Summary Of the Markets Today:

- The Dow closed up 133 points or 0.40%,

- Nasdaq closed up 0.69%,

- S&P 500 up 0.75%,

- WTI crude oil settled at $73 down $3.88,

- USD $104.29 down $0.23,

- Gold $1859 up $13.00,

- Bitcoin $16,798 up 0. 85% – Session Low 16,649,

- 10-year U.S. Treasury 3.683% down 0.111 points

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

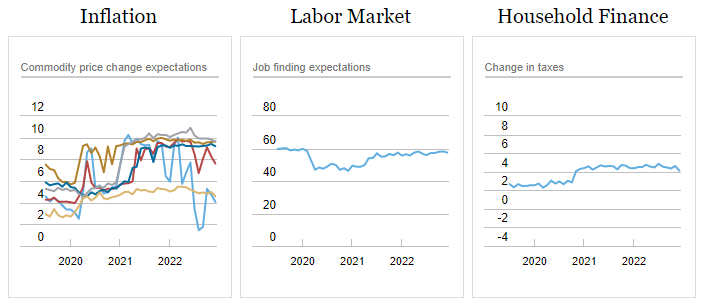

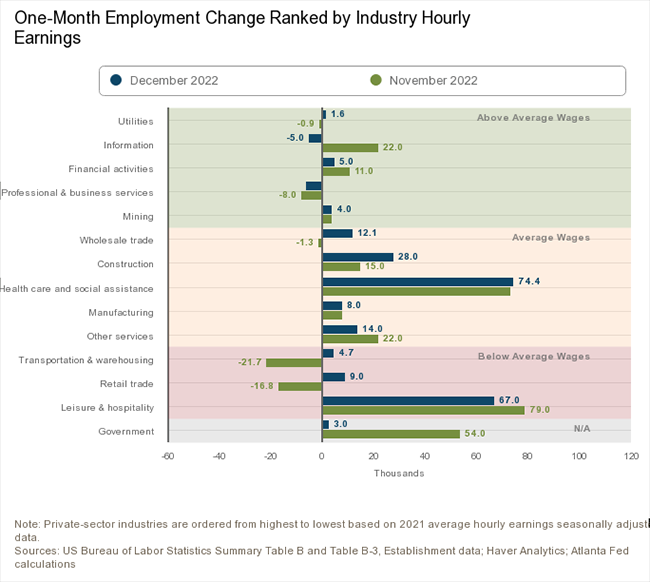

The number of job openings was little changed at 10.5 million on the last business day of November. Over the month, the number of hires and total separations changed little at 6.1 million and 5.9 million, respectively. Historically, hires and separations do not provide clues of the future of the economy or employment. On the other hand, job openings can, and the below graph demonstrates how year-over-year negative growth affects employment and forewarns of a recession,

Are you wondering whether deflation is in the cards? A recent post by Elliott Wave International discussing this subject offers insight stating: “Inflation is an increase in the total amount of money and credit, and deflation is a decrease in the total amount of money and credit.” The money supply is currently shrinking.

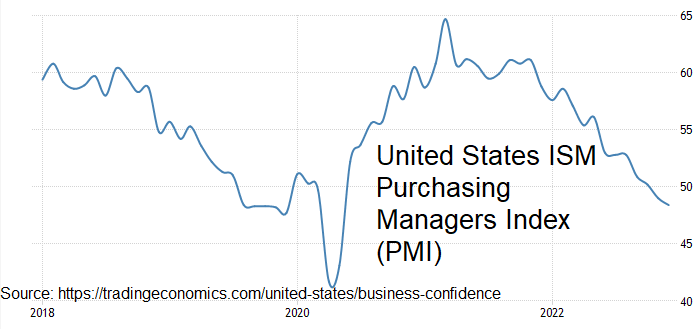

The December 2022 Manufacturing PMI registered 48.4%, 0.6 percentage points lower than the 49.0% recorded in November. Regarding the overall economy, this figure indicates contraction after 30 straight months of expansion. The Manufacturing PMI figure is the lowest since May 2020, when it registered 43.5%.

The Federal Reserve FOMC minutes for their meeting held on December 13–14, 2022 were released today. Highlights:

…. participants noted that recent indicators pointed to modest growth of spending and production. Nonetheless, job gains had been robust in recent months, and the unemployment rate had remained low. Inflation remained elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures …

… With inflation remaining unacceptably high, participants expected that a sustained period of below-trend real GDP growth would be needed to bring aggregate supply and aggregate demand into better balance and thereby reduce inflationary pressures. … [editor’s note: anyone thinking the fed’s tightening policies will be relaxed in 2023 may be disappointed]

… participants noted that growth in consumer spending in September and October had been stronger than they had previously expected, likely supported by a strong labor market and households running down excess savings accumulated during the pandemic. A couple of participants remarked that excess savings likely would continue to support consumption spending for a while. A couple of other participants, however, commented that excess savings, particularly among low-income households, appeared to be lower and declining more rapidly than previously thought or that the savings, the majority of which appeared to be held by higher-income households, might continue to be largely unspent …

… With inflation still well above the Committee’s longer-run goal of 2 percent, participants agreed that inflation was unacceptably high. Participants concurred that the inflation data received for October and November showed welcome reductions in the monthly pace of price increases, but they stressed that it would take substantially more evidence of progress to be confident that inflation was on a sustained downward path. Participants noted that core goods prices declined in the October and November CPI data, consistent with easing supply bottlenecks. Some participants also noted that, by some measures, firms’ markups were still elevated and that a continued subdued expansion in aggregate demand would likely be needed to reduce remaining upward pressure on inflation …

… A few participants remarked that the current configuration of nominal yields, with longer-term yields lower than shorter-term yields, had historically preceded recessions and hence bore watching. However, a couple of them also noted that the current inversion of the yield curve could reflect, in part, that investors expect the nominal policy rate to decline because of a fall in inflation over time …

… No participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023. Participants generally observed that a restrictive policy stance would need to be maintained until the incoming data provided confidence that inflation was on a sustained downward path to 2 percent, which was likely to take some time. In view of the persistent and unacceptably high level of inflation, several participants commented that historical experience cautioned against prematurely loosening monetary policy …

A summary of headlines we are reading today:

- Is China Overly Reliant On Middle Eastern Oil?

- U.S. Natural Gas Prices Rise 4% After Huge Selloff

- GM reclaims title as America’s top automaker after a 2.5% jump in sales last year

- Mortgage demand plunges 13.2% to end 2022, as interest rates head higher again

- Where to keep your cash amid high inflation and rising interest rates: It’s ‘a little tricky,’ says expert

- Ford says the F-Series pickup continued its decades-long dominance in 2022

- BofA’s stock indicator is the closest it’s been to ‘buy’ since 2017

- Futures Movers: Oil futures settle at a more than 3-week low on worries over the global growth outlook

- These and other headlines and news summaries moving the markets today are included below.