Summary Of the Markets Today:

- The Dow closed down 232 points or 0.71%,

- Nasdaq closed down 0.10%,

- S&P 500 closed down 0.3%,

- Gold $1835 up $9.80,

- WTI crude oil settled at $77 up $1.27,

- 10-year U.S. Treasury 3.924% up 0.002 points,

- USD $104.97 up $0.29,

- Bitcoin $23,215 – 24H Change down $101.08 – Session Low $23,223

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

The S&P CoreLogic Case-Shiller 20-City Composite posted a 4.6% year-over-year gain, down from 6.8% in the previous month. Miami, Tampa, and Atlanta reported the highest year-over-year gains among the 20 cities in December. Miami led the way with a 15.9% year-over-year price increase, followed by Tampa in second with a 13.9% increase, and Atlanta in third with a 10.4% increase. All 20 cities reported lower prices in the year ending December 2022 versus the year ending November 2022. CoreLogic Chief Economist Selma Hepp added:

With a full year of data, S&P CoreLogic Case-Shiller Index once again proved that 2022 was incredibly volatile for the housing market. By all accounts, housing markets experienced historic highs and lows in a matter of months. In December, the CoreLogic S&P Case-Shiller Index posted a 5.8% year-over-year increase, marking the eighth straight month of decelerating annual home price gains and a 15-percentage point slower rate of growth than at the peak in May 2022. In contrast, December’s annual gain was the slowest since August 2020. Home prices are down 4.4% from spring peak to December, with four times larger declines in San Francisco and Seattle. New York, Cleveland, and Chicago are faring relatively better, with total declines at only 3% through December.

While the rapid reversal of price growth is evident across markets, West and Mountain West continue to lead with declines while some recently hot markets, such as Tampa, Florida, Dallas and San Diego, are rapidly catching up. Interestingly though, despite recent price declines, the national annual average growth of 15% for 2022 is still the second highest on record.

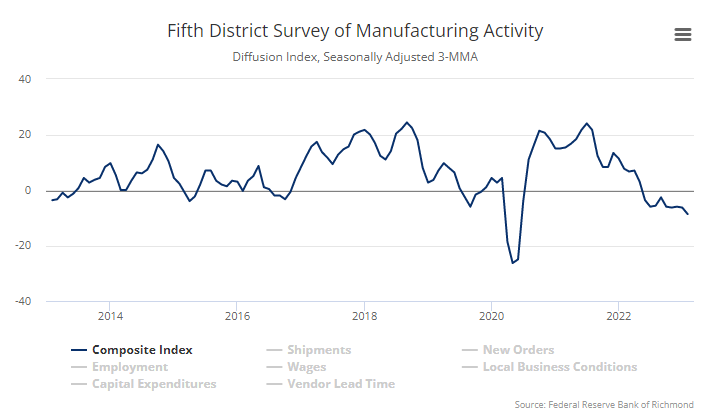

The Richmond Fed’s manufacturing firms reported a deterioration in business conditions in February, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index decreased from −11 in January to -16 in February. Of its three component indexes, shipments saw the largest change, declining notably from −3 in January to −15 in February. The employment index declined from −3 to −7 in February, while the new orders index remained unchanged at −24. Most other manufacturing surveys have shown declining manufacturing.

According to Challenger, Gray & Christmas, Inc., the number of CEO changes at U.S. companies rose 12% from 100 in December to 112 in January. January’s total is down 10% from the 125 CEOs who left their posts in the same month one year prior. January’s has the highest number of CEO exits on average than any other month.

