Summary Of the Markets Today:

- The Dow closed down 38 points or 0.12%,

- Nasdaq closed down 0.44%,

- S&P 500 closed down 0.16%,

- Gold $1975 up $21.00,

- WTI crude oil settled at $73 up $0.59,

- 10-year U.S. Treasury 3.554% up 0.026 points,

- USD $102.41 down $0.45,

- Bitcoin $27,468 up $418,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for March 2023

Today’s Economic Releases:

S&P CoreLogic Case-Shiller Indices show that the trend of declining home price gains continued across the United States with declining prices reported in the San Francisco, San Diego, Portland, and Seattle markets. YEAR-OVER-YEAR The S&P CoreLogic Case-Shiller’s 20-City Composite posted a 2.5% year-over-year gain, down from 4.6% in the previous month. CoreLogic Chief Economist Selma Hepp stated:

Following the housing market freefall at the end of the year, the decline in mortgage rates in December and early January spurred some much-needed optimism for the housing market. In response to lower rates, home sales posted strong monthly gains in January and February, suggesting that pent-up buyer demand is eagerly responding to mortgage rate movements. Given the mortgage investor market response since Fed’s March meeting, home price growth may surprise to the upside if mortgage rates remain favorable, especially in light of continued supply constraints. But, ongoing volatility in mortgage rates and fallout from the banking crisis could put a damper on spring home-buying season, particularly if credit tightening impacts mortgage availability and consumer confidence takes another hit. In January, the CoreLogic S&P Case-Shiller Index posted a 3.8% year-over-year increase, marking the ninth straight month of decelerating annual home price gains. With a sharp 17 percent point decline in home price growth over the year, January’s annual gain was the slowest since the COVID pandemic started in the winter of 2019.

https://econcurrents.com/images/2023/03/case.png

https://econcurrents.com/images/2023/03/case.png

https://econcurrents.com/images/2023/03/case.png

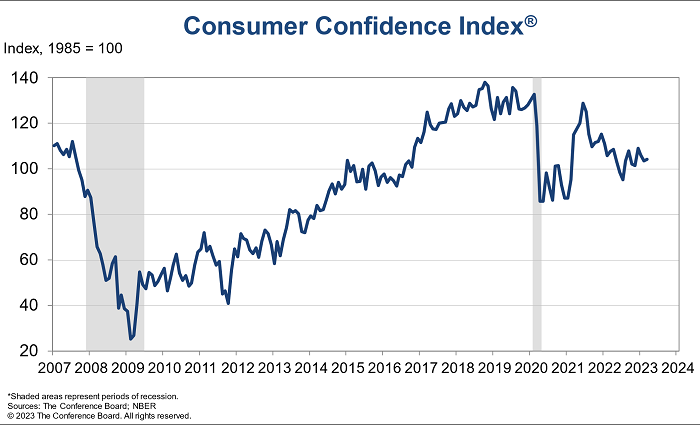

Driven by an uptick in expectations, consumer confidence improved somewhat in March, but remains below the average level seen in 2022 (104.5). The gain reflects an improved outlook for consumers under 55 years of age and for households earning $50,000 and over. While consumers feel a bit more confident about what’s ahead, they are slightly less optimistic about the current landscape. The share of consumers saying jobs are ‘plentiful’ fell, while the share of those saying jobs are ‘not so plentiful’ rose. The latest results also reveal that their expectations of inflation over the next 12 months remains elevated—at 6.3 percent. Overall purchasing plans for appliances continued to soften while automobile purchases saw a slight increase.

