01 Dec 2023 Market Close & Major Financial Headlines: Another Strong Session For The Dow Closing Up 295 Points

Summary Of the Markets Today:

- The Dow closed up 294 points or 0.82%,

- Nasdaq closed up 0.55%,

- S&P 500 closed up 0.59%,

- Gold $2,090 up $32.80,

- WTI crude oil settled at $74 down $1.72,

- 10-year U.S. Treasury 4.217% down 0.135 points,

- USD Index $103.22 down $0.280,

- Bitcoin $38,804 up $1,079 ( 2.86% ),

- Baker Hughes U.S. Rig Count up 3 to 625

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Construction spending during October 2023 was 10.7% above October 2022 (10.0% inflation-adjusted). During the first ten months of this year, construction spending was 5.6% above the same period in 2022. Construction definitely is in a growth spurt.

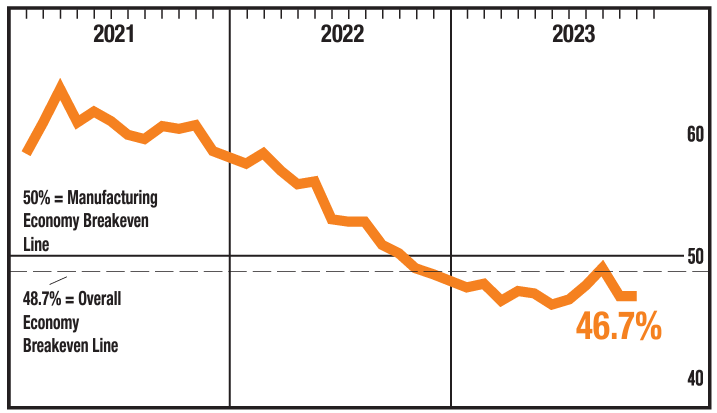

The ISM Manufacturing PMI® registered 46.7% in November 2021, unchanged from the 46.7% recorded in October. A Manufacturing PMI® above 48.7 percent, over a period of time, generally indicates an expansion of the overall economy. The New Orders Index remained in contraction territory at 48.3%.

Here is a summary of headlines we are reading today:

- U.S. Adds Three More Shippers to Russian Sanction List over Oil Price Cap

- U.S. Oil Drillers See More Gains As OPEC+ Agrees to Cut Production

- Guyana on Edge Amid Rumors of a Venezuelan Invasion

- Oil Markets Confused and Underwhelmed by OPEC+ Cuts

- Fed Chair Powell calls talk of cutting rates ‘premature’ and says more hikes could happen

- S&P 500 rises on Friday to close at 2023 high: Live updates

- Bitcoin hits highest level since May 2022 to kick off December: CNBC Crypto World

- Market Snapshot: Dow tops 36,000 after remarks by Fed’s Powell, S&P 500 heads for highest close of 2023

- Futures Movers: Oil prices settle at a 2-week low as OPEC+ decision disappoints

