Summary Of the Markets Today:

- The Dow closed down 38 points or 0.12%,

- Nasdaq closed down 0.44%,

- S&P 500 closed down 0.16%,

- Gold $1975 up $21.00,

- WTI crude oil settled at $73 up $0.59,

- 10-year U.S. Treasury 3.554% up 0.026 points,

- USD $102.41 down $0.45,

- Bitcoin $27,468 up $418,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

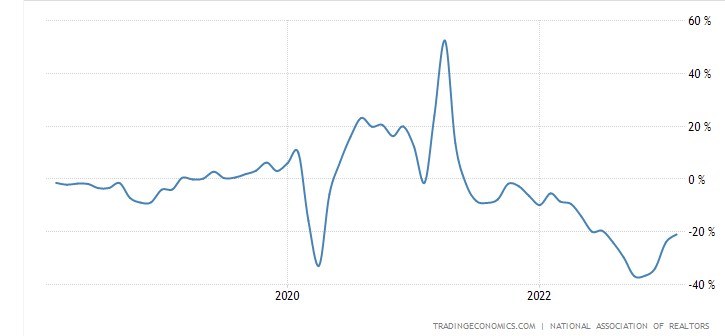

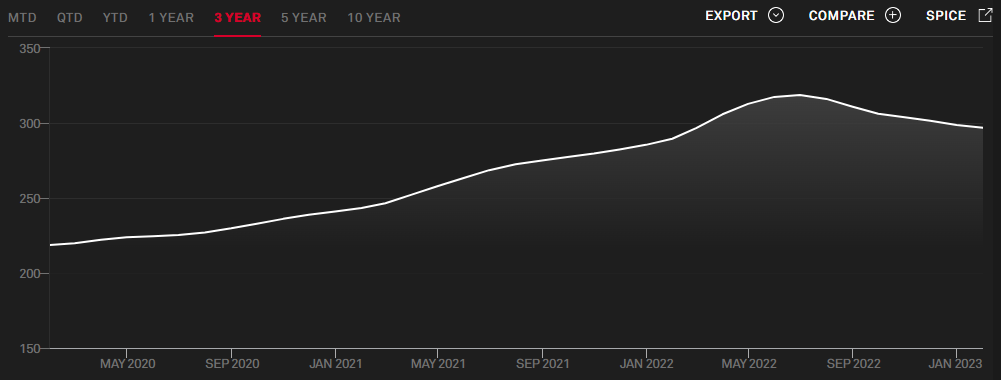

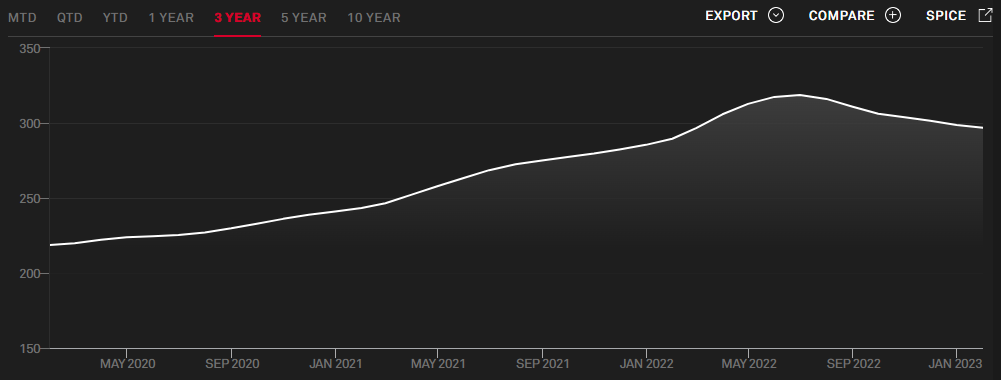

S&P CoreLogic Case-Shiller Indices show that the trend of declining home price gains continued across the United States with declining prices reported in the San Francisco, San Diego, Portland, and Seattle markets. YEAR-OVER-YEAR The S&P CoreLogic Case-Shiller’s 20-City Composite posted a 2.5% year-over-year gain, down from 4.6% in the previous month. CoreLogic Chief Economist Selma Hepp stated:

