NOAA Updates its October 2023 Weather Outlook on September 30, 2023 – There have been some significant changes from the Mid-Month Outlook.

At the end of every month, NOAA updates its Outlook for the following month which in this case is October of 2023. We are reporting on that tonight.

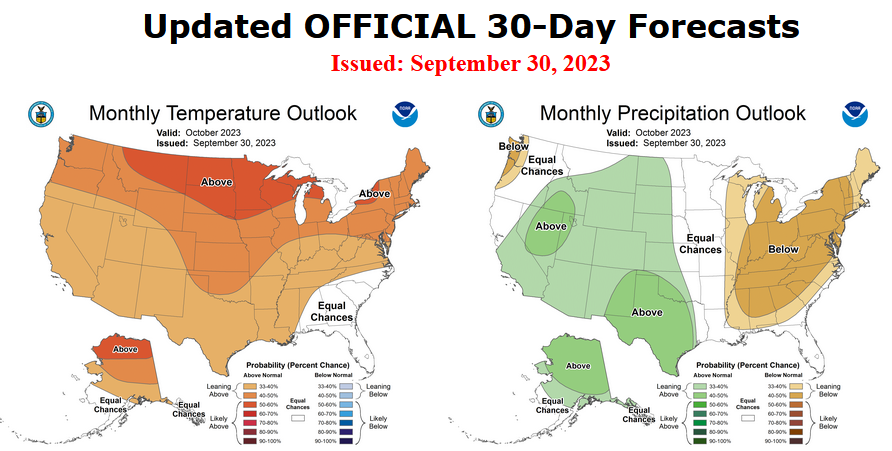

There have been some significant changes in the Outlook for October and these are addressed in the NOAA Discussion so it is well worth reading. We provided the prior Mid-Month Outlook for October for comparison. It is easy to see the changes by comparing the Mid-Month and Updated Maps.

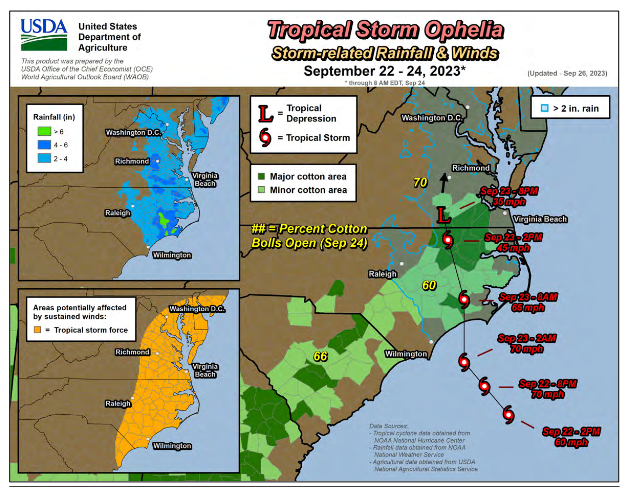

The article includes the Drought Outlook for October. NOAA also adjusted the previously issued Seasonal Drought Outlook to reflect the changes in the October Drought Outlook. We have included a map showing the water-year-to-date precipitation. We also provide the Week 2/3 Tropical Outlook for the World.

The best way to understand the updated outlook for October is to view the maps and read the NOAA discussion. I have highlighted the key statements in the NOAA Discussion.

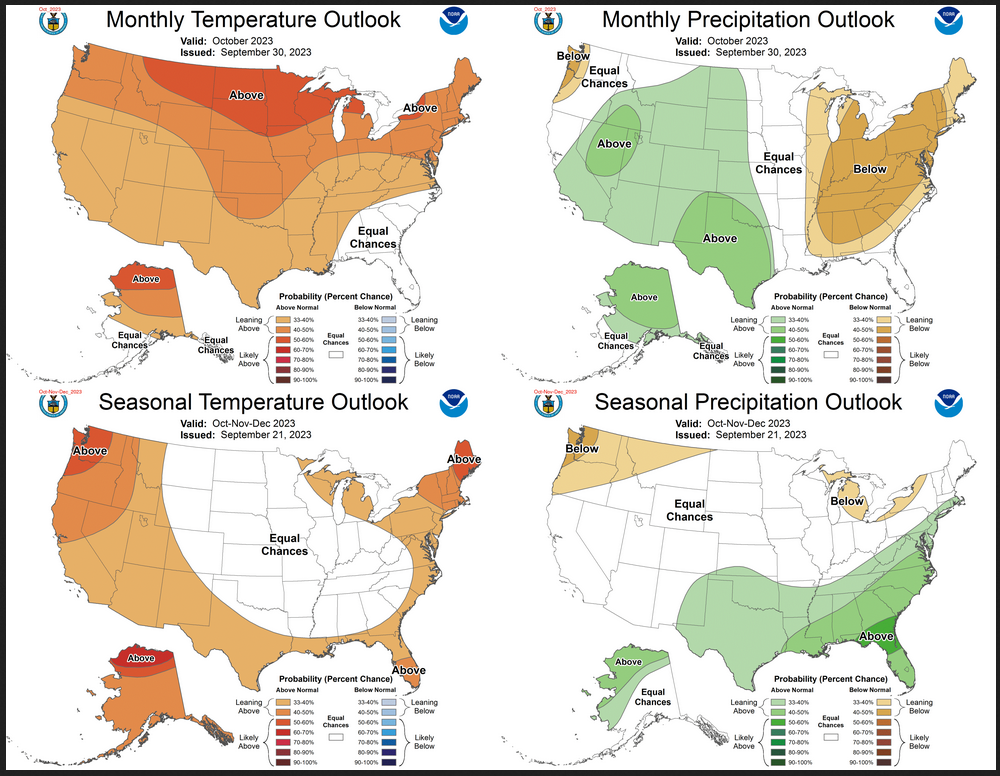

Here is the updated Outlook for October 2023

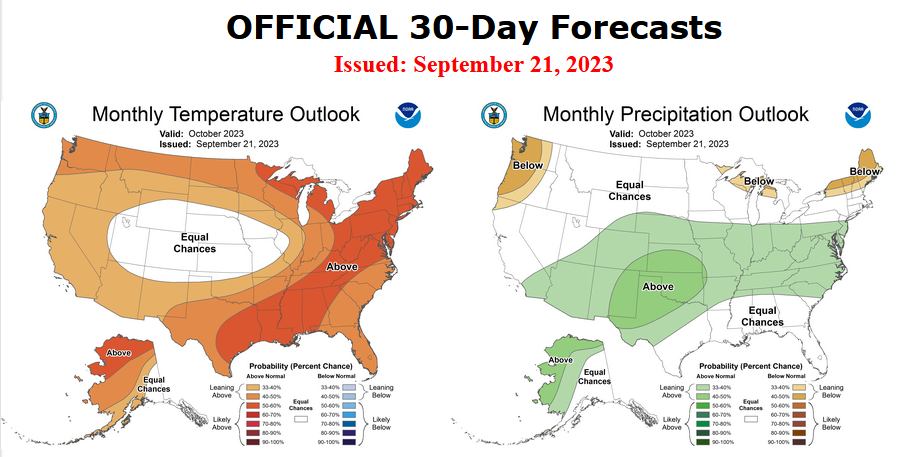

For Comparison Purposes, Here is the Mid-Month Outlook for October.

| There have been some significant changes. Remember, it is the top set of maps that are the current outlook for October. |

Combination of the Updated Outlook for October and the Three-Month Outlook