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

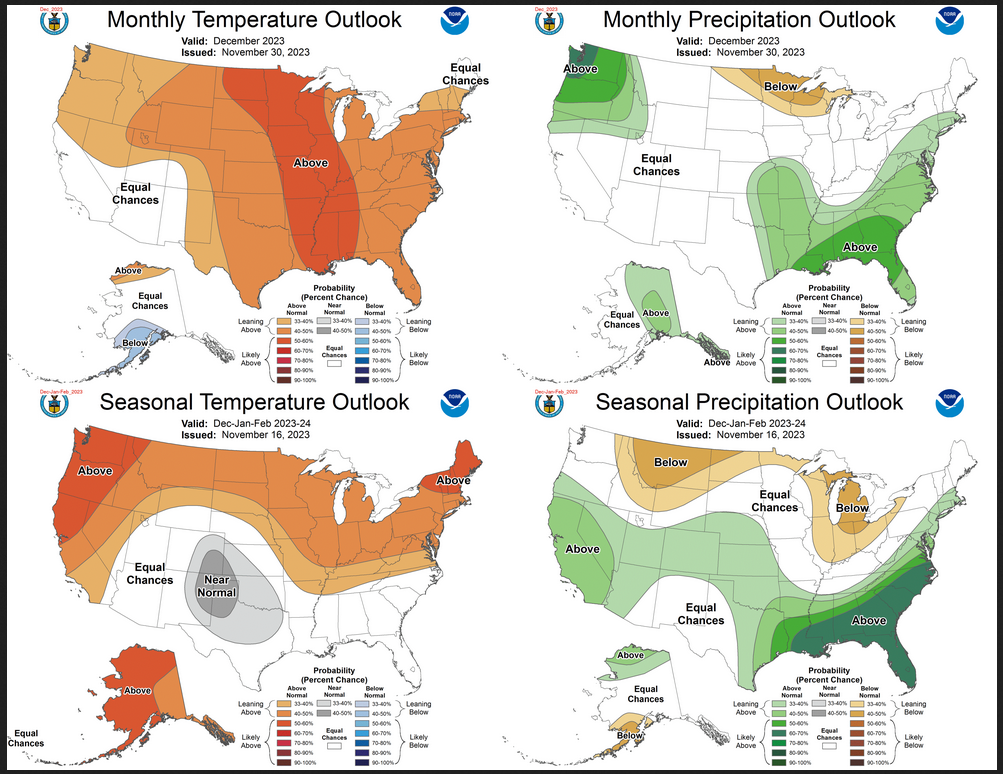

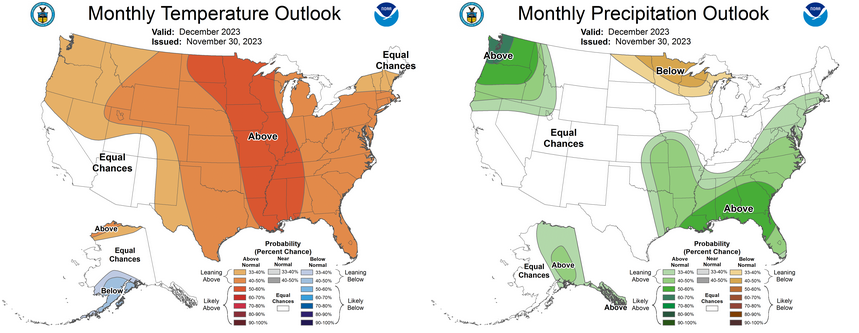

NOAA Updates its December 2023 Weather Outlook on November 30, 2023 – There have been some significant changes from the Mid-Month Outlook.

Slightly modified at 6 pm EST December 1, 2023, to add additional clarity to the author’s comments.

At the end of every month, NOAA updates its Outlook for the following month which in this case is December of 2023. We are reporting on that tonight.

There have been some significant changes in the Outlook for December and these are addressed in the NOAA Discussion so it is well worth reading. We provided the prior Mid-Month Outlook for December for comparison. It is easy to see the changes by comparing the Mid-Month and Updated Maps.

The article includes the Drought Outlook for December. NOAA also adjusted the previously issued Seasonal Drought Outlook to reflect the changes in the December Drought Outlook. We have included a map showing the water-year-to-date precipitation. We also provide the Week 2/3 Tropical Outlook for the World.

The best way to understand the updated outlook for December is to view the maps and read the NOAA discussion. I have highlighted the key statements in the NOAA Discussion.

Here is the updated Outlook for December 2023

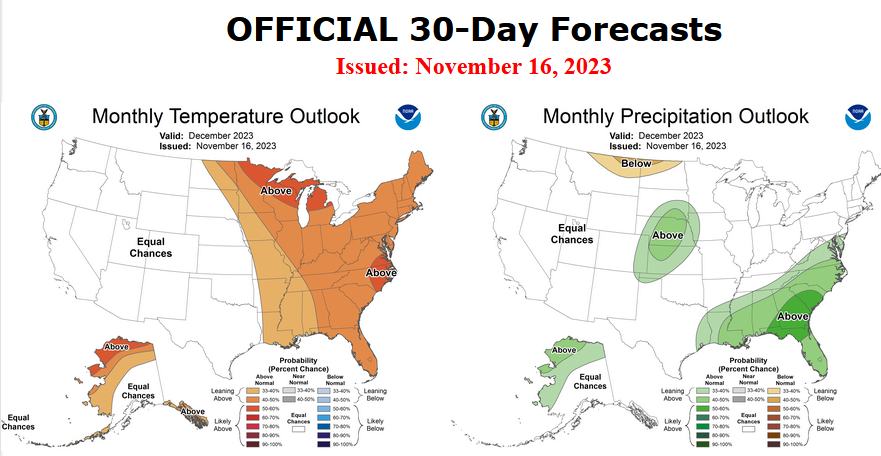

For Comparison Purposes, Here is the Mid-Month Outlook for December.

