13 Dec 2023 Market Close & Major Financial Headlines: Fed holds rates steady, Dow soars, surpassing 37,000 for the first time, Closing At Session High

Summary Of the Markets Today:

- The Dow closed up 512 points or 1.40%,

- Nasdaq closed up 1.38%,

- S&P 500 closed up 1.37%,

- Gold $2,036 up $42.70,

- WTI crude oil settled at $70 up $1.14,

- 10-year U.S. Treasury 4.018% down 0.188 points,

- USD Index $102.92 down $0.950,

- Bitcoin $42,787 up $1,480 ( 3.56% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

This year, 64.4% of companies report they are having in-person holiday parties, up from 57% who reported this last year and 27% who held in-person parties in 2021. This is the highest percentage of companies holding in-person holiday parties since 75% of companies reported they held parties in 2019. Another nearly 4% will hold virtual events this year, up from 2% who reported holding virtual events in 2022, likely due to the adoption of remote and hybrid work. Of those holding parties, 4% reported they will include COVID modifications.

The Producer Price Index for final demand increased 0.9% for the 12 months ending in November 2023 (blue line on the graph below) – down from 1.2% last month. It is Final demand services (green line) which is continuing to elevate the Producer Price Index. However overall, producer prices are not driving inflation.

The Federal Reserve’s FOMC decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent – and stated only “Inflation has eased over the past year but remains elevated”. There was little change in this FOMC meeting statement compared to the previous meeting statement.

Here is a summary of headlines we are reading today:

- Fed Keeps Rates Unchanged, Forecast Series Of Cuts In 2024

- Tesla Recalls 2 Million Vehicles in U.S. over Autopilot Safety Flaw

- U.S. Warship Takes Down Houthi Drone After Attack On Tanker

- Oil Inches Up on Crude Inventory Draw

- OPEC Production Falls While U.S. Oil Output Hits New High

- Fed holds rates steady, indicates three cuts coming in 2024

- Dow rallies more than 500 points to record, closes above 37,000 for the first time: Live updates

- 10-year Treasury yield drops to lowest level since August as Fed forecasts easing rates 3 times next year

- SpaceX valuation climbs to $180 billion

- The Federal Reserve’s period of rate hikes may be over. Here’s why consumers are still reeling

- Federal Reserve signals interest rate cuts next year

- Bond Report: Treasury yields plummet after Fed pencils in 2024 rate cuts

- Market Snapshot: Dow Jones heads for record close after Fed leaves interest rates unchanged, signals pivot ahead

