NOAA Updates its February 2024 Weather Outlook – Substantially Different from the Mid-Month Outlook – February 1, 2024

At the end of every month, NOAA updates its Outlook for the following month which in this case is February of 2024. We are reporting on that tonight.

There have been some significant changes in the Outlook for February and these are addressed in the NOAA Discussion so it is well worth reading. We provided the prior Mid-Month Outlook for February for comparison. It is easy to see the changes by comparing the Mid-Month and Updated Maps.

The article includes the Drought Outlook for February. NOAA also adjusted the previously issued Seasonal (FMA) Drought Outlook to reflect the changes in the February Drought Outlook. We have included a map showing the amount of water in the snowpack waiting to be released in the Spring. We also provide the Week 2/3 Tropical Outlook for the World. We also include a very interesting CLIMAS Podcast.

The best way to understand the updated outlook for February is to view the maps and read the NOAA discussion. I have highlighted the key statements in the NOAA Discussion.

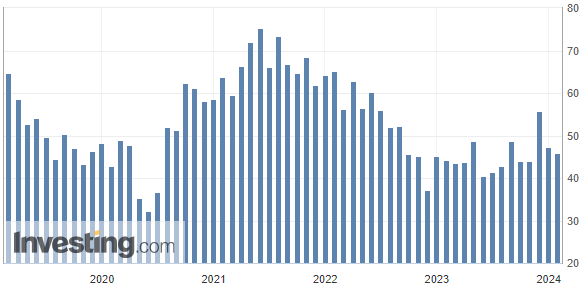

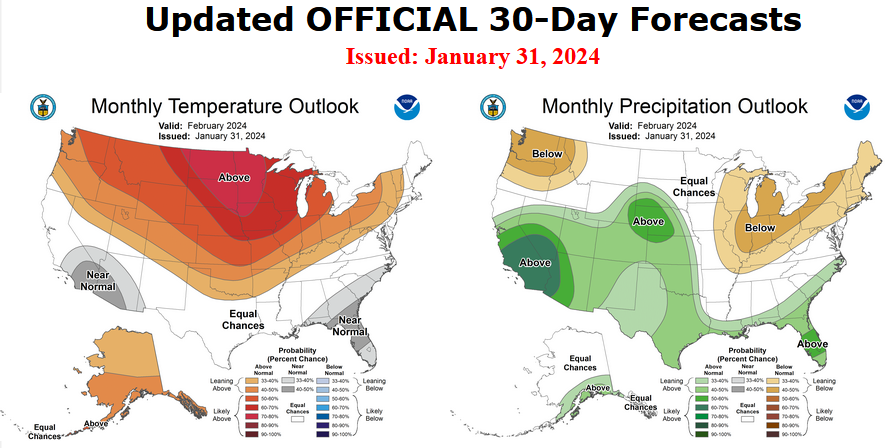

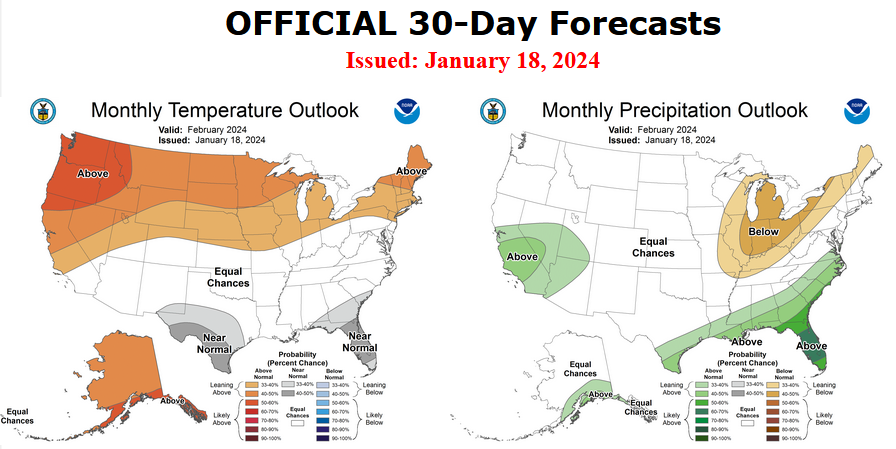

Here is the updated Outlook for February 2024.