| There have been some significant changes especially related to Temperature. Remember, it is the top set of maps that are the current outlook for December. We are not sure that NOAA (actually their CPC Divison) has moved the storm track sufficiently south given the strength of this El Nino as measured by the Nino 3.4 Index. But it takes time for the impacts of an El Nino to be fully felt and there are conflicting factors. The sample size of very strong El Nino’s is very small so this complicates the forecasting process. The probability that his El Nino will record as being historically strong is less than 50% but well above zero. The atmosphere has not responded to the extent one might expect by just looking at the Nino 3.4 Index. The El Ninos with the highest level of the Nino 3.4 Index are not always the wettest but sometimes are. So we are dealing with a fair amount of uncertainty. You can track the changes in our Daily Weather Article. |

Combination of the Updated Outlook for December and the Three-Month Outlook

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted December 1, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

30Nov2023 Market Close & Major Financial Headlines: DOW Surges On Combination of Easing Inflation Concerns, Strong Salesforce Earnings, and Positive Investor Sentiment

Summary Of the Markets Today:

- The Dow closed up 520 points or 1.47%,

- Nasdaq closed down 0.23%,

- S&P 500 closed up 0.38%,

- Gold $2036 down $11,

- WTI crude oil settled at $76 down $2,

- 10-year U.S. Treasury 4.344% up 0.073 points,

- USD index $103.51 up $0.75,

- Bitcoin $37,740 down $85

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Disposable personal income (DPI) in October 2023, personal income less personal current taxes, increased to 3.9% year-over-year (from 3.8% in October 2022) and personal consumption expenditures (PCE) remained steady at 2.2% rise year-over-year [all percentages inflation adjusted]. Excluding food and energy, the PCE price index declined from 3.4% year-over-year last month to 3.0% in October 2023. In plain English, consumer spending and consumer income has essentially flatlined over the last 3 months which translates to a steady GDP growth. Inflation, on the other hand, had a significant improvement this month which may keep future federal funds increases at bay.

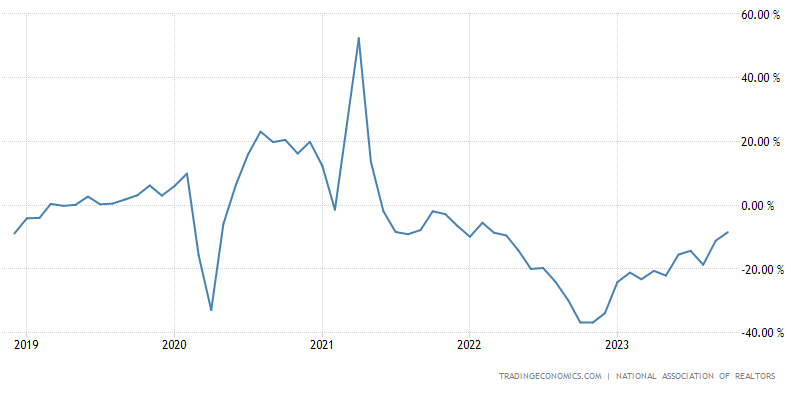

The Pending Home Sales Index (PHSI) – a forward-looking indicator of home sales based on contract signings – dropped 1.5% to 71.4 in October 2023, the lowest number since the index was originated in 2001. Year over year, pending transactions declined 8.5%. An index of 100 is equal to the level of contract activity in 2001. Lawrence Yun, NAR chief economist stated:

During October, mortgage rates were at their highest, and contract signings for existing homes were at their lowest in more than 20 years. Recent weeks’ successive declines in mortgage rates will help qualify more home buyers, but limited housing inventory is significantly preventing housing demand from fully being satisfied. Multiple offers, of course, yield only one winner, with the rest left to continue their search.

In the week ending November 25, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 220,000, a decrease of 500 from the previous week’s revised average. The previous week’s average was revised up by 500 from 220,000 to 220,500.

