Summary Of the Markets Today:

- The Dow closed up 525 points or 1.57%,

- Nasdaq closed up 2.43%,

- S&P 500 closed up 1.96%,

- Gold $1,997 up $1.50,

- WTI crude oil settled at $75 up $0.46,

- 10-year U.S. Treasury 3.526% up 0.096 points,

- EUR/USD $1.102 down $0.002,

- Bitcoin $29,683 up $2,039,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases:

The U.S. Bureau of Economic Analysis reported that the advance estimate for 1Q2023 Real Gross Domestic Product (GDP) grew at an annual rate of 1.1%. This was slower than the 2.6% growth in the fourth quarter of 2022. However, when viewed year-over-year – the economy grew at 1.6% (up from 0.9% in 4Q2023 – blue line in the graph below). Inflation calculate by the BEA fell to 5.3% in 1Q2023 (down from the 6.4% in 4Q2023 – red line in the graph below). The slowdown in GDP growth was driven by a number of factors, including:

- A decline in consumer spending, which accounts for about 70% of GDP.

- A decrease in business investment, which accounts for about 17% of GDP.

- A slowdown in exports, which account for about 12% of GDP.

My takeaway is that economic growth is rather modest – and any black swan event would cause a recession.

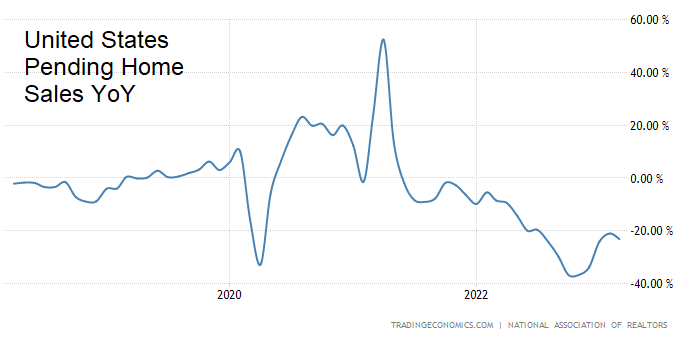

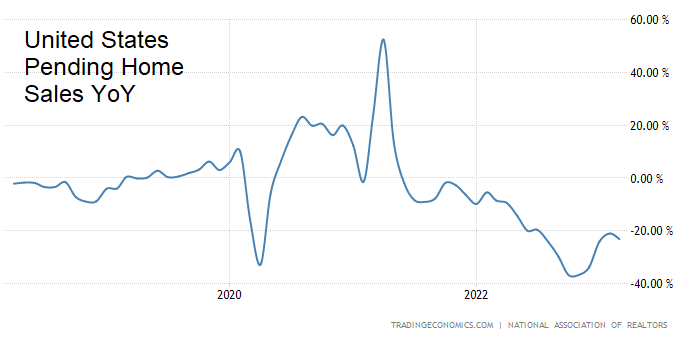

The National Association of Realtors (NAR) reported that pending home sales decreased 5.2% in March 2023 from February. This was the first month-over-month decline since November 2022. On an annual basis, pending home sales were down 23.2%. Pending home sales measures the number of homes that have gone under contract but have not yet closed. The decline in pending home sales is being caused to a significant degree by lower inventory of homes for sale

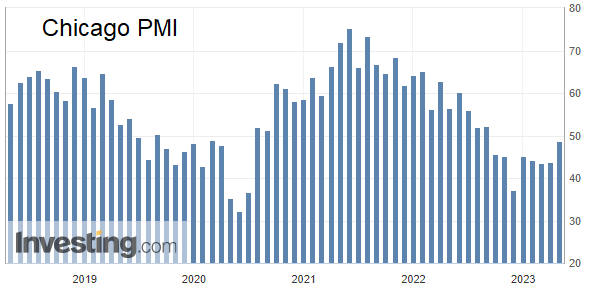

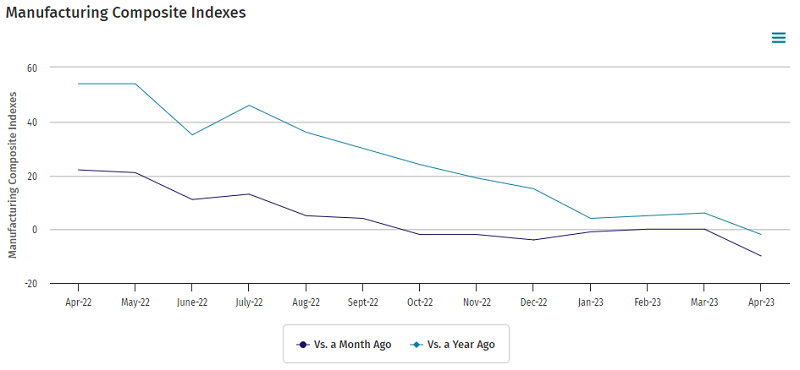

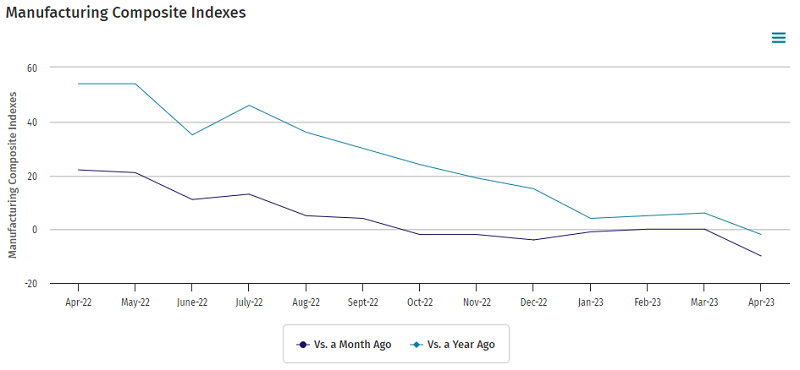

The Kansas City Fed’s Tenth District Manufacturing Activity composite index was -10 in April, down from 0 in March and February. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes.

According to the U.S. Department of Labor, initial claims for state unemployment benefits four-week moving average decreased by 4,000 to 236,000. The decrease in claims was driven by a decline in layoffs in the leisure and hospitality sector. Claims in the sector decreased by 12,000, accounting for all of the decline in initial claims.

A summary of headlines we are reading today:

- Tanker Carrying Oil For Chevron Seized By Iran

- The High Costs Of Electrifying The U.S. Auto Industry

- Wisconsin’s Only Oil Refinery Reopens 5 Years After Explosion

- Falling Crude Prices Drag Down Profits At China’s Oil Giants

- Pioneer CEO Retirement Could Reignite Exxon Takeover Talks

- Dow jumps 500 points on strong earnings, heads for best day since January: Live updates

- Amazon earnings are out — here are the numbers

- Here’s why the stock market is having such a massive rally today

- U.S. GDP rose at a 1.1% pace in the first quarter as signs build that the economy is slowing

- Market Snapshot: Dow jumps over 500 points as stocks rally after earnings from Meta and other big-tech names

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.