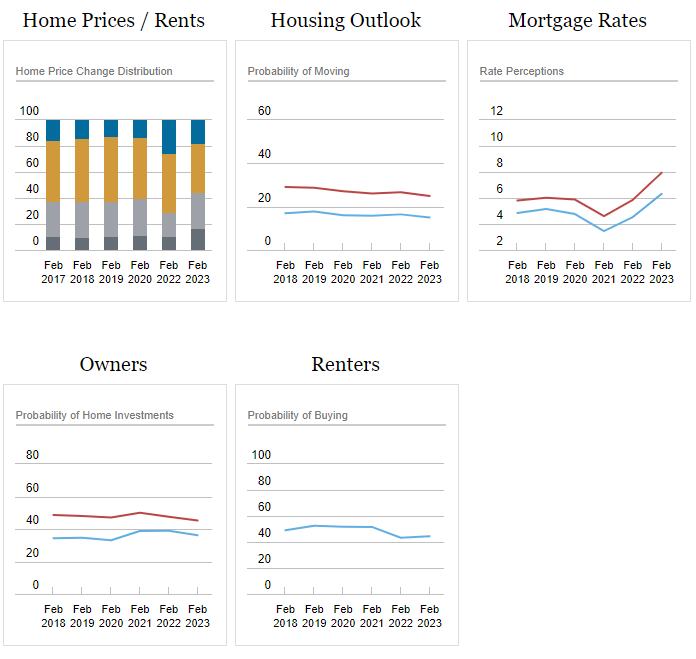

The 2023 SCE Housing Survey, which is part of the broader Survey of Consumer Expectations (SCE) and provides information on consumers’ housing-related experiences and expectations. The results show that households expect home prices to increase over the coming twelve months at the slowest pace since the survey began in 2014. In contrast, home price expectations over the next five years increased relative to last year’s survey. Expectations about the one-year-ahead change in the cost of rent were considerably higher than home price expectations but declined relative to last year’s series high. Homeowners’ expectations about the likelihood of refinancing their mortgage over the next 12 months fell sharply to a new series low. The probability of buying a home conditional on a move over the next three years rose overall, driven by higher expectations among current owners. A large majority of households continue to view housing as a good financial investment, although the share characterizing housing as a “somewhat good” or “very good” investment declined slightly from February 2022.

A summary of headlines we are reading today:

- Why The Fed Could Cut Interest Rates As Early As June

- Power Shortages Disrupt Aluminum Production In South China

- Shell: All Options On The Table For New Energy Strategy

- IRENA: $5 Trillion Per Year Needed To Meet Climate Goals

- Oil Prices Recover As Bullish Sentiment Returns

- Pirates Board Oil Tanker Offshore West Africa

- SVB customers tried to withdraw nearly all the bank’s deposits over two days, Fed’s Barr testifies

- Stocks close lower, Nasdaq drops a second day as higher yields press tech names: Live updates

- DOJ alleges SBF paid $40 million in bribe to China, and Binance responds to CFTC suit: CNBC Crypto World

- Home prices cool in January, even falling in some cities, S&P Case-Shiller says

- Rent growth drops back to pre-pandemic levels, but some markets are falling much harder

- Futures Movers: Oil ends at a more than a 2-week high as natural-gas futures mark the lowest finish in over 2 years

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Market in Perspective

| Here are the headlines moving the markets. | |

|

Why The Fed Could Cut Interest Rates As Early As JuneThe labor market, the yield curve, inflation, and a stock-market selloff are poised to force the Federal Reserve into a rate cut sooner than the market is currently pricing. In markets, it pays to remember that things take longer to happen than you think they will, and then they happen much faster than you thought they ever could. It was only two weeks ago that the market was expecting up to another four rate hikes. Now it’s effectively pricing the end of the rate-hike cycle, and the first cut by the end of the third quarter. But there are… Read more at: https://oilprice.com/Finance/the-Economy/Why-The-Fed-Could-Cut-Interest-Rates-As-Early-As-June.html |

|

EU Extends Natural Gas Price Cap For Spain And PortugalThe European Union has agreed to extend a cap on natural gas prices for power generation in Spain and Portugal until the end of the year. Spanish Energy Minister Teresa Ribera explained that the decision will protect Spanish and Portuguese consumers. While the decision is still pending endorsement by the Commission, it has expressed explicit support for the move. According to an Energy Ministry spokesperson, “The agreement enables the extension of this temporary mechanism that will cap the gas price at an average of 55 euros ($59.48)… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-Extends-Natural-Gas-Price-Cap-For-Spain-And-Portugal.html |

|

Power Shortages Disrupt Aluminum Production In South ChinaVia AG Metal Miner China’s aluminum production faces a “touch and go” situation once again. In this case, the problem is mainly due to a power supply crisis in the southwest area of the country. The Yunnan province, the aluminum manufacturing hub of southern China, is reducing the production of metal due to a severe water shortage. This shortage has, in turn, hampered the area’s hydroelectric power supply. Currently, the impact this will have on the global aluminum price remains unknown. According to reports,… Read more at: https://oilprice.com/Metals/Commodities/Power-Shortages-Disrupt-Aluminum-Production-In-South-China.html |