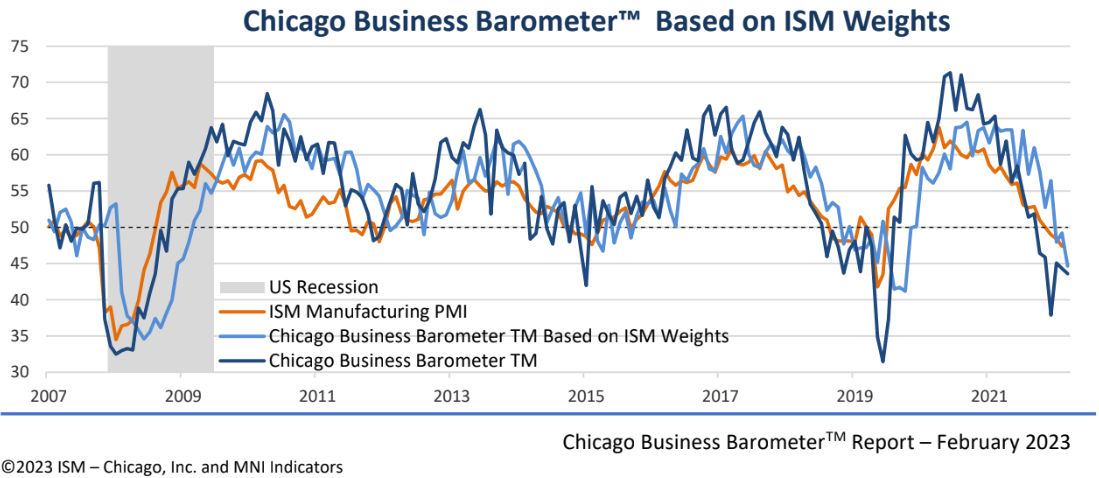

The Chicago Business Barometer declined by a further 0.7 points in February to 43.6, the lowest since November ’22. The headline index signaled a sixth consecutive month of contractionary business activity. The markets believe this index provides a good forecast for the national ISM Manufacturing PMI.

The Conference Board Consumer Confidence Index decreased in February for the second consecutive month. The Index now stands at 102.9 (1985=100), down from 106.0 in January (a downward revision). According to the authors of this index, the decrease reflected large drops in confidence for households aged 35 to 54 and for households earning $35,000 or more.

A summary of headlines we are reading today:

- Wind Power Accounted For 25% Of Texas’ Electricity Generation In 2022

- Russia’s Oil Exports Still Strong Despite Sanctions

- OPEC’s February Oil Production Jumped By 150,000 Bpd

- BP’s CEO Warns Of Oil And Gas Price Spikes If Energy Transition Is Rushed

- Dow closes more than 200 points lower Tuesday, major averages end February with losses: Live updates

- 10-year Treasury yield hits highest level since November

- Bitcoin, ether on track for a positive February despite mid-month drop and fading 2023 risk rally

- Newsom’s Plan To Cap Oil Profits In California Faces Bipartisan Skepticism

- The Margin: Elon Musk may create ChatGPT rival, new report says

- Market Extra: 10-year Treasury yield knocks on door of 4% as threats to markets and economy grow

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Red States Benefit Most From Biden’s Inflation Reduction ActRepublicans are not exactly known to embrace renewable energy, with GOP elected officials and fossil fuel supporters frequently criticizing the clean energy drive. Not a single Republican voted to support the historic Inflation Reduction Act (IRA) when it was passed in August, while Iowa Republican Sen. Joni Ernst last year lambasted “the Democrats’ push towards renewables,” claiming that “‘Biden blackouts’ will make it impossible to run even fans and air conditioners on the hottest days of the summer”. It, therefore, comes… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/Red-States-Benefit-Most-From-Bidens-Inflation-Reduction-Act.html |

|

Wind Power Accounted For 25% Of Texas’ Electricity Generation In 2022Texas has long been known for its oil and gas industry, but in recent years, it has become a leader in renewable energy, particularly wind power. According to ERCOT, wind energy accounted 25% of the state’s electricity generation in 2022. The Growth of Wind Power in Texas The growth of wind power in Texas can be attributed to several factors. First and foremost is the state’s abundant wind resources. Texas has some of the strongest and most consistent winds in the country, particularly along its western and southern coasts.… Read more at: https://oilprice.com/Alternative-Energy/Wind-Power/Wind-Power-Accounted-For-25-Of-Texas-Electricity-Generation-In-2022.html |

|

How U.S. Shale Changed The Face Of Global PoliticsIn the early 2000s, a revolution was unfolding in the energy industry. Technological advancements in horizontal drilling and hydraulic fracturing had unlocked vast reserves of oil and natural gas trapped in shale rock formations deep beneath the earth’s surface. The U.S. was sitting on top of one of the largest shale deposits in the world, known as the Permian Basin, which spans parts of Texas and New Mexico. As companies began to explore and drill in this region, they discovered that there were immense amounts of oil and gas waiting to be extracted.… Read more at: https://oilprice.com/Energy/Crude-Oil/How-US-Shale-Changed-The-Face-Of-Global-Politics.html |

