Summary Of the Markets Today:

- The Dow closed down 46 points or 0.14%,

- Nasdaq closed up 0.07%,

- S&P 500 closed up 0.12%,

- Gold $1,985 up $20.20,

- WTI crude oil settled at $73 down $3.79,

- 10-year U.S. Treasury 4.449% down 0.088 points,

- USD Index $104.42 up $0.020,

- Bitcoin $36,903 down $1,660 ( 4.42% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Industrial production declined 0.7% year-over-year in October 2023 (blue line in the graph below). The manufacturing component fell 1.7% year-over-year (red line in the graph below), the utilities component was up 2.9% year-over-year (green line in the graph below), and the mining component was up 2.2% year-over-year (orange line in the graph below). Much of the decline this month in manufacturing was due to a 10 percent drop in the output of motor vehicles and parts that were affected by strikes at several major manufacturers of motor vehicles. Capacity utilization moved down 0.6 percentage points to 78.9 percent in October, a rate that is 0.8 percentage point below its long-run (1972–2022) average. Manufacturing remains in a recession.

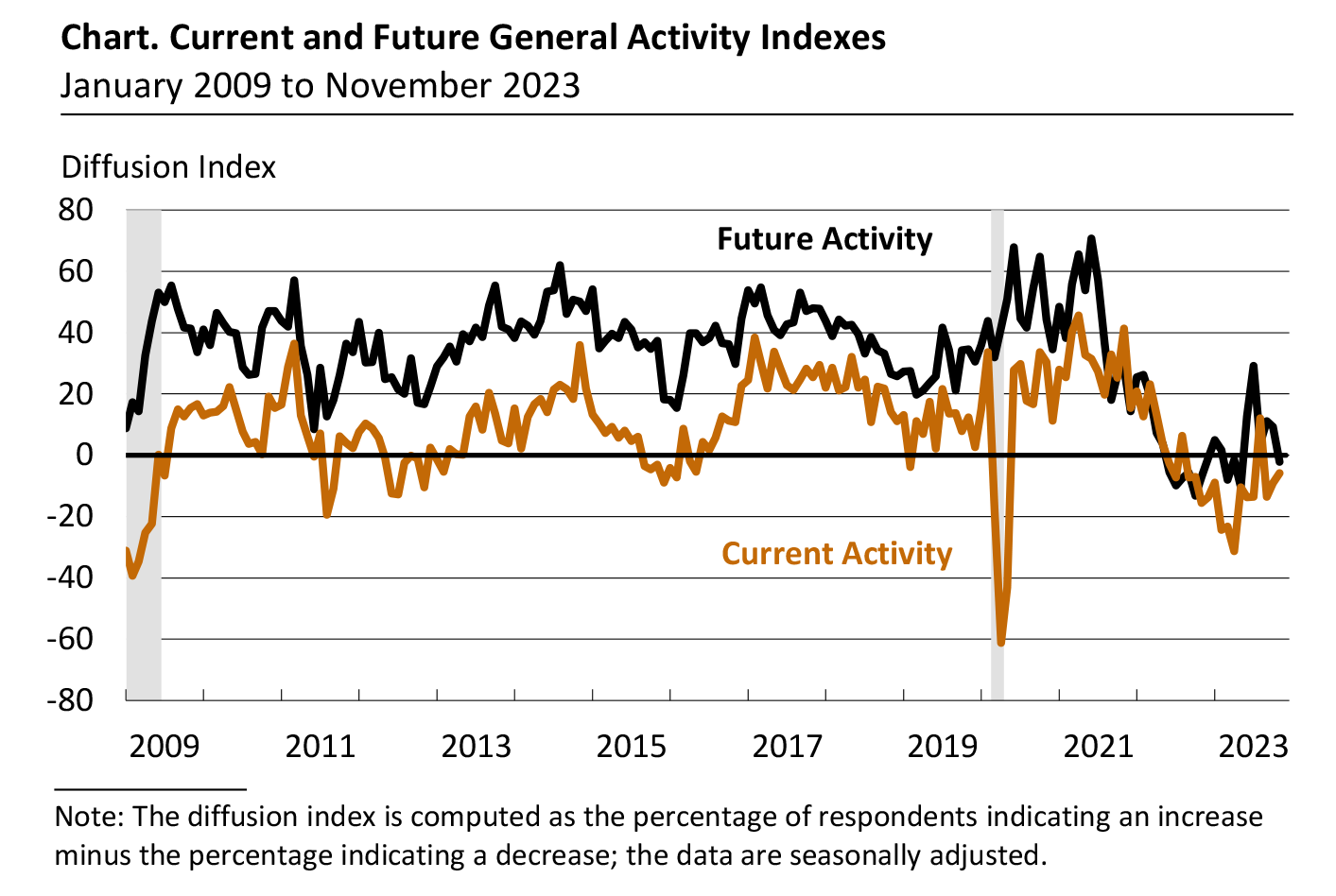

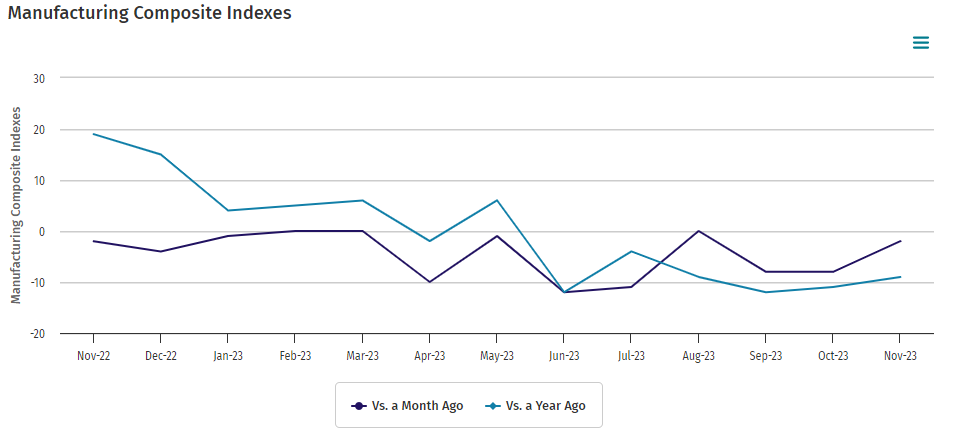

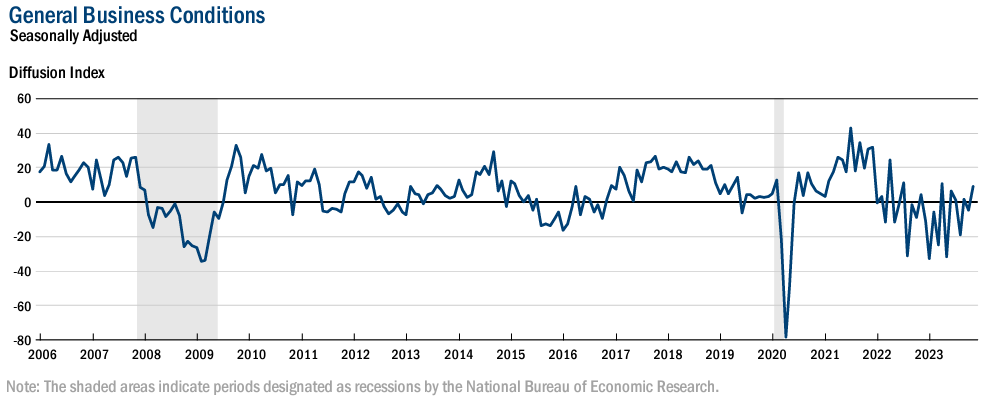

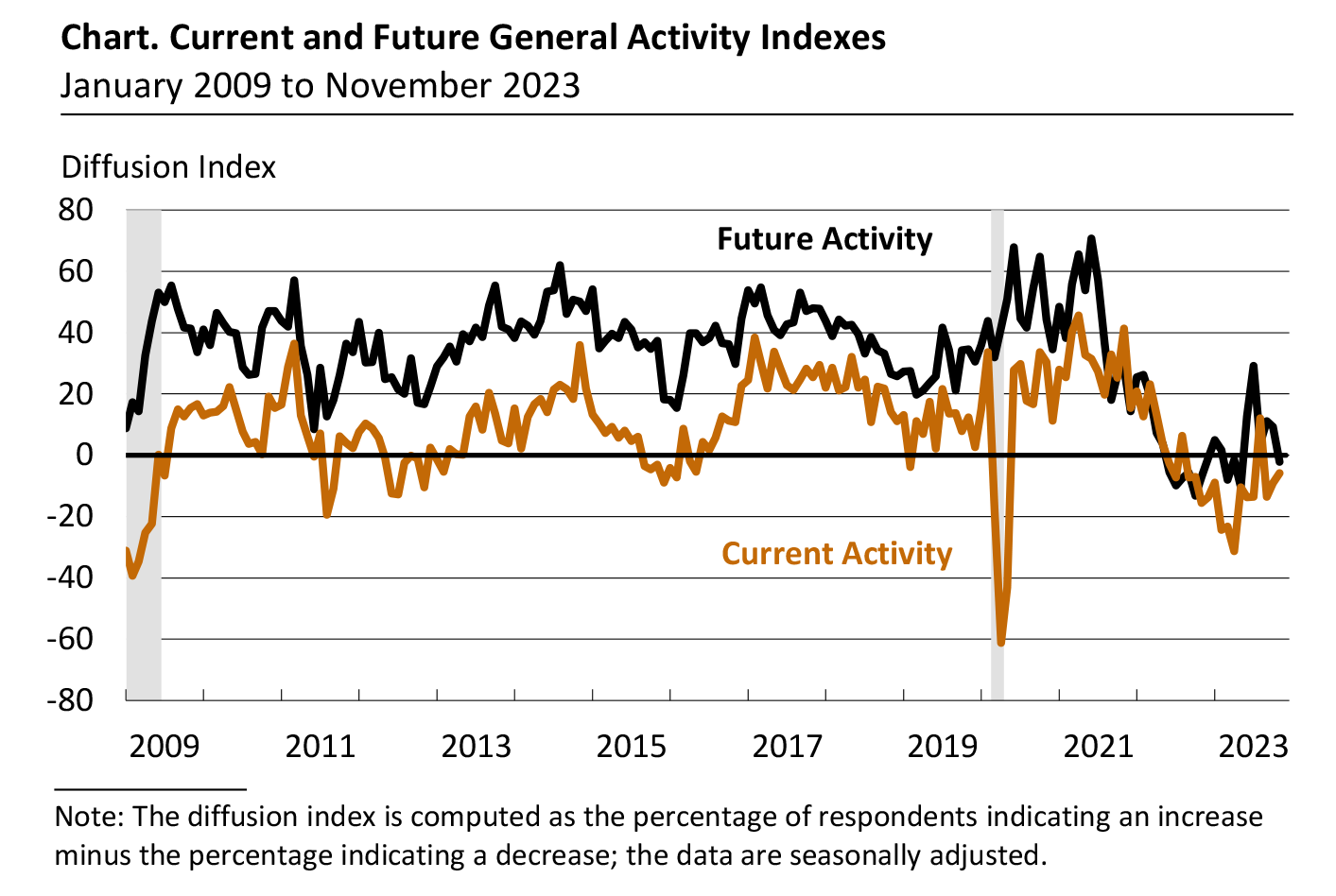