|

M&A Action Continues In The Canadian Oil Patch With $1.2 Billion DealYesterday we reported about the Energy Transfer LP takeover of midstream operator Lotus energy and the Brookfield Renewable Partners acquisition of Australia’s Origin Energy for $10 billion. Today, the M&A action continues upstream in Canada where Crescent Point Energy (CPG.TO) has agreed to acquire $1.24 billion ($1.7B CAD) worth of oil and gas assets in Alberta’s Montney formation from Spartan Delta Corp. (SDE.TO). According to Crescent Point CEO Craig Bryska, the Montney formation is one of Canada’s most attractive oil… Read more at: https://oilprice.com/Latest-Energy-News/World-News/MA-Action-Continues-In-The-Canadian-Oil-Patch-With-12-Billion-Deal.html |

|

BP And ADNOC Make $2 Billion Bid For Stake Israeli Gas ProducerBP and the Abu Dhabi National Oil Company (ADNOC) have bid to acquire a 50% stake in Israel’s NewMed Energy, an offshore natural gas producer. The proposal, valued at roughly $2 billion, could signify a significant shift in relations between the Middle East and Israel. The deal holds the potential to bring considerable investment into the Israeli energy sector. With this agreement, further cooperation between Israel and the United Arab Emirates could also be on the table. NewMed Energy has been operating since 2017 and has developed several… Read more at: https://oilprice.com/Energy/Energy-General/BP-And-ADNOC-Make-2-Billion-Bid-For-Stake-Israeli-Gas-Producer.html |

|

Siemens And FATA To Build Billion-Dollar Power Link In ItalySiemens Energy and Italy’s FATA have landed a contract worth almost $1.08 billion to supply transmission technology for a 970 km long power link joining Sardinia, Sicily, with the Italian mainland. The deal includes the delivery of four converter stations that will enable more efficient use of renewable energy. Siemens explained that the project “will enable more efficient use of renewable energy, increase the stability of the power grids, and enable the close down of coal-fired power plants on the two islands to reduce CO2… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Siemens-And-FATA-To-Build-Billion-Dollar-Power-Link-In-Italy.html |

|

Shell: All Options On The Table For New Energy StrategyShell is currently deliberating how to reconcile energy security with climate targets in a new strategy expected in June, with all options on the table, the supermajor’s chief executive Wael Sawan told The Wall Street Journal in a recent interview. Whatever the decision of Sawan, other top executives, and the board, Shell is likely to disappoint investors, environmentalists, or both. “I think the heat will come no matter what I do,” Sawan, the new CEO who took over from Ben van Beurden on January 1, told the Journal. … Read more at: https://oilprice.com/Energy/Energy-General/Shell-All-Options-On-The-Table-For-New-Energy-Strategy.html |

|

Strikes Cripple France’s Fuel SupplyFour weeks of protests against the pension reform in France have crippled supply to French refineries and refinery operations as workers join the nationwide industrial action, while prices for European crude grades are depressed due to low French demand. Earlier this month, French President Emmanuel Macron pushed through with a controversial pension reform without a vote in Parliament under a parliamentary clause known as 49:3. The pension reform proposes to raise the retirement age in France by two years to 64. The strikes in France against the… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Strikes-Cripple-Frances-Fuel-Supply.html |

|

IRENA: $5 Trillion Per Year Needed To Meet Climate GoalsA new report from the International Renewable Energy Agency (IRENA) has found that we need to increase our annual investments in renewable energy by four times to meet climate goals. According to IRENA, global investments in renewable energy technologies must exceed $5 trillion annually to align with the Paris climate accord’s commitment to limiting temperature increases to 1.5 degrees Celsius above pre-industrial levels. Last year, investments in renewable energy reached a record of $1.3 trillion, but that is insufficient… Read more at: https://oilprice.com/Alternative-Energy/Renewable-Energy/IRENA-5-Trillion-Per-Year-Needed-To-Meet-Climate-Goals.html |

|

EU To End Sales Of New Gasoline And Diesel Cars In 2035The European Union member states on Tuesday approved an emissions regulation under which the bloc will end sales of new carbon dioxide-emitting cars and vans in 2035. The new rules target 55% CO2 emission reductions for new cars and 50% for new vans from 2030 to 2034 compared to 2021 levels, as well as 100% CO2 emission reductions for both new cars and vans from 2035, the EU said today. The landmark deal was made possible after Germany – the biggest economy, the biggest car market, and the biggest car manufacturer – sought… Read more at: https://oilprice.com/Latest-Energy-News/World-News/EU-To-End-Sales-Of-New-Gasoline-And-Diesel-Cars-In-2035.html |