Following the housing market freefall at the end of the year, the decline in mortgage rates in December and early January spurred some much-needed optimism for the housing market. In response to lower rates, home sales posted strong monthly gains in January and February, suggesting that pent-up buyer demand is eagerly responding to mortgage rate movements. Given the mortgage investor market response since Fed’s March meeting, home price growth may surprise to the upside if mortgage rates remain favorable, especially in light of continued supply constraints. But, ongoing volatility in mortgage rates and fallout from the banking crisis could put a damper on spring home-buying season, particularly if credit tightening impacts mortgage availability and consumer confidence takes another hit. In January, the CoreLogic S&P Case-Shiller Index posted a 3.8% year-over-year increase, marking the ninth straight month of decelerating annual home price gains. With a sharp 17 percent point decline in home price growth over the year, January’s annual gain was the slowest since the COVID pandemic started in the winter of 2019.

https://econcurrents.com/images/2023/03/case.png

https://econcurrents.com/images/2023/03/case.png

https://econcurrents.com/images/2023/03/case.png

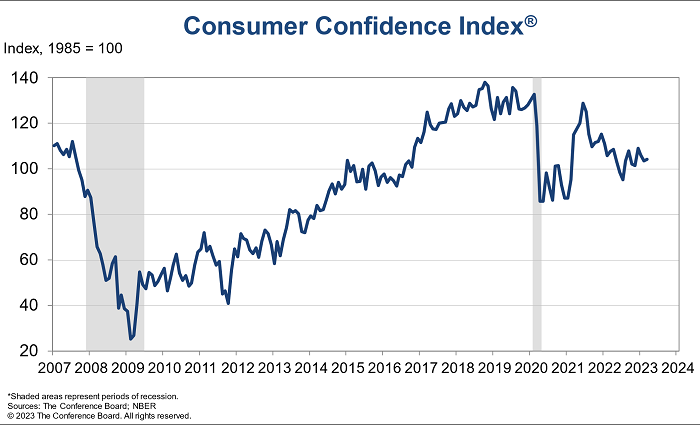

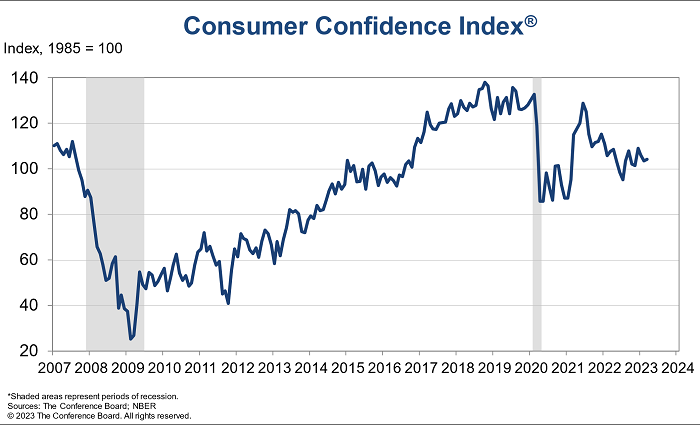

Driven by an uptick in expectations, consumer confidence improved somewhat in March, but remains below the average level seen in 2022 (104.5). The gain reflects an improved outlook for consumers under 55 years of age and for households earning $50,000 and over. While consumers feel a bit more confident about what’s ahead, they are slightly less optimistic about the current landscape. The share of consumers saying jobs are ‘plentiful’ fell, while the share of those saying jobs are ‘not so plentiful’ rose. The latest results also reveal that their expectations of inflation over the next 12 months remains elevated—at 6.3 percent. Overall purchasing plans for appliances continued to soften while automobile purchases saw a slight increase.

