27 June 2023 Market Close & Major Financial Headlines: May Durable Goods Data And Consumer Confidence Improved – Home Sales Showed Unexpected Strength. Markets Close Higher

Summary Of the Markets Today:

- The Dow closed up 212 points or 0.63%,

- Nasdaq closed up 1.65%,

- S&P 500 closed up 1.15%,

- Gold $1,924 down $10.00,

- WTI crude oil settled at $68 down $1.71,

- 10-year U.S. Treasury 3.762% up 0.041 points,

- USD Index $102.47 down $0.22,

- Bitcoin $30,673 up $394,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for June 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The CoreLogic S&P Case-Shiller 20-city composite index was down 1.7% year-over-year. Compared with the 2006 peak, the 20-city composite is up by 49%. Adjusted for inflation, which continues to remain concerningly elevated, the 20-city index showed a 3% increase compared with its 2006 high point. The latest CoreLogic’s latest Home Price Index projects that home prices nationally will average a 4% increase in 2023 compared with the previous year.

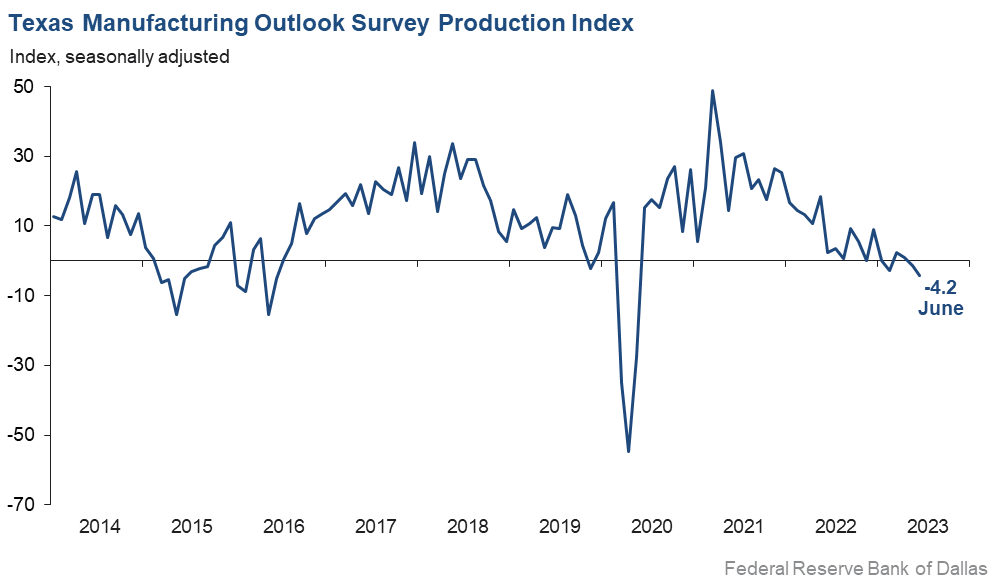

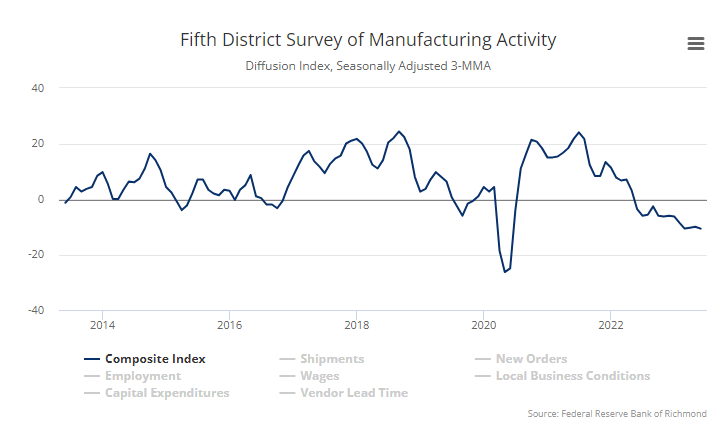

The Richmond Fed manufacturing activity remained relatively flat in June, according to the most recent survey from the Federal Reserve Bank of Richmond. The composite manufacturing index rose from −15 in May to −7 in June. Two of its three component indexes — shipments and new orders — also improved but remained below zero. Manufacturing in the US remains in a recession.

New orders for manufactured durable goods in May were up 5.4% year-over-year (3.6% inflation-adjusted). Before one thinks this is a strong report – this monthly increase was almost totally due to Boeing’s new orders – and does not show a broad-based improvement in this sector.

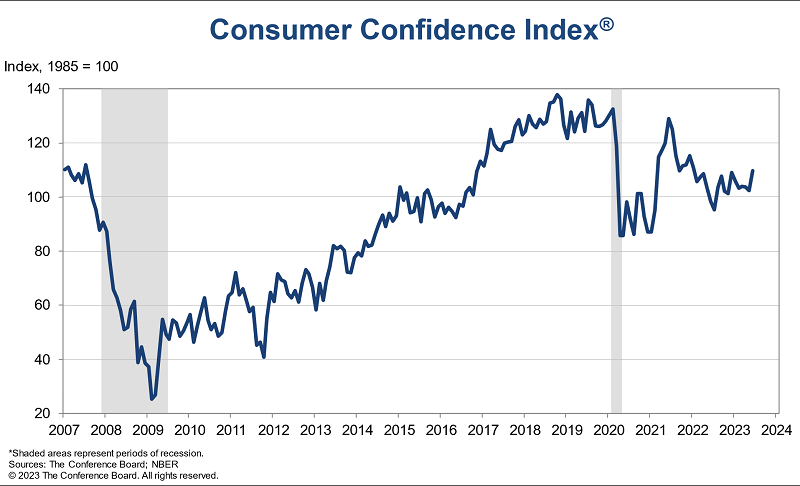

US Consumer Confidence Improved Substantially in June to 109.7, up from 102.5 in May. Dana Peterson, Chief Economist at The Conference Board stated:

Consumer confidence improved in June to its highest level since January 2022, reflecting improved current conditions and a pop in expectations. Greater confidence was most evident among consumers under age 35, and consumers earning incomes over $35,000. Nonetheless, the expectations gauge continued to signal consumers anticipating a recession at some point over the next 6 to 12 months.

Sales of new single‐family houses in May 2023 were 25.9% above May 2022. The median sales price of new houses sold in May 2023 was $416,300 – down 7.6% year-over-year. The average sales price was $487,300. Not a surprise that when you sell a cheaper house – the sales volumes increase.

Here is a summary of headlines we are reading today:

- Fuel From Thin Air: A Technological Feat Or Economic Folly?

- Copper Can Go Up 10 Times, Warns Billionaire Mine-Owner

- Russia Asks For Same Oil Deal Chevron Has In Venezuela

- The Hidden Costs Of The IEA’s Net Zero Vision

- Russia’s Crude Oil Exports Dip By Nearly 1 Million Bpd

- S&P 500, Nasdaq rally more than 1% as tech leads turnaround, Dow closes 200 points higher: Live updates

- Morgan Stanley Sees First Negative Payroll Print In August Or September

- Banking: UBS cutting half of Credit Suisse staff and about 35,000 or 30% of combined staff after merger: Bloomberg

- ‘This is a game-changer’: Ahead of Amazon Prime Day, a new law makes it harder for online sellers to hawk fake or stolen products

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.