|

Oil Prices Recover As Bullish Sentiment ReturnsOil prices jumped on Monday as a disruption to Kurdistan’s oil exports refocused the market on fundamentals. As oil prices continue to recover from the sentiment-driven crash a couple of weeks ago, there are plenty of catalysts ahead that could push prices higher.Investor Alert: Whether you are new to the oil and gas industry or an energy market veteran, you will regret not signing up for Global Energy Alert. Oilprice.com’s premium newsletter provides everything from geopolitical analysis to trading analysis, and all for less than a cup of… Read more at: https://oilprice.com/Energy/Energy-General/Oil-Prices-Recover-As-Bullish-Sentiment-Returns.html |

|

Oil’s Low Prices Draw Rash Of HedgingLast week’s crashing oil prices were awfully tempting last week for big oil consumers, who took advantage of the low prices to hedge against the inevitable price rise. Major oil consumers such as airlines boosted their hedging at a rapid pace, according to a Bloomberg analysis of trading data. It was clear last week that there was a sharp rise in trading activity for crude oil, but the extent of the flurry of activity is only now quantifiable with bank positioning data, Bloomberg said. Swap dealers saw the second-largest increase on record… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Oils-Low-Prices-Draw-Rash-Of-Hedging.html |

|

How Herd Mentality Sparked Chaos In Oil MarketsThe only certainty an oil industry observer can bank on right now is that no one understands the markets. The extreme end of globalization has introduced so many variables that market analysts can no longer effectively predict the non-linear ripples. Right now is a case in point. We have a clean cut dividing line between key markets analysis, with those who fear a banking failure contagion threatening oil demand, and those who say there is no systemic catastrophe and oil will be bulldozing its way back to $100 in no time. Neither narrative… Read more at: https://oilprice.com/Energy/Oil-Prices/How-Herd-Mentality-Sparked-Chaos-In-Oil-Markets.html |

|

Pirates Board Oil Tanker Offshore West AfricaAn oil and chemical tanker was attacked by pirates in the Gulf of Guinea offshore West Africa, a spokesperson for the Danish shipping company which owns the vessel told Reuters on Tuesday. The pirates have boarded the Monjasa Reformer tanker, whose 16 crew members sought refuge in the vessel’s safe room, according to the spokesperson. All communication with the ship is down, they added. Monjasa Reformer is operated by Montec Ship Management, which is owned by Denmark-based shipping firm Monjasa. Montec Ship Management is currently working… Read more at: https://oilprice.com/Latest-Energy-News/World-News/Pirates-Board-Oil-Tanker-Offshore-West-Africa.html |

|

Russia Claims To Have Completely Redirected Oil Exports To Avoid EmbargoRussia has succeeded in redirecting its crude oil and fuel exports after the EU embargoes and the price cap set by the West, Russian Energy Minister Nikolai Shulginov said on Tuesday. Russia hasn’t reduced its sales of crude and petroleum products, the minister was quoted as saying by the Russian news agency TASS. “As far as sanctions are concerned, it is important to not only keep the production and refining volumes but exports, too, and thus the revenues for the federal budget,” Shulginov was quoted as saying. The minister… Read more at: https://oilprice.com/Energy/Energy-General/Russia-Claims-To-Have-Completely-Redirected-Oil-Exports-To-Avoid-Embargo.html |

|

SVB customers tried to withdraw nearly all the bank’s deposits over two days, Fed’s Barr testifiesThe run on Silicon Valley Bank’s deposits this month went far deeper than was initially known. Read more at: https://www.cnbc.com/2023/03/28/svb-customers-tried-to-pull-nearly-all-deposits-in-two-days-barr-says.html |

|

Sam Bankman-Fried paid over $40 million to bribe at least one official in China, DOJ alleges in new indictmentFTX co-founder Sam Bankman-Fried paid over $40 million in bribes to at least one Chinese government official, federal prosecutors alleged in a new indictment. Read more at: https://www.cnbc.com/2023/03/28/sam-bankman-fried-paid-over-40-million-to-bribe-at-least-one-chinese-official-doj-alleges-in-new-indictment.html |

