Summary Of the Markets Today:

- The Dow closed down 159 points or 0.45%,

- Nasdaq closed down 0.79%,

- S&P 500 closed down 0.42%,

- Gold $1,960 down $10.00,

- WTI crude oil settled at $83 up $0.93,

- 10-year U.S. Treasury 4.022% down 0.056 points,

- USD Index $102.54 up $0.49,

- Bitcoin $29,904 up $774,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

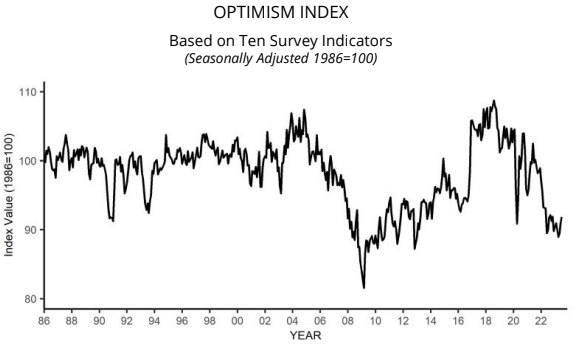

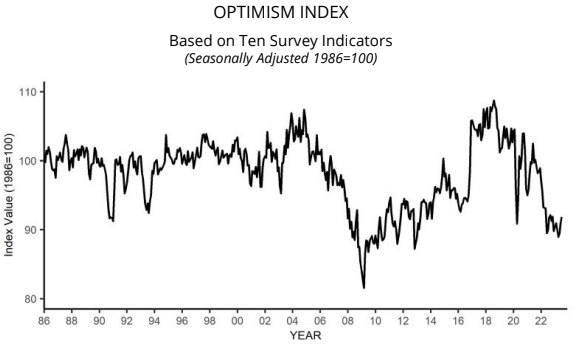

The NFIB Small Business Optimism Index increased 0.9 of a point in July to 91.9, marking the 19th consecutive month below the 49-year average of 98. Twenty-one percent of owners reported that inflation was their single most important problem in operating their business, down three points from June. NFIB Chief Economist Bill Dunkelberg stated:

With small business owners’ views about future sales growth and business conditions dismal, owners want to hire and make money now from solid consumer spending. Inflation has eased slightly on Main Street, but difficulty hiring remains a top business concern.

June 2023 inflation-adjusted exports were up 7.7% year-over-year, imports were down 1.7% year-over-year, and the trade deficit continues to improve. The decrease in imports was widespread as was the increase in exports.

June 2023 sales of merchant wholesalers are down 6.7% from June 2022 (green line on the graph below). While sales are falling, inventories grew 1.3% year-over-year – so the inventory-to-sales ratio worsened from 1.30 a year ago to 1.41 (blue line on the graph below). Normally this is a sign of a slowing economy but there are many factors in play that clouds the interpretation of this data set.

Here is a summary of headlines we are reading today:

- EIA Raises Brent Spot Price Forecast

- U.S. And China Locked In Underwater Tug-of-War

- Will The Steel Price Slide Help Drive The Auto Industry Forward?

- America’s Credit Downgrade: A Sign Of The Times Or Tip Of The Iceberg?

- Cloud stocks falter as Datadog trims 2023 revenue expectations

- Credit card balances jumped in the second quarter and are above $1 trillion for the first time

- Moody’s cuts ratings of 10 U.S. banks and puts some big names on downgrade watch

- Electric Cadillac Escalade to test GM’s EV strategy, cash machine

- Mortgage credit availability sinks to decade low

- Market Snapshot: Dow falls 150 points after weak China data, Moody’s downgrade on regional banks

- Financial Face-Off: Cats vs. dogs: Which pet makes better financial sense?

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.