Dancing Queens & Kings: Call for Participation (6)

My forthcoming book, “Dancing Queens & Kings,” is calling for participation. The only requirement is that you have competed at the USDC or OSB and have an interesting story to tell. Below is the new and final timeline:

- 12/31/2023: 1 page highlighting your compelling story in pro/am ballroom dancing.

- 1/31/2024: 10-page full story.

- 4/30/2024: Book review by Sam Sodano.

- 6/30/2024: Publication at Amazon.

I am looking for 40 stories and will accept up to 50 submissions of 1 page (1st come, 1st accepted). After your 1 page is accepted, your 10-page is almost guaranteed to be included in the book, unless it is so poorly written that it is totally unsalvageable.

05 Dec 2023 Market Close & Major Financial Headlines: Dow Repeats Yesterday’s Session, Trading Mostly Sideways. Markets Closed Mixed

Summary Of the Markets Today:

- The Dow closed down 80 points or 0.22%,

- Nasdaq closed up 0.31%,

- S&P 500 closed down 0.06%,

- Gold $2037 down $5.10,

- WTI crude oil settled at $72 down $0.67,

- 10-year U.S. Treasury 4.178% down 0.108 points,

- USD index $103.96 up $0.25,

- Bitcoin $43,749 up $2,001

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

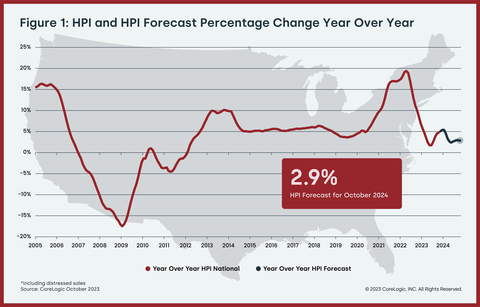

U.S. single-family home prices increased by 4.7% year over year in September, the 141st straight month of annual appreciation. CoreLogic projects that annual home price growth will relax to 2.9% by October 2024.

The number of job openings decreased to 8.7 million on the last business day of October 2023. Over the month, the number of hires and total separations changed little at 5.9 million and 5.6 million, respectively. Within separations, quits (3.6 million) and layoffs and discharges (1.6 million) changed little. Generally speaking, as the number of job openings decline – so does employment gains. So one would logically expect lower employment gains this week as the BLS releases its November employment data.

In November 2023, the Services PMI® registered 52.7 percent, 0.9 percentage point higher than October’s reading of 51.8 percent. The Business Activity Index registered 55.1 percent; a 1-percentage point increase compared to the reading of 54.1 percent in October. A reading below 55% indicates a weak economy.

Here is a summary of headlines we are reading today:

- What Peak Demand for Fossil Fuels Will Look Like

- New Technology May Reduce Battery Fires

- Tesla Set To Break Deliveries Record In China

- European Commission To Delay EV Tariffs By Years

- Green Energy Giants to Invest $16 Billion in Offshore Wind and Hydrogen

- Elon Musk’s AI startup — X.AI — files to raise $1 billion in fresh capital

- Goldman breaks down the laggard trade and gives its comeback picks for first quarter 2024

- Bitcoin surges to $44,000 for the first time since April 2022: CNBC Crypto World

- Pentagon Chief Slams US Non-Interventionists As Weakening America

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

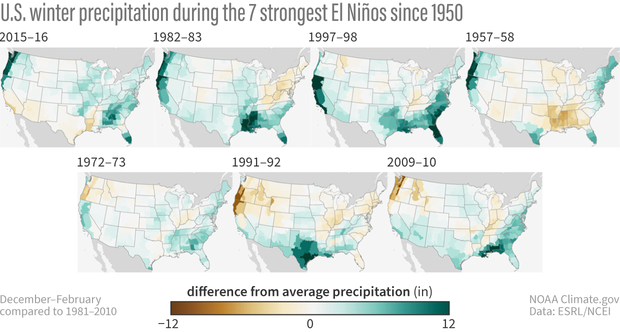

ENSO Blog: “How does El Niño influence winter precipitation over the United States?” December 5, 2023

You can read this post on the ENSO Blog HERE but you might find it convenient to read it here.

It is a great article and very worthwhile reading.

I have not added any comments to it in the body of this article. Any comments I have are here in the lede.

A. I question some of the graphics. re the La Nina part of the graphic since -1 is not stronger than -2

B. I was shocked at how poor the performance of the models is. I think how much of a coat our animals grow may be a better predictor.

It is an excellent article, you should read it.

Perhaps I should publish my analysis tool which I used to do. But I would have to update it and that is a lot like work. I think I have the information to do the analysis now

Please click below to read the full article and the comments to the article that show up as footnotes.

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted December 5, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

04Dec2023 Market Close & Major Financial Headlines: Markets Modestly Down. Bitcoin Surges.

Summary Of the Markets Today:

- The Dow closed down 41 points or 0.11%,

- Nasdaq closed down 0.84%,

- S&P 500 closed down 0.54%,

- Gold $2048 down $42,

- WTI crude oil settled at $73 down $0.76,

- 10-year U.S. Treasury 4.261% up 0.037 points,

- USD index $103.64 up $0.37,

- Bitcoin $41,882 up $1,796

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

New orders for manufactured goods in October 2023 are down 1.4% year-over-year (blue line on the graph below). This compares favorably with the Federal Reserve’s manufacturing data which has manufacturing down 1.7% year-over-year (green line on the graph below). Manufacturing remains in a recession in the U.S.

Here is a summary of headlines we are reading today:

- Why Diesel Usually Costs More Than Gasoline

- The Minerals That China, the EU, and the US Deem Critical to National Security

- Is This The Technical Limit for Refilling the Strategic Petroleum Reserve?

- How China And The U.S. Were Both Key To OPEC+’s Bearish Oil Supply Cuts

- COP28 President: There Is ‘No Science’ Behind Calls for Fossil Fuel Phase-Out

- Swiss bank Banque Pictet admits hiding $5.6 billion of Americans’ money from IRS

- White House says U.S. funding about to run out; Ukraine to probe apparent shooting of two unarmed soldiers by Russian forces

- Regulators Hope You Don’t Notice The Massive Hidden Losses In The Banking System

- Nvidia Insiders File Paperwork To Dump 370,000 Shares

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted December 4, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted December 3, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

Adventures with 3 Coin Flips. Part 5: Identifying and Counting Outcomes

This article describes the process of identifying all possible outcomes when there are 8 trials of 3 coin flips each. Then, the outcomes are divided into types, and the number of outcomes for each type is determined.

NCA5: Drought and Climate Change in 10 Maps – December 2, 2023

I am just providing a report from NCA5. I am providing the full report but you can access it HERE and then there will be live links that you can click on for additional information. There is a lot more in that report than these 10 Maps but they feature these 10 Maps as sort of a summary of the key points in that report. I have added some comments to each map to perhaps help interpret these 10 Maps but I have not read the full report so I may not understand enough to fully interpret them. But I will do my best. It appears to me that this set of 10 maps is intended to entice people to read the chapter or chapters where the material is presented in more depth.