|

Apple launches its Pay Later serviceApple on Tuesday introduced Apple Pay Later, which will allow users to split their purchases into four payments spread over six weeks. Read more at: https://www.cnbc.com/2023/03/28/apple-pay-later-launches-in-us.html |

|

Stocks close lower, Nasdaq drops a second day as higher yields press tech names: Live updatesAn uptick in rates put pressure on the broader market. Read more at: https://www.cnbc.com/2023/03/27/stock-market-today-live-updates.html |

|

Hedge funds are dumping these stocks most exposed to tight financial conditionsHedge funds turned bearish on financials and other stocks exposed to tightening credit conditions, according to Goldman. Read more at: https://www.cnbc.com/2023/03/28/hedge-funds-are-dumping-these-stocks-most-exposed-to-tight-financial-conditions.html |

|

DOJ alleges SBF paid $40 million in bribe to China, and Binance responds to CFTC suit: CNBC Crypto WorldCNBC Crypto World features the latest news and daily trading updates from the digital currency markets and provides viewers with a look at what’s ahead with high-profile interviews, explainers, and unique stories from the ever-changing crypto industry. On today’s show, Rebecca Rettig, the chief policy officer at Polygon Labs, discusses the impact of the CFTC’s lawsuit against Binance. Read more at: https://www.cnbc.com/video/2023/03/28/doj-alleges-sbf-40-million-bribe-china-binance-responds-cftc-suit-crypto-world.html |

|

Pence ordered to testify in probe of Trump’s efforts to overturn 2020 electionPence had previously vowed to challenge the subpoena in the special counsel probe of Donald Trump’s efforts to overturn his election loss to Joe Biden. Read more at: https://www.cnbc.com/2023/03/28/pence-ordered-to-testify-in-probe-of-trumps-efforts-to-overturn-2020-election.html |

|

Home prices cool in January, even falling in some cities, S&P Case-Shiller saysPrices have been falling for seven straight months, but the decline was a bit smaller in January likely due to a brief drop in mortgage rates. Read more at: https://www.cnbc.com/2023/03/28/home-prices-cool-in-january-even-falling-in-some-cities-sp-case-shiller.html |

|

Dominion wants Tucker Carlson, Sean Hannity, other Fox News hosts to testify at trialDominion Voting Systems wants Fox News hosts including Tucker Carlson and Maria Bartiromo to appear at April’s defamation trial. Read more at: https://www.cnbc.com/2023/03/28/dominion-fox-news-hosts-testify-trial.html |

|

Ukraine war live updates: German and British tanks arrive in Ukraine; Russia fires supersonic missiles off Japan’s coastThe first shipment of German and British tanks have arrived in Ukraine, ahead of an expected spring counter-offensive. Read more at: https://www.cnbc.com/2023/03/28/ukraine-war-live-updates-latest-news-on-russia-and-the-war-in-ukraine.html |

|

The salt paradox: Why it’s both essential and a threat to the environmentThe global market for salt was worth over an estimated $13 billion in 2021, according to Research Insights. Read more at: https://www.cnbc.com/2023/03/28/salt-paradox-why-its-essential-and-a-threat-to-the-environment.html |

|

Rent growth drops back to pre-pandemic levels, but some markets are falling much harderApartment rents have increased slightly for the past few months, as seasonally stronger spring activity kicks in. Read more at: https://www.cnbc.com/2023/03/28/rent-growth-drops-to-pre-covid-levels.html |

|

Walmart sued by EEOC for firing deli worker with Crohn’s diseaseThe U.S. sued Walmart Monday for firing a North Carolina employee with Crohn’s disease after allegedly refusing to grant her disability-related leave. Read more at: https://www.cnbc.com/2023/03/28/walmart-sued-by-eeoc-for-firing-worker-with-crohns-disease.html |