|

Russia’s Oil Exports Still Strong Despite SanctionsRussia’s crude oil producers managed to export 7.32 million barrels per day of crude oil and crude oil products in February, Kpler data showed, indicating to some that the ban on Russian seaborne crude shipments into Europe and the price cap mechanism have done little to curb the flow of Russia’s crude. The 7.32 million barrels per day of crude oil exported from Russia in February is largely on par with that exported in December, shortly after the crude sanctions went into effect. But that comparison is based on a December that saw… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russias-Oil-Exports-Still-Strong-Despite-Sanctions.html |

|

The Ultimate Guide To Different Types Of Lithium BatteriesLithium batteries have become the go-to choice for many industries due to their high energy density, long lifespan, and low self-discharge rate. With so many different types of lithium batteries available on the market today, it can be challenging to determine which one is right for your specific needs. In this article, we’ll explore the various types of lithium batteries available and their unique features. Lithium-Ion (Li-ion) Batteries Lithium-ion batteries are one of the most common types of rechargeable batteries. They are widely used in portable… Read more at: https://oilprice.com/Metals/Commodities/The-Ultimate-Guide-To-Different-Types-Of-Lithium-Batteries.html |

|

Russian Oil And Gas Project Misses Output Targets After Exxon ExitRussian oil and gas output at the Sakhalin-1 project in the Far East is only half of what it was projected to be for 2022 after Russia’s invasion of Ukraine set off a series of Western sanctions that led to the departure of ExxonMobil. In a televised meeting with Russian President Vladimir Putin, Sakhalin governor Valery Limarenko said production was less than 50% of that planned, Reuters reported. “First, in May, oil production was practically stopped, and in September, it was gas production. We lost a large amount, more than half, of the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Russian-Oil-And-Gas-Project-Misses-Output-Targets-After-Exxon-Exit.html |

|

OPEC’s February Oil Production Jumped By 150,000 BpdOPEC’s crude oil production for February was, on average, 150,000 bpd more than it was in January, a Reuters survey found on Tuesday. OPEC’s February crude oil production rose to 28.97 million bpd, the survey said but is still 700,000 bpd less than it was in September. OPEC+–responsible for producing around 40% of the world’s crude oil– cut its oil production targets as demand took a tumble during the pandemic. The group slowly raised its production targets last year as demand increased but consistently failed to… Read more at: https://oilprice.com/Energy/Crude-Oil/OPECs-February-Oil-Production-Jumped-By-150000-Bpd.html |

|

Mexico’s Oil Major Has A Flaring ProblemMexico’s state-controlled oil and gas giant Pemex has continued gas flaring at a massive field despite a pledge to stop doing so by mid-January, according to satellite data researchers have analyzed exclusively for Reuters. In November, Pemex’s chief executive Octavio Romero said that the company would stop gas flaring at the Ixachi field by January 15, 2023, after it was fined for breaching its emission-control plan. Pemex has a poor environmental record and has regularly failed to reduce flaring as promised due to a lack of… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Mexicos-Oil-Major-Has-A-Flaring-Problem.html |

|

BP Boss Defends Oil And Gas SpendingBP boss Bernard Looney today called for an “orderly” transition to renewable energy, which will require investment in both future green energy projects and “today’s energy system, which is predominantly an oil and gas system.” “To be clear, orderly is not another word for slow. What it does mean is keeping affordable energy flowing, where and when it’s needed. Investing in the transition and investing in energy security,” Looney told a London conference today. The chief executive pointed to BP’s… Read more at: https://oilprice.com/Energy/Crude-Oil/BP-Boss-Defends-Oil-And-Gas-Spending.html |

|

Gazprom Neft: Russian Oil Output Cut Will Help Balance The MarketRussia’s decision to reduce its oil production by 500,000 barrels per day (bpd) in March will help balance the global oil market, which is in a surplus now, Alexander Dyukov, chief executive of Russian oil company Gazprom Neft, said on Tuesday. “Currently the market is in a surplus, so the Russian government’s decision to cut supply is aimed at rebalancing it,” Dyukov told reporters today, as carried by Russian news agency Interfax. Russian Deputy Prime Minister Alexander Novak said in early February that Russia,… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Gazprom-Neft-Russian-Oil-Output-Cut-Will-Help-Balance-The-Market.html |

|

Tesla’s New Germany Plant Is Firing On All CylindersIf Tesla’s new plant in Germany is any indication, not only is demand, not a problem, but the company is moving along efficiently and firing on all cylinders. The company’s new plant in Brandenburg has reportedly “reached an output of 4,000 cars per week”, according to Bloomberg this week. The milestone is three weeks ahead of planned schedule for the new production facility, according to a production plan Bloomberg reviewed. Volume from the new plant amounts to about a third of Tesla’s Model Y production in Shanghai. The company’s… Read more at: https://oilprice.com/Energy/Energy-General/Teslas-New-Germany-Plant-Is-Firing-On-All-Cylinders.html |

