04Sep2023 Market Close & Major Financial Headlines: Closed For Labor Day

The stock markets are closed today for Labor Day but there is still news. Click on the “Read More” below to read all the headlines we are following today.

Summary Of the Markets Today:

- The Dow n/a,

- Nasdaq n/a,

- S&P 500 n/a,

- Gold n/a,

- WTI crude oil n/a,

- 10-year U.S. Treasury n/a,

- USD index n/a,

- Bitcoin $25,900 down $70

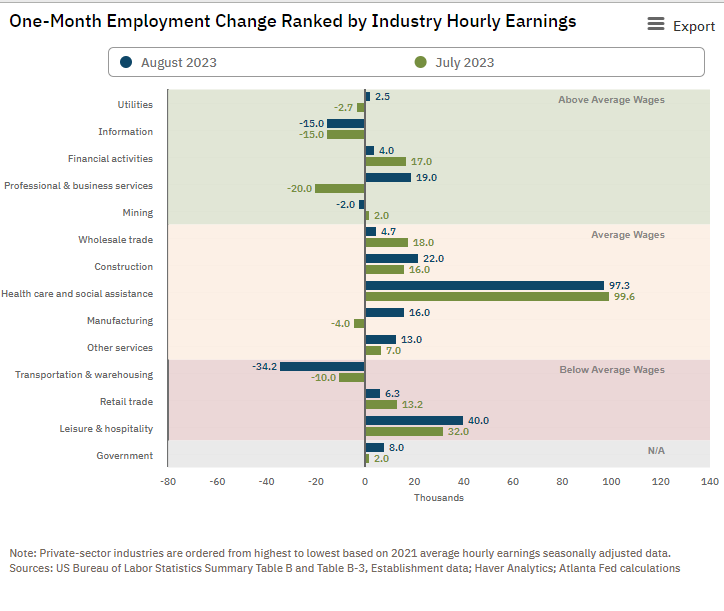

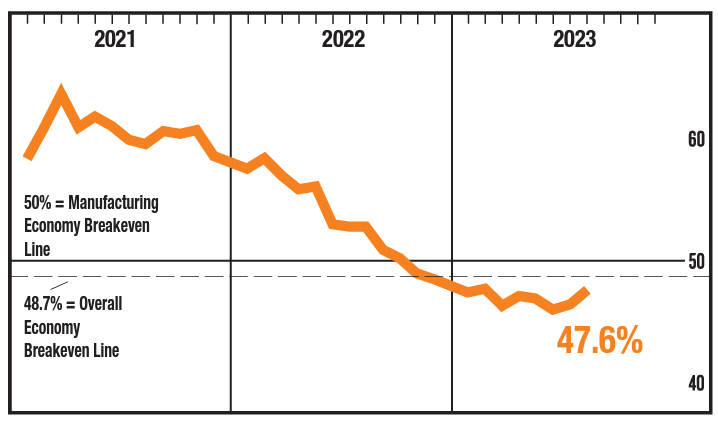

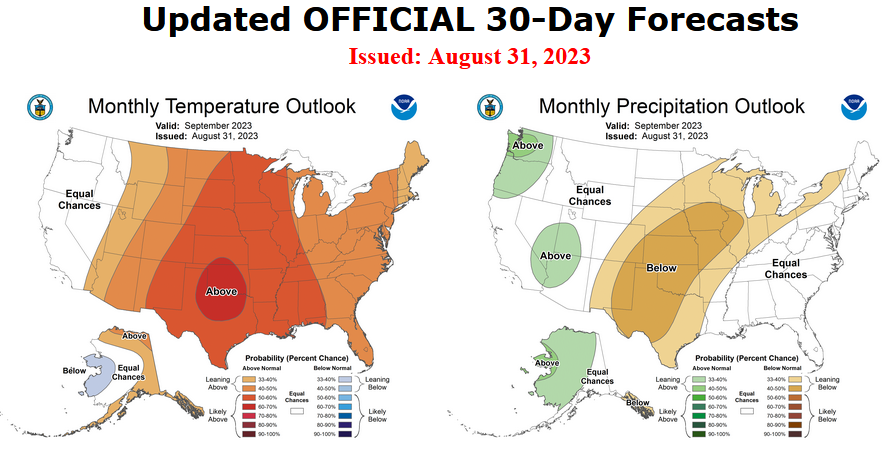

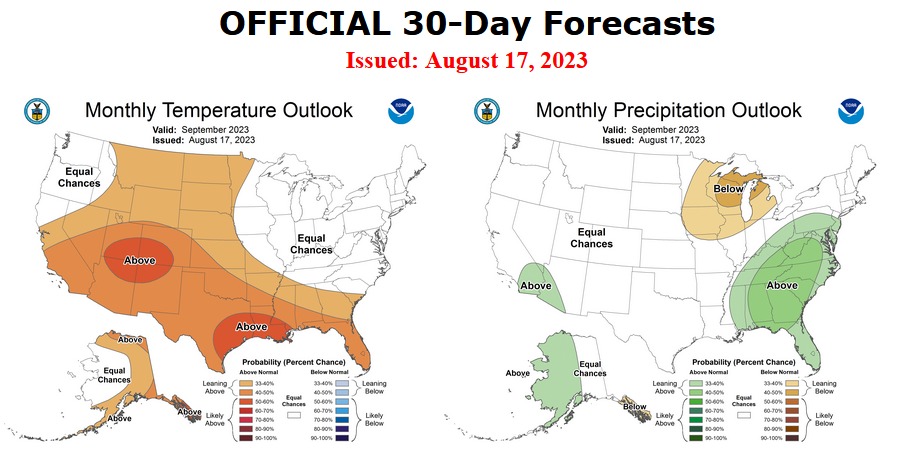

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

No economic releases today

Here is a summary of headlines we are reading today:

- Alaska Air Force Base Home To Mini-Nuclear Reactor Pilot Project

- Putin’s Natural Gas Leverage Over The EU Is Not Entirely Gone

- UK Fuel Prices See One Of The Largest Monthly Increases In 23 Years

- Venezuela’s Oil Exports Plunge By 38% From Three-Year High

- Biden gets low marks on economy and major concerns about his age as he looks to Trump rematch, new poll shows

- BMW: Gasoline Car Ban Poses “Imminent Risk” To European Automakers

- Putin and Erdogan discuss grain deal; Kyiv replaces defense minister

- Germany is the ‘sick man of Europe’ — and it’s causing a shift to the right, top economist says

- Zuckerberg’s “Twitter Killer” App Struggles For Traction

- “Exodus Begins”: Thousands Attempt To Flee Burning Man

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.