|

Small Float SPACs Use Meme Playbook For Crazy SwingsBy Bailey Lipschutz, Bloomberg ECB Watch reporter The ailing SPAC market is getting wildly volatile as speculators pour into and out of low-float companies, ripping off the strategy that brought meme-stock mania to the masses. The special-purpose acquisition company that merged with Ambipar Emergency Response spiked as much as 411% after its deal won shareholder approval on Feb. 28, only for Ambipar to slump below $10 after the tie-up was completed. Lionheart III Corp. followed a similar trajectory in its merger with SMX Security Matters on March 7, while JATT Acquisition Corp. slumped before its tie-up with Zura Bio Ltd. and then soared after it. “For the retail guy, it’s the same playbook that they have grown to know and love over the past three years: Find something that’s a low float, put it on a screener, once it starts to move tweet it out to your closest followers,” said Matthew Tuttle, CEO and CIO of Tuttle Capital Management. “Move a little bit, and all their followers will jump in.” The volatility is being fueled by the low floats of many SPACs, with shareholders this year redeeming an average of almost 90% of their shares before any merger is completed. Holders in the two SPACs that merged with Ambipar and SMX Security cashed in more than 95% of their stock, leaving the blank-check companies with just 918,000 and 303,000 shares, respectively. Read more at: https://www.zerohedge.com/markets/small-float-spacs-use-meme-playbook-crazy-swings |

|

Baltimore City Mayor Blocks Toxic Ohio Train Waste From Being Dumped Into Treatment SystemWe have been following this developing story since Friday regarding the Biden administration’s Environmental Protection Agency (EPA) decision to transport toxic water from East Palestine, Ohio, to a water treatment facility in Baltimore. On Monday, local lawmakers from both Democratic and Republican parties united in expressing their concerns about the EPA’s strategy and how it would be devastating for the Chesapeake Bay. Now, the mayor of Baltimore has found a way to block the EPA’s plan. According to Fox Baltimore, Clean Harbors Environmental in Baltimore is set to receive the 675,000 gallons of the contaminated water as early as Thursday. They plan to flush the water into the city’s sewer lines, where it would then flow to the troubled Back River Wastewater Treatment Plant for processing. Read more at: https://www.zerohedge.com/political/baltimore-city-mayor-blocks-toxic-ohio-train-waste-being-dumped-treatment-system |

|

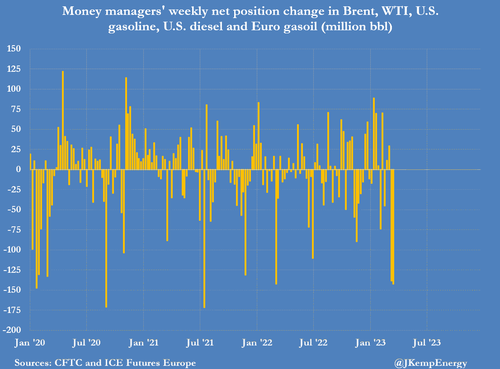

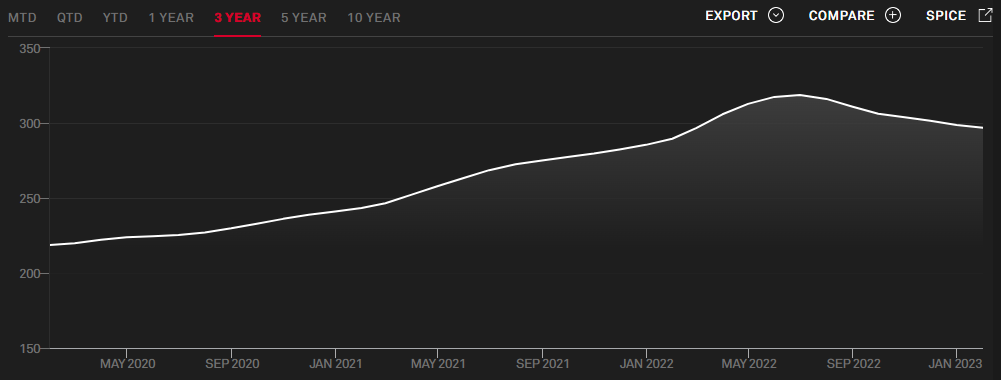

Fearing Credit Crunch, Hedge Funds Flee PetroleumBy John Kemp, Senior Market Analyst at Reuters Portfolio investors sold oil-related futures and options contracts at the fastest rate for almost six years as traders prepared for the onset of a recession driven by tighter credit conditions in the aftermath of the banking crisis. Hedge funds and other money managers sold the equivalent of 142 million barrels in the six most important contracts in the seven days ending on March 21, after selling 139 million barrels in the week to March 14.