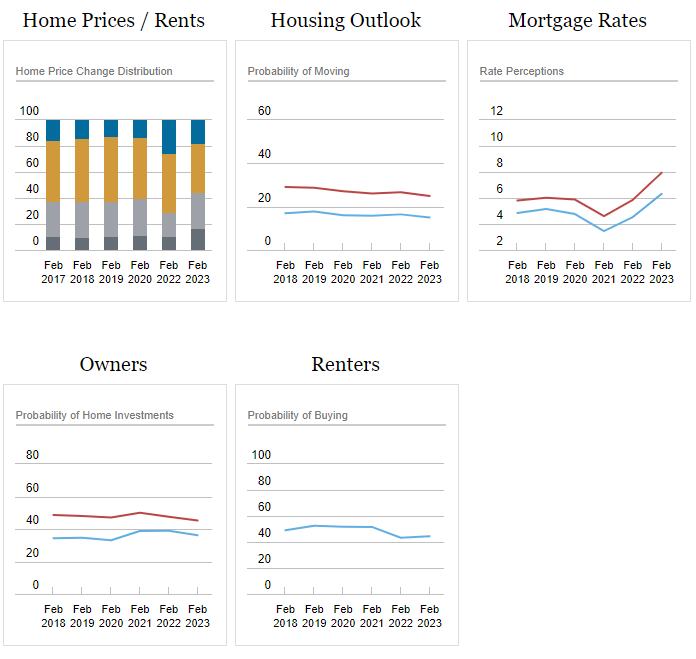

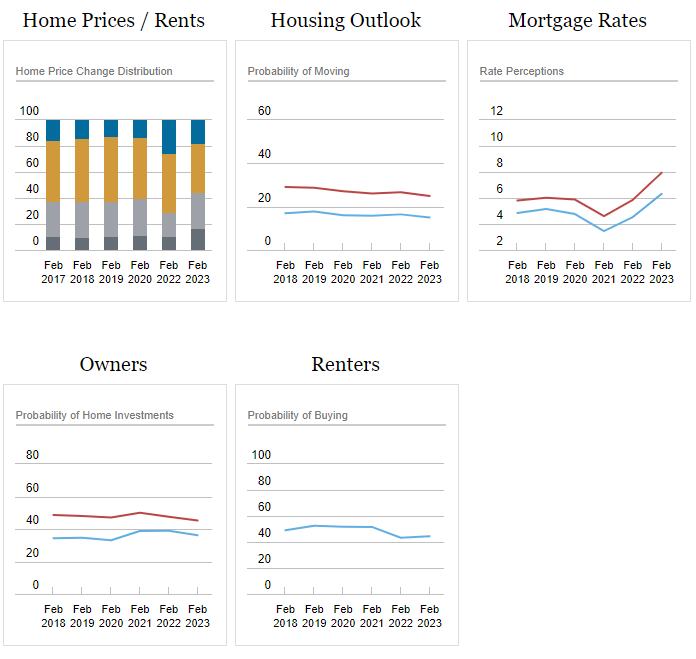

The 2023 SCE Housing Survey, which is part of the broader Survey of Consumer Expectations (SCE) and provides information on consumers’ housing-related experiences and expectations. The results show that households expect home prices to increase over the coming twelve months at the slowest pace since the survey began in 2014. In contrast, home price expectations over the next five years increased relative to last year’s survey. Expectations about the one-year-ahead change in the cost of rent were considerably higher than home price expectations but declined relative to last year’s series high. Homeowners’ expectations about the likelihood of refinancing their mortgage over the next 12 months fell sharply to a new series low. The probability of buying a home conditional on a move over the next three years rose overall, driven by higher expectations among current owners. A large majority of households continue to view housing as a good financial investment, although the share characterizing housing as a “somewhat good” or “very good” investment declined slightly from February 2022.

A summary of headlines we are reading today:

- Why The Fed Could Cut Interest Rates As Early As June

- Power Shortages Disrupt Aluminum Production In South China

- Shell: All Options On The Table For New Energy Strategy

- IRENA: $5 Trillion Per Year Needed To Meet Climate Goals

- Oil Prices Recover As Bullish Sentiment Returns

- Pirates Board Oil Tanker Offshore West Africa

- SVB customers tried to withdraw nearly all the bank’s deposits over two days, Fed’s Barr testifies

- Stocks close lower, Nasdaq drops a second day as higher yields press tech names: Live updates

- DOJ alleges SBF paid $40 million in bribe to China, and Binance responds to CFTC suit: CNBC Crypto World

- Home prices cool in January, even falling in some cities, S&P Case-Shiller says

- Rent growth drops back to pre-pandemic levels, but some markets are falling much harder

- Futures Movers: Oil ends at a more than a 2-week high as natural-gas futures mark the lowest finish in over 2 years

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.