America: It is democracy, stupid!

In a previous post, I called out “America: It is the political system, stupid!” What, then, is America’s political system?

Democracy!

In other words, “it is democracy, stupid!”

In a previous post, I called out “America: It is the political system, stupid!” What, then, is America’s political system?

Democracy!

In other words, “it is democracy, stupid!”

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

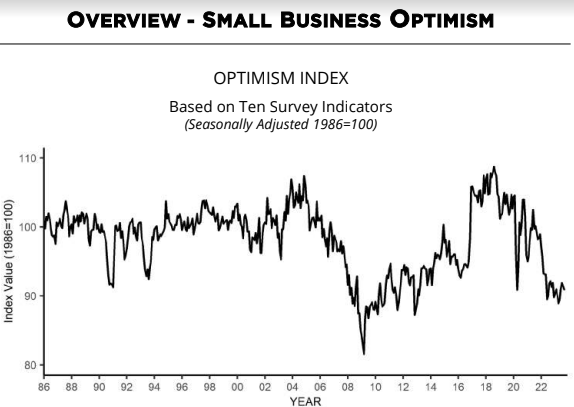

The NFIB Small Business Optimism Index decreased half of a point in September to 90.8. September’s reading marks the 21st consecutive month below the 49-year average of 98. Twenty-three percent of owners reported that inflation was their single most important problem in operating their business, unchanged from last month and tied with labor quality as the top concern. Bill Dunkelberg, NFIB Chief Economist stated:

Owners remain pessimistic about future business conditions, which has contributed to the low optimism they have regarding the economy. Sales growth among small businesses have slowed and the bottom line is being squeezed, leaving owners few options beyond raising selling prices for financial relief.

August 2023 sales of merchant wholesalers were down 1.7% from August 2022. Total inventories were down 1.0% from the revised August 2022 level. The August inventories/sales ratio for merchant wholesalers was 1.36. The August 2022 ratio was 1.35. Overall, my view is that this economic sector is little changed from one year ago.

The Federal Reserve Bank of New York’s Center for Microeconomic Data today released the September 2023 Survey of Consumer Expectations, which shows that inflation expectations increased slightly at the short- and medium-term horizons, while they decreased at the longer-term horizon. Labor market expectations were mixed with unemployment expectations deteriorating and perceived job loss risk improving. Households’ perceptions and expectations for credit conditions deteriorated slightly.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Tue Oct 10 2023

Valid 12Z Tue Oct 10 2023 – 12Z Thu Oct 12 2023…Colder and unsettled weather to move east from the Pacific Northwest

and northern California through mid-week while above average temperatures

shift into parts of the Great Plains……Surge of tropical moisture to bring an increased threat for heavy rain

and flash flooding for portions of the Gulf Coast through Wednesday…

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

No releases today due to Columbus Day et al

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Mon Oct 09 2023

Valid 12Z Mon Oct 09 2023 – 12Z Wed Oct 11 2023…Colder and unsettled weather to move east from the Pacific Northwest

and northern California through mid-week while above average temperatures

shift from the Interior West into the Great Plains……Below average temperatures continue for the Great Lakes and Ohio Valley

while lake effect showers persist through Tuesday……Surge of tropical moisture to bring an increased threat for heavy rain

and flash flooding for southern Texas on Tuesday…

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Sun Oct 08 2023

Valid 12Z Sun Oct 08 2023 – 12Z Tue Oct 10 2023…Heavy rain from the remnants of Philippe will come to an end across

Maine this morning but lingering areas of flooding and gusty winds will

remain into the day……Below average temperatures for much of the Great Lakes and eastern U.S.

along with lake effect rain showers and thunderstorms downwind of the

Great Lakes……Colder and wetter weather to arrive on the West Coast Monday, but above

average warmth to remain for the Interior West and Rockies..

The full data sets for the 71 years from 1952 to 2022 show no discernable association patterns (correlations) for mortgage debt growth and inflation changes.1 This post continues that analysis by looking specifically at the various regimes of inflation change during the 71-year timeline.