For Comparison Purposes, Here is the earlier Mid-Month Outlook for February.

| There have been some significant changes especially related to precipitation. Remember, it is the top set of maps that are the current outlook for February. When the Mid-month Outlook was issued we were not sure that it and the FMA map agreed with the discussion. It is a huge change. You can track the actual weather and updates of the outlook in our Daily Weather Article. |

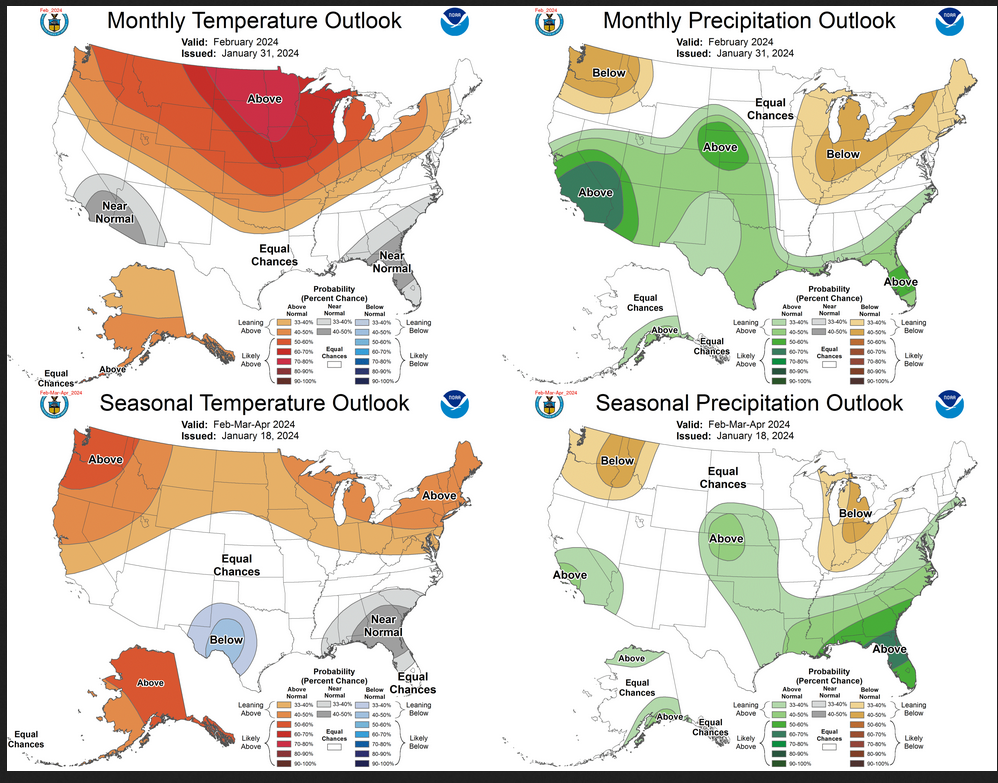

Combination of the Updated Outlook for February and the Three-Month Outlook

| The top row is the Updated Outlook for the new month. There is a temperature map and a precipitation map. The second row is a three-month outlook that includes the new month. I think the outlook maps are self-explanatory. What is important to remember is that they show deviations from the current definition of normal which is the period 1991 through 2020. So this is not a forecast of the absolute value of temperature or precipitation but the change from what is defined as normal or to use the technical term climatology. |

| The three-month map was issued on January 18, 2024. One expects some changes 13 days later. But the change to the precipitation map is very dramatic. Thus to some extent, I question the reliability of the FMA three-month map. As an example look at Arizona and New Mexico. Assuming February turns out as shown, imagine how dry March and April would have to be for the three-month map to be accurate. The same goes for the North Central Temperature Map. We have to take into consideration what wetter than normal means in different months. For Arizona and New Mexico February tends to be dry so wetter than normal may not be much in terms of inches of precipitation. |