Total sales over the two weeks were the fastest for any fortnight since May 2017, according to records published by ICE Futures Europe and the U.S. Commodity Futures Trading Commission. Fund managers have slashed their combined position to just 289 million barrels (6th percentile for all weeks since 2013) from 570 million (46th percentile) on March 7. The fund community liquidated 163 million barrels of previous bullish long positions in the two most recent weeks, while establishing 115 million barrels of new bearish short ones. … Read more at: https://www.zerohedge.com/markets/fearing-credit-crunch-hedge-funds-flee-petroleum |

|

How The Collapse Of SVB Led To A $16 Billion Taxpayer-Funded Gift For One BankSomething remarkable happened yesterday: just after midnight on Sunday night, the FDIC announced that a small bank that almost nobody had heard of before, First-Citizens Bank & Trust (FCNCA) would scoop up the remaining assets of the now-defunct Silicon Valley Bank, which imploded on March 9 following a furious bank run, that saw $42BN in deposits drained in hours (and where another $100 billion in deposits were about to be yanked on Friday, which is why the FDIC stepped in and shuttered the bank before market open on Friday, March 10)…

… and what happened next shocked everyone” FCNCA stock almost doubled, soaring to the highest on record. Read more at: https://www.zerohedge.com/markets/how-collapse-svb-led-16-billion-taxpayer-funded-handout-one-bank |

|

Royal Mail talks over pay on brink of collapseA source says continuing strike action could mean Royal Mail is put into administration. Read more at: https://www.bbc.co.uk/news/business-65099143?at_medium=RSS&at_campaign=KARANGA |

|

AI could replace the equivalent of 300 million jobs – reportChatGPT-style AI will have a large impact but new jobs could emerge, a Goldman Sachs report says. Read more at: https://www.bbc.co.uk/news/technology-65102150?at_medium=RSS&at_campaign=KARANGA |

|

Retailer Next buys Cath Kidston in £8.5m dealThe deal does not include its four shops, and administrators warn there will be redundancies. Read more at: https://www.bbc.co.uk/news/business-65103576?at_medium=RSS&at_campaign=KARANGA |

|

Promoters increase stake in Aster DM Healthcare by 4% for Rs 460 crThe hospital chain operates 15 hospitals offering 4,095 beds, which will go up to 4,670 across 18 hospitals by the next financial year and is the largest chain in the GCC countries with 15 hospitals. They also operate 113 clinics and 257 pharmacies in these Gulf Cooperation Council markets Read more at: https://economictimes.indiatimes.com/markets/stocks/news/promoters-increase-stake-in-aster-dm-healthcare-by-4-for-rs-460-cr/articleshow/99069358.cms |

|

Maruti Suzuki among top 5 auto picks ahead of March sales data>> For more such web stories click on the ET icon below Read more at: https://economictimes.indiatimes.com/markets/web-stories/maruti-suzuki-among-top-5-auto-picks-ahead-of-march-sales-data/articleshow/99067569.cms |

|

US officials signal new rules for banks after SVB, Signature failuresFederal Deposit Insurance Corp. Chairman Martin Gruenberg said, in his testimony to the panel, that the failures of SVB, as Silicon Valley Bank is known, and Signature Bank “demonstrate the implications that banks with assets of $100 billion or more can have for financial stability Read more at: https://economictimes.indiatimes.com/markets/stocks/news/us-officials-signal-new-rules-for-banks-after-svb-signature-failures/articleshow/99069427.cms |

|

The Margin: ‘Digital Blackface’? Levi’s gets pushback for using AI models to add diversity.Levi’s says using AI models over real people helps create an inclusive shopping experience, but many social-media posters aren’t buying it. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C4-6056DE53F014%7D&siteid=rss&rss=1 |

|

Futures Movers: Oil ends at a more than a 2-week high as natural-gas futures mark lowest finish in over 2 yearsOil futures end Tuesday at their highest in more two weeks, while natural-gas prices mark their lowest settlement in over two years. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C3-F35C298B7A15%7D&siteid=rss&rss=1 |

|

Debt-ceiling standoff: McCarthy floats spending cuts, work requirements in letter to BidenHouse Speaker Kevin McCarthy outlines some of his demands in the debate over raising the U.S. debt ceiling, as President Joe Biden insists on a ‘clean’ bill. Read more at: http://www.marketwatch.com/news/story.asp?guid=%7B20C06575-04D4-B545-71C4-10EF620E7939%7D&siteid=rss&rss=1 |