|

BP’s CEO Warns Of Oil And Gas Price Spikes If Energy Transition Is RushedThe energy transition needs to happen in an orderly fashion, BP’s chief executive Bernard Looney said on Tuesday, warning of renewed oil and gas price spikes if supply is cut too quickly without a drop in demand. “Reducing supply without also reducing demand inevitably leads to price spikes – price spikes, leads to economic volatility,” Looney said at the International Energy Week event in London today, weeks after BP scaled back its emissions targets and said it would produce more oil and gas for longer. In early February, Looney stressed… Read more at: https://oilprice.com/Latest-Energy-News/World-News/BPs-CEO-Warns-Of-Oil-And-Gas-Price-Spikes-If-Energy-Transition-Is-Rushed.html |

|

House Republicans Look To Block ESG Investing In Retirement PlansThe U.S. House, controlled by Republicans, is expected to vote on a bill on Tuesday that would void a recent Biden Administration rule to approve ESG investing in retirement plans. Last November, the U.S. Department of Labor announced a final rule that allows plan fiduciaries to consider climate change and other environmental, social, and governance factors when they select retirement investments and exercise shareholder rights, such as proxy voting. “Today’s rule clarifies that retirement plan fiduciaries can take into account the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/House-Republicans-Look-To-Block-ESG-Investing-In-Retirement-Plans.html |

|

Oil Prices Climb But Remain On Course For A Fourth Consecutive Monthly LossOil prices were up early on Tuesday morning, but both WTI and Brent remain on course for a fourth consecutive monthly loss, although there are some bullish catalysts looming in March. Investor Alert: This month’s Intelligent Investor will be landing in the inbox of Global Energy Alert subscribers this morning, make sure you’re one of them! This investment deep dive compares two of the oilfield services giants and the new tech that might make one of them a buy. Don’t miss out on this latest research, and try out our premium Global Energy Alert service… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Climb-But-Remain-On-Course-For-A-Fourth-Consecutive-Monthly-Loss.html |

|

Chevron Hikes Annual Share Buyback Target To $17.5 BillionChevron will raise its targeted annual share buyback rate to $17.5 billion, up from $15 billion, as it looks to grow shareholder distribution, the U.S. supermajor said on Tuesday. High-return production growth supports growing shareholder distributions, Chevron said at its annual investor meeting today. At $60 a barrel Brent price, the company expects its annual free cash flow to grow by more than 10%. It is raising its share buyback guidance range to $10 billion to $20 billion per year and will raise its targeted annual share buyback rate to $17.5… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Chevron-Hikes-Annual-Share-Buyback-Target-To-175-Billion.html |

|

Dow closes more than 200 points lower Tuesday, major averages end February with losses: Live updatesDespite a solid start to the year, the major indexes posted their second negative month in three. Read more at: https://www.cnbc.com/2023/02/27/stock-futures-live-update-open-to-close.html |

|

10-year Treasury yield hits highest level since NovemberU.S. Treasury yields rose Tuesday, adding to their sharp February gains, as traders weigh the prospects of higher tighter monetary policy for longer. Read more at: https://www.cnbc.com/2023/02/28/treasury-prices-fall-slightly-to-close-out-bumper-month-for-yields.html |

|

Supreme Court questions if Biden plan for student loan relief is legalPresident Joe Biden’s student loan debt relief plan would forgive up to $20,000 for borrowers. The Supreme Court could rule on the legality of it this summer. Read more at: https://www.cnbc.com/2023/02/28/biden-student-loan-case-argued-at-supreme-court.html |

|

Target leans into ‘affordable joy’ and its cheap chic reputation as sales slowTarget is investing money in new services and brands that it hopes will convince more budget-conscious customers to spend. Read more at: https://www.cnbc.com/2023/02/28/target-affordable-joy-cheap-chic-sales-slow.html |

|

These stocks won February — but it may be time to dump 2 popular tech playsA pair of major tech names may now be overbought and aren’t expected to perform like they did in February. Read more at: https://www.cnbc.com/2023/02/28/these-stocks-won-february-but-it-may-be-time-to-dump-2-popular-tech-plays.html |