From a photo by Tierra Mallorca on Unsplash

Drought has been a problem this year in the corn and soybean growing area but it has been an ongoing problem for some time. Global Warming makes it worse especially in areas where it leads to reduced precipitation. But in all areas, it results in higher rates of evaporation and possible transpiration.

We are not going into drought in detail in this article but I am showing you some of what comes across my desk from NOAA that you might find interesting.

| You need to click HERE to watch the droughts unfold. Then you can scroll down to see how drought unfolded since 1921. It uses different metrics than the current drought monitor which allows us to go back farther in time. It is very dramatic. It was not possible for me to directly show the images in this article. |

Now we will take a look a the drought history from 2000 to 2020

| I have not included the criteria for the various categories of drought but you can see that since the Drought Monitor has been in existence drought has been fairly prevalent with short periods of minimal drought. |

Short Range Forecast Discussion

NWS Weather Prediction Center College Park MD

Sat Oct 07 2023

Valid 12Z Sat Oct 07 2023 – 12Z Mon Oct 09 2023…Remnants of Philippe to bring heavy rainfall with the risk of flash

flooding as well as gusty winds to the Northeast through early Sunday

morning……Much cooler temperatures to spread eastward from the central U.S. into

much of the eastern U.S. this weekend……Much above average temperatures and dry conditions for the West…

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

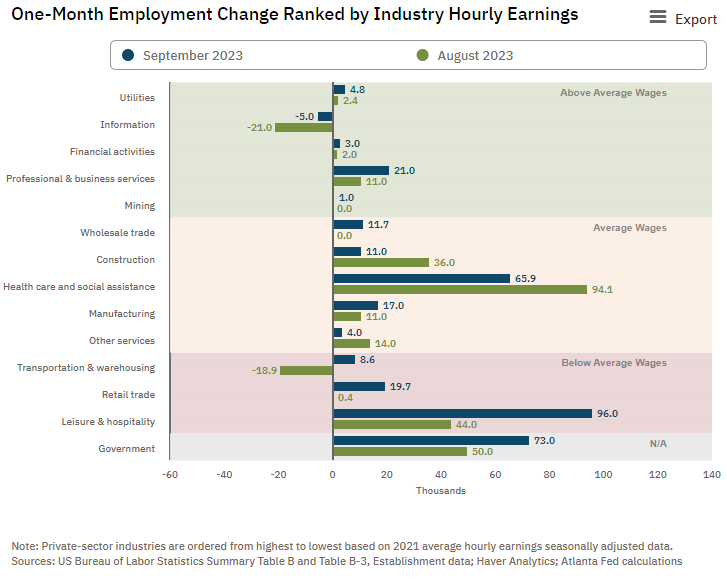

The markets were hoping for small employment gains in expectation that the Fed would stop raising the federal funds rate but instead, the total nonfarm payroll employment rose by 336,000 in September 2023 with the unemployment rate unchanged at 3.8%. The largest job gains occurred in leisure and hospitality (96,000); government (73,000); and health care (65,900). Any job gains over 150,000 is considered enough to provide jobs to those newly entering the workforce. The September employment gain was the second largest of 2023.

Interestingly, the household survey of the employment report showed only 90,000 employment gains against the headline establishment survey gain of 336,000 which throws into question the large gains of the establishment survey.

In August 2023, consumer credit decreased at a seasonally adjusted annual rate of 3.8%. Revolving credit increased at an annual rate of 13.9%, while nonrevolving credit decreased at an annual rate of 9.8%. I personally do not like the Federal Reserve’s methods for calculating changes in growth – I use year-over-year growth to remove the volatility. Using year-over-year methodology, consumer credit growth fell to 4.0% (blue line on the graph below), and adjusting for inflation growth was 2.0% year-over-year (red line on the graph below). The bottom line is that overall consumer credit is growing around the historical average, however, credit card (revolving credit) use has returned to the levels seen in the higher inflation periods of 1970s to 2000.

Here is a summary of headlines we are reading today:

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.