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

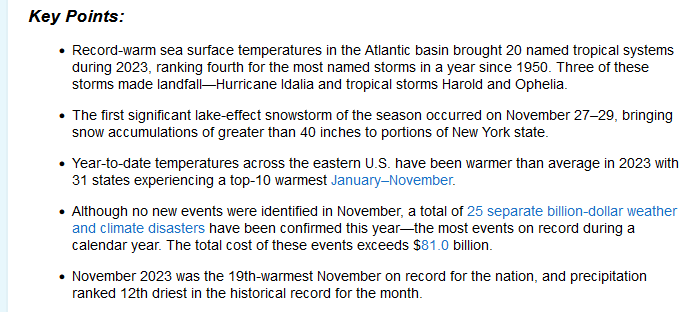

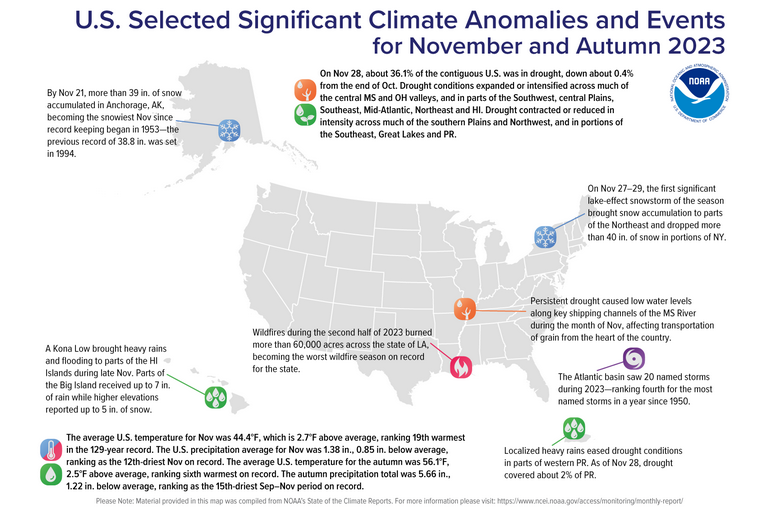

Assessing the U.S. Climate in November 2023 – December 13, 2023

Much of the information in this article comes from the monthly email I receive from John Bateman. He does public outreach for NOAA and in particular NCEI. I could find the same information and more on the NCEI website but John produces a good summary so I use it or most of it. I also sometimes add additional information from NCEI or other NOAA websites. John Bateman sends me two emails. One on the World situation and one for the U.S. One of the things I like to add to what John Bateman sends me is the state ranking maps. These maps show how temperature and precipitation for each state rank relative to the 129 years of what is considered to be the most reliable data we have.

This article is about November 2023 in the U.S.

This trend analysis comes from Climate at a Glance also from NCEI

| This is the U.S. November temperature trend. This past November was by no means a record but it was above the trend line. It was a relief in a way as some recent months have been much above trend and record breakers so the factors that were causing that may have been short-term but in any event did not show up this November. I will compare this to the world trend in a future article. |

Now I will present the information provided by John Bateman with one additional graphic also from NCEI plus the state ranking maps.

It is democracy, stupid!

In a previous post, I called out, “America: It is democracy, stupid!” In this post, I will make the same call far beyond America …

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted December 13, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

12 Dec 2023 Market Close & Major Financial Headlines: Wall Street Opened Mixed, Trended Moderately Higher After Latest Inflation Data, Markets Finally Closing At Session Highs

Summary Of the Markets Today:

- The Dow closed up 173 points or 0.48%,

- Nasdaq closed up 0.70%,

- S&P 500 closed up 0.46%,

- Gold $1,995 up $1.60,

- WTI crude oil settled at $69 down $2.63,

- 10-year U.S. Treasury 4.208% down 0.031 points,

- USD Index $103.80 down $0.300,

- Bitcoin $41,223 up $379 ( 0.93% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

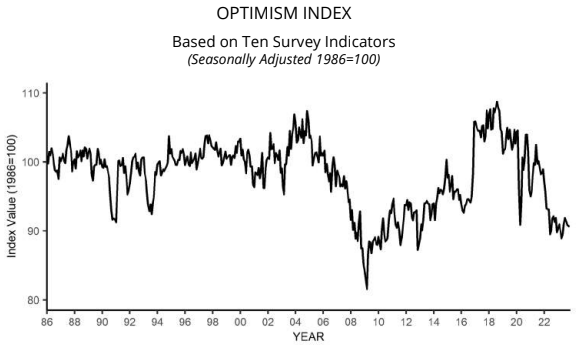

NFIB’s Small Business Optimism Index decreased 0.1 point in November to 90.6, which marks the 23rd consecutive month below the 50-year average of 98. Twenty-two percent of owners reported that inflation was their single most important problem in operating their business, unchanged from October but 10 points lower than this time last year. NFIB Chief Economist Bill Dunkelberg added:

Job openings on Main Street remain elevated as the economy saw a strong third quarter. However, even with the growing economy, small business owners have not seen a strong wave of workers to fill their open positions. Inflation also continues to be an issue among small businesses.

