19 DEC 2024 Market Close & Major Financial Headlines: The Dow Finally Closed Fractionally Higher In The Green After A positive Session Today Following Yesterday’s Rout

Summary Of the Markets Today:

- The Dow closed up 15 points or 0.04%,

- Nasdaq closed down 20 points or 0.10%,

- S&P 500 closed down 5 points or 0.09%,

- Gold $2,612 down $40.90 or 1.54%,

- WTI crude oil settled at $70 down $0.73 or 1.03%,

- 10-year U.S. Treasury 4.570 up 0.072 points or 1.601%,

- USD index $108.37 up $0.34 or 0.32%,

- Bitcoin $95,904 down $4,546 or 4.74%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Market Summary

U.S. stocks stabilized on Thursday following a significant sell-off triggered by the Federal Reserve’s hawkish outlook on interest rates yesterday. The Dow Jones Industrial Average broke a ten-consecutive-day losing streak. The market decline yesterday stemmed from the Fed reducing their forecast for 2025 rate cuts from four to just two. Chair Jerome Powell described the rate cut decision as a “closer call” than anticipated. Looking ahead, investors are now focused on the upcoming Personal Consumption Expenditures (PCE) index report on Friday, which will provide further insights into inflation trends. The market’s volatility reflects ongoing uncertainty about the Fed’s monetary policy and the trajectory of inflation in 2025.

Click here to read our current Economic Forecast – December 2024 Economic Forecast: Insignificant Improvement And Still Indicating a Weak Economy

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

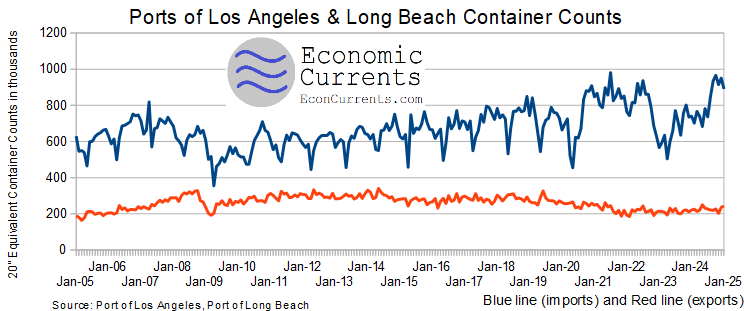

The Ports of Los Angeles and Long Beach are crucial economic drivers for the United States, playing a vital role in international trade and the national economy. These twin ports form the largest trade complex in North America, handling approximately 40% of all U.S. imports – and their data is released significantly earlier than other import data providing an early metric for trade. Loaded 20″ equivalent containers into the ports in November 2024 are up 20% year-over-year whilst exports are up 10% year-over-year. We can estimate that the trade balance will worsen in November 2024.

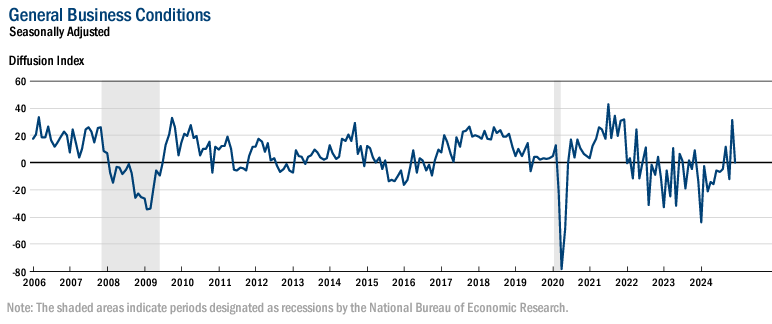

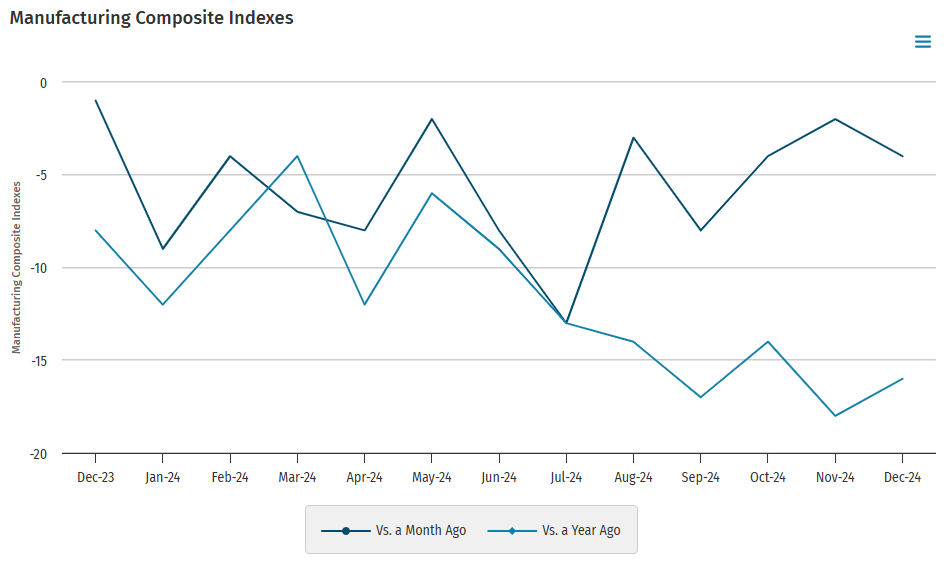

December 2024 Philly Fed Manufacturing Business Outlook Survey shows the current general activity remained negative declining from -5.5 to -16.4 and fell further and the indices for new orders and shipments declined and turned negative. The employment index edged down but continued to suggest increases in employment overall. The prices paid index moved higher, while the prices received index declined; both indices continue to indicate overall increases in prices. Manufacturing in the US remains in a recession.

