stands for, is equality of opportunity.

Rights vs. Privileges

Access to the factors of production today is acquired as a privilege and naturally leads to unbridled inequality. The four horses of inequality are these four unbridled privileges:

- Privileged access to land and natural resources;

- Privileged access to money;

- Privileged access to the labor of others;

- Privileged access to the wealth of others.

Each one of these privileges—historically rooted mostly in plunder and conquest—has to be turned into a universal right for everyone, if we want to build a just and ordered society. We can then forget the past, and concentrate on the present and the future.

The opportunity is ours. We only need to realize that, while privileges divide, rights unite. Rights unite because they are born out of the exercise of corresponding responsibilities.

Four Economic Rights and Responsibilities

No other economic rights or responsibilities seem to be essential. The consistent assumption of these four responsibilities is all that can and ought to be ingrained into government policies—at various levels. These four policies, gradually pursued, will yield all the certainty and economic security that we need, because they foster structural changes that create conditions of economic freedom and justice for all. As an unearned consequence, the need for Hoarding will almost be rooted out of existence. A fringe of misers will always be with us. But when the majority of the population does not copy the miser, the damage will be minuscule.

Who Are the Opponents?

Who are the powerful people who would object to this program of action? Four presumed antagonists are supposed to be:

- Landowners who do not want to pay their fair share of taxes on the value of their land;

- Central bankers who do not want to serve the public interest;

- Entrepreneurs who do not want to offer full compensation for services received; and

- Business people who want to gobble up the fruit of other people’s effort.

Where are they? Apart from their minuscule apparitions, when measured against the billions of entrepreneurs who behave morally, they are four phantoms—but more dangerous for being ingrained in the imagination of people who, blinded by their institutional power, see neither economics nor morality clearly. READ: tax assessors, politicians, and academicians who, unable to speak truth to power, make themselves powerless and paralyze entire nations.

Illustration 3. Henry George (1839-1897) Wikipedia, Public Domain.

George promoted the belief that people should own the value

they produce themselves, but that the economic value of land

(including natural resources) should belong equally to all members of society.

Serving Four Masters

You might think that this writer is a lone ranger roaming these vast expanses of economic territory—all alone. Nothing could be farther from the truth. He has consistently been serving four Masters of Economics. Four great American Masters of Economics. Forget Keynes… Forget Hayek.

For the control of land and natural resources, we all ought to be devoted servants of Henry George. By the way, mirabile dictu, do you know that not one but eight Nobel laureates in economics endorsed Henry George’s prescription to tax the value of the land….…while reducing taxes on buildings and, eventually, income?

Illustration 4. Benjamin Franklin (1706-1790) Wikipedia Public Domain.

Franklin is arguably the preeminent authority on paper money in

America (state letters of credit) in the 18th century. See here.

For the control of money, with its relevant inscription into Article 1, Section 8 of the US Constitution, we all ought to be devoted servants of Benjamin Franklin.

For the control over the fruits of one’s labor, we all ought to be devoted servants of Louis O. Kelso.

Illustration 5. Louis O. Kelso (1913-1991) Intercentar.

Kelso is the inventor and pioneer of the employee stock ownership plan (ESOP).

For the control over such basic industrial tools as the corporations (physical capital), we all ought to be devoted servants of Louis D. Brandeis. The writer actually did his dissertation at the University of Naples on the political thought of Louis D. Brandeis; this work was awarded a Council of Europe Scholarship; and he entered the academic awards wind tunnel, in which he even caught a Fulbright Scholarship.

Illustration 6. Louis Brandeis (1856-1941) Wikipedia, Public Domain.

Brandeis’ book entitled Other People’s Money and How the Bankers Use It,

suggested ways of curbing the power of large banks and money trusts.

He fought against powerful corporations, monopolies, public corruption,

and mass consumerism, all of which he felt were detrimental to American

values and culture. He served as Associate Justice of the Supreme Court

of the United States from 1916-1939.

Conclusion

This is not “my” vision, says the writer. He does not claim originality. This is the vision that unfolds mathematically by inserting Hoarding, the core of the Parable of the Talents, into the structure of economic theory.

Once the root source of Concordian economics became clear to this writer in 2006 (!), analyzing what else Jesus, Moses, and St. Thomas Aquinas thought about economics became an intellectual necessity.6 That is a train of thought, explored mainly on the pages of Mother Pelican, that has led to the conclusion that there is no such thing as religion without economics and ultimately to a book titled The Centrality of the Resurrection. Thus Concordian economics is on the cusp of some serious cultural developments.

Confucius and Orwell might say that perhaps the most important long-term contribution of Concordian economics is to bring the language of economics in line with the language of common mortals. Stated more directly, Concordian economics adds clarity and reduces the possibilities of corruption in the daily interface between economics, politics, and culture.

True, the econometrics of Concordian economics are still missing. They will come as soon as official data are collected in accordance with the specific categories of thought of the new paradigm. For the time being, this lacuna is not too worrisome. Apart from overwhelming factual evidence about the dangerousness of decisions taken on the basis of econometric models, thanks to Philip Pilkington, the readers of Econintersect have been recently reminded that neither Keynes nor Hicks placed much trust in current mainstream econometrics.7

Perhaps, this is a worthwhile resolution to make. Let us abandon the dangerous misconceptions of mainstream economics. Let us wholeheartedly plunge into the new/old world of Concordian economics.

Notes

1. Carmine Gorga, 2014. “Economics of Morality” at www.researchgate.net/publication/267569298_Economics_of_Morality.

2. John Maynard Keynes, 1936. The General Theory of Employment, Interest, and Money. NY: Harcourt, p. 36.

3. On p. 328, Keynes (op. cit) says: A “view” that considers that saving is not equal to investment is “more usually supported by arguments which have no foundation at all apart from confusion of mind.” This I took to be not a scientific explanation, but a dogma.

4. Carmine Gorga, 2002. The economic process: An instantaneous non-Newtonian Picture. Lanham, Md., and Oxford: University Press of America. Third expanded paperback edition 2016. For reviews, see http://www.carmine-gorga.us/id18.htm.

5. See, esp. Carmine Gorga, 2009. “Concordian Economics: Tools to Return Relevance to Economics.” Forum for Social Economics, vol. 38, issue 1, pages 53-69.

6. The economic profession is waking up to the need to analyze many aspects of the relationship between economics and religion. See, Shiya Iyer, “The New Economics of Religion.” Journal of Economic Literature 2016, 54(2), 395-441. Yet, because of ideology and political correctness perhaps, the analysis of the economic content of religions is still missing from academic investigations. 7. See, e.g., Daniel W. Drezner, “The state of macroeconomics is not good.” The Washington Post, September 15, 2016.

7. Philip Pilkington, “John Hicks’ Book on Non-Ergodicity: A Forgotten Post-Keynesian Classic”, Global Economic Intersection, December 30, 2016