Here is a summary of headlines we are reading today:

- The Last 6 Months Have Been Devastating For U.S. Clean Energy Stocks

- Oil Prices Retreat As OPEC+ Cuts Another 684KBPD, Brazil Joins OPEC+

- The First-Ever Enhanced Geothermal Plant in the United States

- Russia’s Biggest Oil and Gas Exporters See Revenues Slump by 41%

- Consumer Reports: EVs Are Less Reliable Than Gasoline Cars

- Now at a new 2023 high, the Dow is approaching a record. These stocks could push it over the top

- Money Laundering Expert Raised Alarm Over “Unusual” Chinese Payments To Hunter Biden

- Tesla Hosts ‘Biggest Event On Earth This Year’ To Launch Cybertruck

- Bank of America, Wells Fargo lead gains in big-bank stocks to add to November’s win

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

December 2023 Economic Forecast: Economy Is Likely To Decelerate

Authored by Steven Hansen

EconCurrent‘s Economic Index declined but remains in positive territory. We do not see a recession baked in but there remain four major indicators signaling a recession. Read on to understand the currents affecting our economic growth.

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted November 30, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

29Nov2023 Market Close & Major Financial Headlines: Markets Flatline

Summary Of the Markets Today:

- The Dow closed up 13 points or 0.04%,

- Nasdaq closed down 0.16%,

- S&P 500 closed down 0.09%,

- Gold $2046 up $6.00,

- WTI crude oil settled at $78 up $1.32,

- 10-year U.S. Treasury 4.265% down 0.069 points,

- USD index $102.84 up $0.01,

- Bitcoin $37,710 down $133

Click here to read our Economic Forecast for November 2023

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The second estimate of real gross domestic product (GDP) increased at an annual rate of 5.2% in the third quarter of 2023 – up from the advance estimate of 3Q2023 GDP of 4.9%. HOWEVER, the headline view of GDP exaggerates change, and the year-over-year growth was 3.0%. In the second quarter, real GDP increased 2.15. The update primarily reflected upward revisions to nonresidential fixed investment and state and local government spending that were partly offset by a downward revision to consumer spending. Imports, a subtraction in the calculation of GDP, were revised down. Also, note that the implicit price indicator (the measure of inflation) was revised down from the advance estimate’s 2.9% to 2.8% year-over-year.

The Federal Reserve’s 29 November, 2023 Beige Book shows that on balance, economic activity slowed since the previous report, with four Districts reporting modest growth, two indicating conditions were flat to slightly down, and six noting slight declines in activity. Retail sales, including autos, remained mixed; sales of discretionary items and durable goods, like furniture and appliances, declined, on average, as consumers showed more price sensitivity. Travel and tourism activity was generally healthy. Demand for transportation services was sluggish. Manufacturing activity was mixed, and manufacturers’ outlooks weakened. Demand for business loans decreased slightly, particularly real estate loans. Consumer credit remained fairly healthy, but some banks noted a slight uptick in consumer delinquencies. Agriculture conditions were steady to slightly up as farmers reported higher selling prices; yields were mixed. Commercial real estate activity continued to slow; the office segment remained weak and multifamily activity softened. Several Districts noted a slight decrease in residential sales and higher inventories of available homes. The economic outlook for the next six to twelve months diminished over the reporting period.

Here is a summary of headlines we are reading today:

- New U.S. Sanctions on Iran Target Oil Revenues Feeding Military

- A Tech Breakthrough That Counters Critical Issues for Lithium-Sulfur Batteries

- South America’s Offshore Oil Boom Will Challenge OPEC’s Dominance

- Oil Prices Extend Gains as Market Awaits Key OPEC+ Meeting

- Here’s what it would take for the Fed to start slashing interest rates in 2024

- Nvidia CEO Jensen Huang says AI will be ‘fairly competitive’ with humans in 5 years

- Americans are ‘doom spending’ — here’s why that’s a problem

- Panama Forcing First Quantum To Close Mega-Copper Mine Is A “Significant Event”

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted November 29, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

Ten Dancing Queens & Kings at OSB 2023

In this post, I will present 10 amateur ballroom dancers who attended OSB 2023 after choosing to participate in my book (“Dancing Queens & Kings”):

- Annette Burden (S2): Winner of both Closed-Gold Rhythm and Smooth.

- Irene Fong (S1): Winner of Closed-Gold Smooth.

- Eric Leininger (S1): a danceholic.

- Brian Ames (C): Placed 3rd in MIB Rhythm and Smooth.

- Nichelle Kennedy (C): A new champion in Open Smooth.

- Giovanni Fortezza (C): 2nd place in Open Rhythm.

- Sara Granberg (B): A finalist in Ballroom – Silver.

- Alexis Salapatek (A): A new champion in Open Smooth.

- Francesca Mattozzi (A): A rising star in Smooth and Ballroom.

- Frank Li (S1): Winner of the top male student award (Gold) two years in a row.

Now, let me briefly highlight them one by one …