Summary Of the Markets Today:

- The Dow closed down 232 points or 0.71%,

- Nasdaq closed down 0.10%,

- S&P 500 closed down 0.3%,

- Gold $1835 up $9.80,

- WTI crude oil settled at $77 up $1.27,

- 10-year U.S. Treasury 3.924% up 0.002 points,

- USD $104.97 up $0.29,

- Bitcoin $23,215 – 24H Change down $101.08 – Session Low $23,223

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

The S&P CoreLogic Case-Shiller 20-City Composite posted a 4.6% year-over-year gain, down from 6.8% in the previous month. Miami, Tampa, and Atlanta reported the highest year-over-year gains among the 20 cities in December. Miami led the way with a 15.9% year-over-year price increase, followed by Tampa in second with a 13.9% increase, and Atlanta in third with a 10.4% increase. All 20 cities reported lower prices in the year ending December 2022 versus the year ending November 2022. CoreLogic Chief Economist Selma Hepp added:

With a full year of data, S&P CoreLogic Case-Shiller Index once again proved that 2022 was incredibly volatile for the housing market. By all accounts, housing markets experienced historic highs and lows in a matter of months. In December, the CoreLogic S&P Case-Shiller Index posted a 5.8% year-over-year increase, marking the eighth straight month of decelerating annual home price gains and a 15-percentage point slower rate of growth than at the peak in May 2022. In contrast, December’s annual gain was the slowest since August 2020. Home prices are down 4.4% from spring peak to December, with four times larger declines in San Francisco and Seattle. New York, Cleveland, and Chicago are faring relatively better, with total declines at only 3% through December.

While the rapid reversal of price growth is evident across markets, West and Mountain West continue to lead with declines while some recently hot markets, such as Tampa, Florida, Dallas and San Diego, are rapidly catching up. Interestingly though, despite recent price declines, the national annual average growth of 15% for 2022 is still the second highest on record.

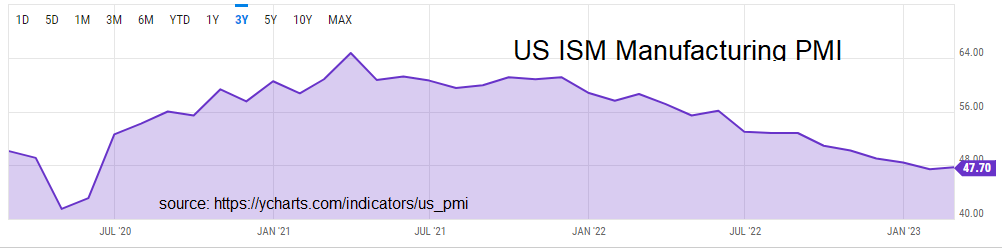

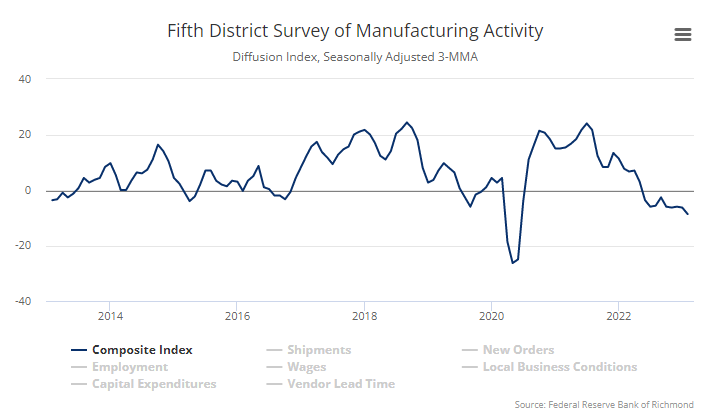

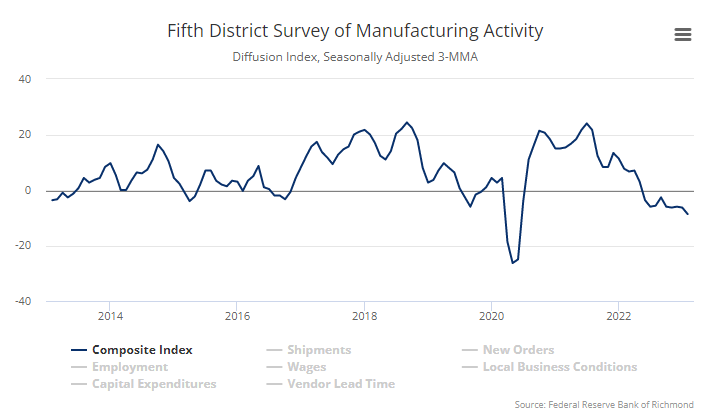

The Richmond Fed’s manufacturing firms reported a deterioration in business conditions in February, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index decreased from −11 in January to -16 in February. Of its three component indexes, shipments saw the largest change, declining notably from −3 in January to −15 in February. The employment index declined from −3 to −7 in February, while the new orders index remained unchanged at −24. Most other manufacturing surveys have shown declining manufacturing.

