12 Sept 2023 Market Close & Major Financial Headlines: Wall Street Opened Lower, Climbed Sharply Higher, But Session Ended Lower

Summary Of the Markets Today:

- The Dow closed down 16 points or 0.05%,

- Nasdaq closed down 1.04%,

- S&P 500 closed down 0.57%,

- Gold $1,936 down $11.5,

- WTI crude oil settled at $89 up $1.71,

- 10-year U.S. Treasury 4.266% down 0.022 points,

- USD Index $104.73 up $0.160,

- Bitcoin $26,097 up $1,092,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our Economic Forecast for September 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

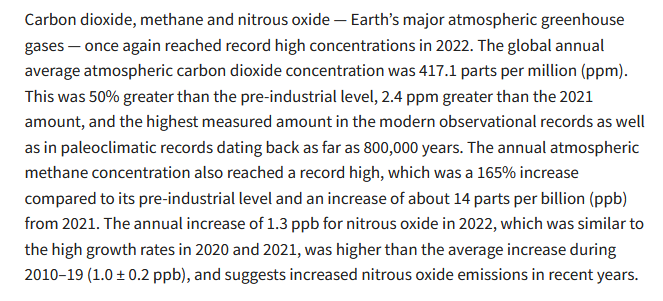

NFIB’s Small Business Optimism Index decreased 0.6 of a point in August to 91.3, the 20th consecutive month below the 49-year average of 98. 23% of small business owners reported that inflation was their single most important business problem, up two points from last month. I believe that Main Street is in a recession, and the index value for small businesses supports this opinion. NFIB Chief Economist Bill Dunkelberg stated:

With small business owners’ views about future sales growth and business conditions discouraging, owners want to hire and make money now from strong consumer spending. Inflation and the worker shortage continue to be the biggest obstacles for Main Street.

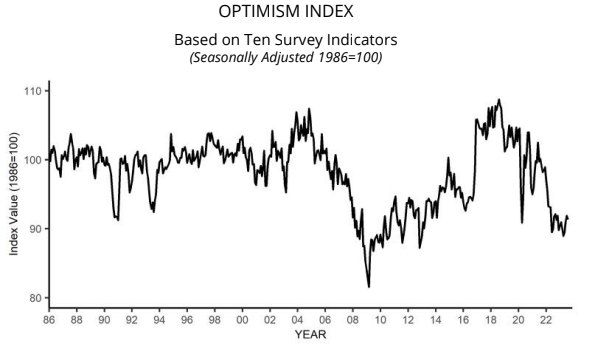

The CoreLogic Home Price Index (HPI) and HPI Forecast for July 2023 show U.S. home prices rebounded year over year in July, increasing to 2.5% and following two months of 1.6% annual gains. The annual reacceleration reflects six consecutive monthly gains, which drove prices about 5% higher compared to the February bottom. The 11 states that saw home price declines were all in the West, but since many of those markets continue to struggle with inventory shortages, that trend may be short-lived, and recent buyer competition will causes prices to heat up again. CoreLogic projects that all states that saw year-over-year losses in July will begin posting gains by October of this year. Selma Hepp, chief economist for CoreLogic stated:

Annual home price growth regained momentum in July, which mostly reflects strong appreciation from earlier this year. That said, high mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages. In other words, home prices are still growing but are in line with historic seasonal expectations. Nevertheless, the projection of prolonged higher mortgage rates has dampened price forecasts over the next year, particularly in less-affordable markets. But as there is still an extreme inventory shortage in the Western U.S., home prices in some of those markets should see relatively more upward pressure.

Here is a summary of headlines we are reading today:

- U.S. Discovers Lithium Deposit Bigger Than Bolivia’s Salt Flats

- Chevron To Be Majority Owner Of World’s Largest Hydrogen Production Facility

- Oil Prices Soar To 10-Month High

- Renewables Are Gaining Ground, But Coal Is Still King

- Here’s everything Apple just announced at its 2023 event: iPhone 15 models, new Apple Watch, new AirPods

- Nasdaq closes lower by 1% Tuesday as Apple slides and tech suffers, Oracle sheds 13%: Live updates

- Sen. Blumenthal plans action against telemarketing scams masquerading as political, charitable causes

- Oracle stock is poised for its steepest drop since 2002 on weak revenue guidance

- US Real Household Incomes Slide For 3rd Year In A Row As White Incomes Tumble; Blacks, Hispanics Gain

- 10Y Treasury Auction Prices On The Screws At Highest Yield Since Nov 2007

- 8 commodities stocks touched their 52-week high, gaining up to 40% in a month

- Market Snapshot: Stocks fall after Apple unveils iPhone 15, with U.S. inflation data looming

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The Federal Reserve data release (Z.1 Flow of Funds) – which provides insight into the finances of the average household – shows an increase in average household net worth and an improvement in income. Our modeled “Joe Sixpack” – who owns a house and has a job, but essentially no other asset – is better off than he was last quarter.

The Federal Reserve data release (Z.1 Flow of Funds) – which provides insight into the finances of the average household – shows an increase in average household net worth and an improvement in income. Our modeled “Joe Sixpack” – who owns a house and has a job, but essentially no other asset – is better off than he was last quarter.