The Philly Fed Manufacturing Business Outlook Survey shows manufacturing activity in the region continued to decline overall in November 2023. The survey’s indicator for general activity rose but remained negative. The indicator for shipments turned negative, while the indicator for new orders was positive but low. I will never be a fan of surveys, and this one directly contradicts the New York Fed’s Empire manufacturing survey released yesterday. I see very few signs of the manufacturing sector climbing out of its current recession.

U.S. import prices declined 2.0% year-over-year in October 2023 – down from -1.5% year-over-year the previous month. Export prices also declined -4.9% year-over-year – down from -4.3% year-over-year the previous month. Disinflation continues in export/import data – and is normally a signal of weak economies.

The number of CEO changes at U.S. companies fell in October as 105 CEOs left their posts in the month. It is down 34% from the 164 CEO changes announced in September, and up 48% from the 71 CEOs who left their posts in the same month last year, according to a report released Thursday by global outplacement and business and executive coaching firm Challenger, Gray & Christmas, Inc. So far this year, 1,530 CEOs have left their posts, up 47% from the 1,040 CEO changes during the same period in 2022. It is the highest total in the first ten months of the year since the firm began tracking in 2002. Andrew Challenger, workplace expert and Senior Vice President stated:

Boards are making leadership changes to better manage the issues of remote workers, to weather economic headwinds, and incorporate new technology. Meanwhile, CEOs who have taken on unprecedented challenges the last few years are taking the opportunity to leave.

In the week ending November 11, the advance figure for seasonally adjusted

initial unemployment claims 4-week moving average was 220,250, an increase of 7,750 from the previous week’s revised average. The previous week’s average was revised up by 250 from 212,250 to 212,500.

Here is a summary of headlines we are reading today:

- EU Clamps Down on Companies Aiding Russian War Efforts

- Innovative Glass Coating Harnesses Cosmic Cold for Climate Control

- Thanksgiving Travel Surges To Pre-Covid Peaks, Marking A Return To Normalcy

- Oil Sheds Over 3% As Markets Remain Unconvinced On China

- America’s Best-Selling Sedan Will Be Hybrid-Only by 2025

- Deflation could be coming this holiday season, Walmart CEO says

- Judge lifts Trump gag order in $250 million New York business fraud case

- Boeing bonanza leaves rival Airbus in the dust at 2023 Dubai Air Show with three times more aircraft orders

- Over 100 Faculty Rip Harvard President’s Condemnation Of Slogan “From The River To The Sea”

- Elon Musk pours cold water on Starlink IPO in 2024

- Bond Report: 10-year Treasury yield sinks to 4.4% on softer economic data, Walmart CEO talks of ‘deflation’

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.