According to Challenger, Gray & Christmas, Inc., the number of CEO changes at U.S. companies rose 12% from 100 in December to 112 in January. January’s total is down 10% from the 125 CEOs who left their posts in the same month one year prior. January’s has the highest number of CEO exits on average than any other month.

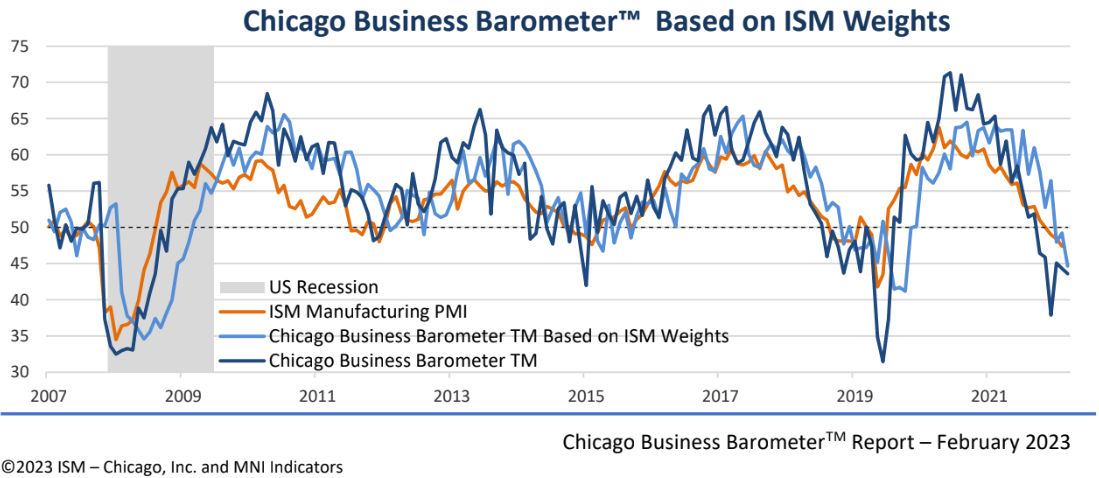

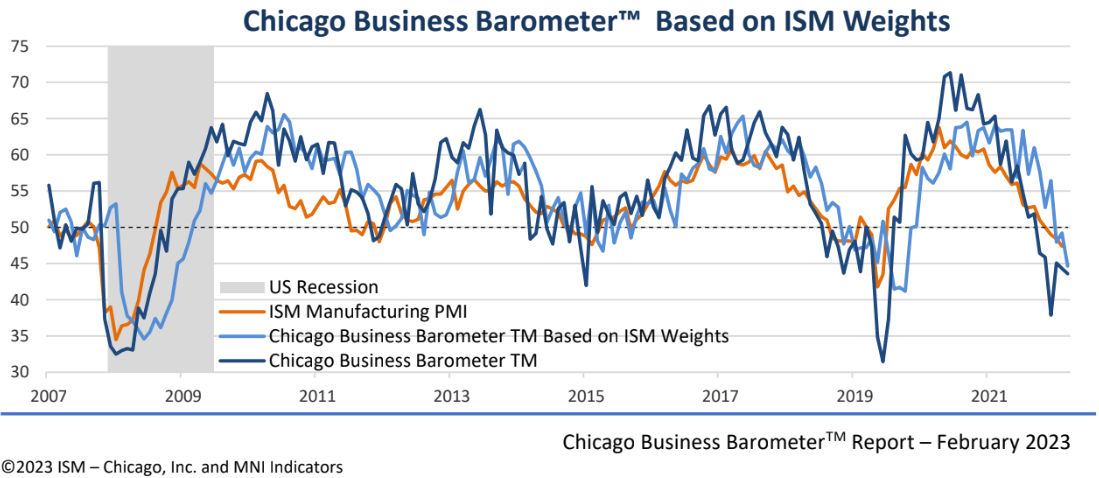

The Chicago Business Barometer declined by a further 0.7 points in February to 43.6, the lowest since November ’22. The headline index signaled a sixth consecutive month of contractionary business activity. The markets believe this index provides a good forecast for the national ISM Manufacturing PMI.

The Conference Board Consumer Confidence Index decreased in February for the second consecutive month. The Index now stands at 102.9 (1985=100), down from 106.0 in January (a downward revision). According to the authors of this index, the decrease reflected large drops in confidence for households aged 35 to 54 and for households earning $35,000 or more.

A summary of headlines we are reading today:

- Wind Power Accounted For 25% Of Texas’ Electricity Generation In 2022

- Russia’s Oil Exports Still Strong Despite Sanctions

- OPEC’s February Oil Production Jumped By 150,000 Bpd

- BP’s CEO Warns Of Oil And Gas Price Spikes If Energy Transition Is Rushed

- Dow closes more than 200 points lower Tuesday, major averages end February with losses: Live updates

- 10-year Treasury yield hits highest level since November

- Bitcoin, ether on track for a positive February despite mid-month drop and fading 2023 risk rally

- Newsom’s Plan To Cap Oil Profits In California Faces Bipartisan Skepticism

- The Margin: Elon Musk may create ChatGPT rival, new report says

- Market Extra: 10-year Treasury yield knocks on door of 4% as threats to markets and economy grow

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.