Summary Of the Markets Today:

- The Dow closed down 63 points or 0.18%,

- Nasdaq closed down 0.59%,

- S&P 500 closed down 0.20%, High 4,319: 4,200 = critical resistance level)

- Gold $2,001 up $20.70,

- WTI crude oil settled at $78 down $0.01,

- 10-year U.S. Treasury 4.406% down 0.016 points,

- USD Index $103.60 up $0.160,

- Bitcoin $36,869 down $574 ( 1.53% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

CoreLogic’s Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas shows annual U.S. single-family rent growth dropped to the lowest level in three years in September, but the 2.6% increase is down only slightly from the pre-pandemic average. Molly Boesel, principal economist for CoreLogic stated:

Single-family rent growth eased again in September and is now back to the rate recorded before the pandemic. While low-tier rental gains are slowing, they have still surpassed those of their higher-priced counterparts since early 2020. Slowing month-over-month rent growth in September reflects typical seasonal patterns, but indications are that annual gains will remain positive through the rest of 2023.

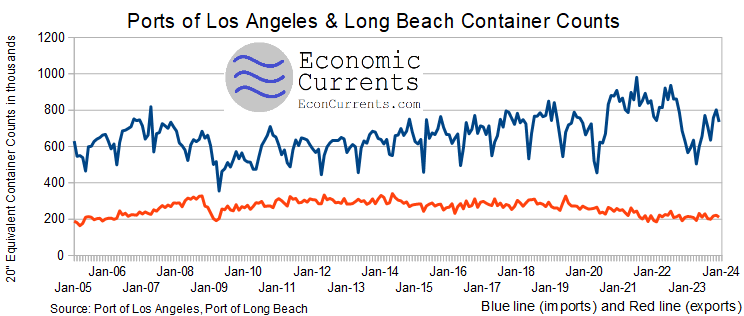

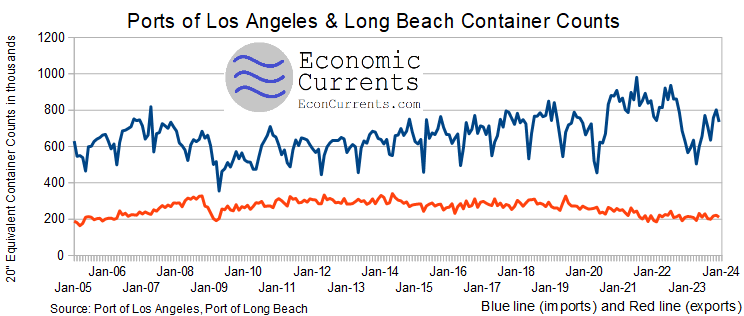

The Ports of Los Angeles and Long Beach (who handle over 40% of container freight traffic in the US) had another good month in October 2023 with imports up 17.0% year-over-year and exports unchanged YoY. Rising import data generally signals an improving US economy.

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) three-month moving average, CFNAI-MA3, decreased to –0.22 in October from a neutral value in September. I believe the CFNAI is the best coincident indicator which is saying that the economy has slowed. Periods of economic expansion have historically been associated with values of the CFNAI-MA3 above –0.70.

Existing-home sales dropped in October 2023 with year-over-year sales tumbling 14.6%. The median existing-home price for all housing types in October was $391,800, an increase of 3.4% from October 2022 ($378,800). NAR Chief Economist Lawrence Yun added:

Prospective home buyers experienced another difficult month due to the persistent lack of housing inventory and the highest mortgage rates in a generation. Multiple offers, however, are still occurring, especially on starter and mid-priced homes, even as price concessions are happening in the upper end of the market.

Highlights of the minutes of the Federal Open Market Committee held on October 31–November 1, 2023:

… Participants noted that real GDP had expanded at an unexpectedly strong pace in the third quarter, boosted by a surge in consumer spending … Participants assessed that while labor market conditions remained tight, they had eased since earlier in the year, partly as a result of recent increases in labor supply.

… some participants remarked that the finances of some households—especially those in the low- and moderate-income categories—were increasingly coming under pressure amid high prices for food and other essentials as well as tight credit conditions. Several participants added that delinquencies on auto loans and credit cards had risen for these households.

… Participants observed that, notwithstanding the moderation of inflation so far, inflation remained well above the Committee’s 2 percent longer-run objective and that elevated inflation was continuing to harm businesses and households, particularly low-income households. Participants stressed that they would need to see more data indicating that inflation pressures were abating to be more confident that inflation was on course to return to 2 percent over time.

… Participants noted that in recent months, financial conditions had tightened significantly because of a substantial run-up in longer-term Treasury yields, among other factors. Higher Treasury yields contributed to an increase in 30-year mortgage rates to levels not seen in many years and led to higher corporate borrowing rates. Many participants observed that a range of measures suggested that the rise in longer-term yields had been driven primarily or substantially by a rise in the term premiums on Treasury securities. Participants generally viewed factors such as a fiscal outlook that suggested greater future supply of Treasury securities than previously thought and increased uncertainty about the economic and policy outlooks as likely having contributed to the rise in the term premiums.

… Participants commented on the significant tightening in financial conditions in recent months, driven by higher longer-term yields, with many noting that it was uncertain whether this tightening of financial conditions would persist and to what extent it reflected expectations for tighter policy or other factors. Amid these economic conditions, all participants judged it appropriate to maintain the target range for the federal funds rate at 5¼ to 5½ percent at this meeting. Participants judged that maintaining this restrictive stance of policy at this meeting would support further progress toward the Committee’s goals while allowing more time to gather additional information to evaluate this progress.

… But with inflation still well above the Committee’s longer-run goal and the labor market remaining tight, most participants continued to see upside risks to inflation. These risks included the possibility that the imbalance of aggregate demand and supply could persist longer than expected and slow the progress on inflation, geopolitical tensions and risks emanating from global oil markets, the effects of a tight housing market on shelter inflation, and the potential for more limited declines in goods prices.

Here is a summary of headlines we are reading today:

- Is Elon Musk’s Social Media Drama Hurting Tesla?

- Thanksgiving Travel Underway With Gasoline Demand Jumping 7.6%

- Ford Scales Back Capacity Of New Battery Plant By 42%

- Copper Prices Inch Higher on Shifting Sentiment

- Trillion Dollar Bailout: What Xi Really Wants From Biden

- Fed gave no indication of possible rate cuts at last meeting, minutes show

- The S&P 500 is starting to form a ‘cup and handle’ pattern. How to watch for the potential breakout ahead

- ‘Funflation’ drives sporting event ticket prices up a whopping 25%

- High-End Retailers Face Downturn As Wealthy Americans Cut Back On Spending

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.