Kansas City Fed’s manufacturing survey for December 2024 shows manufacturing declined to -4 from a -2 in November (a negative number is a decline from the previous month. Manufacturing in the US remains in a recession.

The third estimate of 3Q2024 Real gross domestic product (GDP) increased 2.7% year-over-year and the implicit price deflator (inflation) was 2.3% year-over-year. There was little change from the second estimate when looking at year-over-year change. In January 2025, we will get our first look at 4Q2024 GDP.

Annual U.S. rent growth registered a 1.7% increase in October 2024, down from the 2.3% year-over-year growth rate seen at the same time last year and marking the lowest rate since June 2020. Prior to 2020, single-family rent growth increased in the range of 2% to 4% for nearly a decade and averaged 3.5%. This decline is good for inflation growth but is not good for investment in rental real estate.

Total existing-home sales improved to 6.1% year-over-year. The median existing-home sales price rose 4.7% from November 2023 to $406,100, the 17th consecutive month of year-over-year price increases. I would expect a few more months of gain but the gain in median home prices will hinder overall sales growth.

In the week ending December 14, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 225,500, an increase of 1,250 from the previous week’s unrevised average of 224,250. Unemployment levels are consistent with an expanding economy.

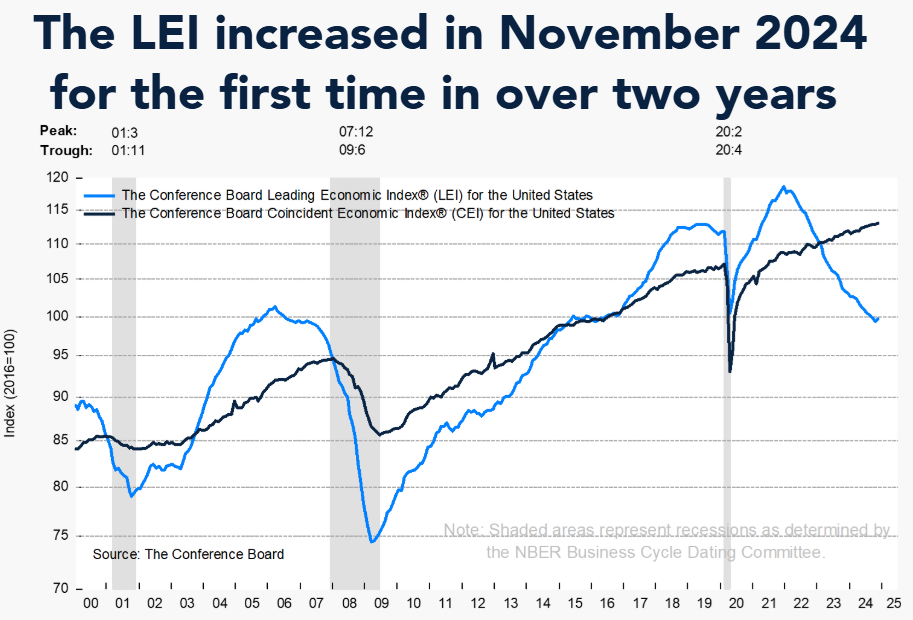

The Conference Board Leading Economic Index® (LEI) for the US increased by 0.3% in November 2024 to 99.7 (2016=100), nearly reversing its 0.4% decline in October. Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board view:

The US LEI rose in November for the first time since February 2022. A rebound in building permits, continued support from equities, improvement in average hours worked in manufacturing, and fewer initial unemployment claims boosted the LEI in November. It’s worth noting that gains in building permits were not widespread geographically or by building type; they were concentrated mainly to the Northeast and Midwest, and on buildings with 5+ units rather than single-family dwellings. Overall, the rise in LEI is a positive sign for future economic activity in the US. The Conference Board currently forecasts US GDP to expand by 2.7% in 2024, but growth to slow to 2.0% in 2025.

Here is a summary of headlines we are reading today:

- Precious Metals Prices Mixed Amidst Market Volatility

- North Dakota Crude Output Cut By 520,000 b/d After October Wildfires

- Argentina’s YPF and Shell Strike $50 Billion Deal

- Israel Strikes Yemen Energy Targets in Latest Middle East Flare-Up

- China Connects One of World’s Biggest Solar Projects to the Grid

- Dow ekes out narrow gain to snap 10-day losing streak, its longest in 50 years: Live updates

- House Republicans say they have deal to avert government shutdown

- Tom Lee says ‘back up the truck’ after Wednesday’s panic selling

- Senate expected to hold final vote on bill to change Social Security rules. Here’s what leaders have said

- November home sales surged more than expected, boosted by lower mortgage rates

- Billionaire DOGE Insider Teases Musk’s ‘Really Bold’ Plans To Drain Swamp: ‘A Lot of Stuff Ready For Day One’

- Oil prices settle at lowest in over a week after Fed rattles markets

- Treasury yield curve steepens as 10-, 30-year yields end at almost 7-month highs

Click on the “Read More” below to access these, other headlines, and the associated news summaries moving the markets today.