The November 2023 Consumer Price Index for All Urban Consumers (CPI-U) all items index over the last 12 months increased 3.1 percent before seasonal adjustment – marginally down from the 3.2% YoY increase last month. The index for shelter continued to rise in November, offsetting a decline in the gasoline index. The all items less food and energy index rise was unchanged at 4.0% YoY. The question becomes – is inflation under control enough for the Federal Reserve to stop raising the federal funds rate? IMO, only a slowing economy moderates inflation – so the real question is whether the economy is slowing. Our economic forecast projects a slowing economy which would allow the Federal Reserve to hold interest rates steady.

Here is a summary of headlines we are reading today:

- Oil Sinks to 6 Month Low As Inflation Fears Persist

- How Greenwashing Could Undermine Hydrogen’s Future

- OPEC May May Need 5-Year Plan To Prevent Oil Price Collapse

- Interest Rate Concerns Keep Oil Prices Under Pressure

- COP28 Headed for ‘Complete Failure’ as Fossil Fuel Debate Rages

- Houthis Attack Another Vessel in the Red Sea

- Fed to start cutting rates midyear in 2024 with high chance of soft landing, CNBC Fed survey finds

- Inflation slowed to a 3.1% annual rate in November

- Citadel Returning $7 Billion In Profits To Investors After 15% Return In 2023

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

Short Term and Intermediate-Term Weather Outlooks for the U.S. and a Six-Day Forecast for the World: posted December 12, 2023

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term outlooks and a six-day World weather outlook which can be very useful for travelers.

We start with the U.S. Information. That is the longest part of the article. Then we have a short section on World Weather and then we address the Tropics. When there are tropical storms that might impact the U.S. we provide more detailed information which updates frequently on those storms.

Please click on “Read More” below to access the full report as I have moved the highlights into the body of the report where it is followed by the Today, Tomorrow and the Next Day maps and a lot more. I will try to feature the most important graphic in the lede paragraph on the home page. But there are often multiple maps that are very important so it is best to read the full article. We now have a snow report and it is possible to get a ten-day NWS forecast for the zip code of your choice.

11Dec2023 Market Close & Major Financial Headlines: Markets Rise On the Back Of a Strengthening Dollar

Summary Of the Markets Today:

- The Dow closed down 157 points or 0.43%,

- Nasdaq closed down 0.20%,

- S&P 500 closed down 0.39%,

- Gold $1997 down $18,

- WTI crude oil settled at $71 up $0.24,

- 10-year U.S. Treasury 4.235% unchanged,

- USD index $104.08 up $0.07,

- Bitcoin $40,825 up $2,968

Click here to read our current Economic Forecast – December 2023 Economic Forecast: Economy Is Likely To Decelerate

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Here is a summary of headlines we are reading today:

- OPEC+ Output Cuts May Have No Effect Unless Extended Further

- The Battle for Australia’s Lithium Reserves

- U.S. Natural Gas Prices Tumble 10% on Mild Weather

- Is China Undermining Putin’s Plan for Higher Oil Prices?

- Chinese Demand for Saudi Crude Slumps to 5-Month Low

- UAW files unfair labor practice charges against Hyundai, Honda and VW, accusing them of union busting

- “This Is The Big Fight!” Bitcoin Battered As Sen. Warren Unveils Bill To “Crack Down” On Crypto

- The Price Of Rent Surged 27 Straight Months. Is Relief Finally Coming?

- Dow slightly higher as investors await inflation data and Fed policy meeting

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.

The State of Joe Sixpack in 3Q2023: Joe Should Feel Financially Better Off

Written by Steven Hansen

The Federal Reserve data release (Z.1 Flow of Funds) – which provides insight into the finances of the average household – shows a decrease in average household net worth from the previous quarter but up from one year ago. Our modeled “Joe Sixpack” – who owns a house and has a job, but essentially no other asset – is better off than he was a year ago.

The Federal Reserve data release (Z.1 Flow of Funds) – which provides insight into the finances of the average household – shows a decrease in average household net worth from the previous quarter but up from one year ago. Our modeled “Joe Sixpack” – who owns a house and has a job, but essentially no other asset – is better off than he was a year ago.