|

Bitcoin, ether on track for a positive February despite mid-month drop and fading 2023 risk rallyBitcoin and ether are on pace for a modest February win, even after suffering a big drop earlier in the month. Read more at: https://www.cnbc.com/2023/02/28/bitcoin-ether-on-track-for-a-positive-february-despite-fading-2023-risk-rally.html |

|

UAW leadership faces historic upheaval ahead of union negotiations with Detroit automakersThe leadership shuffle follow a yearslong federal investigation that uncovered systemic corruption involving bribery and embezzlement by top UAW leaders. Read more at: https://www.cnbc.com/2023/02/28/uaw-presidential-runoff.html |

|

Ukraine war live updates: Zelenskyy speaks to ICC prosecutor about possible war crimes; Putin tells spy agency to step up activityUkraine President Volodymyr Zelenskyy acknowledged Monday that the situation is deteriorating in and around Bakhmut, a besieged mining city in Donetsk. Read more at: https://www.cnbc.com/2023/02/28/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

Biden taps CEOs of 3M, CVS, FedEx, Citi, others to join his Export Council on tradeThe 25-member board includes Dana Walden, co-chairman of Disney Entertainment, Jane Fraser, Citigroup CEO, and Michael F. Roman, chairman and CEO of 3M. Read more at: https://www.cnbc.com/2023/02/28/biden-taps-ceos-of-3m-cvs-fedex-citi-others-to-join-his-export-council-on-trade.html |

|

FTX ex-engineering chief Nishad Singh pleads guilty to criminal chargesFTX’s former engineering head Nishad Singh pleaded guilty to criminal charges in New York on Tuesday Read more at: https://www.cnbc.com/2023/02/28/ftx-ex-engineering-head-nishad-singh-pleads-guilty-to-criminal-charges.html |

|

You don’t have to put down 20% on a home—here’s when a smaller down payment makes senseA report from the National Association of Realtors found that the median down payment on a house in 2022 was a lot less than 20%. Read more at: https://www.cnbc.com/select/when-make-smaller-down-payment/ |

|

Home price gains weakened sharply to end 2022, according to S&P Case-ShillerHigher mortgage rates weighed on home price gains in December. Read more at: https://www.cnbc.com/2023/02/28/home-prices-weakened-sharply-december.html |

|

These ‘fortress’ stocks are beating the market this year as a perilous March loomsMany investors expect the stock market will take a bearish turn in March, but certain “fortress” stocks can allow investors to beat the market. Read more at: https://www.cnbc.com/2023/02/28/fortress-stocks-beating-the-market-this-year-for-a-perilous-march.html |

|

Airpods Maker Races To Divest From China As Clients Push For India ExpansionRising geopolitical tensions and Covid uncertainty has forced Apple to reevaluate its manufacturing supply chain of iPhones, AirPods, HomePods, and MacBooks in China. Momentum has been building behind the scenes as Apple suppliers shift production capacity out of the country to friendlier shores in Southeast Asia. Apple suppliers rarely comment on supply chain shifts due to secrecy, but a new report via Bloomberg reveals AirPods maker GoerTek Inc.’s view of the shifting world and how it plans to diversify out of China. GoerTek is one of Apple’s many suppliers and is exploring new production facilities outside China. The company assembles AirPods and other consumer electronic products, such as drones, speakers, Bluetooth products, 3D electronic glasses, and LED series products.

GoerTek Deputy Chairman Kazuyoshi Yoshinaga told Bloomberg the company is investing $280 million in a new production facili … Read more at: https://www.zerohedge.com/geopolitical/airpods-maker-races-divest-china-clients-push-india-expansion |

|

Newsom’s Plan To Cap Oil Profits In California Faces Bipartisan SkepticismAuthored by Jill McLaughlin via The Epoch Times, Californians might have to choose between higher gas prices or scaling back its climate agenda, state regulators told legislators last week at a special state Senate hearing on a proposed oil industry windfall profits penalty.

Gov. Gavin Newsom called the special session of the Legislature Feb. 22 to consider imposing penalties on oil companies to restrict them from making excessive profits in the state. During the hearing, state regulators were not able to explain why gas prices spiked last year, which caused some residents to pay up to $8 a gallon, but said the state’s environmental laws contributed to the high prices.

|

|

SPAC Mania Ends In Bankruptcies And Fire SalesSPAC Mania Ends In Bankruptcies And Fire SalesThe Securities and Exchange Commission’s crackdown on SPACs, top investment banks scaling back activity in the space, and mounting macroeconomic headwinds have led to a continued freeze and the start of a possible de-SPAC bankruptcy wave. The latest figures about the SPAC market collapse come from a recent note via Water Tower Research’s chief analyst Robert Sassoon, who told clients, “depleted SPAC trust funds, along with reduced availability of PIPE financing, have left many de-SPACs underfunded.”

