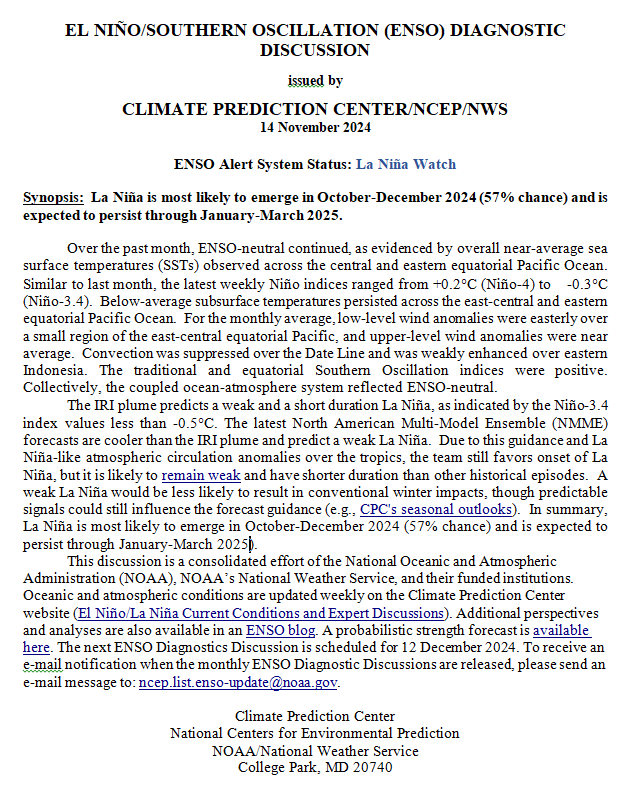

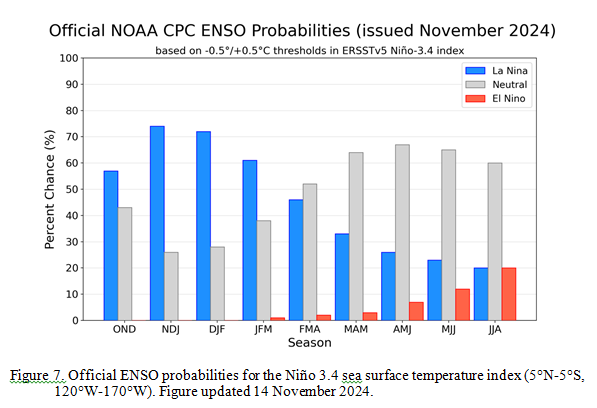

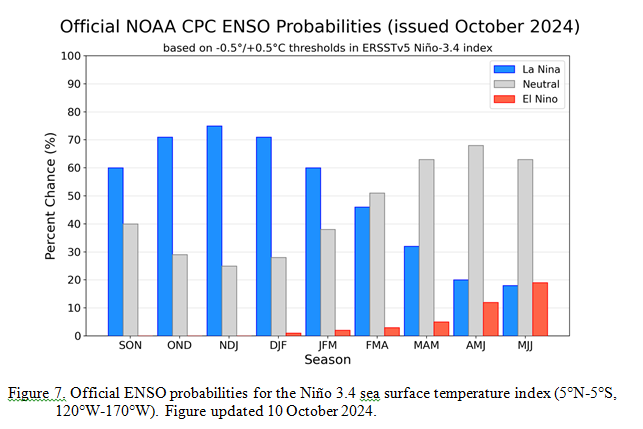

Weather Outlook for the U.S. for Today Through at Least 22 Days and a Six-Day Forecast for the World: posted November 18, 2024

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and a six-day World weather outlook which can be very useful for travelers.

First the NWS Short Range Forecast. The afternoon NWS text update can be found here after about 4 p.m. New York time but it is unlikely to have changed very much from the morning update. The images in this article automatically update.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Mon Nov 18 2024

Valid 12Z Mon Nov 18 2024 – 12Z Wed Nov 20 2024…A potent storm system over the central U.S. today will create chances

for heavy rainfall, severe thunderstorms, and gusty winds, while moderate

snowfall is possible across the northern Plains by Tuesday……Heavy rain and flash flooding potential exists throughout the central

and eastern Gulf Coast over the next few days……Powerful Pacific low pressure system to impact the Northwest with high

winds and heavy mountain snow, while an atmospheric river takes aim at

northern California by Wednesday…An amplified weather pattern and two separate strong storm systems are set

to impact the Nation during the first half of this week. First, a deep low

pressure system ejecting out of West Texas early this morning is

anticipated to further organize over the central U.S. today and produce

areas of heavy rain, severe weather, and gusty winds to the

southern/central Plains. Thunderstorms forming along an attached cold

front may contain damaging winds and perhaps a few tornadoes between

central Oklahoma and North Texas today. This region is where the Storm

Prediction Center has hoisted a Slight Risk (level 2/5) of severe

thunderstorms. As the system progresses northward into the Upper Midwest

on Tuesday, showers are also forecast to spread north throughout parts of

the Midwest and Great Lakes. Meanwhile, cold air working into the western

side of the storm will likely allow for precipitation to fall as snow

across parts of North Dakota and northern Minnesota into Wednesday.

Snowfall may also be accompanied by gusty winds, leading to lower

visibility on roadways. Current snowfall probabilities for at least 4

inches of snow are greatest (70-90%) across north-central North Dakota.As the associated cold front pushes eastward through Tuesday, numerous

showers and thunderstorms interacting with a surge of moisture being

lifted northward from the Gulf of Mexico could contain intense rainfall

rates capable of producing flash flooding. Heavy rainfall is most likely

tonight across eastern Louisiana and southern Mississippi, with the threat

expanding east to the Florida Panhandle on Tuesday. Scattered flash floods

are most likely throughout low-lying and urban regions. Residents and

visitors are reminded to have multiple ways to receive warnings and never

drive across flooded roadways.For much of the Northwest, northern Great Basin, and northern Rockies, a

cold front pushing across the region today and enhanced onshore flow will

allow for unsettled weather to continue ahead of a powerful storm system

forecast to develop off the coast of the Northwest on Tuesday. This

appetizer of precipitation to start the workweek will mainly include the

potential for moderate to heavy snowfall across the Cascades and northern

Rockies. However, by Tuesday night the rapidly strengthening Pacific low

pressure system will aid in producing high winds across the Pacific

Northwest and increasing precipitation intensity. Wind gusts up to 70 mph

are possible across parts of northern California and Oregon, with strong

winds also expected over parts of western Washington. These winds will

have the potential to knock down trees and produce power outages. Heavy

snowfall with amounts potentially exceeding two feet are possible over the

northern California ranges and Cascades. By Wednesday, an associated

atmospheric rive event is expected to take shape and direct continuous

Pacific moisture towards northern California and southwest Oregon.

Widespread rainfall amounts of 4 to 7 inches are expected through

Wednesday across this region, which could produce areas of river flooding

and increase the risk of mudslides. Heavy rain and the associated weather

hazards from this atmospheric river event are also expected to continue

beyond midweek.Below average temperatures are forecast to remain over much of the western

U.S. over the next few days while gradually spreading eastward into the

Great Plains. Meanwhile, high pressure over the East will continue to

create mild and dry conditions through Tuesday as rainfall chances enter

the Mid-Atlantic and Northeast on Wednesday.

![[Image of rainfall potential]](https://www.nhc.noaa.gov/storm_graphics/AT19/refresh/AL1924INTQPF+gif/053133INTQPF_sm.gif)