Summary Of the Markets Today:

- The Dow closed up 54 points or 0.14%,

- Nasdaq closed down 0.03%,

- S&P 500 closed up 0.04%,

- Gold $2,077 down $16.50,

- WTI crude oil settled at $72 down $2.20,

- 10-year U.S. Treasury 3.844% up 0.055 points,

- USD Index $101.24 up $0.25,

- Bitcoin $42,521 down $977 ( 2.25% )

*Stock data, cryptocurrency, and commodity prices at the market closing.

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

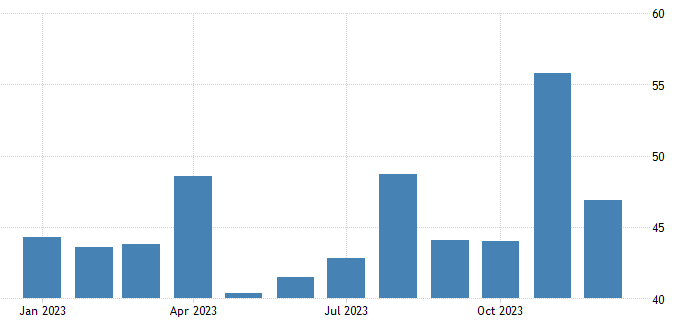

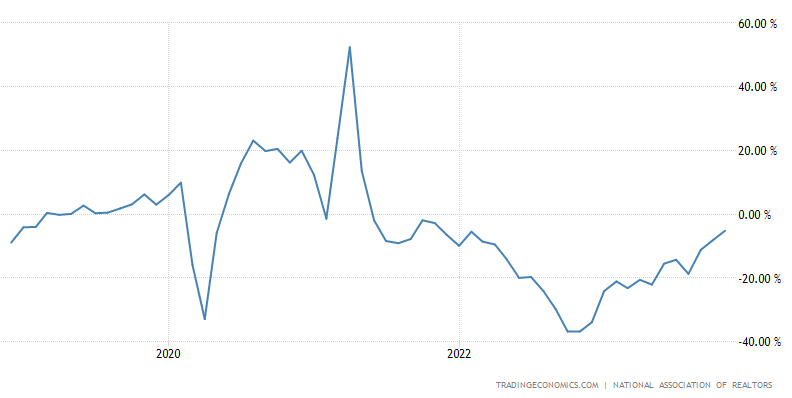

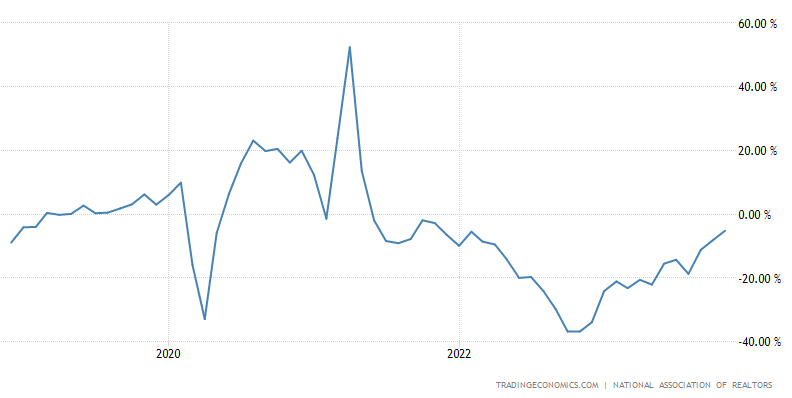

The Pending Home Sales Index – a forward-looking indicator of home sales based on contract signings –year over year, pending transactions were down 5.2% – an improvement from last month’s -8.2%.. Lawrence Yun, NAR chief economist stated:

Although declining mortgage rates did not induce more homebuyers to submit formal contracts in November, it has sparked a surge in interest, as evidenced by a higher number of lockbox openings.

In the week ending December 23, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 212,000, a decrease of 250 from the previous week’s revised average. The previous week’s average was revised up by 250 from 212,000 to 212,250.

Here is a summary of headlines we are reading today:

- GasBuddy: Gasoline and Diesel Prices To Fall In 2024

- Record Global Gasoline Consumption Defies IEA Forecast

- Aerospace Industry Eyes Full Recovery by 2025

- Cheap Imports Threaten India’s Steel Sector

- Houthi Attacks Fail to Stop Middle East’s Pricing Problem

- S&P 500 closes little changed Thursday, struggles to reach record: Live updates

- Startup bubble fueled by Fed’s cheap money policy finally burst in 2023

- Could a bitcoin ETF approval be a sell-the-news event? What investors are expecting on the big day

- November pending home sales were unchanged, despite a sharp drop in mortgage rates

- Boeing Urges Airlines To Inspect 737 Max After “Possible Loose Bolt” For Rudder System

- Treasury yields extend bounce after weak 7-year note auction in final full trading day of 2023

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.