“Coincident with prevailing economic headwinds, many de-SPACs are facing financial challenges that have forced some into bankruptcy,” Sassoon wrote. He continued:

|

|

Cruz: “Abominable” Fauci Has “Hurt Millions Of Kids”Authored by Steve Watson via Summit News, Senator Ted Cruz blasted Anthony Fauci in a fresh interview Monday as new documents came to light highlighting yet another U.S. government agency’s belief that the coronavirus pandemic was caused by a lab leak.

“Dr. Fauci’s behavior on this has been abominable,” Cruz said in an appearance on Fox Business. “I think he has done more damage than any bureaucrat in the history of the United States,” Cruz continued, adding “He has championed policies that have hurt millions of Americans, hurt millions of school kids in particular.” “And he has also done more to damage the credibility of the United States government when it comes to medical and scientific advice because Dr. Fauci allowed his advice to be … Read more at: https://www.zerohedge.com/political/cruz-abominable-fauci-has-hurt-millions-kids |

|

Brexit deal: Sausage, plant and potato firms welcome new frameworkSausage producer Heck, garden centre Hillmount and Wilson’s Country potato growers express their “delight”. Read more at: https://www.bbc.co.uk/news/business-64785114?at_medium=RSS&at_campaign=KARANGA |

|

Sainsbury’s to axe Argos depots with 1,400 jobs hitThe supermarket giant plans to shut two of the Argos sites over the next three years. Read more at: https://www.bbc.co.uk/news/business-64802615?at_medium=RSS&at_campaign=KARANGA |

|

Grant Shapps ‘sympathetic’ to scrapping energy bill riseEnergy secretary claims he and the chancellor are looking “very carefully” at April’s £500 increase. Read more at: https://www.bbc.co.uk/news/business-64797779?at_medium=RSS&at_campaign=KARANGA |

|

Nikki Haley bashes Pakistan; reiterates US won’t be world’s “ATM” if she voted to power“I will cut every cent in foreign aid for countries that hate us. A strong America doesn’t pay off the bad guys. A proud America doesn’t waste our people’s hard-earned money. And the only leaders who deserve our trust are those who stand up to our enemies and stand beside our friends,” the 51-year-old two-term Governor of South Carolina, who earlier this month formally launched her 2024 presidential bid, wrote in an op-ed in the New York Post. Read more at: https://economictimes.indiatimes.com/news/international/world-news/nikki-haley-bashes-pakistan-reiterates-us-wont-be-worlds-atm-if-she-voted-to-power/articleshow/98314775.cms |

|

Gainers and Losers: Adani Ent, Adani Ports among 6 stocks that made headlines todayTracking weak global sentiments, Indian equity indices continued their losing streak for the 8th consecutive session on Tuesday. Nifty ended at 17,303, down 89 points or 0.51%, while Sensex fell 326 points or 0.55% to end at 58,962. Read more at: https://economictimes.indiatimes.com/markets/web-stories/gainers-and-losers-adani-ent-adani-ports-among-6-stocks-that-made-headlines-today/articleshow/98305593.cms |

|

US stocks open lower as Treasury yields riseFive of the 11 major S&P 500 sectors were lower on Tuesday, with defensive utilities and consumer staples leading losses. Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-stocks-open-lower-as-treasury-yields-rise/articleshow/98311444.cms |

|

The Margin: Fan-favorite Girl Scout cookies harder to get this year. Blame the supply chain.Some troops say there are limited supplies of the popular Samoas cookie along with other varieties. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71A5-80A10C866F38%7D&siteid=rss&rss=1 |

|

The Margin: Elon Musk may create ChatGPT rival, new report saysMusk co-founded ChatGPT’s creator OpenAI in 2015, but left the company in 2018 over a ‘potential future conflict’ as CEO of Tesla. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71A5-D0372393C81D%7D&siteid=rss&rss=1 |

|

Market Extra: 10-year Treasury yield knocks on door of 4% as threats to markets and economy growThe benchmark 10-year Treasury yield briefly approached 4% on Tuesday, a milestone level at which it hasn’t sustainably held above for more than a decade. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71A5-AACCC1C0F80B%7D&siteid=rss&rss=1 |