Summary Of the Markets Today:

- The Dow closed up 285 points or 0.84%,

- Nasdaq closed up 1.45%,

- S&P 500 closed up 1.23%,

- Gold $1,928 up $9.80,

- WTI crude oil settled at $71 up $0.66,

- 10-year U.S. Treasury 3.819% down 0.035 points,

- USD Index $102.92 down $0.43,

- Bitcoin $30,418 down $175,

- Baker Hughes Rig Count: U.S. -8 to 674 Canada -2 to 167

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Real disposable personal income (DPI), inflation-adjusted personal income less personal current taxes, increased 4.0% year-over-year, and real personal consumption expenditures (PCE) increased 2.1% year-over-year. Personal income remains on an up-trend whilst consumption expenditures remain little changed. The PCE price index, which is the data set the Federal Reserve uses to monitor inflation, moderated to 3.8% year-over-year. Excluding food and energy, the PCE price index increased 4.6% year-over-year. Please note that there has been little progress in reducing inflation when one excludes food and energy.

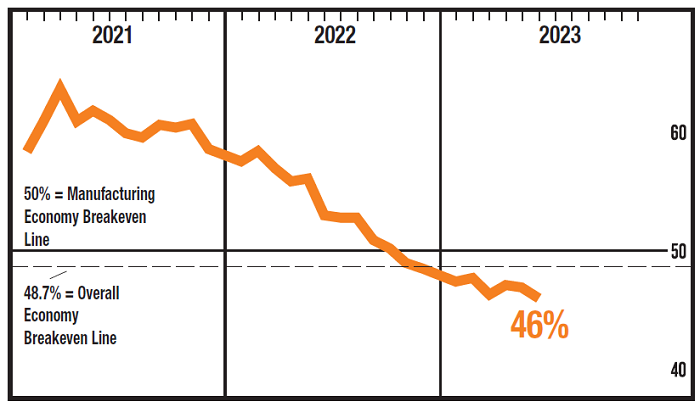

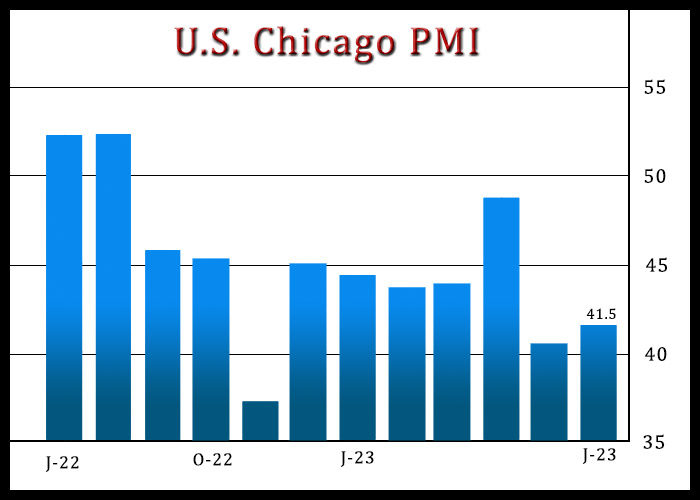

Chicago business barometer inched up to 41.5 in June from 40.4 in May, although a reading below 50 still indicates contraction. Pundits believe the Chicago Business Barometer is a window into the ISM manufacturing index. [graph below from RTT News]

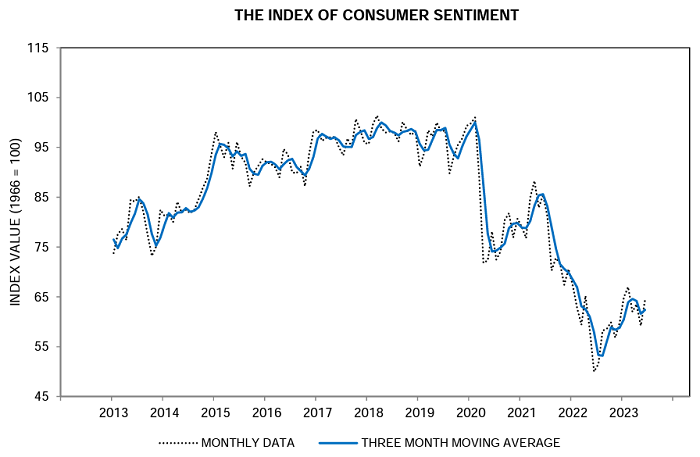

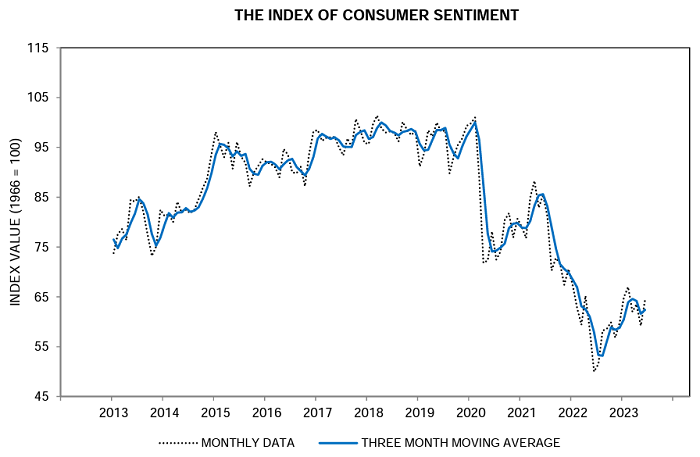

Consumer sentiment rose 9% this month, a consensus improvement across all demographic groups. The year-ahead economic outlook soared 28% over last month, and long-run expectations rose 11% as well. Overall, this striking upswing reflects a recovery in attitudes generated by the early-month resolution of the debt ceiling crisis, along with more positive feelings over softening inflation. Views of their own personal financial situation were unchanged, however, as persistent high prices and expenses continued to weigh on consumers.

Here is a summary of headlines we are reading today:

- Azerbaijan And NATO Deepen Ties

- Bulls And Bears Face Off As Copper Outlook Flashes Mixed Signals

- U.S. Oil And Gas Rig Counts Decline For Second Consecutive Month

- The Freight Industry Dilemma: Legacy Leases And Saturated Market

- Oil Prices Remain Rangebound Despite Growing Optimism

- Russia Remains On The Brink Of Civil War

- Supreme Court strikes down Biden’s student loan forgiveness plan

- S&P 500 rises on Friday to close out big first half, Nasdaq posts best start to a year in 4 decades: Live updates

- Bitcoin soars in first half of 2023, and fintech firm Revolut to delist altcoins: CNBC Crypto World

- Futures Movers: Oil futures climb, with global prices registering the first monthly gain of the year but a 4th straight quarterly decline

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.