Summary Of the Markets Today:

- The Dow closed up 6 points or 0.02%,

- Nasdaq closed up 0.01%,

- S&P 500 closed up 0.07%,

- Gold $1,954 up $8.20,

- WTI crude oil settled at $92 up $0.95,

- 10-year U.S. Treasury 4.313% down 0.009 points,

- USD Index $105.12 down $0.200,

- Bitcoin $26,834 up $331,

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

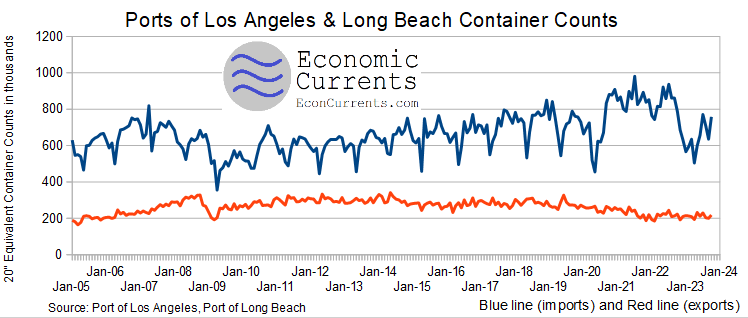

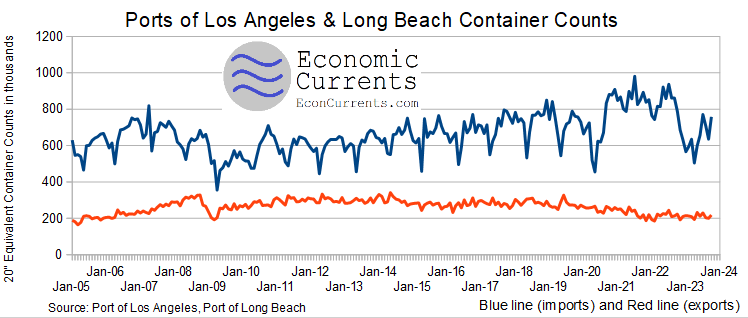

40% of sea container imports come through the Ports of Los Angeles and Long Beach. Container statistics are published weeks to months before import data is released by the government. For the month of August 2023, there was an improvement (imports only down 4% and exports only down 2%) but as you can see from the graph below – imports and exports are below their historical averages. Imports are normally a sign of how well the US economy is performing, and imports are saying the economy is weak. The quantity of imports could have been elevated by container ships from Asia to east coast ports rerouting cargo to the west coast due to congestion / delays in the Panama Canal.

Here is a summary of headlines we are reading today:

- Oil Closes In On $95 Per Barrel, Hitting $100 In Some Markets

- $6 Billion In Iranian Oil Funds Unfrozen As Tehran Releases U.S. Prisoners

- U.S. Gasoline Prices Rise On Refinery Outages

- ChatGPT’s Surprising Environmental Footprint Revealed

- Striking unions impacting the economy at a level not seen in decades

- Stellantis could close 18 facilities under UAW deal — here are the full details of its latest offer

- S&P 500 closes little changed Monday as traders await Fed policy meeting: Live updates

- Goldman says iPhone demand outpacing supply, sees more than 20% upside for Apple shares

- Elon Musk says Twitter, now X, is moving to small monthly subscription and has 550 million users

- Moderna Plunges After Pfizer Sees Just 24% Of Americans Seeking Covid Boosters

- “How Do You Lose An F-35?”: US Military Can’t Find Stealth Jet After “Mishap”

- Bitcoin climbs above $27,000 for the first time since August

- Economic Report: UAW auto strike looms large for inflation and economy

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.