Summary Of the Markets Today:

- The Dow closed down 109 points or 0.32%,

- Nasdaq closed down 0.68%,

- S&P 500 closed down 0.37%,

- Gold $1,968 down $2.60,

- WTI crude oil settled at $72 up $1.03,

- 10-year U.S. Treasury 3.769% up 0.039 points,

- USD Index $102.32 up $0.02,

- Bitcoin $26,355 up $894,

- Baker Hughes Rig Count: U.S. -8 to 687 Canada +23 to 159

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The 15 participants in the June Livingston Survey predict higher output growth for the first half of 2023 than they predicted in the December 2022 survey. The forecasters, who are surveyed by the Federal Reserve Bank of Philadelphia twice a year, now project that the economy’s output (real GDP) will grow at an annual rate of 1.1 percent during the first half of 2023. They expect weaker conditions in the second half of 2023, when growth is expected to be at an annual rate of -0.7 percent. Both projections represent upward revisions from those of the December 2022 survey. Growth is expected to average an annual rate of 1.0 percent in the first half of 2024. Additionally:

- On an annual-average over annual-average basis, CPI inflation is expected to be 4.1 percent in 2023 and 2.5 percent in 2024.

- The interest rate on three-month Treasury bills is now predicted to be 5.25 percent at the end of June 2023, an upward revision from 5.05 percent in the previous survey. The forecasters predict the three-month rate will fall to 4.80 percent at the end of December 2023 and 3.05 percent at the end of June 2024. The panelists see the rate at 2.95 percent at the end of December 2024.

- The panelists predict the S&P 500 index will finish the first half of 2023 at a level of 4200.0, marking an upward revision from their previous prediction of 3927.4. Stock prices are expected to rise to 4260.4 at the end of 2023 and continue to rise to 4350.9 at the end of June 2024. The index is predicted to reach 4411.0 by the end of 2024. All forecasts for stock prices mark upward revisions from those of the December 2022 survey.

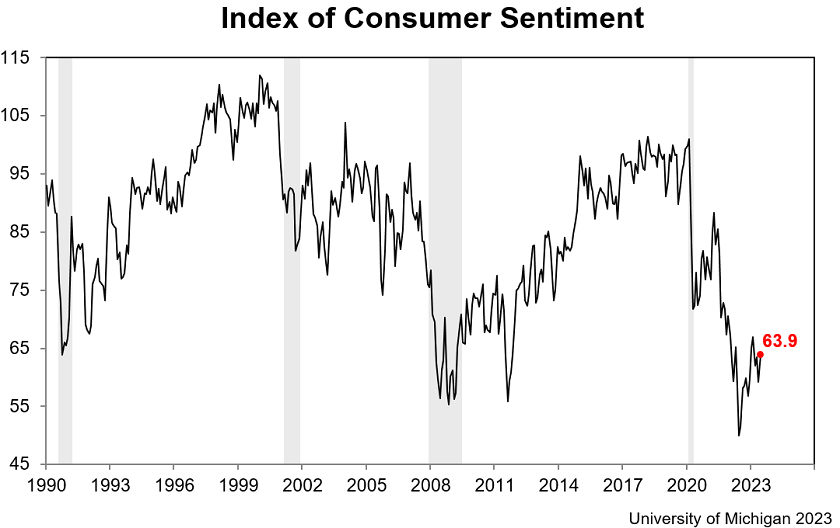

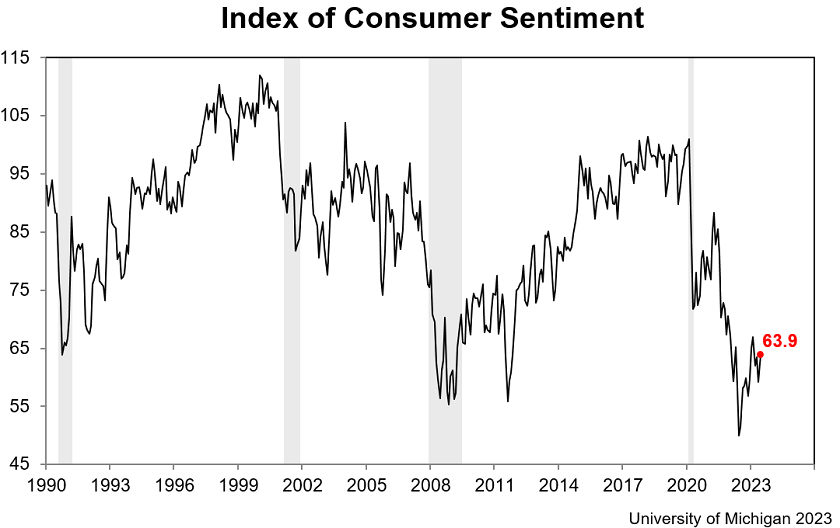

Consumer sentiment lifted 8% in June, reaching its highest level in four months, reflecting greater optimism as inflation eased and policymakers resolved the debt ceiling crisis. The outlook on the economy surged 28% over the short run and 14% over the long run. Sentiment is now 28% above the historic low from a year ago and may be resuming its upward trajectory since then. As it stands, though, sentiment remains low by historical standards as income expectations softened. A majority of consumers still expect difficult times in the economy over the next year.

Here is a summary of headlines we are reading today:

- A Deep Dive Into The World’s Leading Lithium Producers

- U.S. Shale Patch Sees Rig Count Decline By 8 This Week

- How To Protect Your Wealth If The Fed Is Lying About More Interest Rate Hikes

- S&P 500 breaks six-day win streak on Friday, but still notches best week since March: Live updates

- Elon Musk says Tesla’s market cap is directly tied to whether it solves autonomous driving

- An ETF focused on the ‘moats’ strategy of Warren Buffett is beating the market once again

- Ukraine war live updates: Putin says nuclear weapons transferred to Belarus; Ukraine ‘will be equal to NATO allies’

- Cryptocurrencies climb to end the week as investors digest BlackRock’s bitcoin ETF plans

- Converting gas-powered cars to EVs is a booming business

- “Broke Generation”: 64% Of Gen Xers Have Stopped Saving For Retirement

- Average two-year mortgage rate close to 6%

- Bond Report: Two-year Treasury yield rises for a second straight week after Fed officials repeat need for more rate hikes

- Market Snapshot: U.S. stocks trade lower, but S&P 500 on pace for longest weekly win streak since 2021 after Fed pause

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.